You can never eliminate risk; the most you can hope for is to contain it via proper position sizing, portfolio management, and the ability to weather volatility (no leverage, naked options, etc).

“If I ask you what’s the risk in investing, you would answer the risk of losing money. But there actually are two risks in investing: One is to lose money, and the other is to miss an opportunity.

You can eliminate either one, but you can’t eliminate both at the same time.”

-Howard Marks

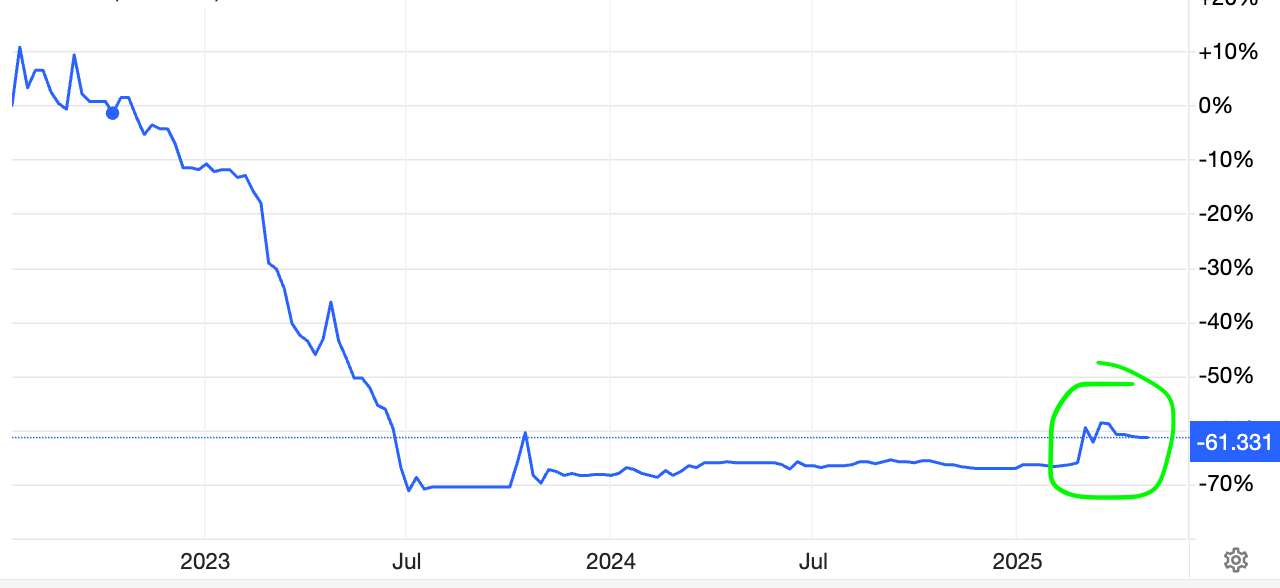

It’s what runs through my head when I see a chart like the one below, especially when it’s disconnected from the recent volatility in the US, as so few own it.

You want something off investors’ radar that can potentially be a multi-bagger before they take notice and the chase begins…

I took the label off the chart, as it’s the chart action I’m highlighting, but if you’ve read my stuff, you can probably guess.

Jokes aside, rhodium illustrates this well with prolonged periods of 60-70% drawdowns and feeling stupid to butt-clenching rallies due to its illiquid nature.

It's always obvious where to have bought in hindsight.

I want a ticket on a number of these rides, ready for when it reminds investors why it's cyclical.

This brings me to today's focus: I can see a bull market kicking off, but I don't yet have a ticket on this particular train.

Emerging Bull Markets

A number of emerging markets are now in bull markets, with little to no coverage; it’s still all eyes on US tech.

Maybe it's because I grew up on a farm, but I always imagine these big rotations as aerial photos of sheep moving from the paddock they've finished to where the grass (returns) are better.

It’s easy to spot the pattern when you zoom right out.

Granted its a commodity but of the cleanest examples of this pattern is platinum, which seems to consolidate for a decade before going crazy for a decade or two…

Emerging market financials are displaying this pattern: blistering performance from the early 2000s until 2010, followed by chopping wood until recently.

They are the forgotten sector, as they have largely gone nowhere for the last decade.

If you bought it in 2010, you’d now be sitting on a net return of 57% vs. 47% inflation over this period.

Its annualized 10-year return is 3.46% vs. 10.3% for the S&P 500 financials, which is some brutal underperformance.

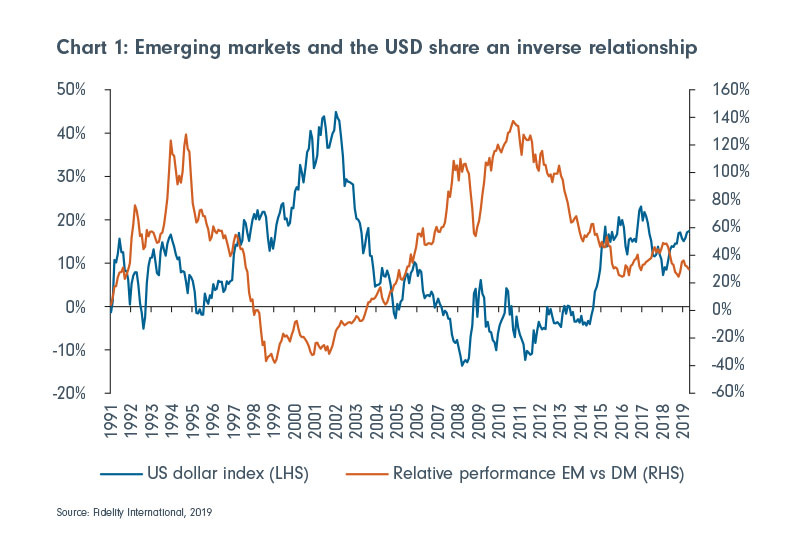

It should be no surprise emerging market financials have had a rough time, as a strong dollar makes life difficult for them. Hence why this trend is just getting warmed up if we are seeing the start of a long period of US dollar weakness.

The 1-year return of 18%, combined with the cheapest P/E at 9.43 and the highest dividend of 3.86%, caught my attention.

Which shouldn’t be a surprise when you consider the below tailwinds

Weak US dollar

Cheap energy

China stimulating

Europe stimulating

US??

It’s the perfect mix for EM banks to do well.

Getting broad exposure is the tricky part.

Emerging Markets Financials ETFs have been canned…

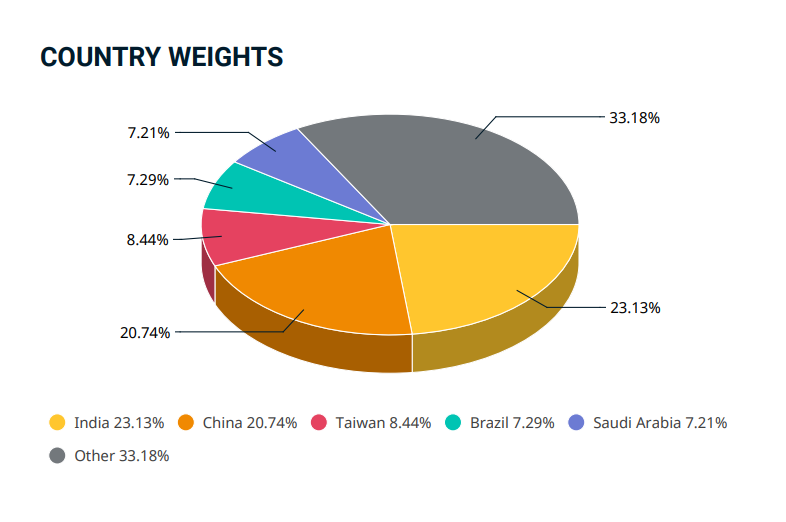

Even if the MSCI Emerging Financials ETF were available, the weighting is far from ideal, with India, China, and Taiwan making up over half the index.

India is on the expensive side. With China, I prefer to hang out in their tech companies rather than their banks, and Taiwan isn't really what I'm after with its semi-heavy market.

You want crazy cheap like Brazil.

I’ll save you a search; its financials ETF has been canned.

Cheap areas with strong demographics and real GDP, such as Africa and parts of Asia seem like a solid bet if you have a long time horizon.

I’ve touched on Africa before digging into Nigeria here, as you can’t beat it for demographic tailwind.

Nigeria was the seventh most populous nation in the world in 2020, with 206.1 million people. Projected to reach a population of 401.3 million by 2050.

The problem is you can no longer access the Nigerian market ETF, let alone financials.

Before looking at the Nigerian banks, I’d point out the Nigerian naira had a large devaluation at the start of 2024.