Coal the Beneficiary of Dumb Energy Policy

Nuclear is the real solution, while coal continues to be the quick-fix

This is an update to the post I wrote about coal back in March 2021.

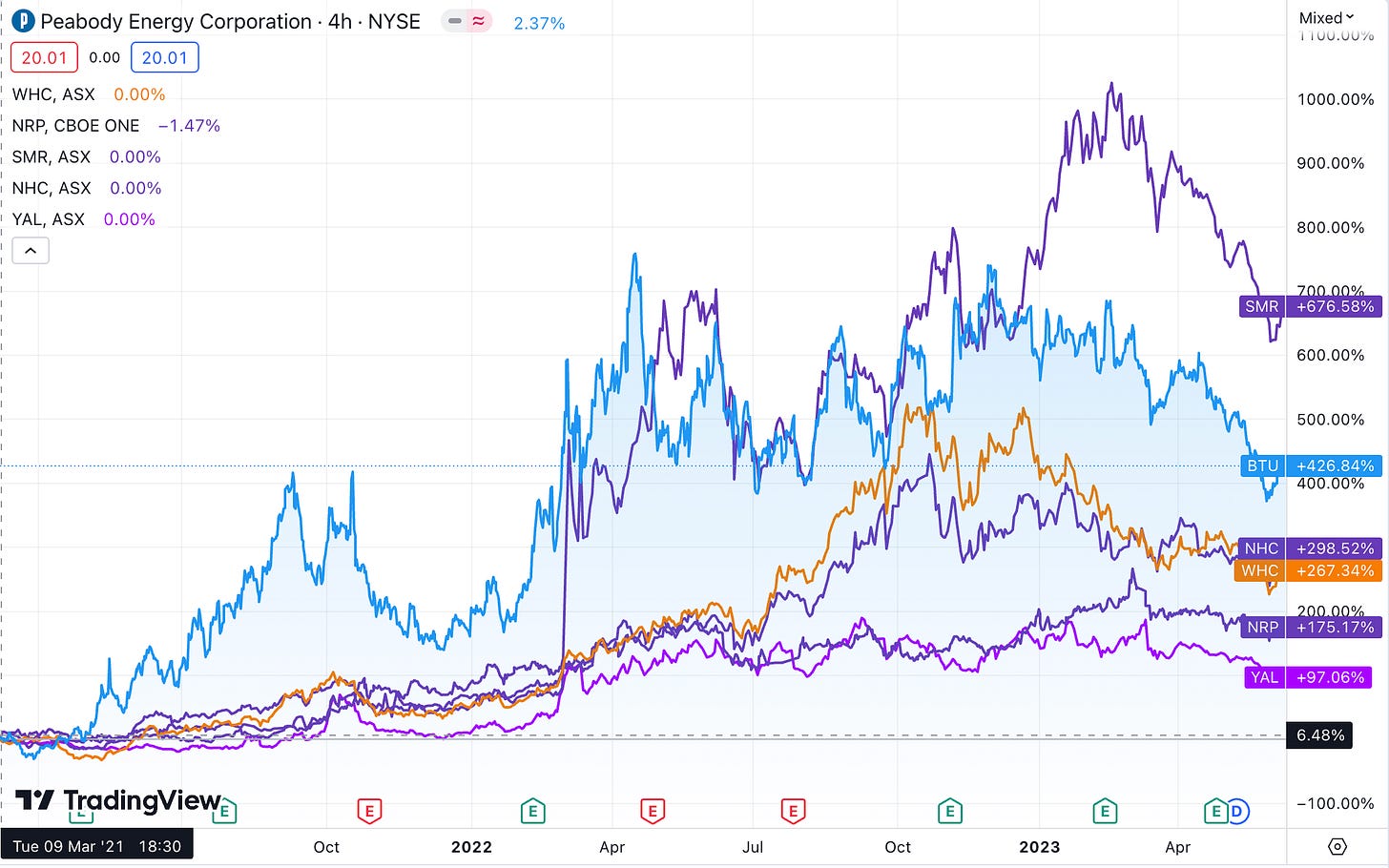

The little coal basket I wrote about has done well (granted, it was a lot nicer a few months ago). Anyone wanting a deeper dive into my thinking and why I targeted Peabody can listen to this hour-and-a-half pitch on coal and Peabody I gave in April 2021.

I’ve decided to write about coal again because the sentiment is bottomed out. I’ve always done my best to get positioned in a hated sector early and then let it do its thing while I move my attention to the next bottom-crawling hated sector. I’m not a fan of the position yourself, then spending the rest of every waking moment pumping your holdings (it’s why I rarely talk about uranium).

This chart seems to visually represent the consensus mood with coal currently. And who can blame them with Newcastle coal futures suggesting it was “transitory” with no premium being priced for winter months out in the future.

Granted, price action has been rough, I, for one, thought it would find support somewhere in $180-200 tonne, yet here we are at $135 tonne (under-estimate commodity volatility at your peril!)

At the core of this transitory belief is the view that the energy crisis is over.

I see this as faulty for the following reasons:

The widespread belief that the Russian invasion was 100% to blame for the price spikes (conveniently ignoring price spikes prior to the invasion).

The fact that it was the warmest European winter in 50 years and ever recorded in some European countries (getting lucky is a blessing unless you are too stupid to understand you got lucky).

The effect of China’s COVID lockdown on winter LNG demand (again lucky).

“China’s LNG imports fell by 16.3 million tonnes or 20% in 2022, according to statistics from the General Administration of Customs.

The slump was a remarkable turnaround after imports had increased at a compound rate of 26% per year for the previous six years.

If China’s imports had continued increasing at the previous rate, they would have approached 100 million tonnes instead of the 64 million tonnes recorded.”

Lastly, the continual erosion of European gross power production (not net) due to the build-out of intermittent generation, i.e. wind and solar.

I could go off on a massive tangent here.

So I will.

Some of my grievances with wind and solar;

The levelised cost of energy (LCOE) was created to compare baseload generation, yet it has been bastardised as an argument for intermittent sources since it leaves out storage costs, ramping costs, balancing costs, and efficiency costs (economics of gas plant that runs 20% of the time).

The capacity factor used to be reasonably uniform, i.e. a nuclear plant will do ~92% while a nat gas plant will do ~54%.

Wind and solar capacity factors should have a great big asterisk next to them as they are averages. Take this example from JP Morgan’s latest energy paper:

“Texas wind capacity factors averaged 32% in December 2022. But that doesn’t mean that wind provided steady power at 32% of installed capacity; as shown on the left, Texas wind generation varied from a low of 5% of capacity to a peak of 70% during the month.”

What’s especially annoying is the fluff pieces that get run on the capacity factor peak; SA hits new record running on 100 per cent renewables (spoiler, it was for ten days in the middle of summer).

Take this egregious chart; you only need a partly operational brain to see that solar seasonality is increasing while there is no way to shift that power to needed winter months; hell, we can’t even do it economically interday.

There is the “learning curve”, which is really just a bunch of academics extrapolating the shit out of prior trends to make their models work while ignoring all physical and economic realities (and the fact their 30-year projections were wrong in year 1).

Next, you have the fact that wind and solar have insufficient Energy return on investment (EROI) to sustain modern society. If you want to understand this better, my chat with Lars Schernikau breaks it down clearly, or there is my chat with Charles Hall, who is credited with developing the concept of EROI.

You have the issue of material constraints, which I discussed here with Simon Michaux: Investing: Discussing Material Constraints.

You have transmission and grid constraints: Investing: Prof Michael Kelly Discussing Engineering Reality and my interview with Meredith Angwin, who wrote the book Shorting the Grid.

I could go on, but I’ve got far enough off-course, and there are a few hours of interview homework above if you do want to understand any of the issues better.

The Takeaway

The point of the above tangent is to illustrate how flawed the idea of running an economy on wind and solar is, with the quick-fix solution usually being coal.

Yes, nuclear is the real answer, but coal is the quick and cheap answer (in a way, they kind of hedge each other).

Coal is LNG without the costly infrastructure. Just pile it on a ship, then truck/rail it and pile it out front of the plant. No multi-billion dollar gasification plant, reactor, specialised tankers, etc.

As Germany illustrated, do dumb shit like taking nuclear offline, and coal will pick up the slack.

Demand

Not much has changed on the demand front from the last post, but it is worth a revisit nonetheless.

Coal demand is a China story (India and South Asia to a lesser extent).

There is no “transition” in China; there is just a massive “addition” to keep up with a population climbing the S-curve.

Western “recommendations” such as; China should ‘rapidly’ close 186 coal plants to help meet its climate goals, study says are met by the below cold hard reality in China.

Stating China and India should follow Australia, the US, and Europe’s lead also ignores the fact that their coal plants are young, so shutting them down early makes no economic sense.

It helps to view China (and other developing countries) via an energy security framework rather than the Western Green ideology. Social stability is their number one aim, and reducing reliance on energy imports is key (shutting down coal plants does not help this objective).

HVAC demand

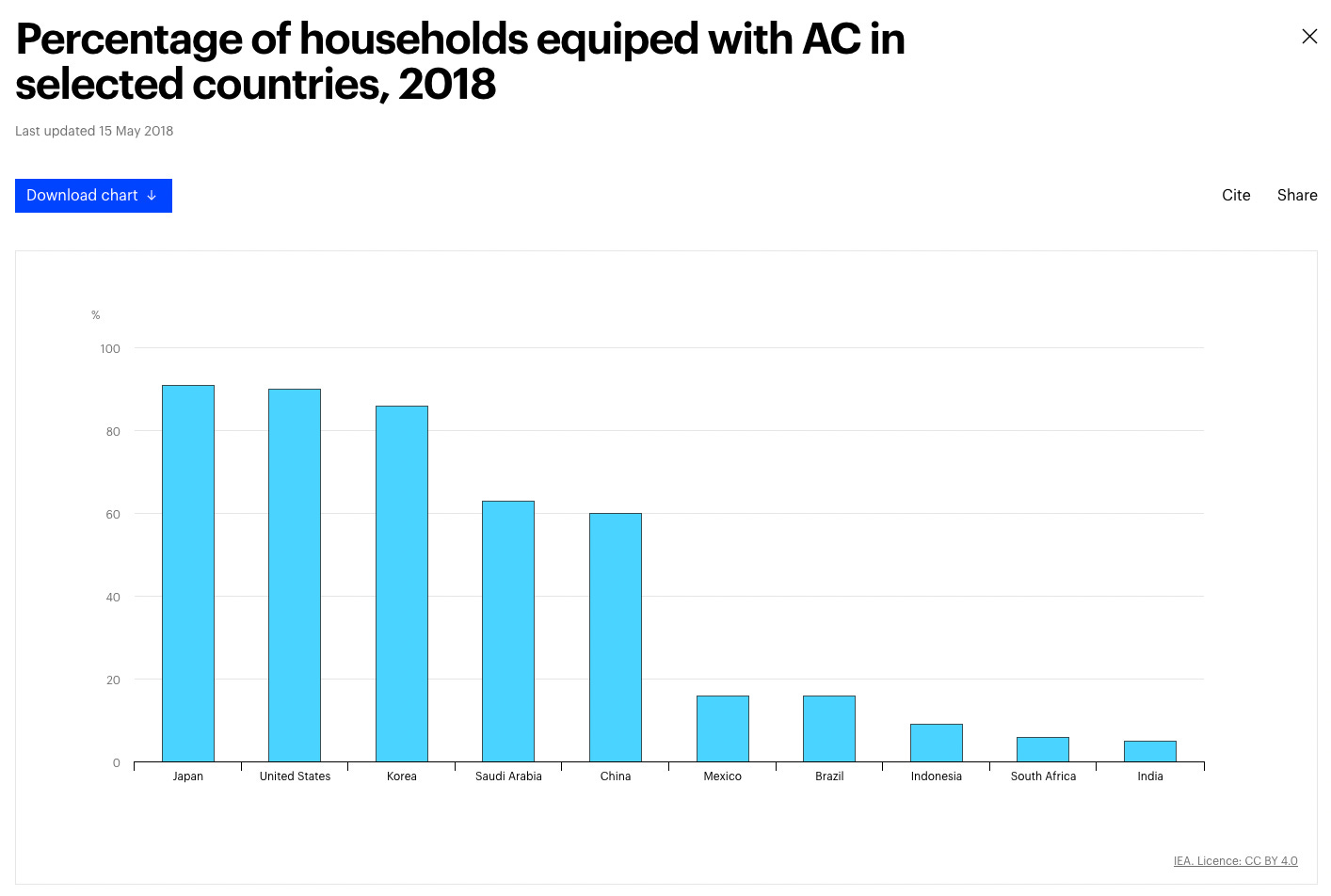

Living in Bali, Indonesia, I can tell you locals aspire to a few things, first, a smartphone (sourcing work and entertainment), a scooter (mobility for a job) and air-con at night (comfort). When we have a power cut at night, I relearn my appreciation for the wonder of air conditioning.

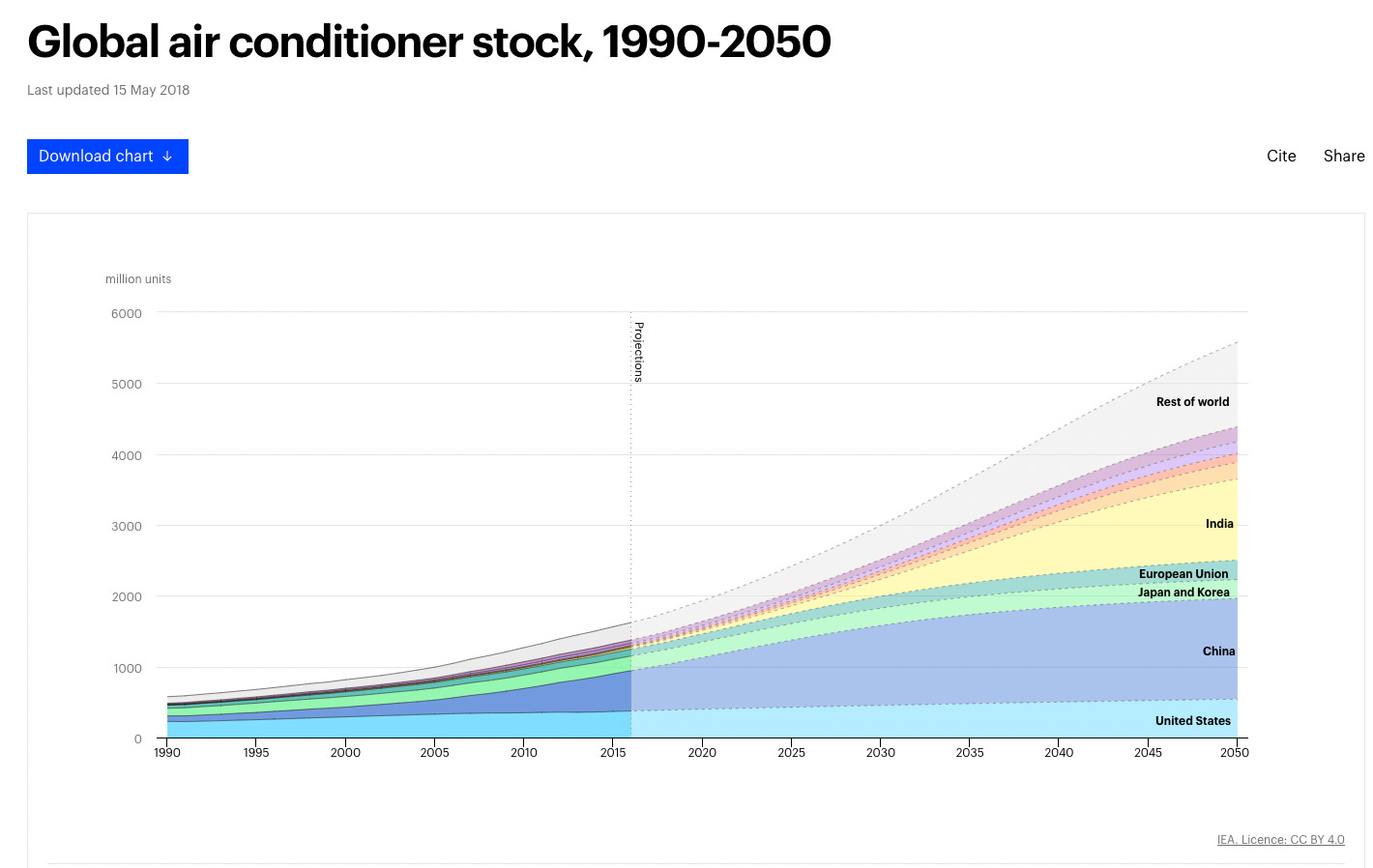

I recommend reading this report: The Future of Cooling

What jumped out to me was the generation mismatch of solar and wind with this massive growth in electricity at night. You can’t shift the solar generation, and most of these countries have inadequate wind. Most aren’t blessed with significant gas reserves, so all that baseload is going to have to come from coal.

There is a lot of catching up to do especially, when you take into account the populations of those countries playing catch up!

Supply

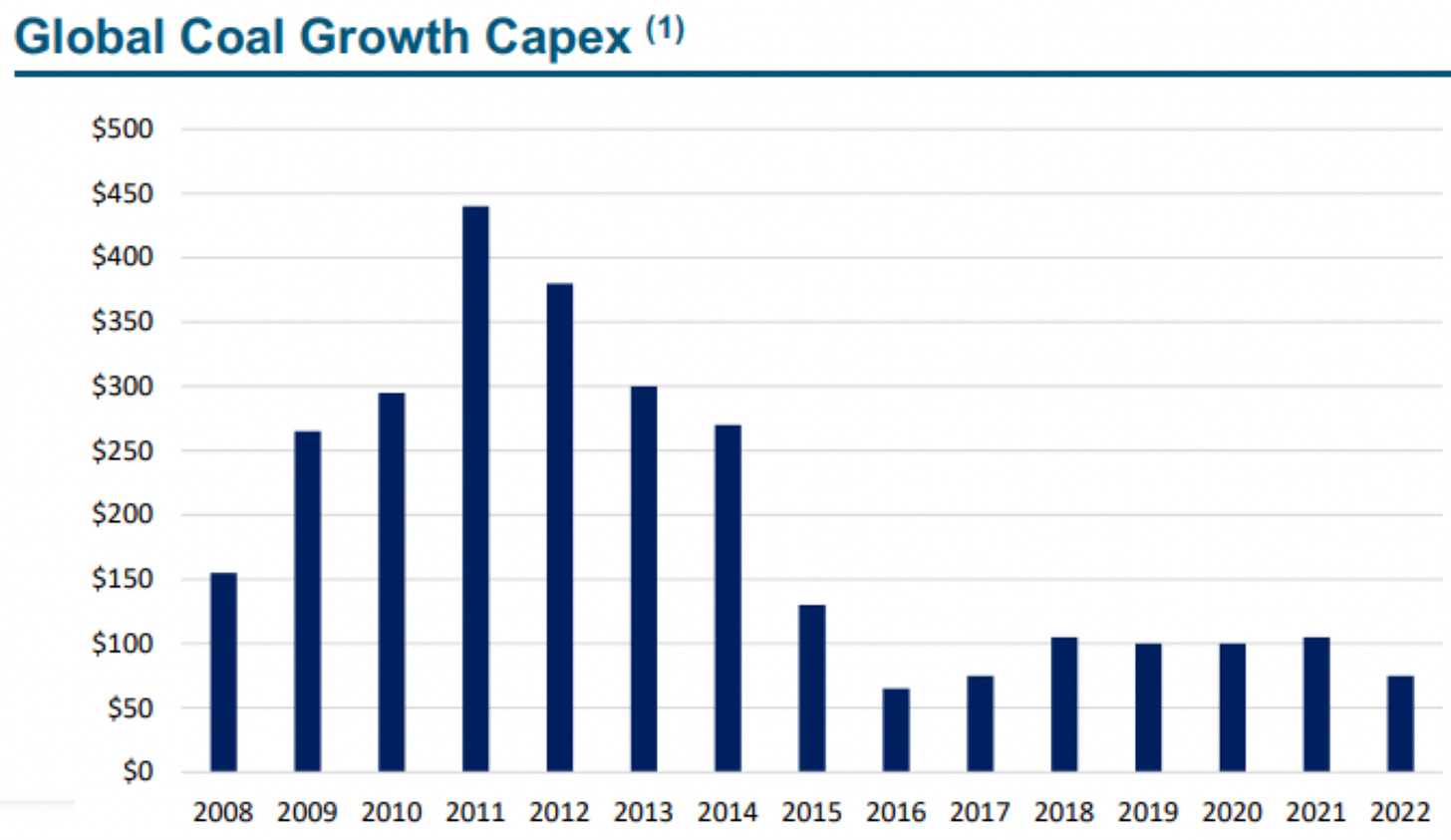

Looking at the below Capex chart, you would be unaware Newcastle hit $450 tonne at one point in September 2022 (Capex actually dropped in 2022).

Another observation is high-energy coal is mostly in countries where ESG is doing its best to destroy supply. High-energy coal is mostly underground, so it comes with higher Capex and longer development timelines. Australia and the US are doing a good job of disincentivising supply, as I’ll get to. Columbia has a president who has pledged to keep coal in the ground, and South Africa is increasingly a basket case.

Sure Russia is the exception, but then they are having to offer heavy discounts (50-60%) to move coal. Lastly, Indonesia is probably the best positioned to ramp supply but largely lacks the quality.

Buybacks > New developments

Similar to shale companies post the boom, investors are demanding capital returns, and you can’t blame them with valuations this cheap buybacks are hugely accretive. Only those already permitted mines with no-brainer economics stand a chance in this environment.

Valuations

Those of you familiar with my work will have heard me declare my love for Whitehaven and Peabody on multiple occasions (my hurdle rate has gone back and forth between Whitehaven and SPUT).

The below valuation is a thing of beauty, half cash, 1x next year’s EV/EBITDA and the backdrop I’ve spent this post outlining.

Anyone who has studied tobacco companies understands the long-term performance high levels of buybacks can achieve.

With Peabody joining the buyback party, I see these companies being long-term cash cows, granted they may lack the outright asymmetry uranium and offshore services provide. I view it as an ideal place to park proceeds from some of my more volatile investments (I’m very aware of the irony in this statement since holding Peabody has felt like one of those videos of a cowboy getting his foot caught in the stirrup at a rodeo).

Risks to the Thesis

Other than me being wrong on a whole lot of my observations above, i.e. renewables scale seamlessly, and demand for coal goes into rapid decline a la UK. By far, the most significant risk I see is government tax raids. Queensland already did it, and soon after, articles like the one below started to appear.

With the Australian transition set to be a dumpster fire of taxpayer money similar to Germany and California, coal company profits will be too juicy for states not to pillage.

The irony is this will further tighten supply as companies hit back, as we have already seen with some of the big miners: BHP confirms new investment on hold due to Queensland royalty tax regime

The worry is Australia goes full retard as we are currently witnessing in the UK with their oil industry.

The tax rate, which has been at 75% for the companies since last year, will return to 40% if average energy prices fall to $71.40 a barrel for oil and 54 pence a therm for gas for two consecutive quarters.

The government said it is aiming to secure energy supply and protect jobs, but it acknowledged that the measure is unlikely to kick in before 2028, when the windfall tax is due to end anyway — and by which time a new government is due to be office.

Final thoughts

The coal setup continues to look great to me, with demand set for steady growth on the back of developing countries while supply will continue to be constrained for the foreseeable future. Most institutions, funds, ETFs won’t touch coal, so it will be the tobacco company playbook, the companies re-rating themselves via buybacks and dividends. The big risk is excessive profit taxes which can be managed to a certain extent with a global basket approach.

Cheers

Ferg

P.S I appreciate you taking the time to read this, and feel free to forward it to anyone you think might enjoy it.

what a banger of an article!!!!!!!!!!!! so glad to see you back, you've gone awol lately!

Great Article. On the demand side I would add that one heat pump installed per houshold would double the energy need of that houshold. Germany and France are allin on heat pumps.One Ev per household increses the nead by 40%.