The four most dangerous words in investing are “this time it's different.”

- John Templeton.

There is an interesting aspect of the interview with John Templeton that is often overlooked.

Many of these arguments will be tempting because they will have some element of truth to them. Even Mr. Templeton concedes that when people say things are different, 20 percent of the time they are right. But the danger lies in thinking that the different factor — like the recent investment in United States stocks by the Japanese — will be uninterrupted.

This brings me to this quote I recently discussed with two sharp thinkers, Paulo Macro and Chase Taylor.

It suggests that in multi-currency commodity markets with net gold settlement options, the release valve of global inflationary pressures will continue to be the gold/commodity ratio rather than the price of commodities.

Most western market participants continue to prefer commodities as their preferred inflation trade expression, trained by 40+ years of experience in a USD commodity monopoly world…which no longer exists.

We continue to believe that gold and BTC should outperform commodities as an inflation hedge in coming years (i.e., “gold and BTC are the new oil”).

-Luke Gromen

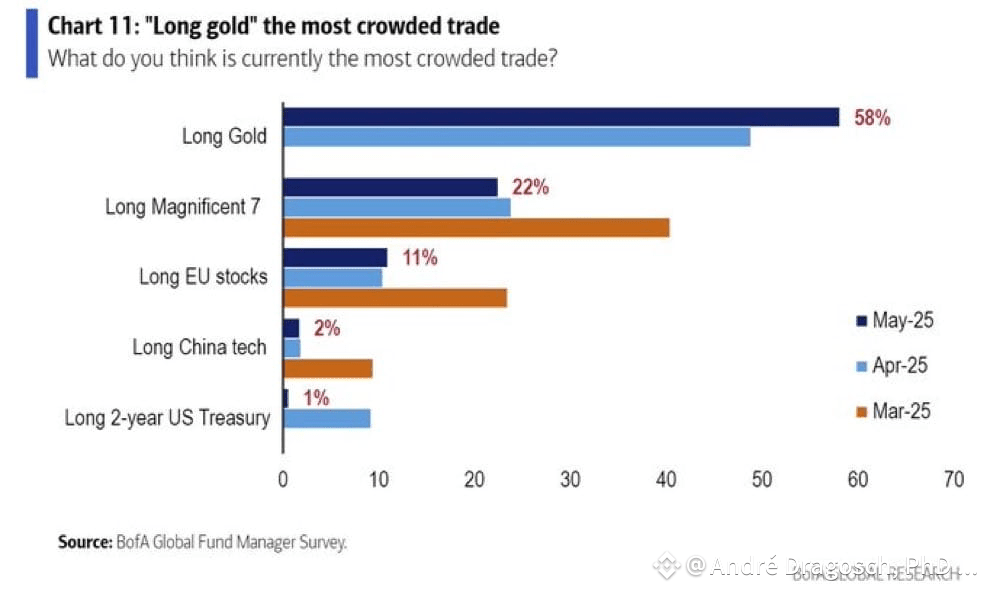

Is this the 20% when it's actually different, despite the charts and surveys indicating that gold is overvalued and the most crowded trade?

58% believe gold is the most crowded, compared to 22% for the Mag7 (I would like to see this survey for June!).

Why, I don't doubt gold is heading way higher.

It's the only asset that can re-collateralise the system without killing demand or breaking things.

The stock-to-flow ratio (inventories divided by consumption) is the most straightforward way to illustrate this. Gold's stock-to-flow ratio is 65, while the majority of commodities hover just above one, meaning you can't separate fundamentals from price for very long. For example, high oil inventories are typically around 1.3, but when the market gets tight, it can drop down to 1.1.

What reinforces this view is the move in gold has primarily been driven by central banks to date, with retail participation largely absent in the West (take GDXJ outflows the last year as a proxy for retail speculative interest in gold).

I've gone over it in multiple pieces now, but the US can't stomach austerity (as we found out with DOGE, TACO, etc.); the US isn't going to default, so printing the difference is the only way forward.

Gold is essentially the other side of long-dated treasuries, which will ultimately be eroded in real terms.

If I were allowed only one trade for the next decade, it would be tough to beat long gold and short, long-dated treasuries.

Bitcoin?

I’ll be the first to admit my skepticism has been dead wrong. From questioning Tether to thinking Saylor would come unstuck, none of which has come to pass. The tight correlation to NASDAQ also makes me question its place in my portfolio; perhaps I’ll reconsider if it has another nasty pullback. Having read more of Luke Gromen’s and Lyn Alden's work on Bitcoin, I do think it has durability.

This troll has a valid point, and congrats to those that have had conviction in it and ridden it to big gains.

This decade’s “Buy and hold”

The way I'd frame it is that gold will be the new "passive" in buy-and-hold; the "always buy the dip" approach is how market consensus will come to view gold, with a focus on real returns, as it becomes clear that Treasuries are on their way to reclaiming the title "Certificates of Confiscation."

I enjoyed Kevin Bambrough's theory that we have a bubble in books and experts recommending buying passive indexes as you can't beat the market, which could well mark the top of its outperformance.

The gold-to-S&P 500 ratio supports this view

What does this all mean for the rest of the commodity complex?

There are two frameworks I’d like to point to:

Paulos's idea of Rolling Crackups, which he outlined here, is a fantastic read (and he touched on it in our recent interview).

Underinvestment has gradually pushed supply curves up and to the left over time, and this in turn has changed the character of today’s commodity price moves. While the 2000s rising tide shifted curves into backwardation all at once, the phenomenon today is characterized by a series of Rolling Crackups precipitated by lack of inventory and investment.

Touching on the same idea is Kevin Bambrough’s idea of playing Whack-a-Mole in the portfolio and that at any time there is likely a superior setup to gold in the commodity space if you are prepared to put in the work and understand supply and demand.

This chart illustrates the idea nicely.

I don't think extrapolating the price action of the gold-to-GSCI ratio from 2008 onward is a bad roadmap for the next decade. While the ratio has headed higher, there was no shortage of opportunities to outperform gold for periods.

Take tin, uranium, and rhodium, where there have been multiple periods of outperformance and underperformance vs. gold in the last decade.

Or, for a little bit of trivia that adds to my confirmation bias.

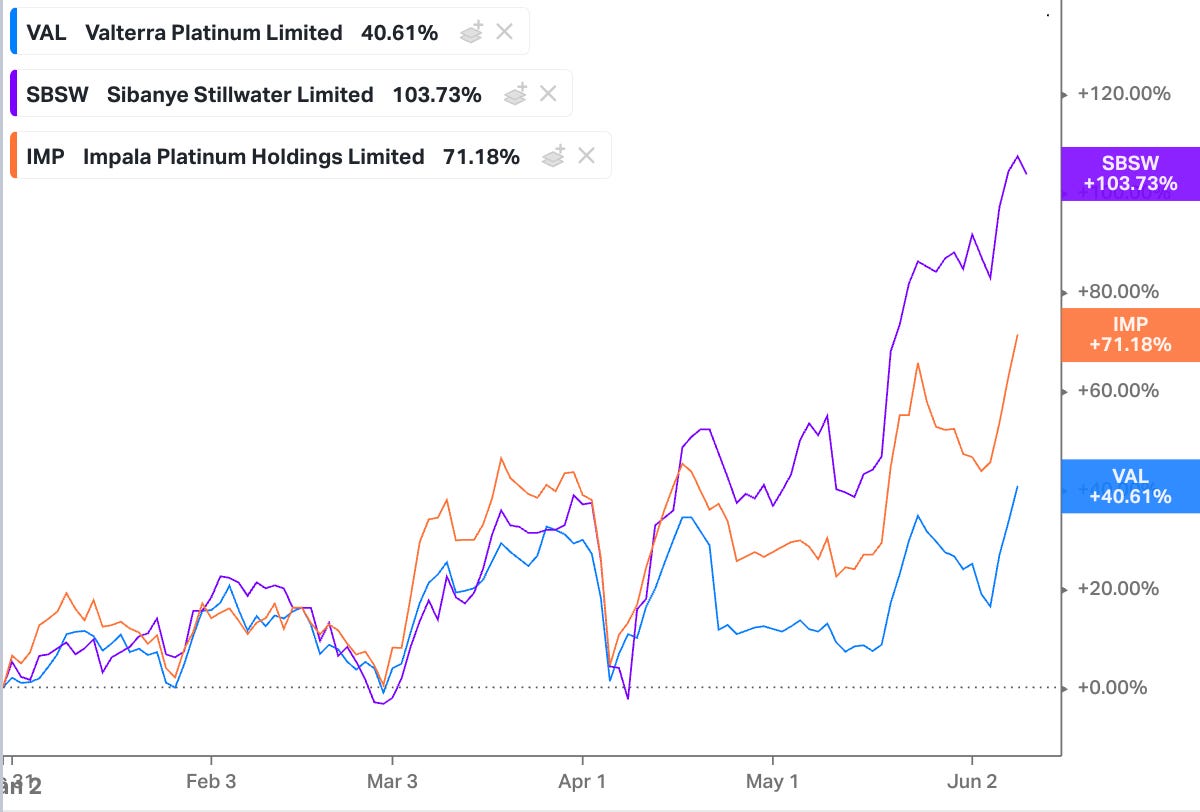

If you run a performance year-to-date comparison, both platinum and rhodium are outperforming gold (yes, rhodium is outperforming gold by 0.6%, but I'll take it…)

I've chewed your ears off enough on the PGM trade lately (here, here and here), so I'll just leave it at this: the fundamentals are outstanding here, with demand likely to be surprisingly resilient while supply and global above-ground stocks are in trouble.

Price is how you resolve the above; it's really that simple, and it looks like investors are catching on to this with PGMs' equity price response over the last few trading sessions.

Playing the ratio game

A practical takeaway from all of this is using gold as a rebalancing mechanism when a commodity really runs, as the supply response will inevitably mean there is a better risk-reward elsewhere.

I know of no clearer example of this in the last few years than coal vs gold (all hindsight bias, of course.)