Rigging the Market...

Some changes to my portfolio post the news of Transocean to acquire Valaris

I sure as shit didn’t see this acquisition coming, not that I’m complaining as a long-suffering driller bull! My heavy allocation to offshore drillers has been an anchor on my performance for a while now.

Nice takeout premium, better management, and better liquidity, what’s not to love!

“Transocean expects its leverage ratio to drop to about 1.5 times within 24 months of closing, alongside improved liquidity and a lower cost of capital.”

-Keelan Adamson, Transocean CEO

This puts an end to the “how will Transocean weather a potential downturn” and, combined with the boost in liquidity, will open the door to big money flows. I’ve learned not to underestimate just how much this can benefit the leader when a hated sector inflects (think Cameco…)

Few would debate that Transocean management’s track record is superior to Valaris, having done a great job navigating a brutal decade for drillers.

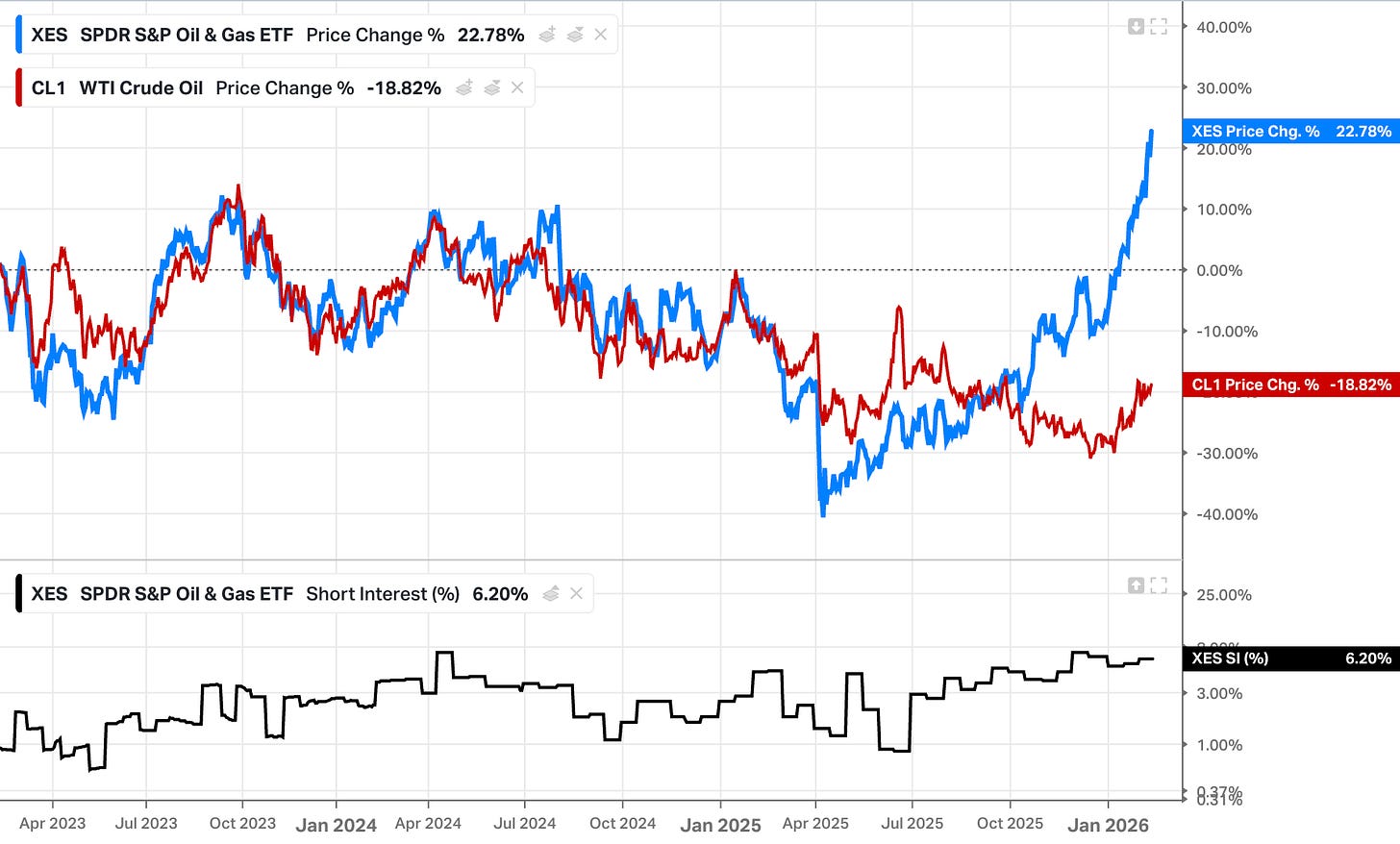

I’ve written a few times now, I believe, that we saw oil services bottom post liberation day (and OFOS ETF delist), as they’ve traded independently of oil for the past year or so.

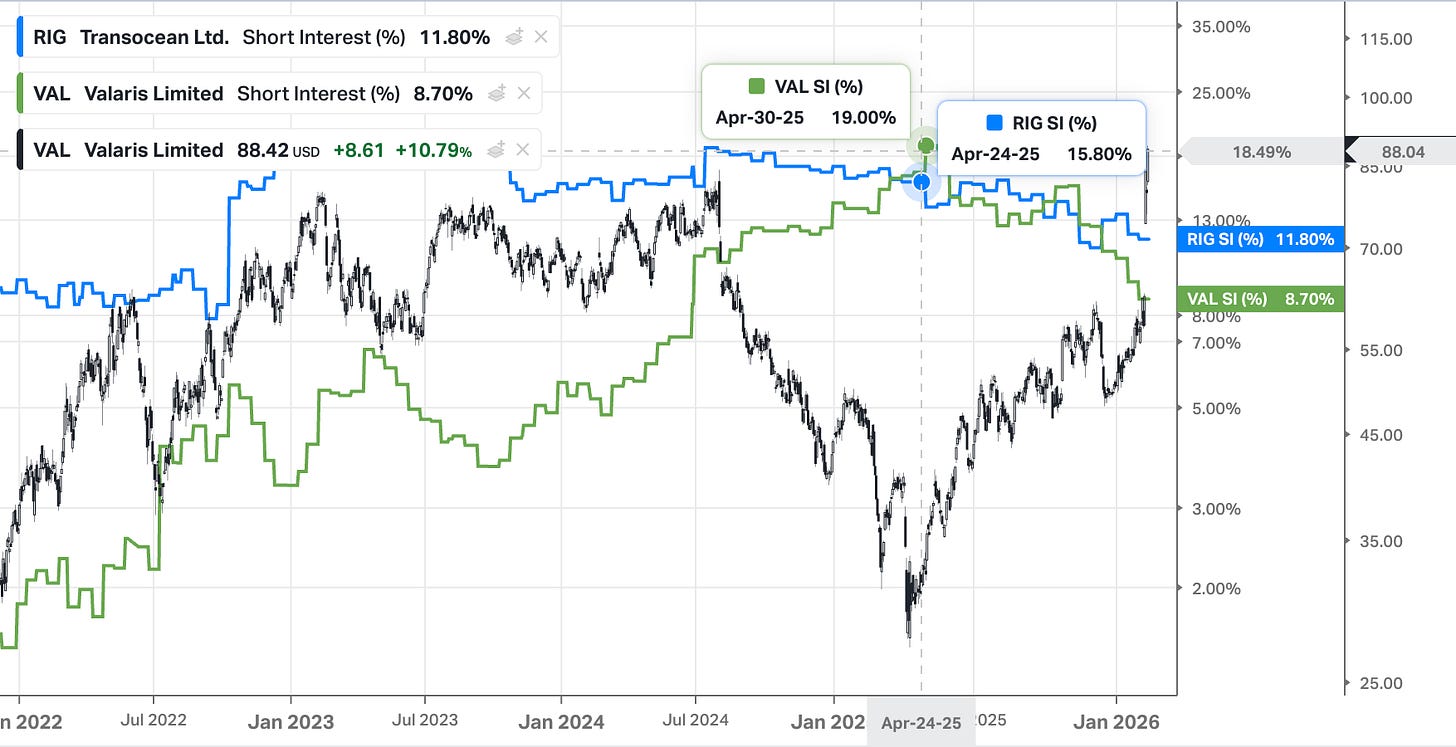

Short interest still sits at 6.20% for the XES ETF and is likely adding fuel to the fire for Transocean and Valaris, which both had high-teens % of their floats short last year. The last few months and the announcement of Transocean’s acquisition will have been brutal for the Valaris shorts.

Sentiment got pretty grim for oil and drillers, especially post the liberation day smash, but for those focused on the consolidation going on behind the scenes, the setup just kept getting better.

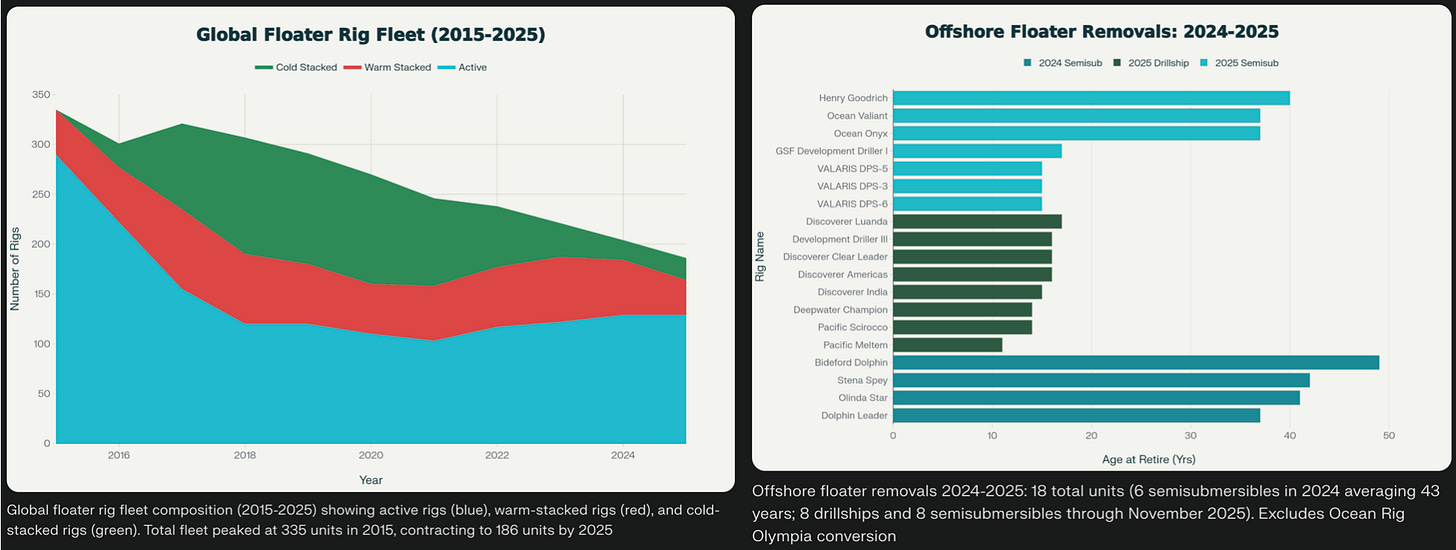

The floater fleet has been cut in half over the last decade and is now consolidating ownership.

Since 2018, 28 drillships have permanently exited the global fleet (24 recycled, 4 converted)

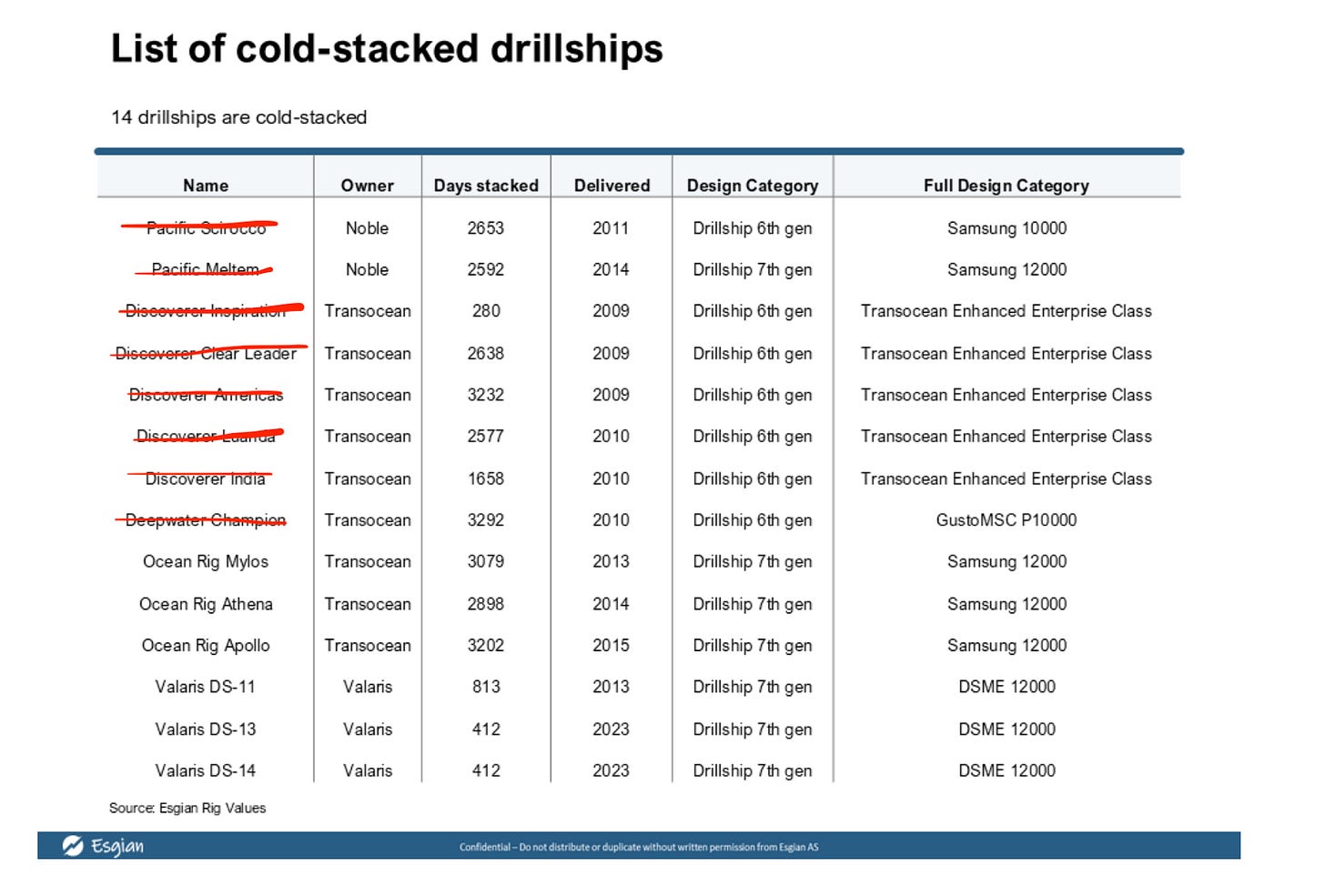

Consider that Transocean will be in charge of ALL the marginal cold-stacked drillships supply (bar Nobles Globetrotter II, which is held for sale). Esgian posted this at the start of 2025, and one by one, they got crossed off.

The rest of the cold-stacked supply is highly unlikely to be contracted at this point.

Seadrill still has its three 6th Gen Semisubs.

West Aquarius — Seadrill (2008)

West Phoenix — Seadrill (2008)

West Eclipse — Seadrill (2011)

Mexican operators (6th Gen)

Bicentenario — Grupo R (Mexico) 2010

Centenario GR — Gremsa / Grupo R (Mexico) 2010

*GSP Deep Driller, a 2005-built semisubmersible owned by GSP Offshore which is almost certainly destined for recycling.

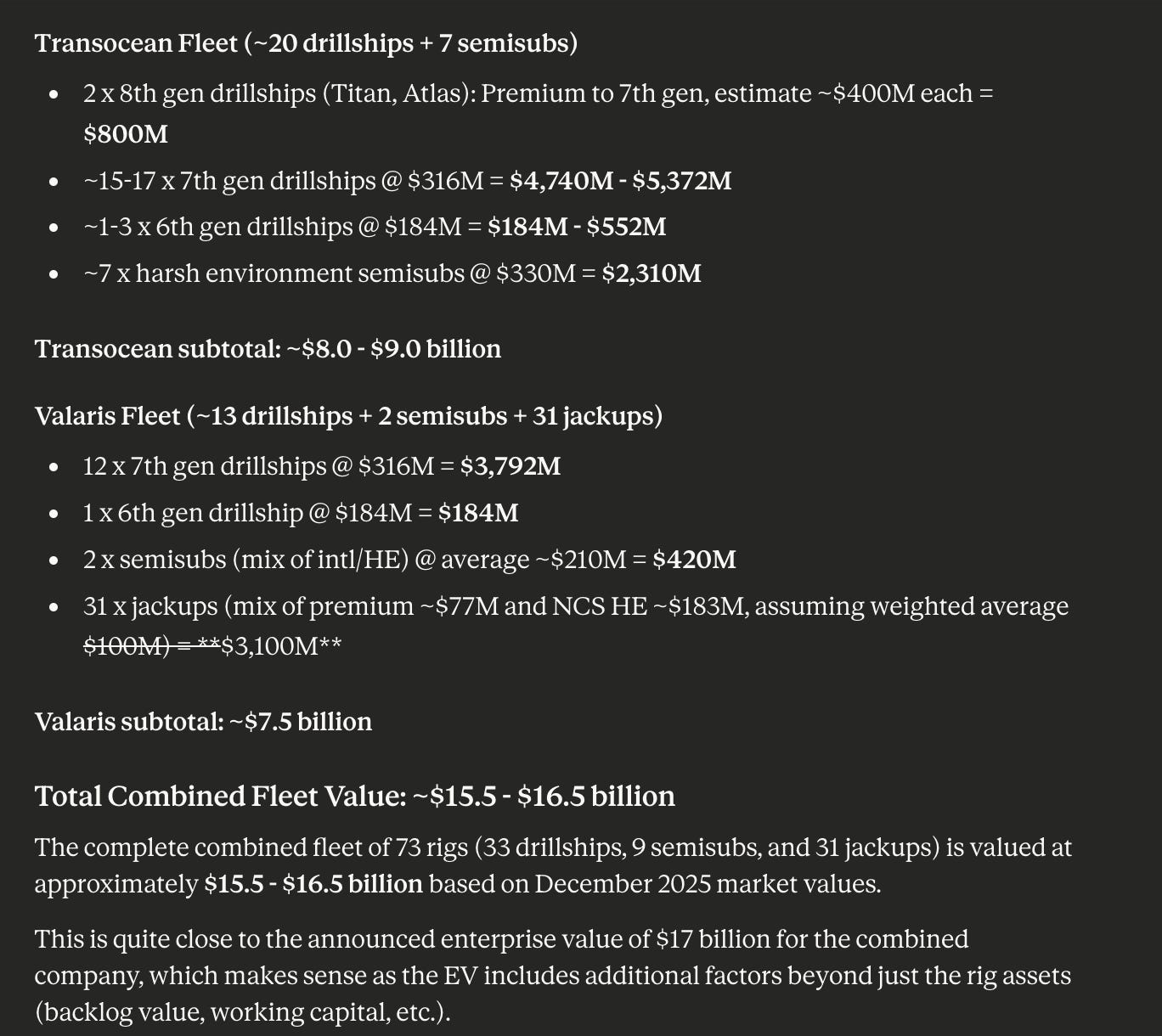

What are the Rigs worth?

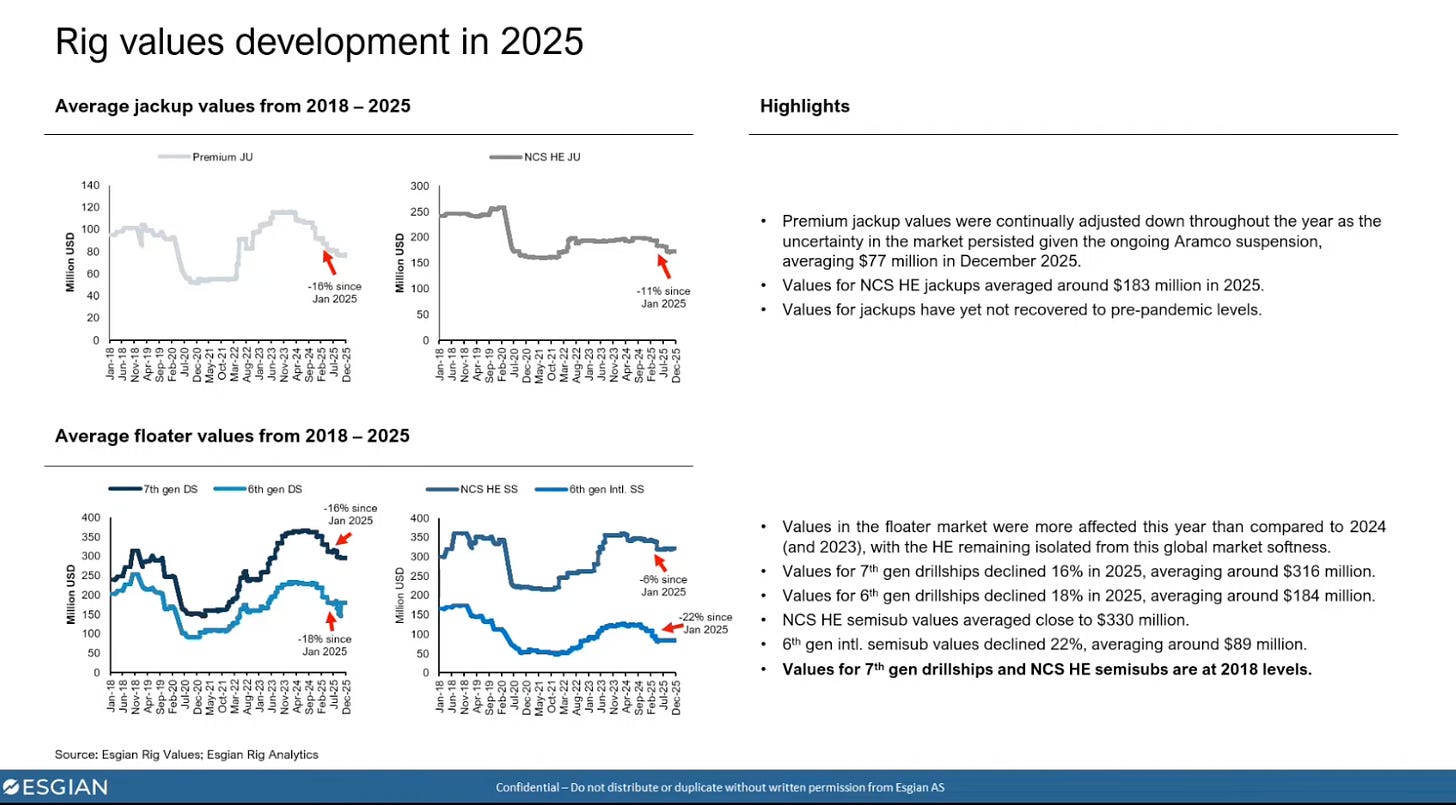

This is what Esgian is pegging their values at today.

$316m for a 7th gen drillship.

$184m for a 6th gen drillship.

$330m for a HE semisub.

$89m 6th gen semisub.

$183m HE jackup.

$77m premium jackup.

These values land pretty much at the announced EV of $17billion.

While the drillship orderbook is currently empty, so there is no recent newbuildvalues, but if you want a new drillship, you are looking at ~$1 billion and a 4-5year wait list before considering the deposit is now 30-40% (compare to ~10% last cycle) due to the capital destructive reputation the drillers have earned themselves the last decade.

I covered it in these pieces: Digging into Shipyards & Heading to the back of the Newbuild Queue.

The summary is essentially that shipyards are at full utilisation and that a whole line of vessels with low order books needs replenishment in the coming years.

What would it take to order a new build drillship?

Newbuild “stimulation zone”

It’s going to have to be north of $700k dayrates before newbuilds are even considered.

Odfjell Drilling, the manager of eight such units, says that a new HE floater could take around four years from project sanction and cost $800 – $ 1,000 million. Furthermore, dayrates needed to justify a newbuild would need to exceed $720,000 with a five-year contract. It is noteworthy that HE rates have crossed the $500,000 threshold this year.

-Odfjell Drilling Management

Other reasons for this cautious approach include limited yard availability, long lead times, and the challenging economics of such an endeavour. One of the largest offshore drilling contractors, Noble Corp., believes that newbuilds are “prohibitively uneconomic.” According to Transocean, newbuilds drillships are expected to cost $1billion+, with a minimum five-year lead time.

-Why newbuild orders face high barriers despite offshore drilling upcycle

According to estimates supplied by rig owner estimates, constructing a new drillship would cost over $1 billion, with a build time of around three years. Assuming 90-95% utilization, a dayrate of $650-700,000 would be needed for a standard 12-15% return on investment over the vessel’s anticipated lifespan of ~25 years.

-No resurgence seen for newbuild rig construction (Sept 2023)

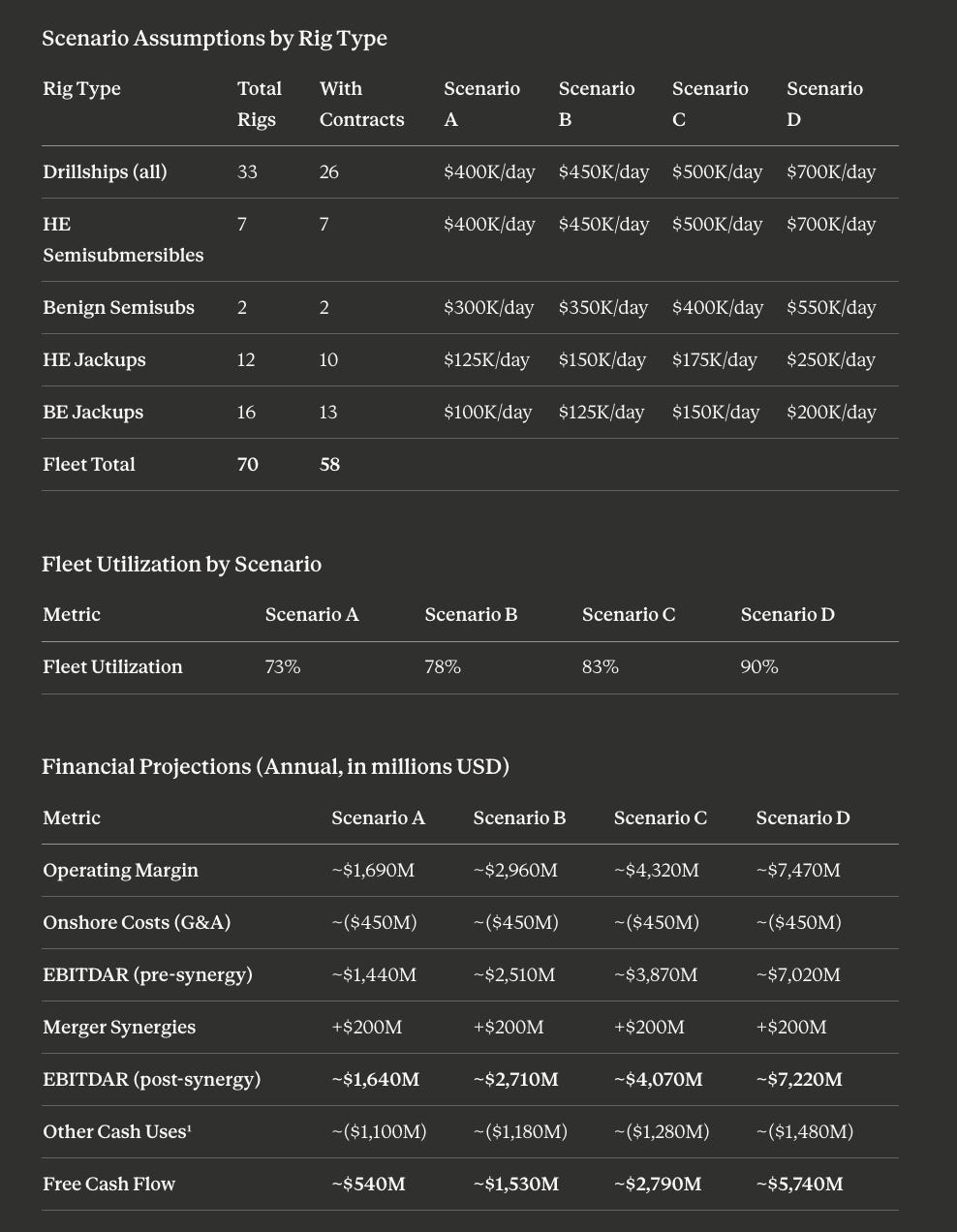

If you run a rough sensitivity table for a range from $400k to $700k dayrates, you see how ridiculous the torque is.

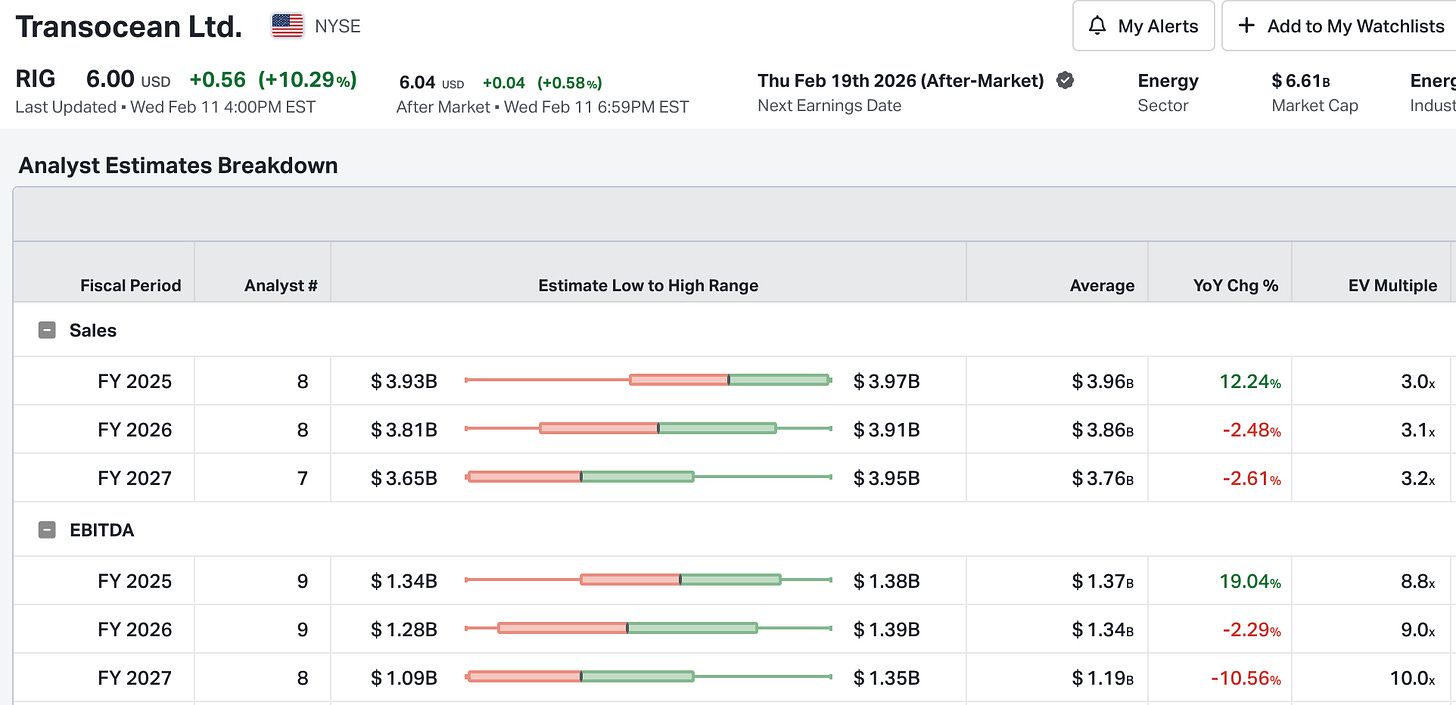

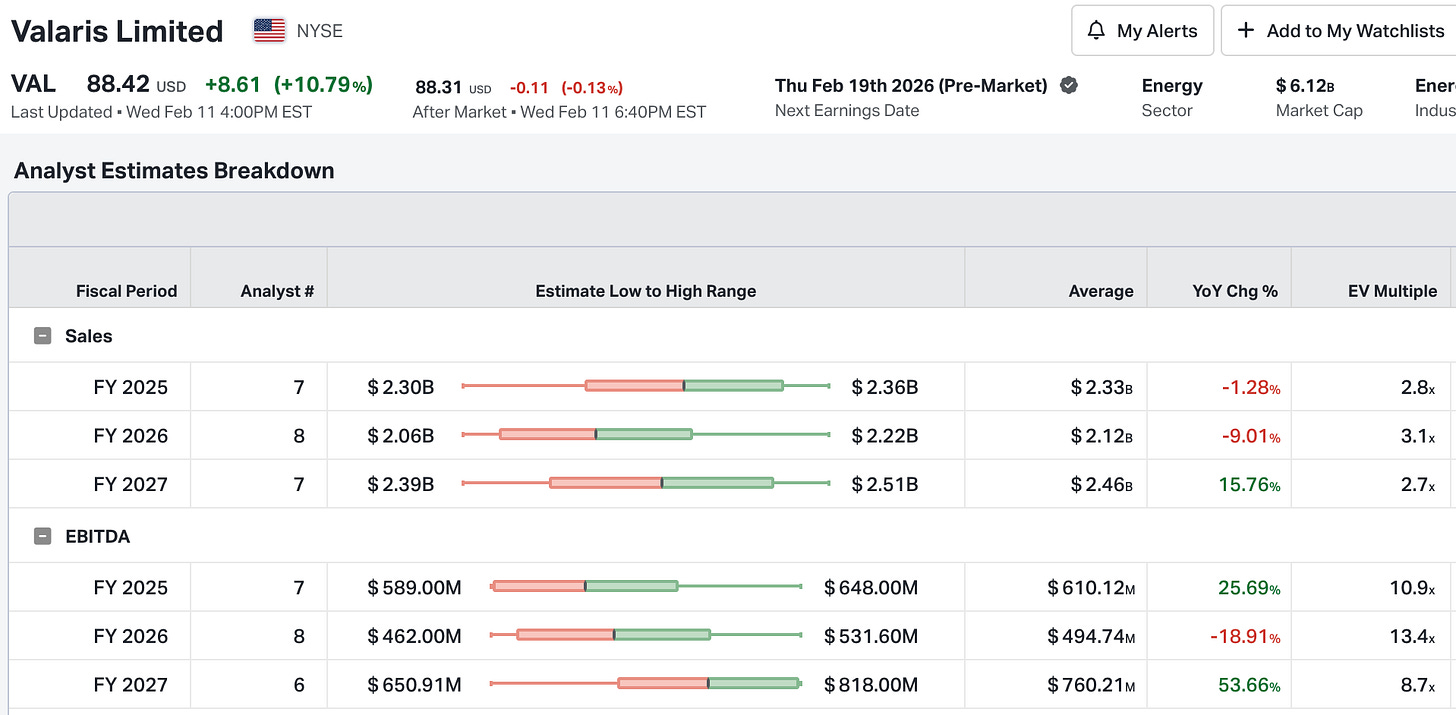

Scenario A roughly aligns with analysts’ current forecasts ($1.34B + $494m = $1.83B EBITDA F26) and a 6% uplift for FY 2027.

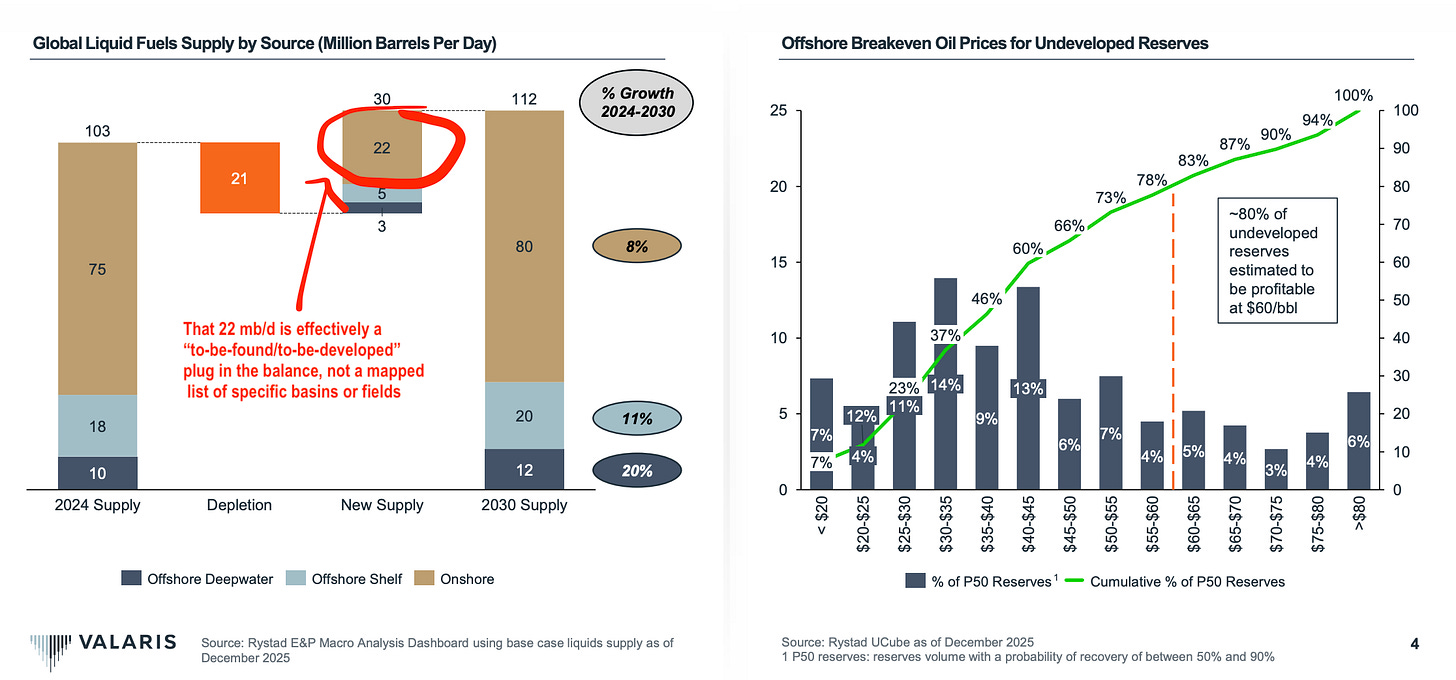

This chart from a Valaris presentation illustrates just how low offshore breakevens have got, with 60% of undeveloped reserves profitable at sub-$45/ barrel… Offshore is where the cheap, undeveloped oil is now that shale growth has stalled out.

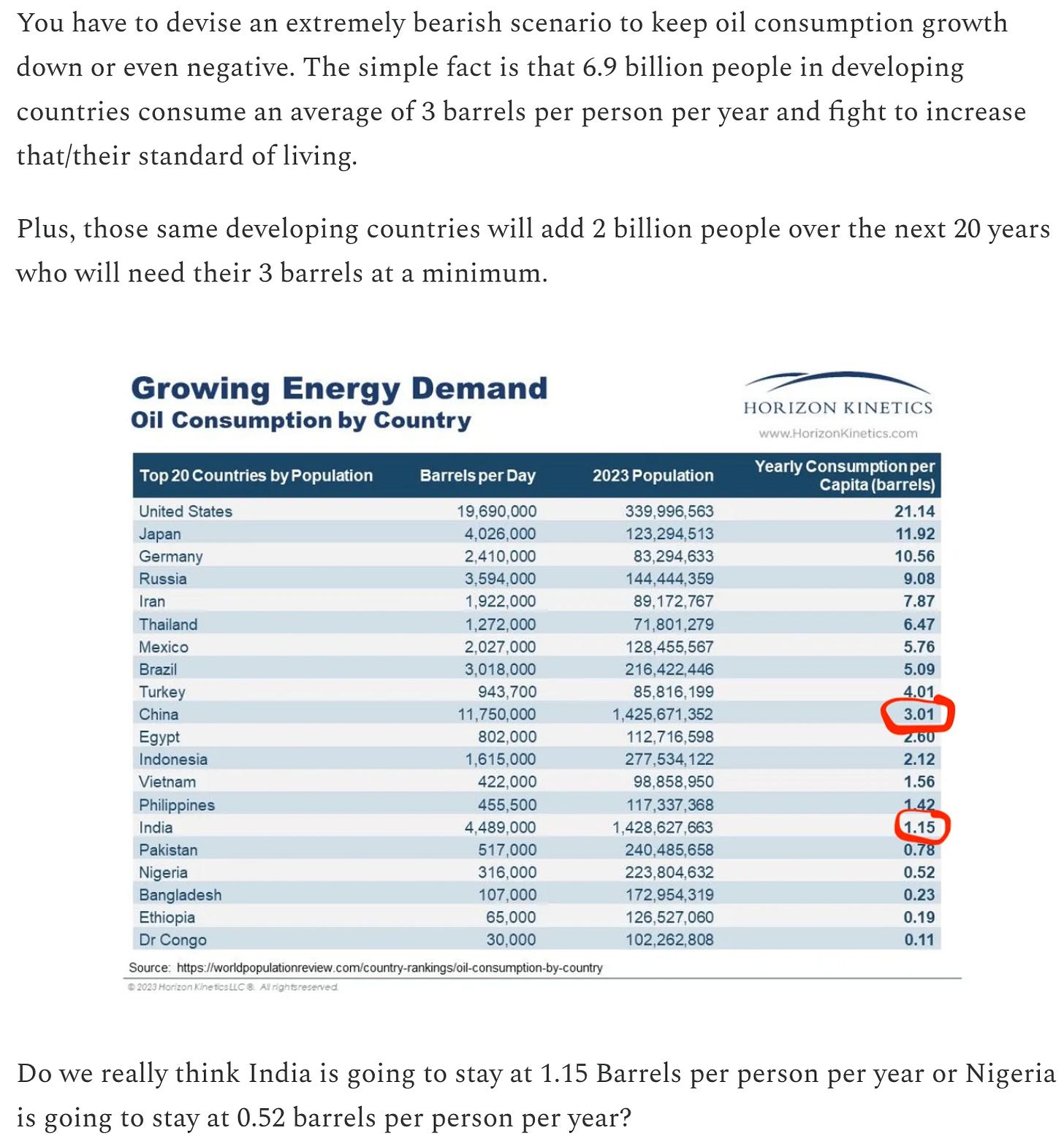

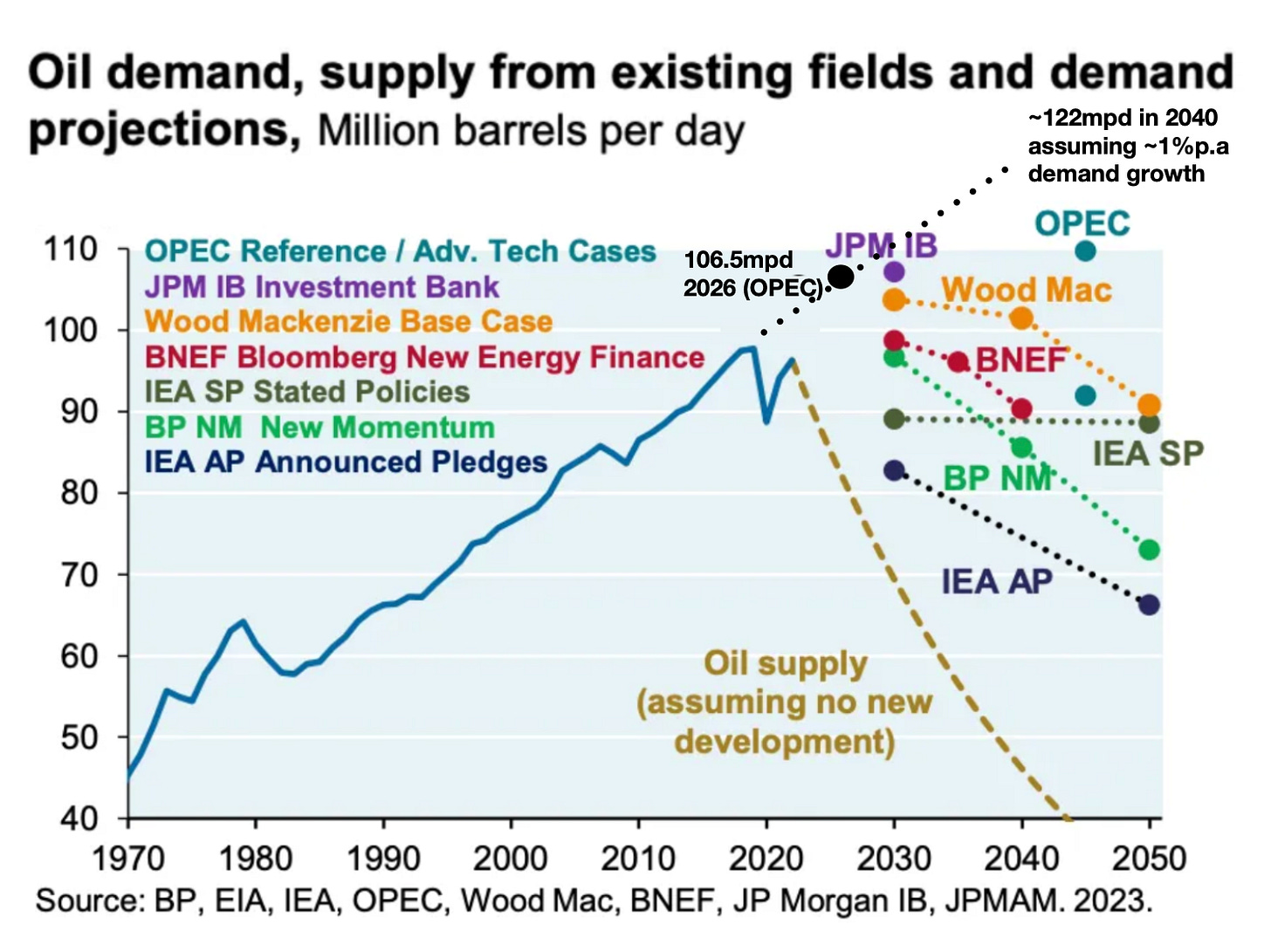

Not to veer off into oil macro, but it never ceases to amaze how oil demand growth is chronically underestimated, particularly in developing countries.

I outlined my view on oil demand in Assessing Oil’s Risk Reward, with my favourite chart being this one.

I guess I should just be thankful the whole Net-Zero ideology exists since I can take the other side of it with my portfolio.

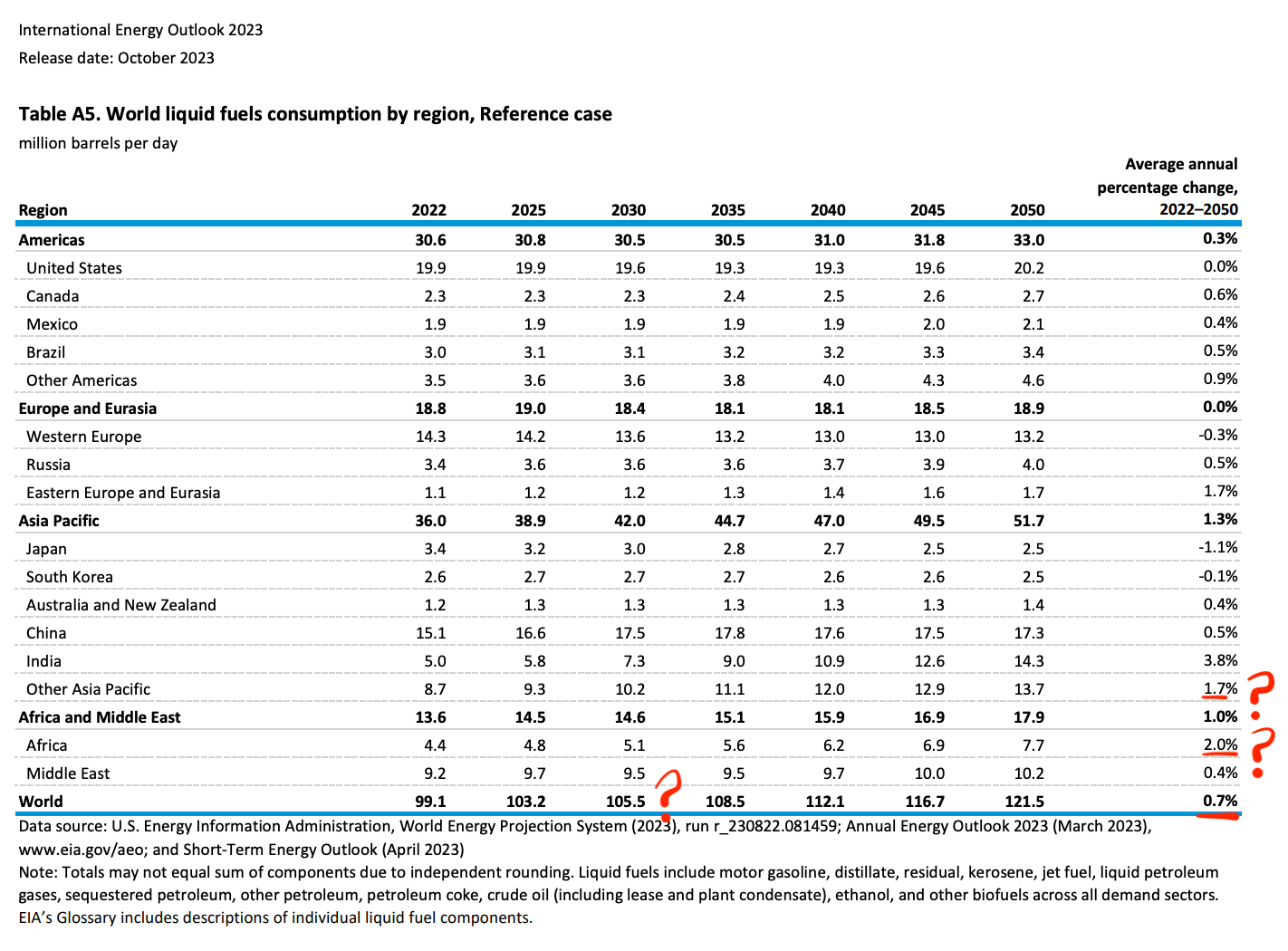

IEA oil forecasting is a comedy show, but I thought the IEO reports from the EIA were decent until they stopped… No IEO 2024 or 2025 has been published, with over 40% of EIA’s workforce gone. This is a disaster in itself as IEA forecasts fill the vacuum left.

We are running 5 years early on IEOs forecasts, and I believe the Asia Pacific and Africa assumptions will prove way off (The Coming Asian Boom).

Once the glut narrative has a quiet death, the OPEC spare capacity will be worked through before the end of 2027, along with the last of cold stack rigs activated or scrapped, then the party really starts.

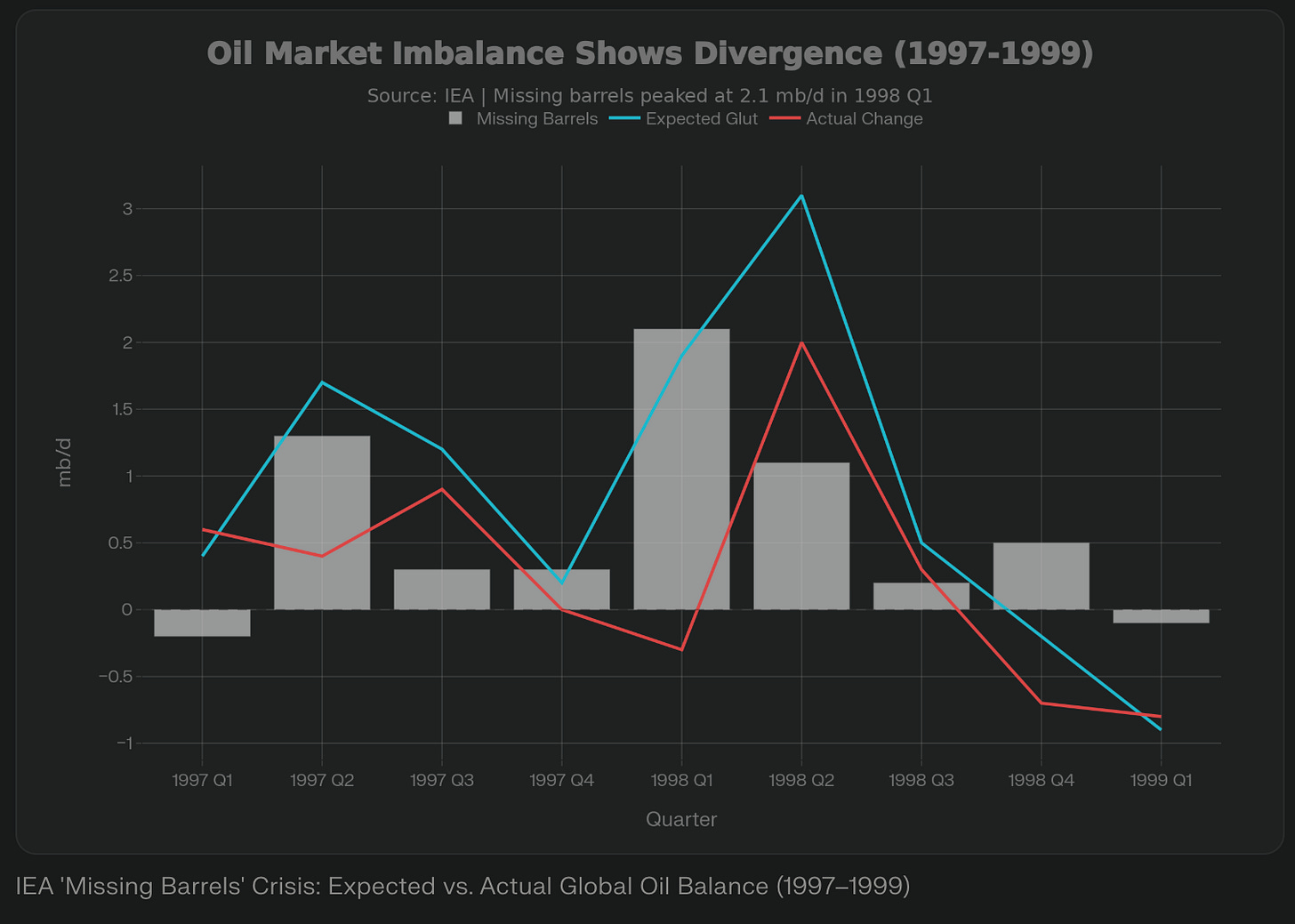

Talking of the “glut”, you might find this little bit of history interesting….

The IEA’s 1998 “Glut Forecast”

The “missing barrels” controversy of 1997-1998 provides evidence of the IEA’s systematic forecasting problems.

During this period, critics accused the IEA of over-estimating supply and under-estimating demand, contributing to perceptions of a market glut that depressed prices. This issue became so controversial that Senator Pete Domenici requested a U.S. Government Accountability Office investigation into the IEA’s statistics.

Asian demand unexpectedly surged back, and the market shifted from significant oversupply to tightness. By the end of 1999, the oil market was experiencing excess demand, and prices had recovered substantially.