Having spent a fair amount of time combing through the fundamentals of uranium and PGMs, watching the short positioning build on my favourite commodities and associated companies makes me think of this scene: Freak Gasoline Fight Accident in Zoolander.

It is one thing to short select companies, but when the shorts are across the whole sector, which you know is in a deep deficit, it is just a matter of time before a spark sets off the reflexive cycle.

Platinum and palladium have large managed money short positions against a backdrop of large deficits for the foreseeable future…

Global demand for the metal, which is also used in catalytic converters and laboratory equipment, is expected to outstrip supply for the rest of this decade, according to Bloomberg Intelligence analysts.

The largest outperformance in assets comes when positioning is offsides with fundamentals, and you don’t get more offside than a heavily short position.

The uranium sector has the same dynamic, except it’s the equities that are heavily shorted.

Trump's executive orders have certainly put the uranium sector back in the spotlight, but what I'm watching here is SPUT…

Only a few weeks ago the narrative was SPUT would run out of cash and be forced to sell pounds into the market. That speculation was ended with the $25m private placement, which in itself was crazy as the NAV was negative 7-8%, meaning they immediately lit a few million on fire.

Yes, the real driver is utilities contracting in size in the term market.

But I've been looking for an excuse to use this Die Hard GIF, so here you go.

I'm not going over uranium today; PGMs and, in particular, platinum is the focus.

The Platinum Setup

Yes, I've already beaten these PGM theme to death:

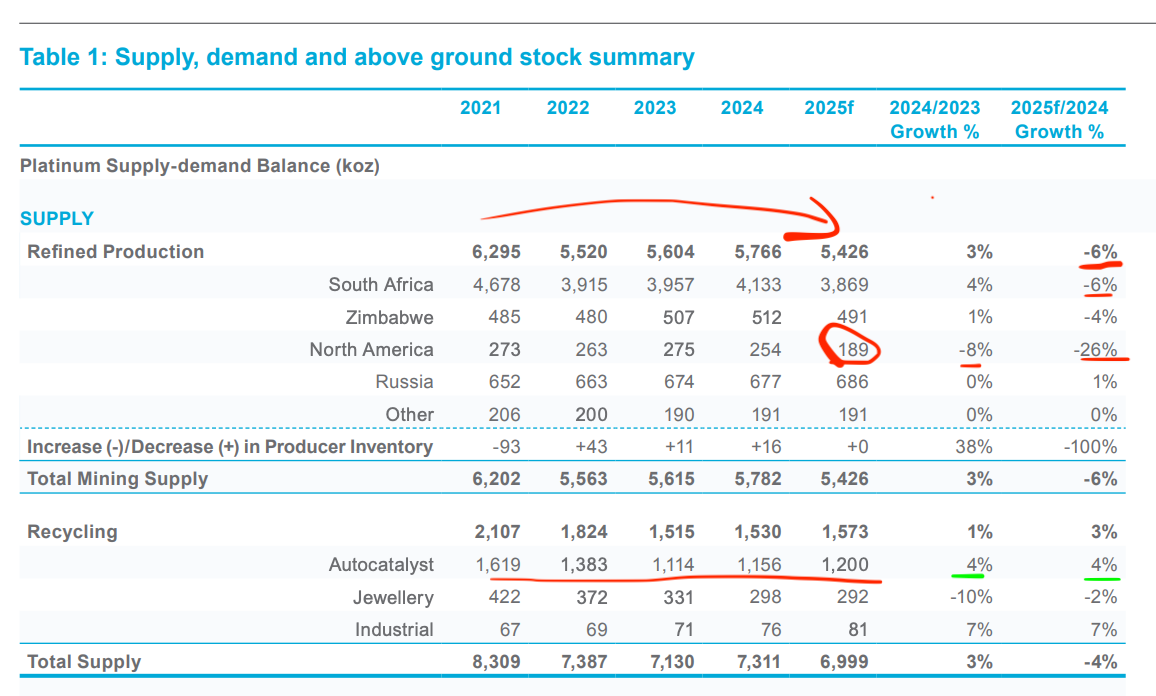

That said, the WPIC Platinum Quarterly Q1 2025 was a must-read and reinforced a lot of what I've been seeing.

When you look at the deficits and inventory stock draws below, you only need to see demand, not face plant, and it's off to the races.

The Chinese may have just fired the starter gun: China Imports the Most Platinum in a Year as Squeeze Tightens, which is important as they have largely cornered global inventories(more on this later).

Platinum Demand

Platinum has the most diverse end-uses of the PGMs, with palladium and rhodium being >85% autocatalyst and platinum 38%.

Platinum correlated to GDP, which is important considering the negative current outlook for demand.

Going through the WPIC demand summary, you see a negative forecast for industrial demand (-15%), which is by far the largest contributor to WPIC forecasting -4% demand growth for 2025.

Autocatalyst demand

While not as vital to platinum as palladium and rhodium, it's still 38% of platinum demand. Looking at historic platinum demand for catalysts can be a bit misleading as since 2021, a proportion of palladium can be substituted for platinum: Platinum for palladium substitution is embedded into automotive demand and unlikely to reverse swiftly

The trade war has done short-term damage to automotive sales and production and PGm demand as a result. This needs to be looked past, as it matters little to the bigger picture as US is not a growth market for auto sales.

The various announcements regarding tariffs on automotive vehicles, parts and raw materials have led several auto manufacturers to pare back or withhold their 2025 production guidance. Against this backdrop, there is growing consensus that light duty vehicles production may, at best, remain flat compared to 2024. This would imply total output of approximately 90 million units, of which around 77 million are expected to be fitted with a PGM-coated aftertreatment system, representing a downward revision of almost 1 million units compared to our PQ Q4’24 report. Global automotive demand for platinum is estimated to fall 2% to 3,052 koz.

The bigger picture is one of growth in the "rest of the world" and China to a lesser extent. With high vehicle ownership, U.S. and European auto sales are anemic looking forward.

This point is important as demand could surprise to the upside based on a large volume of first time buyers in developing markets as a result of how competitively priced Chinese vehicles have become.

PHEV > BEV

My The "New Energy Vehicles" Pivot thesis is that PHEVs will increasingly dominate those emerging sales not BEVs.

You'll continue to see headlines like this from the IEA; it's just that a larger and larger proportion will be PHEVs, not BEVs.

BEVs' adoption curve was extrapolated from subsidies and incentives in developed countries and China, where growth is now stalling out. Emerging markets just want cheap vehicles that aren't beholden to non-existent charging infrastructure or require a parking space to charge (when you present buyers with superior optionality, expect them to choose it every time!)

Observing the month-to-month data, PHEVs account for 43% of Chinese "new energy vehicles," and I see them dominating global sales going forward.

I mean, take a quick look at the Song PHEV specs, and you'll understand why it's up 158% year over year and crushing everyone's bar, Cherys PHEV.

The entry-level version of the BYD Song L DM-i, equipped with the 10 kWh battery, is expected to have a starting price of around 120,000 yuan (approximately 15,300 euros). This price makes the Song L DM-i a competitive option in its segment.

The BYD Song L DM-i promises a total range of over 2,100 kilometres thanks to its plug-in hybrid system and efficient petrol engine. Fuel consumption is remarkably low, at just 2.9 litres per 100 km, highlighting the vehicle’s efficiency.

Also, ICE vehicle sales are holding up, as you can see from Chinese export data.

I’ve made the point that hybrids require higher PGM loadings, as well as tighter emissions standards globally (I wasn’t aware turbocharged engines also required greater PGM loadings until I came across Rob West’s work).

I maintain the view that catalyst demand is going to continue to hold up and defy all the negative EV adoption projections.

Also, there is definitely a correlation between emerging markets and platinum demand, which makes me all the more bullish, considering all the emerging market breakouts I discussed in my last piece, Under-the-Radar Bull Markets.

Industrial Demand

When breaking down why WPIC sees platinum demand coming in at -4%, it's almost entirely (~83%) due to industrial demand, which is correlated to GDP and has already taken a decent hit, suggesting it's priced in unless we get a nasty recession.

The problem isn't so much the tariffs now but the uncertainty causing companies to delay investment decisions to see where things land after the 90-day period. Once this period is behind us, I don't see why industrial platinum demand won't bounce back.

Industrial platinum demand is largely tied to new plants being commissioned, the timing of which is a function of long-term investment decisions. Accordingly, the global economic uncertainty arising from US trade policy is yet to materialise in substantial revisions to the near-term outlook for industrial platinum demand (i.e. 2025 forecasts).

Regarding industrial glass demand (think high-quality screens for electronics, renewables, and automotive lightweighting. “Despite their cost, platinum/rhodium alloys are the only metals that can withstand the heat and corrosive effects of drawing and casting high quality glass fibres and sheets.”

This was informative:China’s demand for glass fibre continues to grow, supporting ongoing platinum industrial demand growth.

The takeaway is that glass fibre is quite cyclical and likely at a low with the smashing it just took (-58%).

Hydrogen Demand?

It’s currently 2.8% of industrial platinum demand and 0.007% of total platinum demand. I’ll believe these forecasts when I see the economics of green hydrogen making sense.

For now I agree with Hans.

"Electrolyzers, which do not exist, are supposed to use surplus electricity, which does not exist, to feed hydrogen into a network that does not exist in order to operate power plants that do not exist. Alternatively, the hydrogen is to be transported via ships and harbors, which do not exist, from supplier countries, which - you guessed it - also do not exist”

-Hanns Neubert in the June 2024 German MIT Technology Review

I doubt any of this demand ends up materising.

WHY HYDROGEN IS A NEW DEMAND DRIVER FOR PLATINUM

Only only has to look at how the hydrogen project pipeline is progressing.

Jewellery

Jewellery demand was strong (+5%) on the back of gold substitution (10% white gold substitution would equate to 1.5 Moz demand).

Chinese jewellery fabricators and retailers have in response to consumers being priced out of gold, begun initiating some switching from gold to more affordable and higher margin platinum jewellery, leading to expectations that Chinese platinum jewellery demand will increase by 15% year-on-year in 2025 (+62 koz).

You can see this in the below chart with platinum jewellery demand grinding higher since COVID.

Either the price gap closes with gold or jewellery and investment demand for platinum is going to continue to ramp.

Investment

This was almost entirely due to Chinese buying, which hit a record high—which is crazy when compared to the US, which had the lowest investment demand in several years.

US, Q1 bar and coin investment fell by 16% year-on-year (-6 koz) to 30 koz, by far the lowest first quarter total for several years.

U.S. investors seem still more interested in tech or crypto and will likely join the party later when prices really move, kicking off a reflexive cycle as ETFs receive positive flows.

You can see the lack of interest in physical platinum via the abrdn Physical Platinum Shares ETF flows which are -$111m on a 3 years period.

Supply

The PGM supply picture is everything you want to see as a bull.

It’s been nothing but disappointments the last 4 years.

This should come as no surprise, with nearly a third of global PGM production underwater with current prices.

This is more significant for platinum production since South Africa has platinum-dominant deposits while Russia (Nornickel) and North America are palladium-dominant.

There are all the usual signs of supply destruction in cutting CAPEX, putting mines on care and maintenance or considering early closure.

Sibanye to halve US mine output as losses persist, shares jump

Impala Platinum considers early mine closure in Canada amid price slump

South Africa’s platinum mining industry in terminal decline, Northam CEO says

Anglo Platinum Says Profit Fell by Up to 52% on Lower Prices

When you look through mine production line by line, you can see how bad it's gotten, with -6% YOY growth now forecast for supply.

Platinum Recycling

Recycling isn't coming to the rescue either, as the average age of vehicles continues to rise. With higher rates and the cost of living climbing, people are holding onto their vehicles longer, causing recycling forecasts to disappoint year after year.

As a illustration of this even when PGM (mostly palladium and rhodium) went crazy in 2022 with the Russian invasion you were only only looking at 180koz higher recycling which is roughly half of forecast loss in primary mine supply this year.

Looking around global supply, there is no solution to offset the scale of losses in South Africa (putting it in context, South Africa is set to lose the equivalent of all of North American platinum production in 2024, which in turn is set to lose a quarter of its production in 2025 with the Stillwater West mine placed on care and maintenance).

Platinum above ground stock

Above-ground platinum stocks are drawing down rapidly, at the same time as producer platinum inventories.

The projected 2025 deficit of 966 koz will draw stocks down to 2,160 koz, which will cover a mere three months of global platinum demand.

Anglo-American Platinum is the largest player in producer inventories and drew down its inventory last year.

In South Africa, the drawdown of Anglo American Platinum’s semi-finished inventories, which boosted supply in 2024, was completed in Q4’24. As a result, refined production in 2025 is expected to align more closely with mined output, which remains in structural decline. While, following recent smelter maintenance, both Implats and Northam retain some excess semi-finished inventory, management teams expect the drawdown to extend beyond 2025. As a result, any drawdown during the year is not expected to offset the impact of the depletion of the Anglo American Platinum inventory.

While the situation already looks tight, it’s actually a lot worse….

China now represents the majority of the platinum above ground stocks, and it doesn't export platinum (except in finished goods).

To grasp the situation, I highly recommend reading The Platinum Stock Supply Crisis by Dr. David Davis (unfortunately, Dr. Davis passed away last year, and he was the only expert on this subject I'm aware of).

Western Europe, Japan and Rest of world are all in a hand to mouth situation with supply in a deep deficit. While China continues to grab every ounce it can get its hands on: China Imports the Most Platinum in a Year as Squeeze Tightens.

Read the extract below from Dr. Davis and understand that above-ground stocks have halved since this was published at the end of 2023.

I am of the clear opinion that the PGM and investment industry as well as research organisations and other interested parties, do not have an accurate understanding of the structural changes in the platinum AGI between 2007 and 2022.

China AGI has absorbed ~12moz, which represents ~57% of the apparent global platinum AGI of ~21.2moz. This is a catastrophic quantum of platinum that will be lost to the Western world, which will undoubtedly impact the rate of global decarbonisation and in turn put significant upward pressure on the price of platinum.

The USA has built its AGI to ~8.1moz.

Western Europe / UK AGIs are on their last legs, possibly bolstered by manufacturing stocks.

Japan’s AGI has declined to ~1.8moz.

The Rest of the Worlds’ AGI is also on its last legs.

So, what’s left? A drawdown of the platinum AGIs from the remaining regions of around ~9.1moz. In this regard, the strategic importance of estimating AGI by region becomes extremely apparent.