What are the top ten going to be come 2030?

I see a few slots opening up in the top ten on the back of headwinds facing the Magnificent Seven, be it taxes, telling $2T of Chinese money to GTFO, antitrust lawsuits, issues with share-based compensation, questionable returns on AI CAPEX, and competing for market share with Chinese companies.

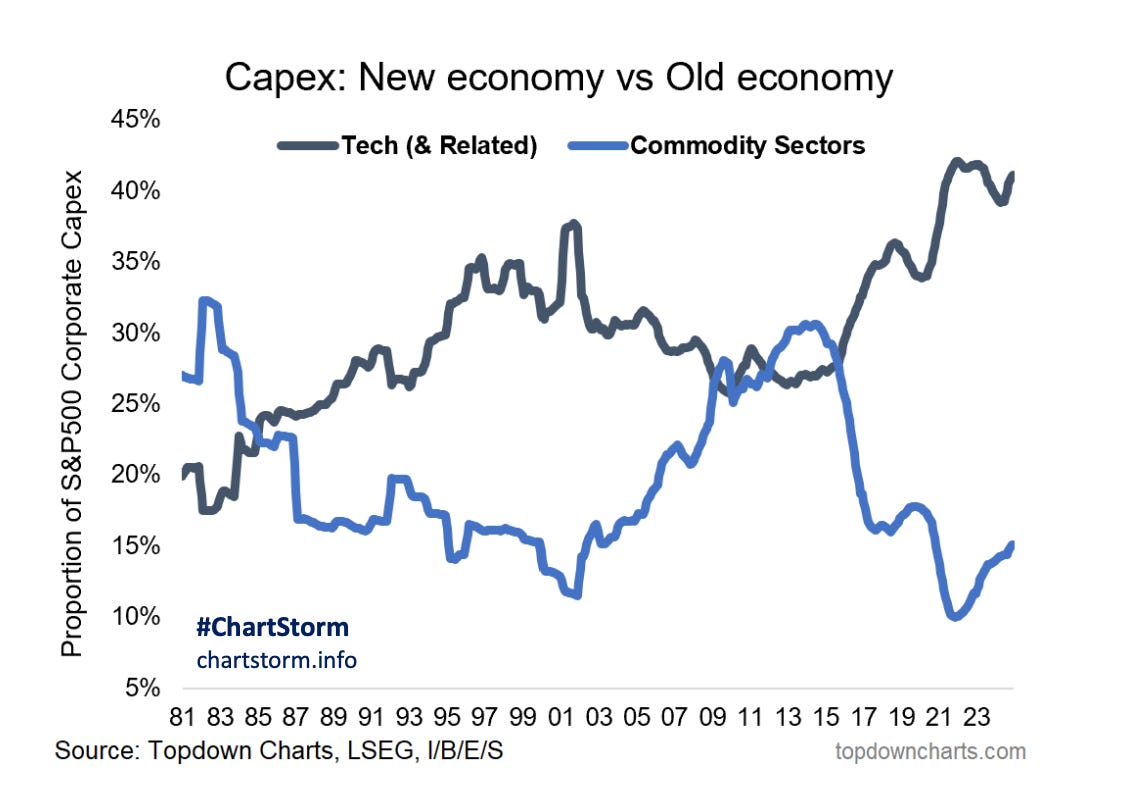

I won’t be surprised to see Chinese companies, oil majors, and perhaps even a miner make the top ten, similar to 2010. The old economy is in the early stages of a comeback following a decade of underinvestment.

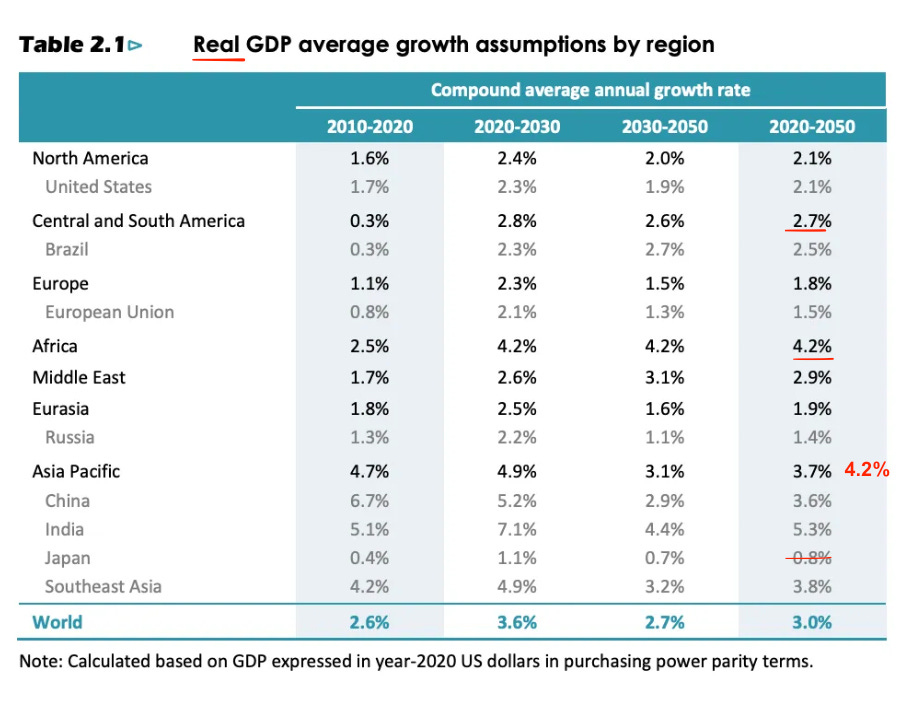

Yes, commodity demand, particularly energy, is going to take a hit due to the trade war. The US is 26.8% of global GDP, so is going to have a substantial impact. That said if you look at it in PPP terms, the US is 14.75% of global GDP and represents 12.40% of China's exports.

China's exports began to decouple from developed countries in 2022, and this trend is only going to accelerate with the trade war.

Whatever happens over the coming months, the rest of the world will continue to trade with each other. The energy story was always one of growth in developing markets, which I see exploding higher over the next decade.

So yes, this year will continue to be volatile. Yet for those able to look through it and take advantage, it's an amazing long-term energy/commodity setup.

Coal is the focus for today

Yes, it’s been a rough year in coal, as it has been in most energy investments.

Articles like this paint a grim outlook for the sector.

Thermal coal prices hit 4-year low in Asia as China imports wane

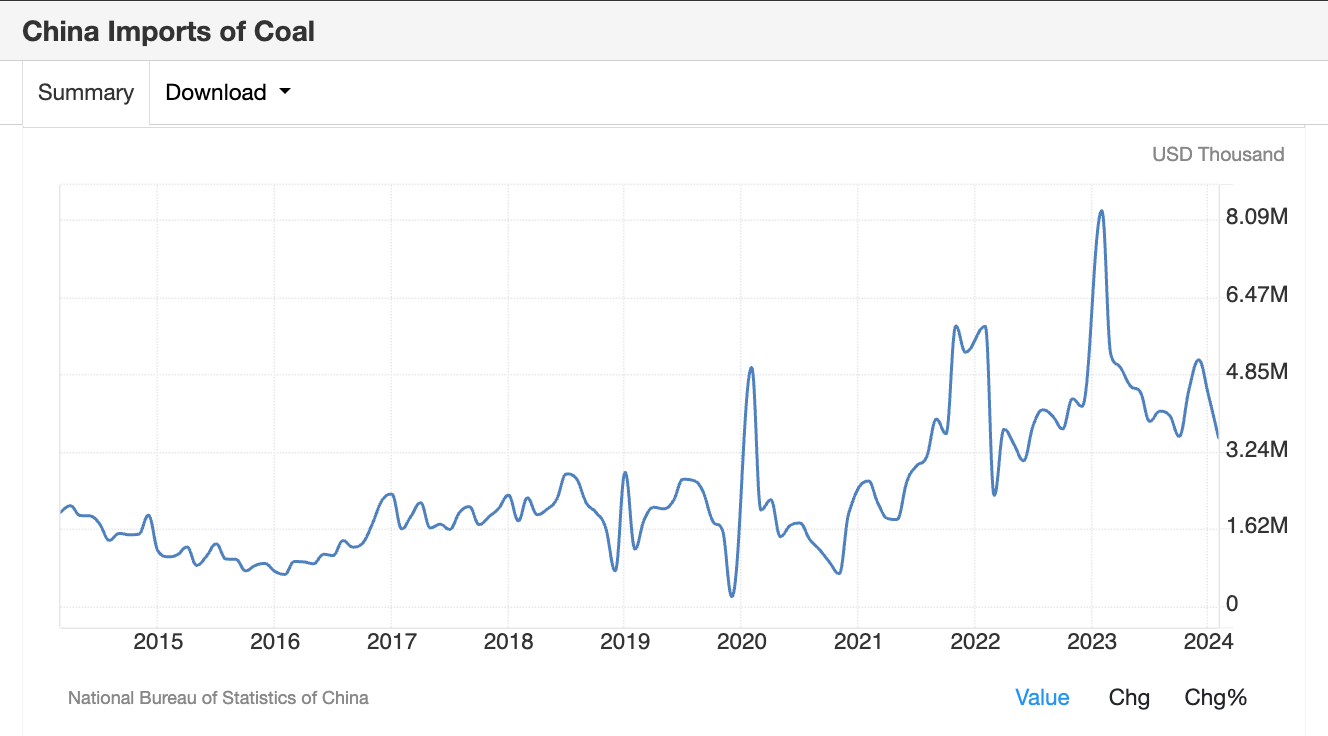

For the first four months of 2025, China imported 91.56 million tons, down 13.1% from the 105.4 million tons in the same period a year earlier, according to Kpler.

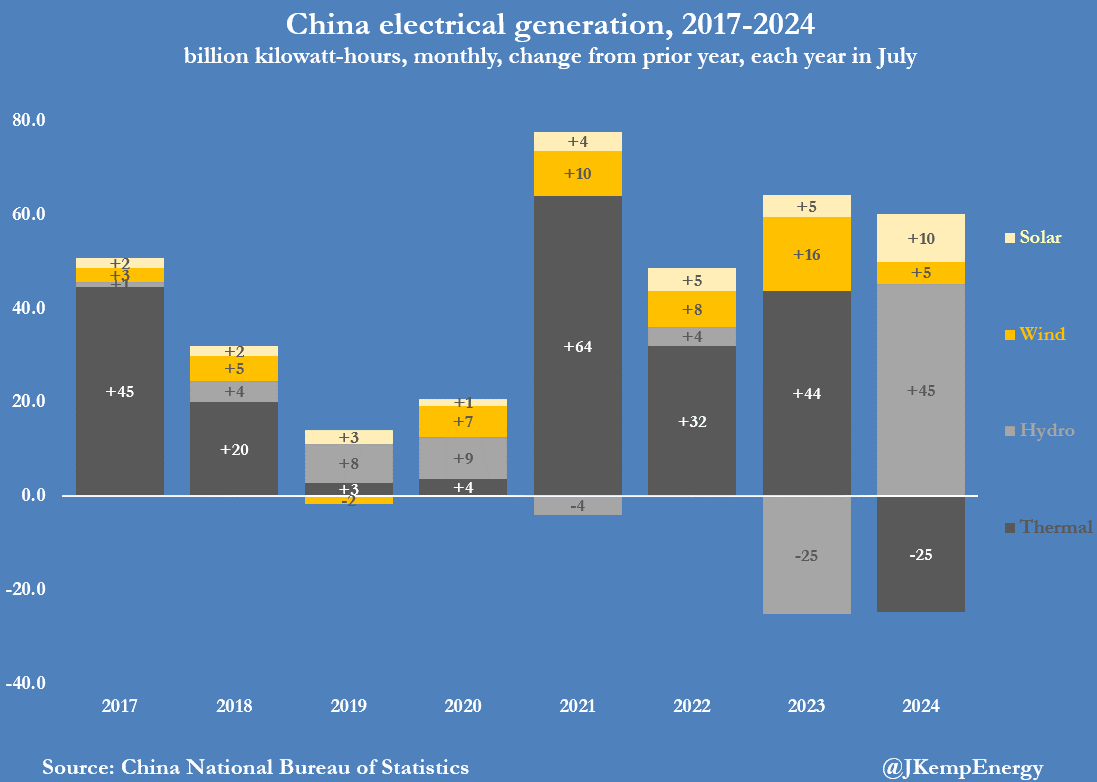

The fall in China's thermal coal imports comes amid weaker coal-fired generation and record high domestic coal output.

First-quarter thermal power generation in China, which is overwhelmingly coal-fired with only tiny volumes of natural gas, fell 4.7% as both hydropower and renewable generation rose.

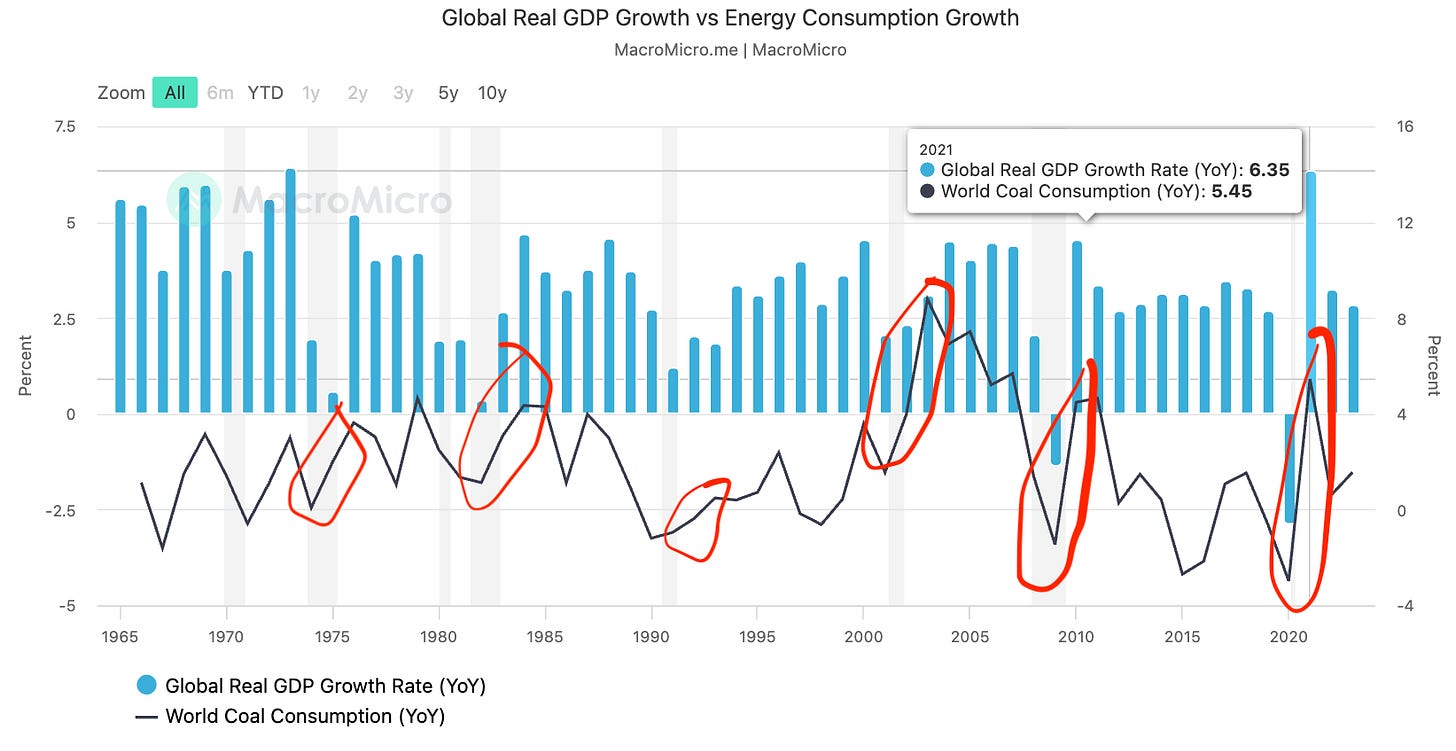

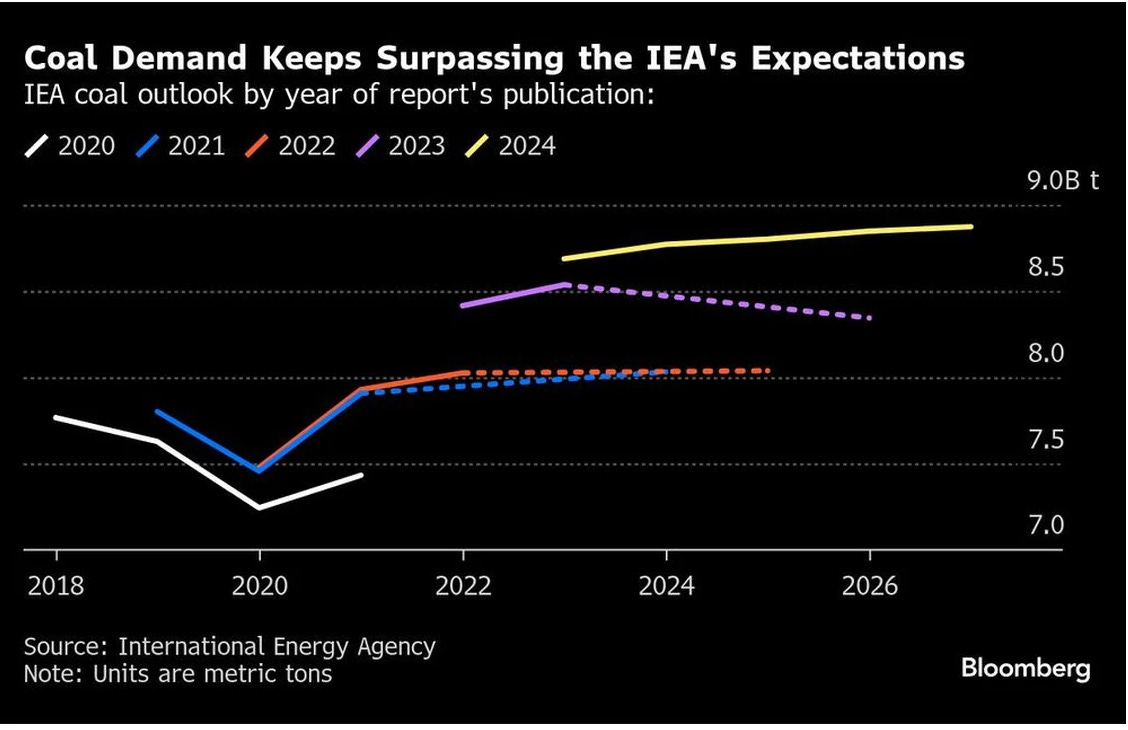

The first point that Anas Alhajji constantly reminds readers is to be very careful forecasting energy demand in recessions and low economic growth (especially with the addition of wind and solar in the energy mix).

Extrapolating energy demand during recessions and low economic growth is a bad idea, but Bloomberg and others do it anyway. During these times, the share of renewables increases as utility managers reduce gas and coal use. They can control gas and coal inputs but not solar and wind. When economic growth resumes, wind and solar output stays the same, but to meet increased energy demand, more gas and coal are needed.

You can see it clearly in the chart below, where coal consumption spikes after periods of slow economic growth or recessions.

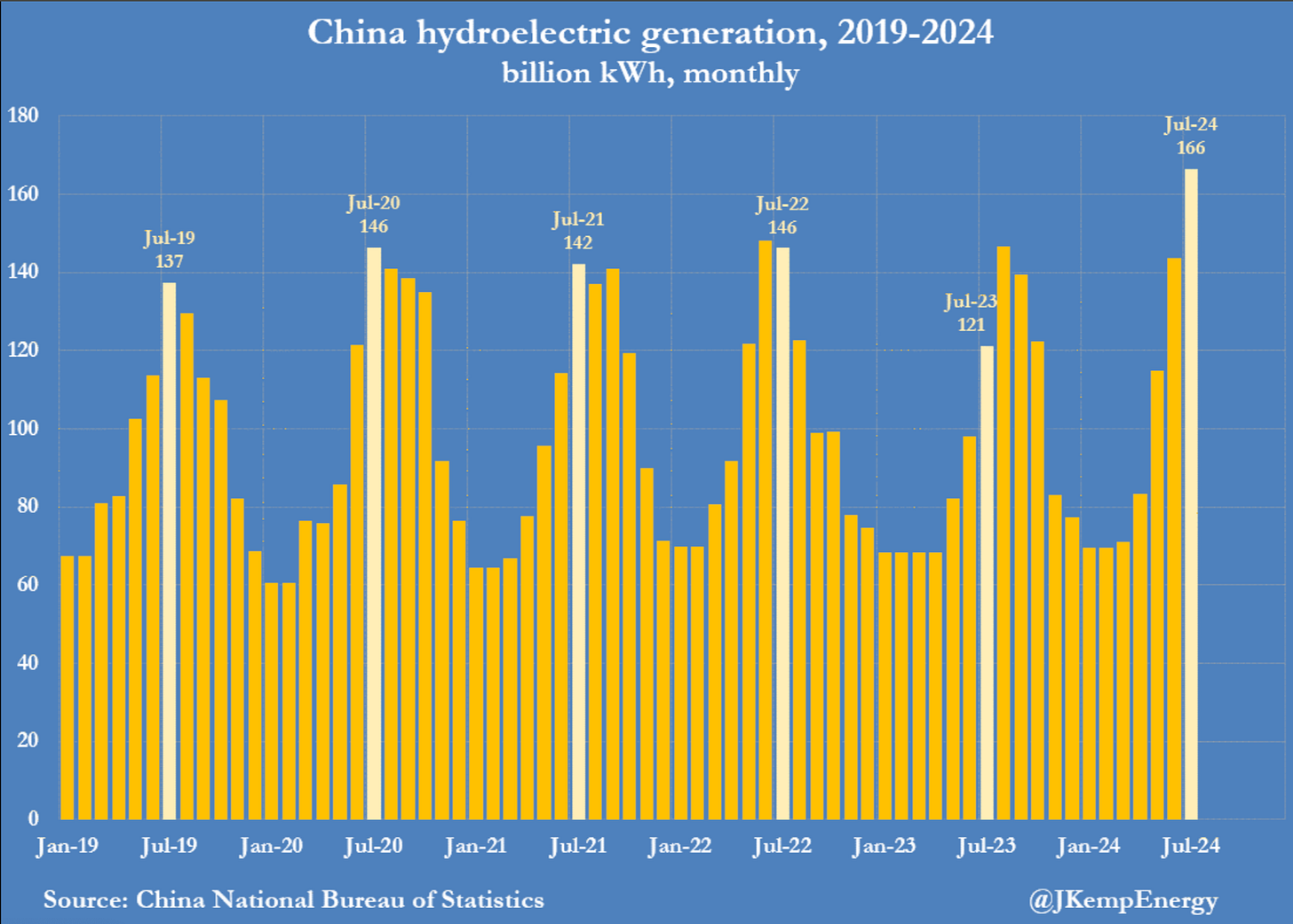

This chart from John Kemp also illustrates the dynamic well, coal is the controllable variable in Chinese generation. Strong growth or low hydro/solar = more coal. Hence, it's a mistake to get bearish on coal when hydro has record generation combined with low economic growth (I mean just look at the prior three years).

Many are aware of how seasonal solar generation is. The seasonality of hydro is less known, and I was shocked the first time I saw this. Yes, the Chinese winter generation leans heavily on coal.

Pragmatism vs. Ideology

The removal of China's renewable price guarantee went largely unnoticed, but it is a big deal when you consider that there is no Net-Zero ideology. The economics have to make sense, unlike in Germany, California, and Australia, where economics left the discussion in favour of ideology.

Renewable generators previously enjoyed a guarantee that grid operators would buy nearly all of their power at a rate tied to the coal index. That guarantee was lifted on April 1 and took effect earlier in some places, three industry experts said.

Now, renewable generation is increasingly subject to less favourable market pricing.

“Coal and gas remain the most accessible balancing tools for grid stability,” said Huaneng’s Zhao.

The deluge of solar power has thrust electricity prices into negative territory in regions with liberalized energy markets, which bodes ill for the economics of further expansion.

Thermal coals big picture is pretty simple Asia (60% of world population) is ramping up their living standards and needs a lot of energy to do so. Coal is abundant in Asia and generally much cheaper than LNG and requires less costly infrusture.

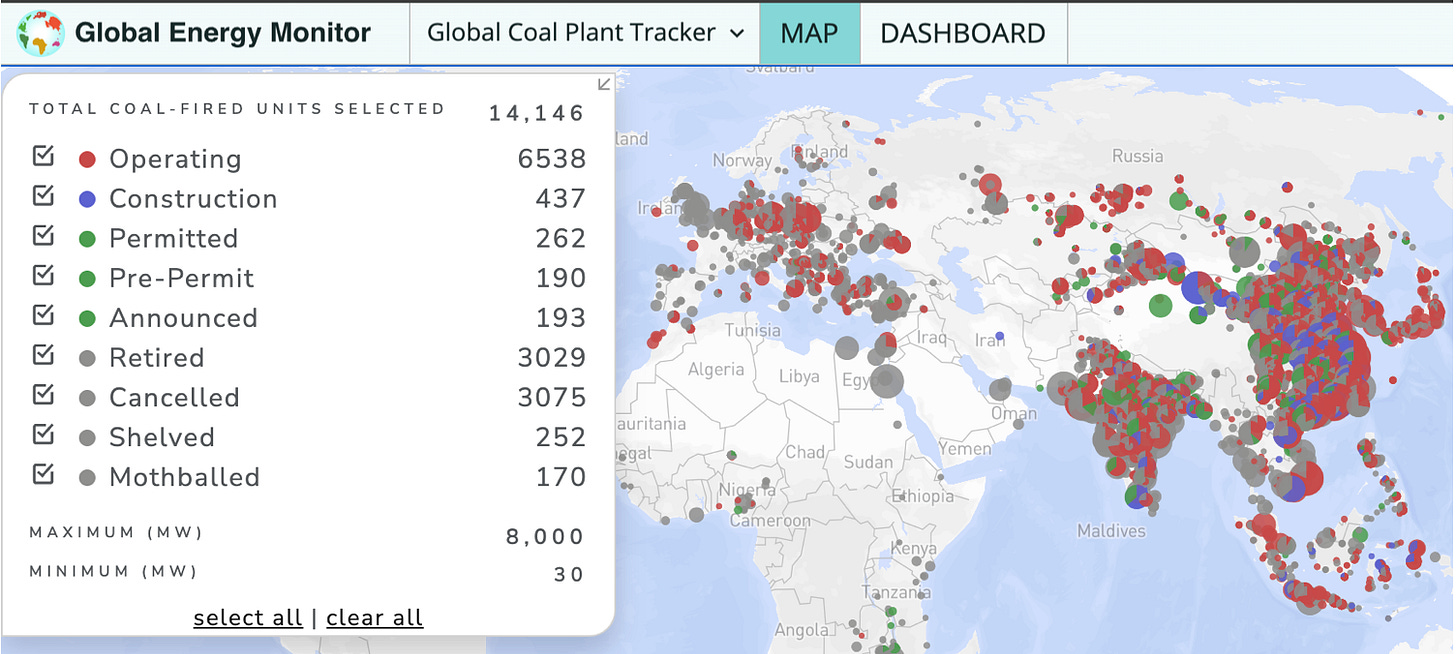

A quick look at the global coal plant tracker makes it pretty clear coal isn’t going anywhere.

+6.7% of global coal plants are currently under construction

+4% of global coal plants are permitted

+2.9% of global coal plants pre-permit

As for retirements, many of the plants that could be retired have been retired in Europe and the US, where the average age of plants is 38 years and 45 years old, respectively (compared to India and China, which have an average age of plants of 13 years).

Expect more of this on the other side of the trade war.

What about Met coal demand?

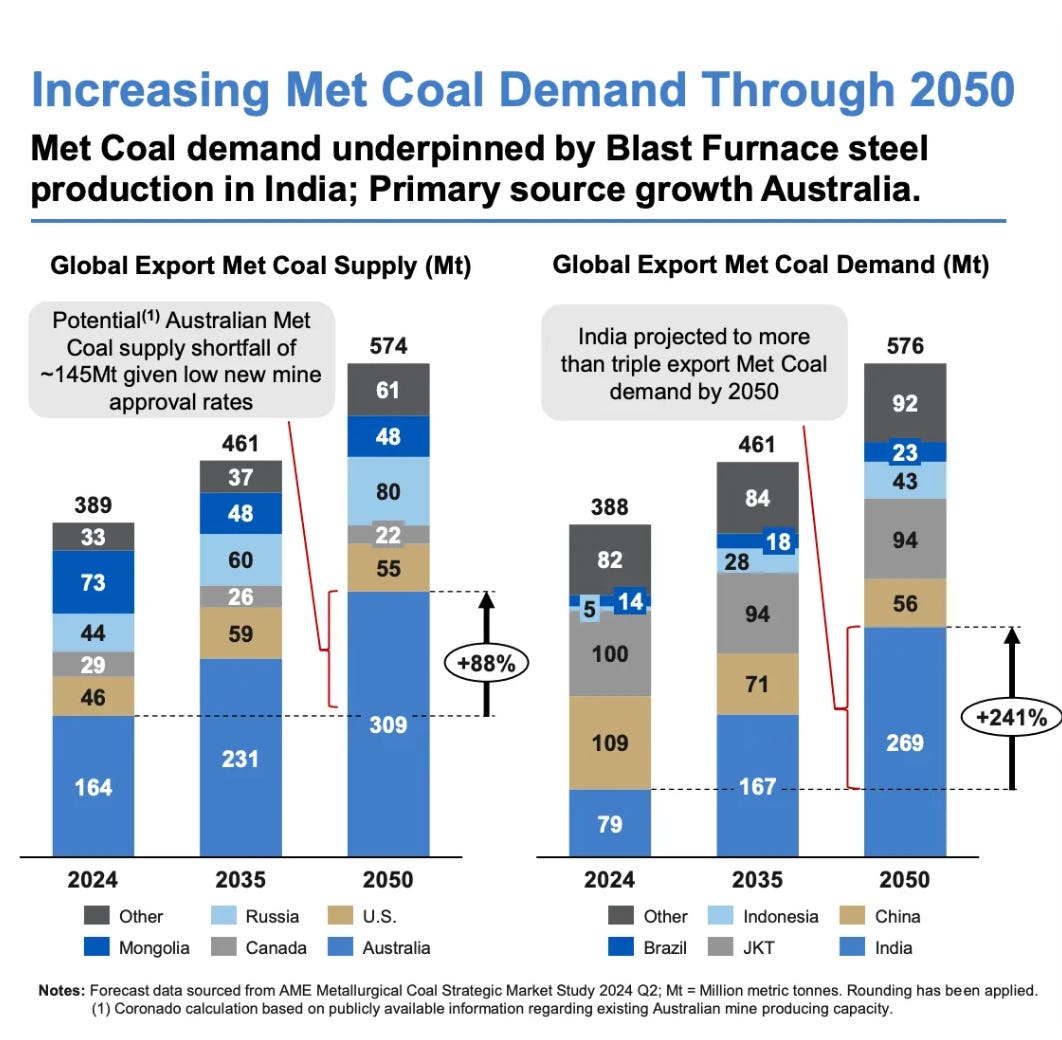

It's an Indian growth story, and there is no alternative (Green hydrogen and green steel are a fairy tale). Going back to the point of strong real growth in Asia of ~4% p.a. out to 2050, met coal demand goes hand in hand with it.

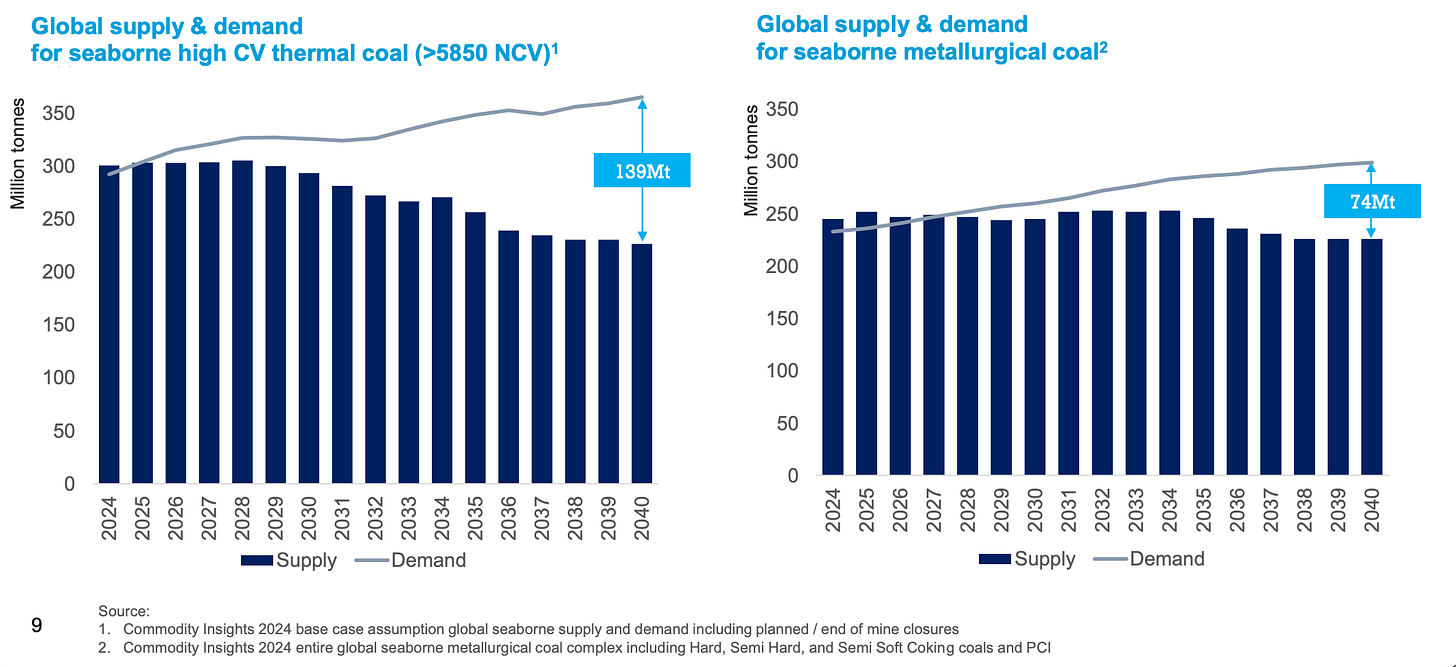

Supply side?

I’ve spilled a lot of digital ink on both thermal and met coal in these two pieces.

To re-cap met and high-CV thermal, is a story of severe underinvestment, which hasn’t been an issue recently with the low-growth environment dampening supply but with the tailwinds of a lower US dollar and cheap energy prices I see this changing.

What about Chinese domestic production?

Well the simple explanation is the Chinese maxed domestic production and imports to avoid a repeat of the 2022 electricity shortages only to have a warm winter in which coal generation dropped 3.8% YOY for first two months of 2025.

A glut of coal in China is set to push falling prices even lower

China’s coal inventories have been boosted by surging domestic production, which hit a record high last month, and rising imports as authorities prioritize energy security over cutting emissions. Efforts to mine more coal locally dates to 2022, when Russia’s invasion of Ukraine pushed up energy prices and led to electricity shortages in China.

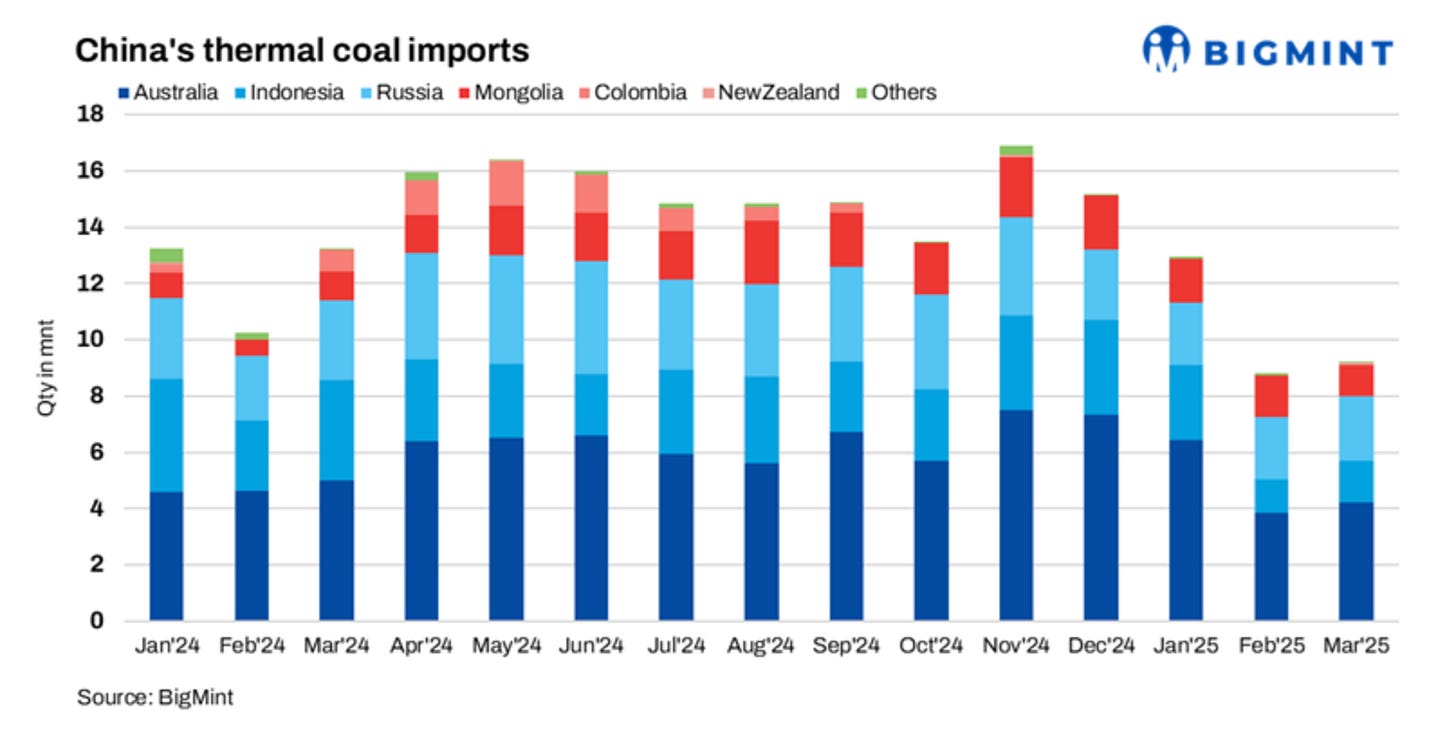

Simply look at China's coal import volatility to prevent one from jumping to conclusions at any particular point in time.

The supply-side variable that could weigh on the thermal supply side is whether Mongolia continues to rapidly expand its coal exports to China. It represented 9.5% of China's imports in 2020, hit 15.5% last year and is on track to do 20% this year, with plans to eventually get to 165mt or ~30% (largely depending on how Chinese generation growth holds up).

Mongolia Aims to Lift Chinese Coal Sales to 100 Million Tons

It’s one of several rail connections Oyun-Erdene is hoping to create, eventually boosting the nation’s coal export capacity to China to 165 million tons, nearly double the almost 84 million tons it sent last year.

If growth remains low this would, crowd out other coal exports and pressure prices.

Lastly the idea Mongolia can supply India with a meaningful amount of coking coal is also worth keeping a eye on. For now the logisitics make little sense.

What is the scope of Mongolian coking coal exports to India?

India's SAIL to import trial coking coal cargo from Mongolia, maybe by air

Buy and hold miner?

Is there such a thing as a quality miner?

What miner could you put in the portfolio and forget about for the next five or even ten years?

As I've touched on in past pieces, the odds are stacked against you with miners.

Operational risk (mining is hard)

Geopolitical risk (politicians are just as likely to steal from you in Australia as in Africa).

Net Zero, ESG and DEI (spinning out quality assets to focus on the “transition”).

Cost inflation (commodities going up and making profits are not always correlated)

Dilution, a large proportion of the mining companies are set up to mine shareholders.

The counterpoint to yes is that it's tough, which is why the market today severely undervalues existing mine production with long-life assets.

There has been underinvestment across the majority of the commodity space.

Quality miners received high multiples in the past, now not so much.

Commodity rich Canada and Australia’s new governments are doubling down on net-zero, which means existing mines are inherently more valuable when countries make mining harder with strict environmental and emission rules.

The inverse of Microsoft?

Using Microsoft as a proxy for the most loved company in the world currently, what’s the most hated ‘quality’ miner in the world?