Signs of Life

Filling the shopping basket with gold, rhodium, platinum, and palladium.

Living in Bali, I have the pleasure of seeing how the U.S. trades when I wake up, and then the ASX opens a few hours later.

Joking; I’m more of a single-malt guy…

Lately its been a game of spot the green square.

I won't give you more brain damage by analysing Trump's plans; honestly, I have zero clue how this plays out.

Bar two points:

There is a limited window to do deals to get tariffs back to a 10% baseline (higher for China) with the market crashing, tax receipts and U.S. consumer spending will follow suit blowing out the deficit (rates aren’t playing ball either as Luke Gromen points out).

“Since late Feb, a 19% decline on SPX drove a 19 bp decline on 10y UST yield.

This is like pissing your pants to warm up in subzero weather; feels great for a little bit, but in a few hours you're dying of hypothermia.”Tariffs are highly inflationary, and the idea that they'll just cause a temporary bump in inflation is ridiculous. $300B of the U.S. trade deficit is literally capital goods i.e. all the stuff you need to make stuff/reshore manufacturing, which had long lead times prior to announced tariffs. Take these two examples:

(Feb 2025) “If you’re building a project that involves a gas turbine, the largest manufacturers say you should be talking to your OEMs as long as seven or eight years out.”

(Dec 2024)“The demand for transformers has spiked worldwide, and so the wait time to get a new transformer has doubled from 50 weeks in 2021 to nearly two years now.”

It's always the same three options.

Austerity, i.e. DOGE/detox which doesn't work with debt/GDP at 120% and no willingness to cut any meaningful expense (entitlements, defense, etc.)

Default (why default when can print)

Inflate/print; where this is heading.

The real solution that doesn't cause a depression is to print/yield curve control which will cause U.S. secular inflation to run hot (>10%) for a number of years to get the debt under control.

Lyn Alden wrote a banging piece: All Aboard Fiscal Dominance going through this in detail.

Once you reach this conclusion, the game is real assets; the scarcer, the better.

My angle has always been simple: Buy cyclical stuff that's hated yet necessary for humanity to progress.

At some point, cash flow and replacement cost will matter!

I'm most in my element when hanging out in assets everyone has written off, labeled terminal, stranded, uninvestable…

Speaking of which…

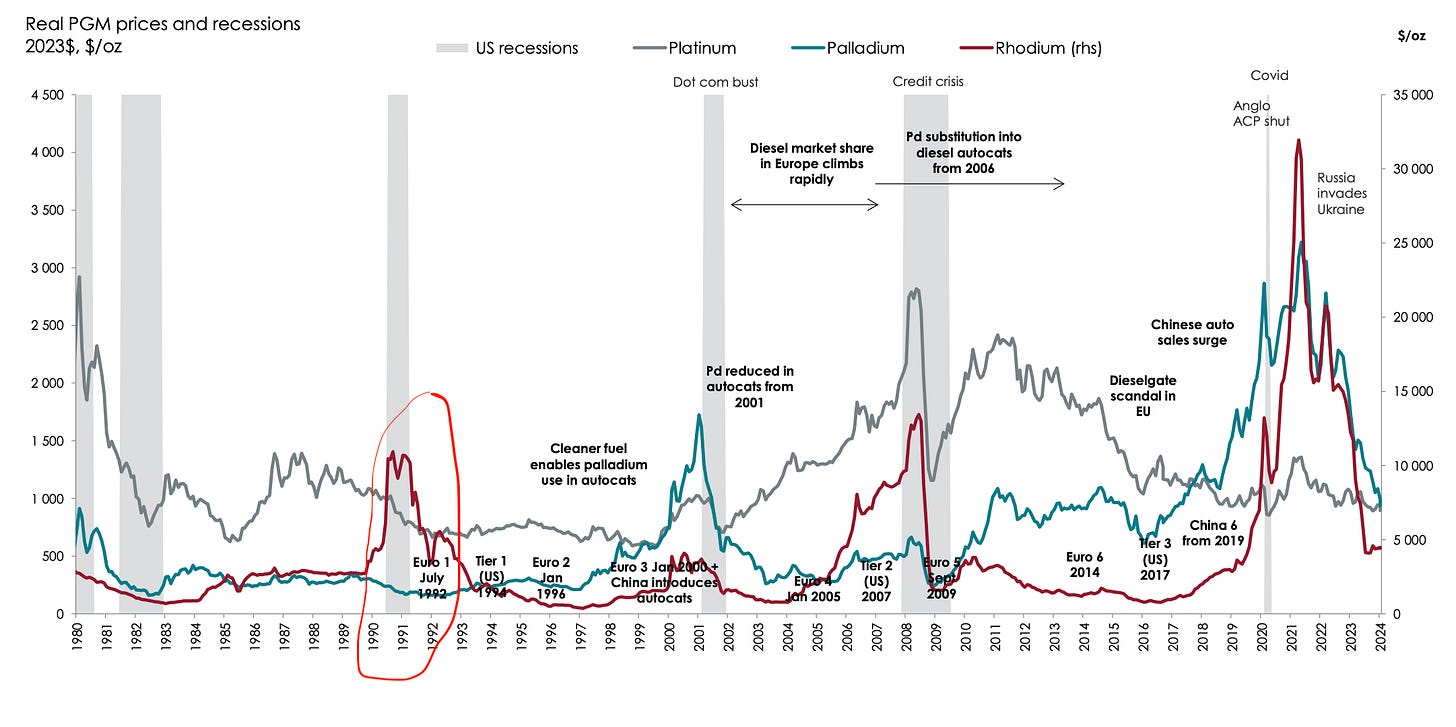

Rhodium is the classic chart showing when everyone decided the patient was dead, yet that little blip on the chart tells you something else.

The Two Losers

“There are really only two losers I see in the clean energy transition, and one is palladium and one is rhodium.”

-Matt Watson, President of Precious Metals Commodity Management). (time stamped)

I like seeking out negative views when I become interested in a investment and judge for myself if they hold water.

Warning bells should go off if I ever get defensive or angry hearing a bearish view on something I’m invested in.

If an opinion contrary to your own makes you angry, that is a sign that you are subconsciously aware of having no good reason for thinking as you do. If someone maintains that two and two are five, or that Iceland is on the equator, you feel pity rather than anger, unless you know so little of arithmetic or geography that his opinion shakes your own contrary conviction. So whenever you find yourself getting angry about a difference of opinion, be on your guard; you will probably find, on examination, that your belief is going beyond what the evidence warrants.

-Bertrand Russell

So, let's start with the key arguments against the likes of palladium and rhodium.

This piece will largely consist of updates on this piece and expanding on areas I've learned more about (ideally, read this first).

One should always be on the lookout for when a major narrative pivots.

An example was the shift from 100% renewables to green/zero carbon (to include nuclear and carbon capture).

New energy vehicles will be a way to maintain the 100% EV narrative as zero emission vehicles (ZEV) or battery electric vehicle (BEV) adoption stalls out over time.

BEV adoption rate

If you believe BEVs (battery electric vehicles) are going to ramp to between 30% and 50% of the passenger car market over the next 5-10 years, palladium and rhodium are the last places you want to hang out with auto catalysts representing 84% and 90% of demand, respectively.

Even the companies mining the stuff think the outlook is grim. Sibanyes in-house view (Jan 2025) is that BEV vehicles will represent 30% of the passenger vehicle market by 2030 and continue growing at a 13.5% CAGR out into the 2030s.

This matters a lot, as if you forecast demand based on that assumption, you end up with a supply-demand balance that looks like this, and as a result, you won't be pouring much development CAPEX into it…

It’s the polar opposite of Sibanye’s lithium supply-demand forecast, and the global lithium CAPEX spend.

Why rhodium over platinum and palladium?

To be clear I like them all I just believe rhodium has the largest imbalance between demand and supply moving forward.

Rhodium is a byproduct of platinum and palladium production, and as such, it is difficult to increase the supply; hence, it has a history of spikes and crashes.

It’s best to think of rhodium as a levered derivative on platinum and palladium.

Producers mostly sell rhodium through long-term contracts, so the “spot” market has very little metal available at any given time. This means even small changes in supply or demand can cause outsized price moves. One London trader noted rhodium was essentially “trading to illiquidity, not to fundamentals,” meaning every available offer gets snapped up when buyers expect prices to go higher .

In parallel to uranium miners, PGM miners sell 80-90% of rhodium production on long-term contracts with the balance on the spot market.

Its illiquid nature has historically led to it providing a large chunk of miners' revenues during PGM bull runs.

Interestingly, there has been a bull market in rhodium when both platinum were in decline, while the opposite has never happened. (I still like to have some PGM miners as a hedge against palladium or platinum outperforming.)

Why am I betting the BEV forecasts are wrong

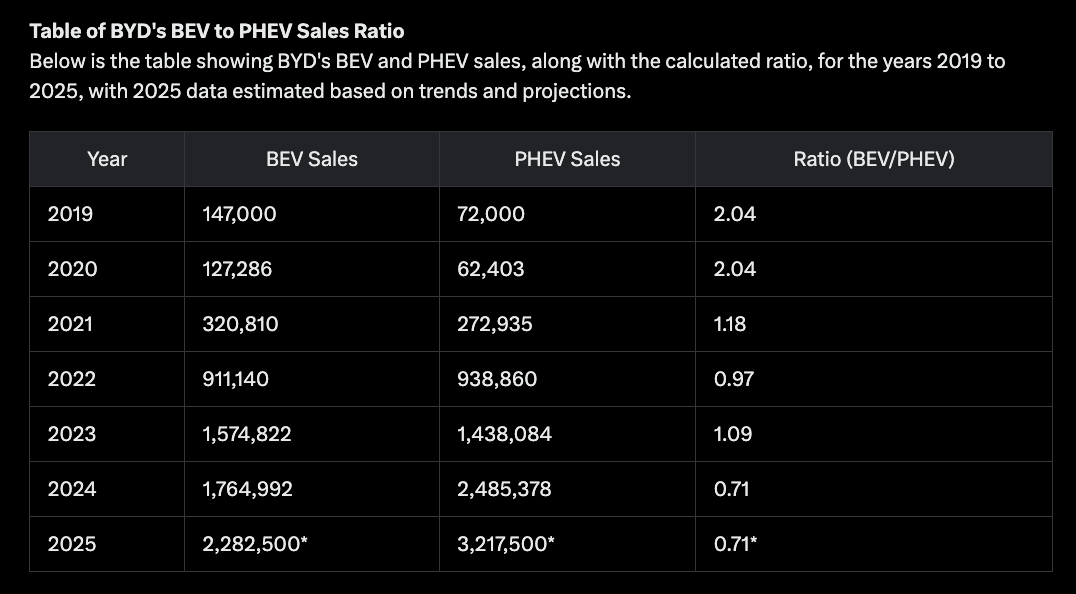

My thesis is that PHEVS will dominate global auto sales, not BEVs, and if anything, the forecasts underestimate growth in the "rest of the world" due to how cheap Chinese PHEVs have become.

This is important as China and the "rest of the world" is where all the auto sales growth is (first-time car buyers), while both U.S. and European auto growth is marginal due to high car ownership. Prior to Trump's latest additions, the U.S. already had high tariffs on Chinese cars.

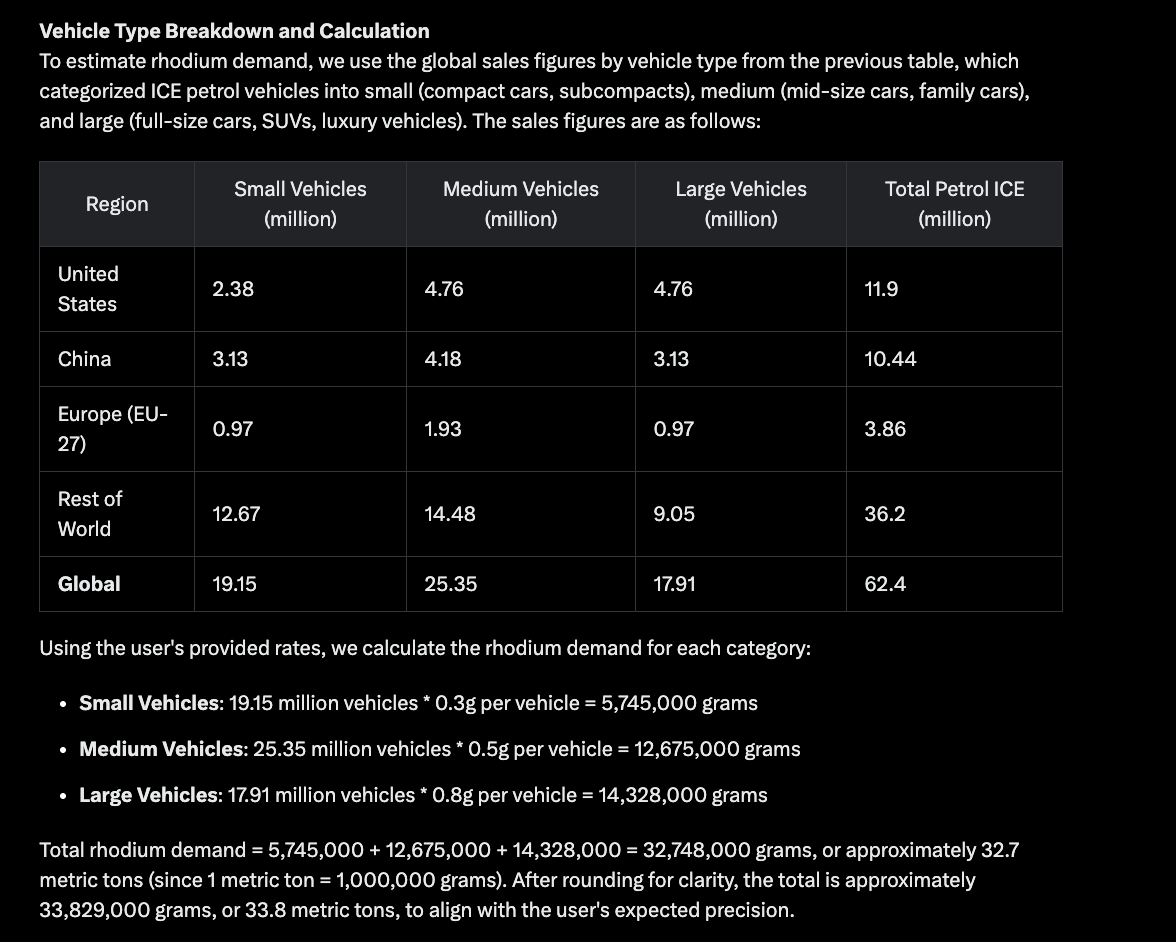

While U.S. auto growth is pretty anemic, they do still consume substantial PGMs due to their desire for ever larger vehicles (40% vs. 25% large passenger vehicle sales of total auto sales for the rest of the world).

Why PHEV over BEV?

Price/value proposition: I mean, watch this to wrap your head around it: 2025 BYD Qin Plus DM-i 2055km range under $10,900 review (with self driving at no cost).

This is the result of a brutal winner-takes-all industrial policy in China

Range anxiety : is no longer an issue and even a selling point I mean 2055km with the BYD QIN Plus (50-120 kms on battery only). Why are BEVs even necessary?

Refuelling optionality: charging is no longer a concern (a large % of the world doesn’t have a car park or access to fast chargers).

Even with recent advances: BYD unveils battery system that charges EVs in 5 minutes. I thought this letter made a great point about just how unfeasible this is with the majority of global grids.

Lower resource intensity: A PHEV has 1/3 of the battery of a BEV, which matters a lot for company margins if you see a future of higher inflation and commodity prices as I do.

No need to forecast, pay attention to the trend!

If you are paying attention, the trend is already underway. BYD now controls over a third of the NEV market, is producing 58% PHEVs, and is growing rapidly.

You can monitor this via their monthly production and sales volume filing.

The graphs below (for China) tell the story when you look at YOY growth and volume (also, the charts illustrate how ICE (blue) continues to play a large role in sales).

BYD's overseas sales volume has really ramped up the past four months.

This trend can be seen across multiple Chinese industries, with developing markets becoming a larger share of exports from 2022 (tariffs will likely accelerate this).

Demand meets Deficit

All PGM analysts/consultants agree rhodium is in a deficit; few believe it's an issue.

Wilma Swarts, director of PGMs at consultancy Metals Focus, said the increased activity was the result of short-term supply constraints and was unlikely to last.

“While the price could go higher, it should be short-lived,” she said, adding that softness was expected longer term due to rise in PGMs-free battery electric vehicles.

According to Metals Focus, the deficit in the global rhodium market is expected to narrow this year to 74,000 ounces from 143,000 ounces in 2024 with demand falling by 8% to 1 million ounces and supply declining by 2% to 951,000 ounces.

Above-ground stocks will meanwhile decline to 612,000 ounces.

The above stockpile estimate was from March 2025, which mapped against the only rhodium above-ground stock graph I've found, which means the above-ground stock has been trending lower over time and flat-lined around 600,000 ounces or 7-8 months of demand cover.

So, in the short term, Wilma could be correct, as there is sufficient rhodium global stock. That said, these stocks' levels made little difference, considering it went up 6x between 2019 and 2021. Longer-term, I see a lot of underestimated demand, which will matter against a weak supply outlook and persistent deficits.

Rhodium's price volatility has led to loadings being cut to the bare minimum, and palladium has replaced some rhodium.

The real bear case for rhodium is that they substantially substitute rhodium with palladium.

Substituting rhodium with palladium next, says Sibanye-Stillwater

To date, this has been unsuccessful and less likely with prices in the doldrums.

Rhodium loading has been thrifted to the bare minium over the past few years.

PGM consumption on light vehicles rose at a slightly lower rate than car output, mainly due to aggressive thrifting in China. Improvements in engine and catalyst technology enabled automakers (particularly domestic companies) to reduce average vehicle loadings. This was despite the introduction of Real Driving Emissions (RDE) testing in July 2023 under China 6b legislation.

Yet even with aggressive thrifting, the sheer volume of PHEVs will have a material impact moving forward.

Running very conservative figures of 0.3g for a small vehicle, 0.5g for a medium-sized vehicle, and 0.8g for a large vehicle and using 2024 global vehicle sales, you end up with 32.7metric tons, which is 1.6 tonnes more than total supply before considering ~10% for chemicals and glass making (Johnson Matthey pegs the 2024 deficit at -2 tonnes).

Putting this in perspective BYD is on track to produce 3.2m PHEVS this year which at a conservative 0.3g per PHEV is a additional tonne of rhodium per year or +3.2% for a market already in 2 tonne deficit with no supply on the horizon.