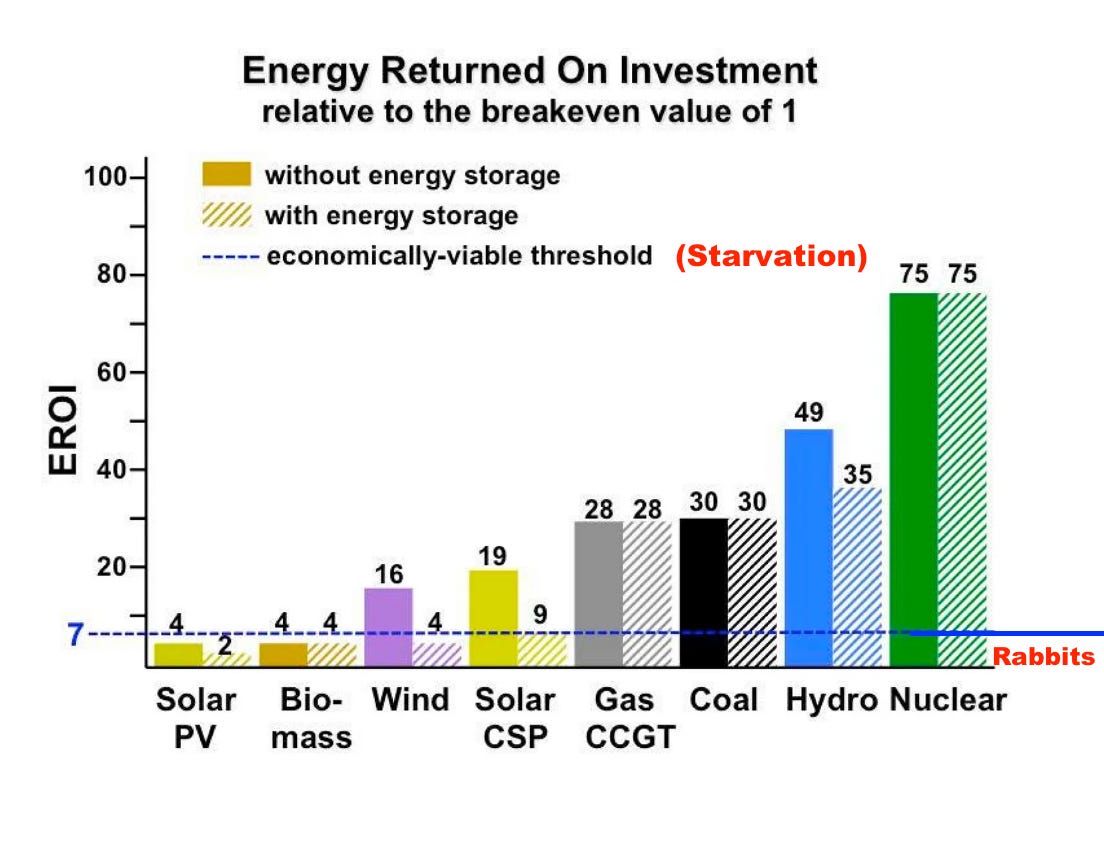

I've wanted to dig into energy return on investment (EROI) for a while now because it helps build a clear picture of the current energy problems.

Climbing the energy density ladder has been how we as a species thrived from the 1700s on. Yet, after decades of energy abundance and, more recently, zero cost of capital, we have fallen under the illusion that we run the world on low energy density/EROI sources in wind and solar.

No place is the hypocritical nature of this more obvious than Germany funding South Africa to ditch coal while repeatedly falling back on their own coal plants and ramping up coal imports from South Africa.

The Iron Law of Nature

The first person whose work I'll draw on is Charles Hall, a professor and ecologist who came up with the energy return on investment ‘EROI’ concept (also referred to as energy return on energy invested ‘ERoEI').

Charles refers to EROI as the iron law of nature.

It's common sense when you think about it.

"Every plant and every animal must conform to this iron law of evolutionary energetics: if you are to survive, you must produce or capture more energy than you use to obtain it; if you are to reproduce, you must have a large surplus beyond metabolic needs, and if your species are to prosper over evolutionary time you must have a very large surplus for the average individual to compensate for the large losses that occur to the majority of the population as less fit or unlucky organisms are weeded out."

Charles has an analogy that I love and have tried to expand on it here:

Consider the economy as a cheetah that has got fat-eating wildebeest.

Well, now this coalition of cheetahs has decided only to eat rabbits moving forward as it's more environmentally friendly (they breed quicker, and rabbit farts produce less emissions).

The problem is hunting rabbits has a low energy return on investment (let's call it an EROI of 4) in that it barely covers the energy needed to hunt them, let alone feed the cubs.

As efficient as the cheetahs get at hunting rabbits, they keep losing weight and will eventually need to return to high EROI wilderbeast or face starvation (there is actually rabbit starvation where you can die due to the lack of fat, i.e. storage.. I know I'm really pushing this analogy).

Losing weight in an economic sense means losing activities that rely on a large energy surplus (gender studies, diversity training, ESG consultants are the first to go.)

This occurs as an ever larger proportion of the economy needs to be devoted to extracting and processing energy.

Off on a quick preemptive tangent

After showing the above EROI of various energy generation, I usually get someone sending me a study such as Vestas on their wind turbines producing an EROI of 40, putting it right up there with the EROI on gas and coal.

Why we see these high EROI figures for wind and solar floating around the internet is a combination of Housel's observation and the bullshit asymmetry principle.

“Tell people what they want to hear and you can be wrong indefinitely without penalty.”

-Morgan Housel

If you want to test this, ask ChatGPT (internet consensus) to rank EROI (what it produces is the inverse of reality).

High EROI for wind or solar usually results from recycling assumptions or capacity factor assumptions (sometimes both).

The most egregious assumption is the "avoided impacts approach", where it is assumed the majority of the materials can be recycled at the end of life, substantially reducing energy input and boosting EROI. "Can be recycled" differs greatly from will be recycled, i.e., the tonnes of rebar in the foundations covered in concrete. Then, even if you do extract it, all you have is scrap, which needs to be processed, hence more energy.

It's a way to get around the below reality.

The other method is the "Recycled content approach", which looks at the percentage of recycled material that is used to make new steel, for example, and reduces the input energy per unit accordingly in the first calculation of embedded energy. This does reduce energy input but by a much smaller amount than the avoided impacts method.

In the Vestas study, the "avoided impacts approach" gave an EROEI of 40, the "Recycled content approach" gave an EROEI of 28.8, and I'm going to take a wild guess and say without it EROEI would be back in the teens.

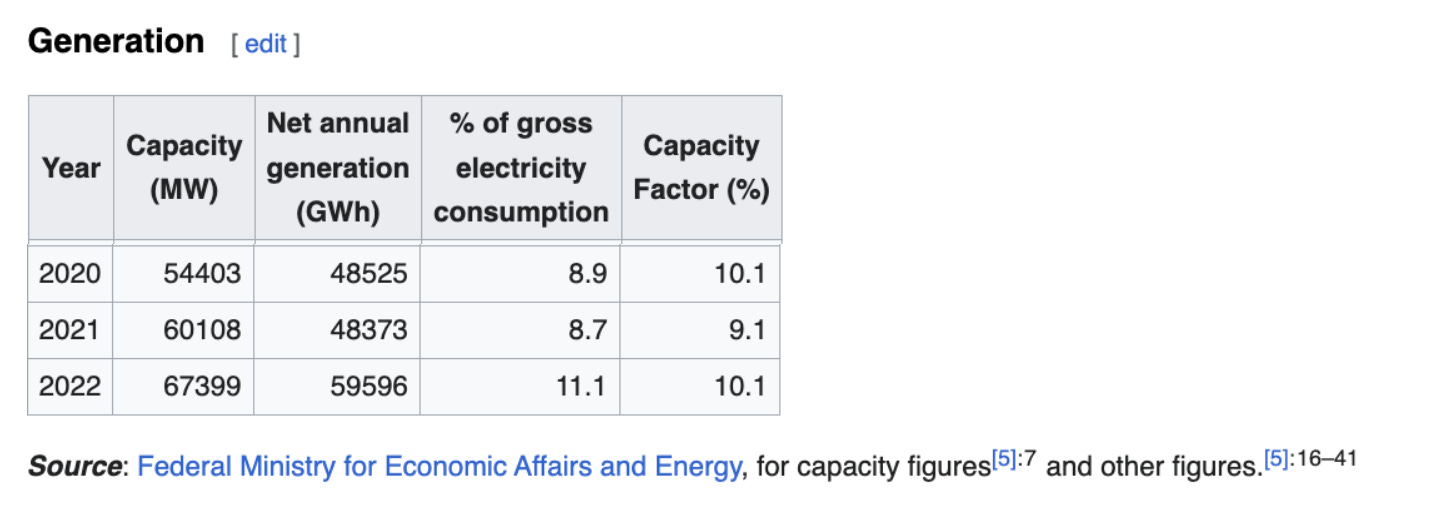

The other way to goose EROEI is to assume nameplate capacity factors instead of actual figures from the operation.

Take the above 24.9% capacity factor vs what Germany is currently achieving (before considering 10% is an average in that most of that is produced in summer months).

Climbing the Energy Ladder Through History

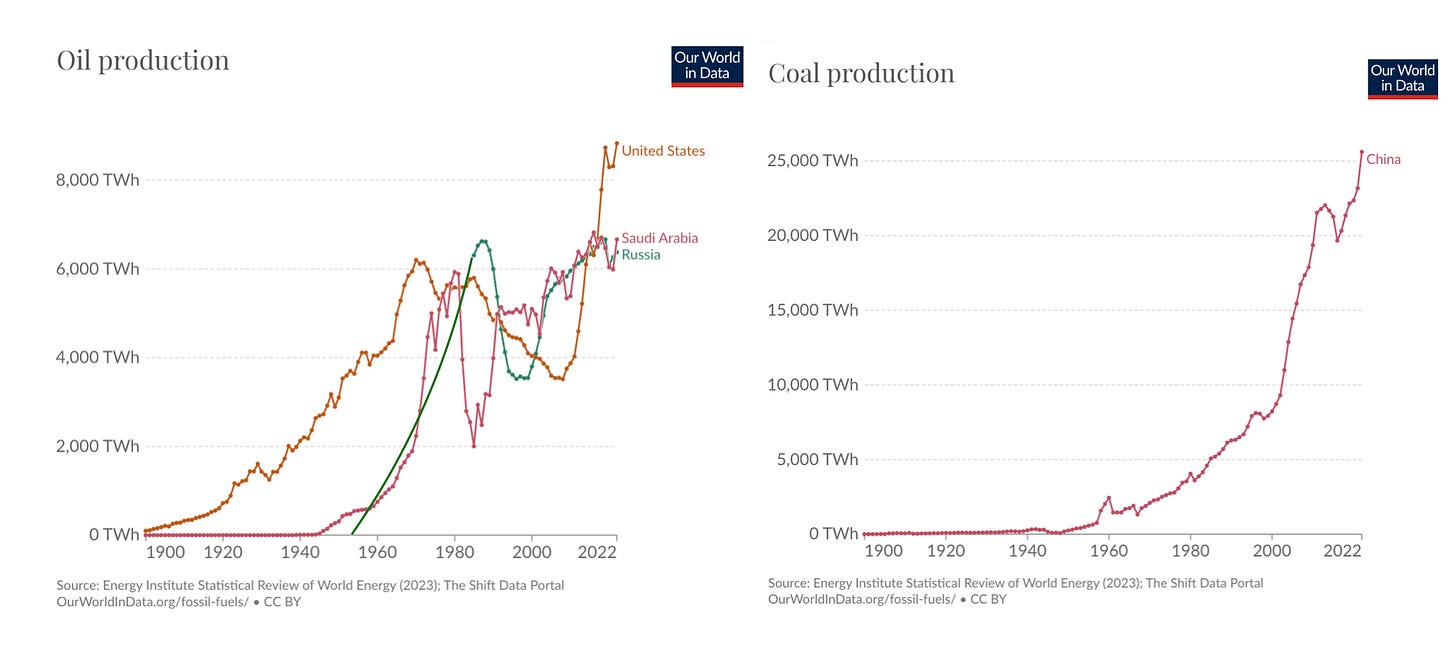

For nearly 12,000 years, the human race's population went nowhere regarding population growth. Then, from the 1800s on, it exploded, which can almost entirely be put down to achieving increasingly high EROI off coal and then oil.

To illustrate this, a strong human can produce 500MJ work per year for, say, $30,000. Compare this with one barrel of oil, which can produce 5000MJ of energy for $70. This order-of-magnitude jump in efficiency has enabled humans to expand rapidly.

A revolution in understanding energy occurred from 1750-1850 in "The Enlightenment", where the new religion was science and the scientific method.

This is a heavy contrast to today, where I think our energy policy could be best described as "the disillusionment", where ideology reins and the scientific method has been cancelled.

The reality of the situation is there is no energy "transition", only energy addition, with 2 billion people being added to the planet by 2050 and 150-200 million being added to the middle class globally each year.

India and China both stand to add over a billion each to the middle class by 2030 and are adding 25% and 32% to their coal fleets, respectively to keep up with this demand growth.

An overly simplistic breakdown of the above charts post-1950s explosion in energy production/consumption is as follows;

The Saudi Field, Ghawar, was discovered in 1948 and put on stream in 1951

The Soviets massively ramped up oil production (and the majority of commodities) before dumping them globally upon the Soviet Union's dissolution in December 1991.

China's enormous ramp in coal production (huge amounts of cheap energy and labour).

The US shale boom in both oil and gas (>90% of all additional oil production over the last decade).

Now, the ideology is that wind and solar will provide the next energy boom (eat rabbits at scale).

The higher EROI sources (bar nuclear) are primarily in decline (as we work through the easy-to-access stuff). While peak oil may be premature, peak cheap oil isn't.

Adding to the decline in EROI is that ~20% of global oil isn't actually oil (it's 40% in the US).

This matters as natural gas liquids only have two-thirds of the energy content of oil, plus ~55% is ethane, which ends up as plastic bags, anti-freeze and detergent. "Other" largely consists of biofuels such as corn ethanol, which is debatable if it even has an EROI above 1 (skinny rabbits).

Hence, similar to a gold coin being de-based with a cheaper metal, oil is being de-based with lower EROI liquids. This has only ramped over the last decade with the rise of tight oil and the associated natural gas production.

This is a huge issue as oil is the master commodity that feeds into almost everything we have come to appreciate in modern society.

There is a bad tendency to pretend all we need to ramp is the electricity side of the energy equation, and we transition to zero carbon Nirvana.

This thinking has four big issues, namely what Vaclav Smil has described as the four pillars of the modern world: ammonia, steel, cement and plastics.

To visualise this, you must understand that electricity is roughly 20% of global primary energy.

I put the diagram below together to understand the enormity of electrifying society, as I couldn't find anything to explain this issue.

Simply put, electricity demand globally is tough to keep up with before even considering electricity expansion to heating/industry and transport.

To illustrate the enormity of the issue, take this example from Dr Michael Kelly

Electricity represents 16% of UK energy use in 2018.

Transport required double the energy use of electricity.

Heating requires triple the energy use of electricity.

“If the UK were to magically shift all heating and transport to electrical forms, we would need a grid six times bigger than the one we have.”

-Dr Michael Kelly

It's also interesting to note heating, mainly gas flows, is 8x bigger in winter than in summer. How do you match the supply and demand in winter with wind and solar? Particularly considering solar output is the lowest when heating demand peaks.

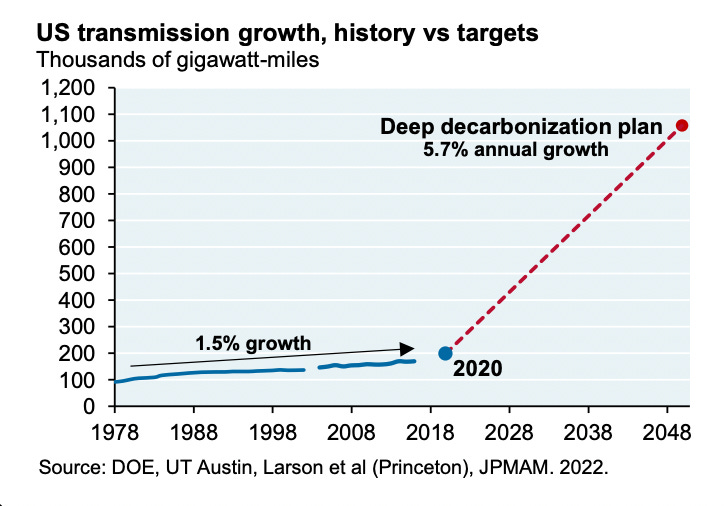

Or take the US: Grid bottlenecks delay the transition to clean energy which is also a nonstarter with supposedly $21tn of investments required by 2050.

"The grid will have to evolve to carry a lot more electricity," Turner says. "As we phase out fossil fuels and switch to EVs and heat pumps, electricity is going to account for almost 70 per cent of the global energy mix, up from 20 per cent today."

The reality is US transmission growth is currently below the historic 1.5% growth trajectory (let alone the 5.7% growth required for deep decarbonisation). This is before questioning material constraints, i.e. copper.

The Impact of EVs on Oil

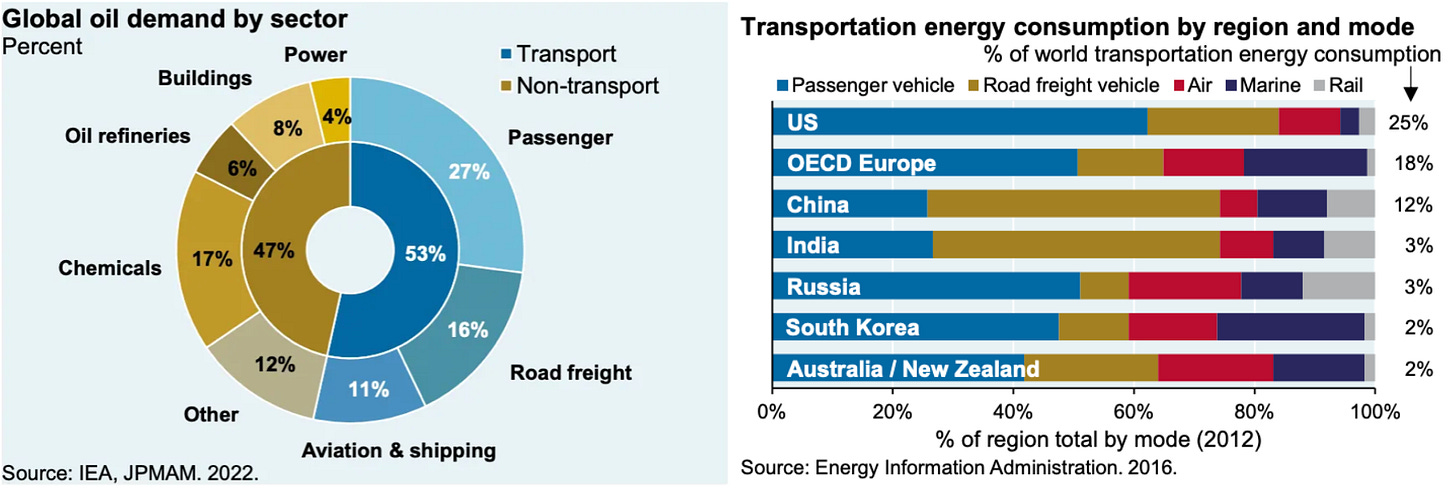

Consider EVs only make up ~1.8% of the global fleet currently (26m EVS / 1.44B ICE), and passenger vehicles, in turn, only make up 27% of oil demand.

EVs hit 10% of global sales last year, meaning 90% of passenger vehicles sold are still ICEs with a minimum life expectancy of 15 years. Even if you assume 100% of cars sold from now on are EVs, it doesn't move the needle for a long, long time.

The percentage of passenger vehicles in a fleet isn't that uniform either, with the US and Europe having more than double China and India (which have higher percentages of road freight that isn't being electrified).

Policy Makers can Ignore Wind and Solars EROI, but investors won’t

In theory, the learning curve, the avoided impacts approach, and the low LCOE mean wind and solar scale to 100% of the energy system.

"In theory, there is no difference between theory and practice - in practice there is."

-Yogi Berra

In practice all these renewable companies were predicated on zero cost of capital and abundant energy/commodities.

Those conditions no longer exist, and neither do their business models.

FAN (First Trust Global Wind Energy ETF) -42% since 2021

TAN (Invesco Solar ETF) -60% since 2021

EVA (Enviva) The world's largest producer of wood pellets -92% since 2021

Governments can keep them on life support as long as they can with subsidies, but ultimately, this is heading the same way as every attempt at a "transition" (this is the 4th attempt).

The only transition that ever sticks is the slow climb of the energy density ladder.

Wind and solar are a historic misstep (one which voters are slowly realising).

Hydro is great, but minimal locations are suitable so limited in ability to scale.

Natural gas is a winner, but it is hard to capture the LNG trend.

Thermal coal (seaborne) Coal the Beneficiary of Dumb Energy Policy

Nuclear is the obvious answer which the world is slowly realising.

Oil is irreplaceable in the energy system for the foreseeable future.

Which energy source is the ultimate outperformer?

I'm not smart enough to figure that out, so I'm spreading my bets across:

Coal (both met and thermal)

Uranium

Oil (Oil futures, oil services and tankers).

Thermal coal and uranium hedge each other to an extent in that thermal coal is the quick and easy fix, while uranium is the long-term solution that could displace coal given a long enough time frame.

Coal is so cheap it could live up to its historical reputation in commodity bull markets:

“From through to peak, coal equities have been the best-performing sector in every commodity bull market since 1900.”

-Goehring & Rozencwajg

With uranium, there is a big deficit this time (last bull market, there was no deficit). So the combination of massive deficits to correct, its tiny size, and ESG/Green inclusion provides an equally convincing argument that it could be the ultimate outperformer.

Oil is a stand-alone trend, as I see zero chance we can ween ourselves off it for the foreseeable future. I'm a massive offshore oil services bull as it is where future CAPEX will need to flow, yet it has been crushed and has gone through a bankruptcy cycle (Offshore the Future Oil Supply Story). Crazy things happen when large amounts of capital try to squeeze into a sector that has been hollowed out.

The hardest part is patience and having the conviction to weather the volatility, which is the price you pay for outperformance (to quote Bill Miller).

Which all sounds easy in theory…

I hope you all have some well deserved holidays planned!

Cheers,

Ferg

P.S. If you’re interested in my story and why I started this Substack, you can read the story here.

Great article!!! My background is mechanical engineering - energy and it's madness to see how my -more intelligent / higher IQ - mates from uni, are brainwashed by this solar/wind BS as well. They just can't see the bigger picture, it really is a religion.

Superb summary article Ferg - well done!

The lunacy is probably good for my investments (and has probably given me my financial independence) - but is absolutely horrible for Western societies. It leaves me with mixed feelings about the continued insanity: I would prefer not to have to leave UK.