I'll save you some reading with this meme if you are short on time.

If not, let me begin.

The cold, hard reality is everywhere in the world other than in a few rich Western countries: growth and energy security concerns outweigh emissions and green aspirations.

India's power minister spelled it out loud and clear at the G20 in New Delhi.

Power Minister Raj Kumar Singh said in an interview this week in New Delhi. India is also planning major investments in renewable energy, but it has to prioritize providing reliable power to spur economic growth, he said.

“My bottom line is I will not compromise with my growth,” Singh said, adding that India will not hesitate to import coal to meet any shortfalls in domestic supply. “Power needs to remain available.”

The G20 summit in New Delhi occurred from the 9th to the 10th of September, where the aim was to double down on the Paris Agreement.

What's barely been reported is instead of these sorts of headlines following the summit.

We got this announcement ten days after the summit ended.

This has little coverage in the media (at the time of writing this, I can't find a Bloomberg or Reuters piece on it). There is no way you can spin this; India (and China) have no intentions of adhering to the Paris Agreement.

To help understand the magnitude of this announcement, consider the current ranking of global coal consumers. The amount of coal India intends to add by 2030 (6 years) is 292 million tonnes per annum. If it were a country, it would be the fourth largest consumer globally ahead of Russia and Indonesia!

China now has 243 GW of coal power under construction and permitted. When projects currently announced or in the preparation stage but not yet permitted are included, this number rises to 392 GW. This means that coal power capacity could increase by 23% to 33% from 2022 levels.

So India intends to add 25% to its coal capacity, and China intends to add between 23% and 33%.

If you use the assumption that 3.5 MT of coal is required to generate 1,000 megawatts (MW) granted, I'm not sure how Indian plant load factors compare to Chinese.

3.5 MT x 243 GW (under construction) = 850 MT per annum

3.5 MT x 392 GW (planned but not permitted) = 1,372 MT per annum

If all those Chinese plants are permitted, then China will be ~5% off adding a whole India, including all the recently announced coal additions. If you use 33% of China's latest annual consumption, it's more than India at 1,500 MT per annum.

Put another way, China could add more coal capacity by 2030 than Russia, Indonesia, Japan, Germany, South Africa, Turkey, Poland, South Korea and Australia combined.

Let that sink in….

I won’t dig into coal supply again here (you can read this if you want that angle) other than to say the below chart is a decent illustration of coal CAPEX across the West.

The steady flow of the below type announcements means coal supply should remain tight for years to come as US has the largest coal reserves globally while Australia comes in third (behind Russia).

Michael Bloomberg pumps $500 million into bid to close all US coal plants

Former New York City Mayor Michael Bloomberg has pledged to invest $500 million in the next phase of his Beyond Carbon initiative. The goal is to close down all remaining coal plants in the United States and reduce gas-fired capacity by half by 2030. This initiative will work with state and local organizations to retire about 150 coal plants, cut current gas generation, and prevent the construction of new gas-fired facilities. The funds will be used for legal action against utilities and power companies, policy advocacy, and financing for communities affected by coal plant closures.

Queensland’s coal bonanza to fund green power shift

Queensland Treasurer Cameron Dick will use a $15.3 billion coal royalty bonanza to cut household power bills* and inject $19 billion into state-owned clean energy projects, a spending spree economists warned could be inflationary.

*The cost-of-living package – which will include a $550 energy rebate for all households and up to $1000 in rebates for vulnerable households

Permian the last hope for oil growth

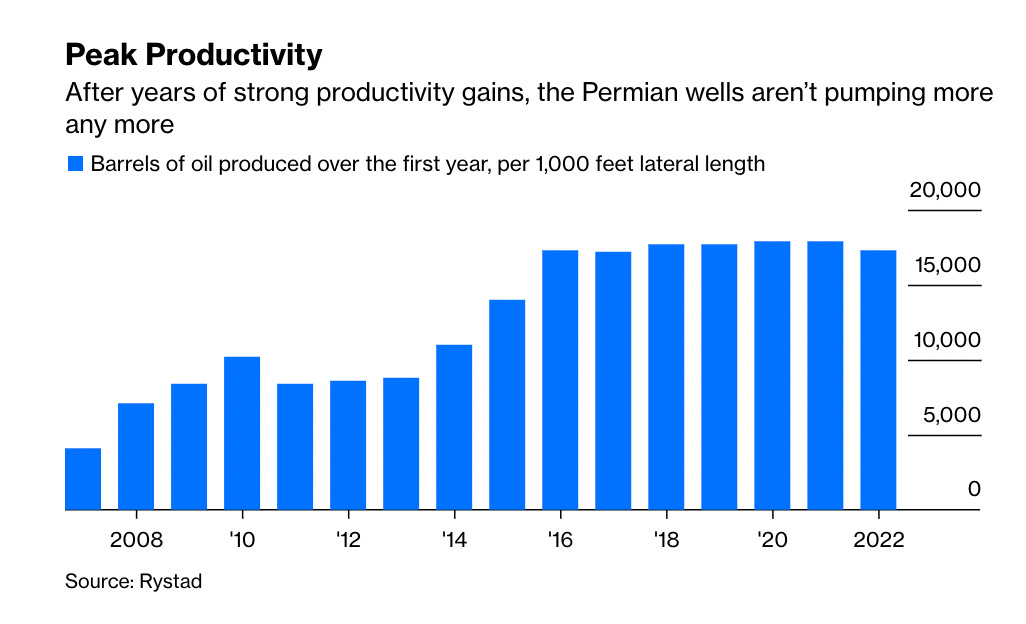

Shale has provided ~90% of the oil* growth over the last decade and is now rolling over.

Yes, even the Permian.

*Less than 60% of U.S. "oil" production is really oil; the rest is non-petroleum and comes from natural gas, plants and refinery gain (if you want to go off on an interesting tangent, read this great piece).

It's no secret that the Eagle Ford, Bakken, Niobrara, Mississippian, and Austin Chalk are now in decline.

The hope lay with the Permian that it could ramp as oil prices rose or, more recently, maintain current production levels.

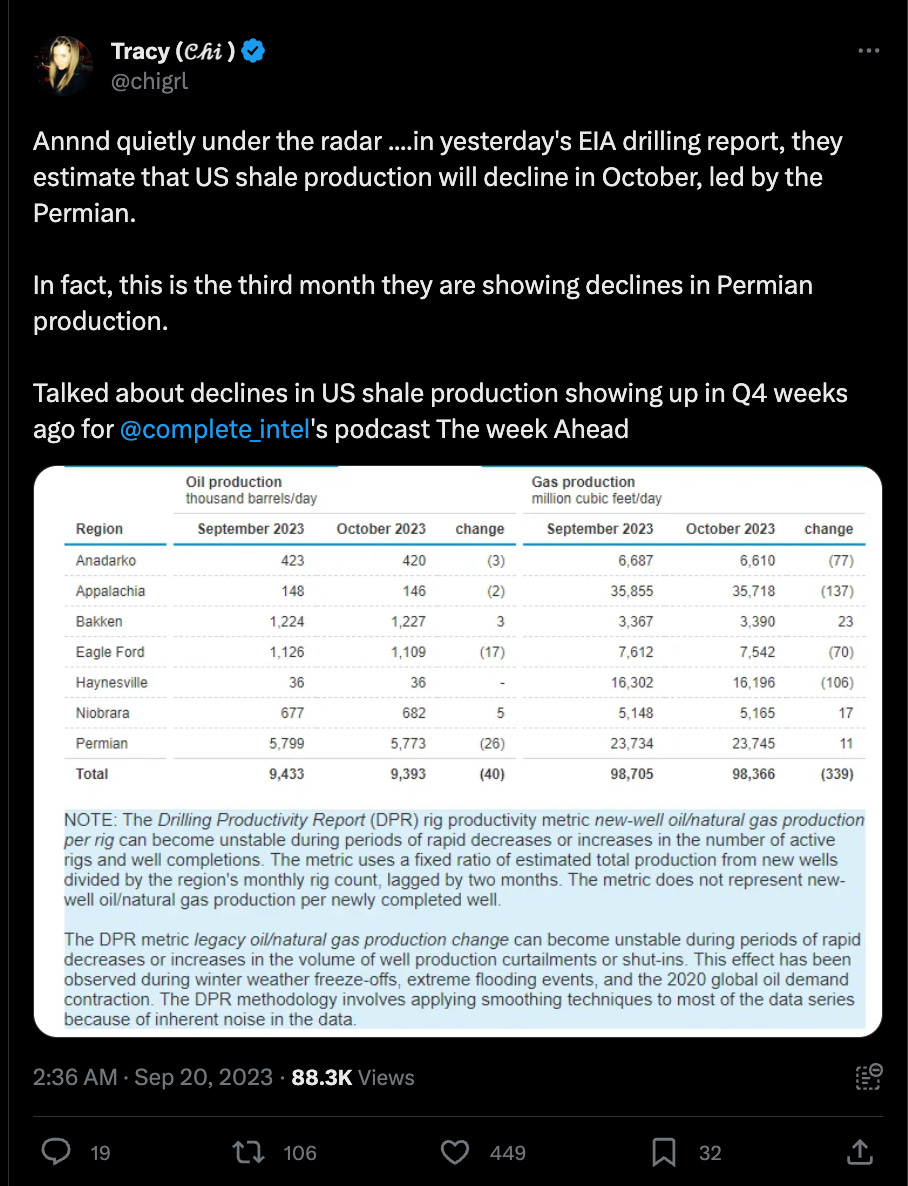

GoRozen had recently been forecasting that we could see Permian roll over Q1 2024, but as Tracy (amazing Twitter follow and recommend her paid Twitter feed) has pointed out below, the Permian has now racked up the third month of declines.

Shale is not going to plug the widening supply-demand gap, if anything, shale's sharp decline rates will make it worse.

Saudi isn’t coming to the rescue.

Global oil markets face a supply shortfall of more than 3 million barrels a day next quarter — potentially the biggest deficit in more than a decade — as Saudi Arabia extends its production cuts

A nasty recession will struggle to plug this gap at this point.

The majority of forecasts over the past few years had oil slowly grinding up to 105 million barrels per day by 2030, but it's now on track to hit it by the end of next year (which gives the Green Transition a whole lot less runway than it thought it had).

Price and resulting supply destruction will have to fix this issue short/medium term.