The last two months have been rough. Everywhere I look in the portfolio, there has been a minimum of a 25% hammering.

There has been no hiding from the beating commodities and energy in particular, has taken.

Whenever I find myself in a drawdown, my mind goes into overdrive, and I triple-check each respective thesis.

Today, I want to work through met coal as I don’t think I’ve done a good job of explaining why I love the met coal setup.

I usually try to avoid talking much macro as I don’t feel I have an edge, but two points seem to be brought up repeatedly, particularly the latter when it comes to met coal.

Nasty US recession

China meltdown

I see a nasty US recession is unlikely because, in this financialised economy the math is a decision tree in which all roads lead to printing, as defaulting and austerity are off the table. I highly recommend taking the time to read Lyn Aldens latest piece: Why Nothing Stops This Fiscal Train).

Lyn makes the point that we have Political Polarization, Except for Deficits in neither side dares touch social security, medicare or military spending.

Or explained via meme:

Below is the baseline the Congressional Budget Office is forecasting with zero recessions forecast…

Consider from the 1960s to 2008 Federal debt increased to ~$ 5 trillion, then from 2008-2020, it increased to $ 17 trillion and 2020-2024, it is just short of $ 28 trillion.

In nominal terms, everything will be fine…

Once you understand the above trajectory the game becomes hunting out scarce real assets which will perform in real terms.

Energy is the clearest example of this with sector being capital starved on the back of transition/ESG aspirations.

Which is the basis for my Moats and Cannibals thesis.

In a low-inflation, easy money paradigm, the game was hunting out future growth; in a high-inflation, tight money paradigm, the game will become keeping up with inflation.

The hunt will be on for scarce assets producing real cash flow, those with the highest replacement cost having the largest moat.

It’s a law of capitalism that if a business achieves superior rates of return, other businesses will come after that opportunity, which will result in reduced rates of return. A business can’t just go around earning outstanding ROIC without competitors trying to copy them and compete with them.

The assets that are the hardest to replace and valued the cheapest are those where there is a wide spread belief they will be in terminal decline.

China Meltdown

I originally brought into the China bear thesis before digging into Louis Vincent Gaves work and questioning the basis for a lot of my assumptions (Making Sense Of The China Meltdown Story).

One of my incorrect assumptions was China’s reliance on the West for trade. Since 2022, China has exported more to emerging countries than to developed countries, and the trend is accelerating.

China's setting new records in its trade surplus should also make you question the meltdown narrative.

It’s underreported how China has leapfrogged the US in many technology fields (with many clinging to the narrative that they are only capable of copying/stealing tech).

Chinese EV’s were laughed at 10 years ago and now the West has had to turn to tariffs to protect their uncompetitive industries (EVs being the clearest example BYD launches next-gen plug-in hybrid system with 2100km range for $14,000 USD).

Now covering 64 critical technologies and crucial fields spanning defence, space, energy, the environment, artificial intelligence (AI), biotechnology, robotics, cyber, computing, advanced materials and key quantum technology areas.

These new results reveal the stunning shift in research leadership over the past two decades towards large economies in the Indo-Pacific, led by China’s exceptional gains. The US led in 60 of 64 technologies in the five years from 2003 to 2007, but in the most recent five years (2019–2023) is leading in seven. China led in just three of 64 technologies in 2003–2007 but is now the lead country in 57 of 64 technologies in 2019–2023, increasing its lead from our rankings last year (2018–2022), where it was leading in 52 technologies.

Lastly China has been proactively addressing it’s energy dependence issue. Energy security is Chinas main concern not emissions like the west. Their rapid expansion of EVS and coal plants at the same time make sense from this angle.

One of China’s largest wins was Russia being pushed into trading in renminbi following the West seizing its USD assets. Being able to purchase the commodities/energy you need in your currency (which you can print) is a game changer and makes perfect sense when you look at the below chart (Europes lost was Chinas gain!)

Digging into Met Coal

There has been a steady flow of media scarce mongering with the China and its effect in the met coal market.

Most after reading a few of the below articles reach the conclusion China’s property crisis is going to drag iron/ore/steel and met coal markets down with it.

The reality paints a different picture

China produces 54% of global steel using 80% of its own met coal.

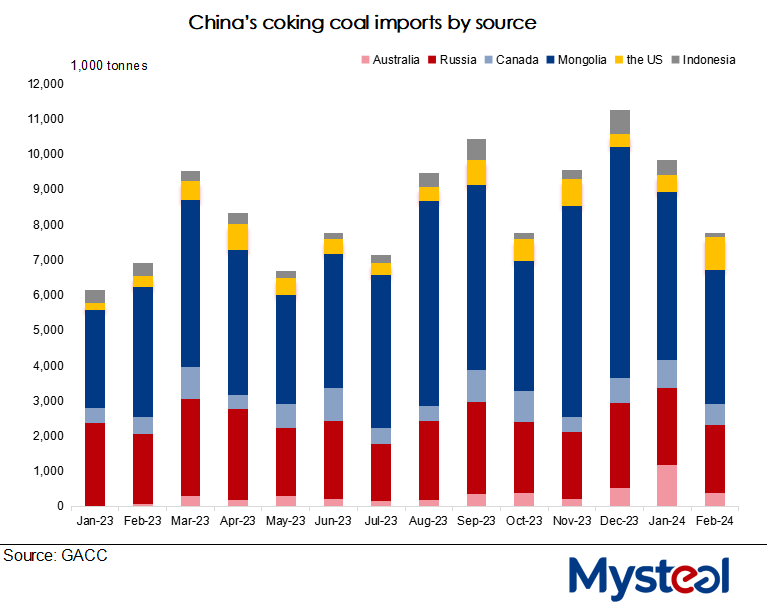

Of the 20% it imports, 78% comes from Mongolia and Russia

Mongolia and Russia combined accounted for 78% of China's 2023 met coal imports of 102.94 million mt, China's customs data showed

And Mongolia is increasingly dominating this with land based trade (I need to look through those Mongolian coal companies).

Massive potential trade growth is expected between Mongolia and China due to the commencement of the railway network between the two countries in 2023 and the construction of two additional rail networks underway.

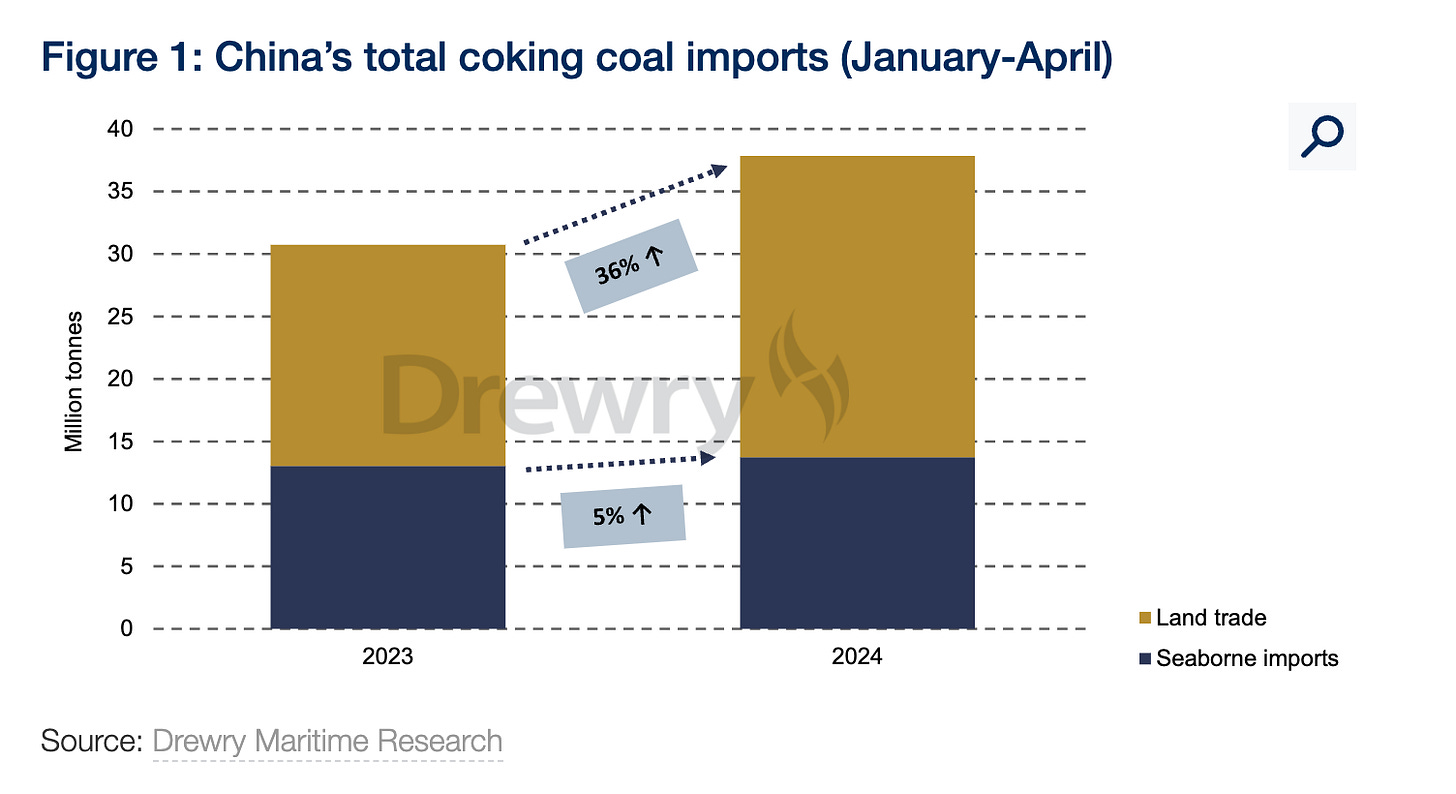

As you can see below, of the 20% China's imports, less than a quarter is seaborne.

The overall trend is slow growth, even during the China property crisis.

When you look at the numbers below, you can see why. Yes, the real estate sector is the largest sector and is contracting negative 4-5% YOY, but the infrastructure and manufacturing sectors are picking up the slack (real estate was 42% of steel consumption in 2010 down to around 30% today).

Where is the demand going to come from?

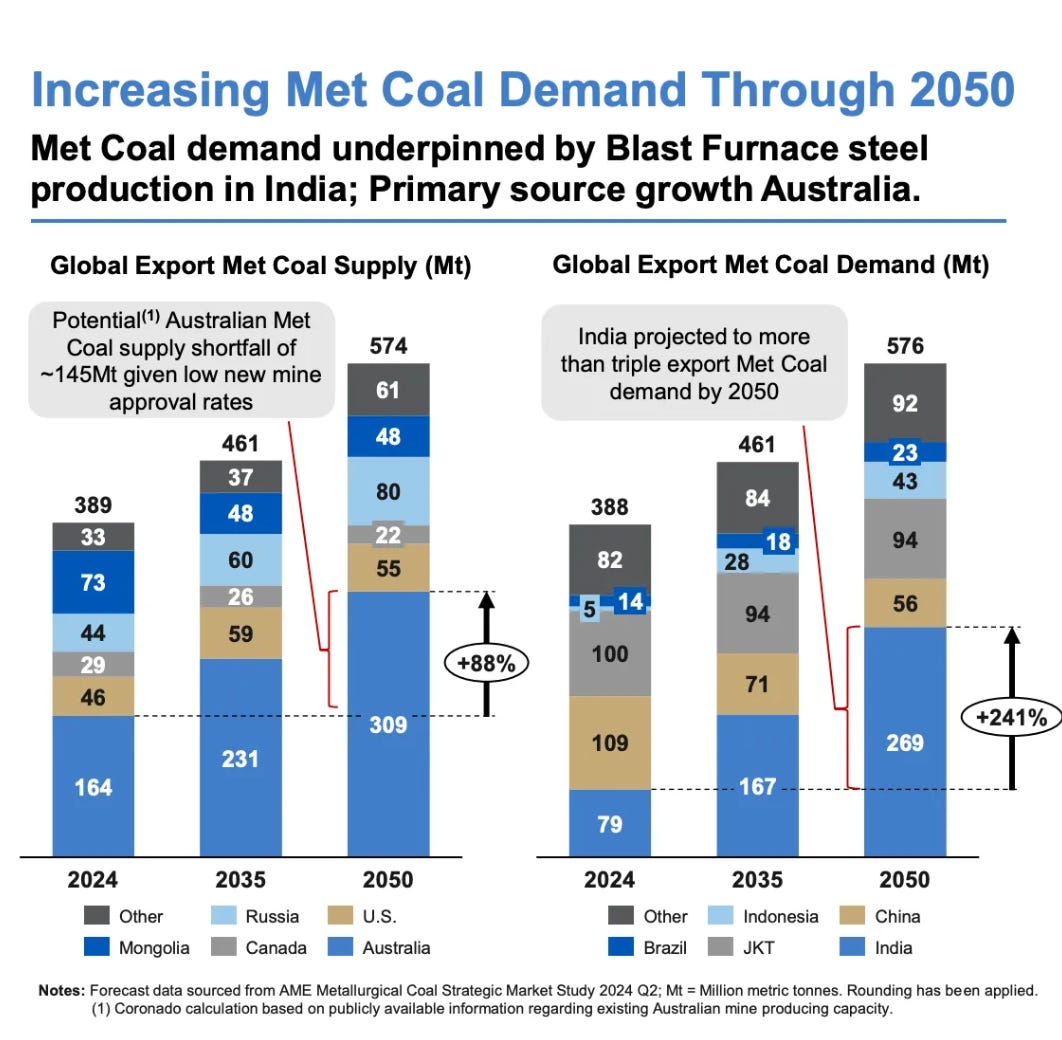

It’s an largely a India story, as while they produce roughly 10% of the steel China does, they import >90% of their coal needs from the seaborne market.

India is set to double its coal demand by 2035 and then nearly double it again by 2050….

I’m very bullish emerging markets growth which ties make to two of the points I made earlier regarding China. If they are happy to conduct trade for goods and commodities in local currencies (net settled in gold) then the bottleneck that is the US dollar is removed which will light a fire under many emerging economies ability to grow which will show up in steel/met coal demand.

How about the supply?

The majority of seaborne met is in countries doing their best to starve coal of capital (Australia, U.S and Canada).

Investors want buybacks/dividends and punish companies for considering development/acquisitions (as both Whitehaven and Yancoal have found out).

Let alone exploration (I used Koyfin to scan for coal explorers globally and there are maybe 30 globally with all the charts looking like death).

You can also have a play with the Global Coal Mine Tracker which is a really cool resource.

The thesis in a nut is the below gap which no-ones doing anything to rectify.

It’s what you want to see as a bull in strong demand, inadequate supply and no desire to spend CAPEX to rectify it.

This brings me to how crazy it is that there is zero mention of met coal CAPEX in mining majors' budgets.

Glencore having canceled it’s coal demerger avoids even naming coal and simply states, “$1.3 billion per year for supporting the continued operations of the energy portfolio in line with the climate commitment.”

The likes of BHP, Rio, and Anglo are busy throwing CAPEX at enabling the below chart while ignoring or try to get rid of the key ingredient for making most of these materials.

It’s why I’m not interested in lithium or copper when I read through the below article and the CAPEX the likes of BHP and Rio are investing in their future supply.

Capex for 30 biggest-spending miners to rise 6.2% in 2023

Where could I be wrong?

Domestic production boost

With India being the main driver of growth, it pays to keep an eye on it’s ability to ramp up its own domestic coking coal production: India aims to ramp up domestic coking coal supplies to trim imports: govt

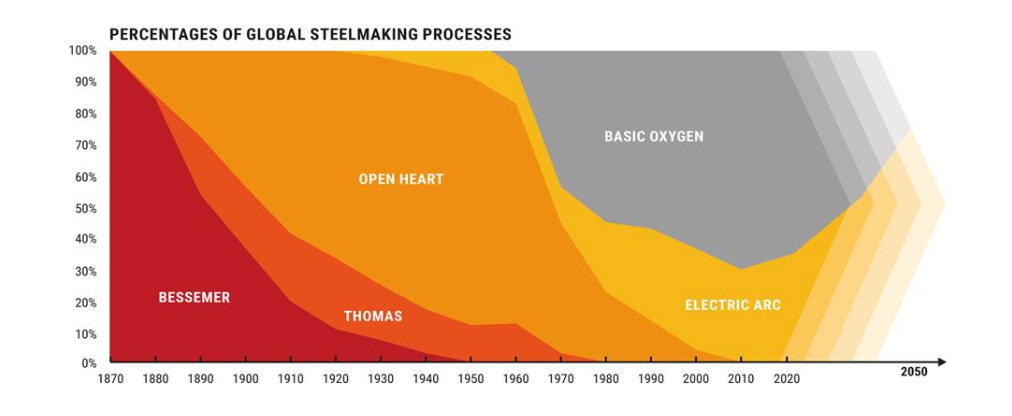

BOF vs EAF growth

On the back of the transition narrative their are projections that EAF (electric arc furnace is about to hockey stick.

Which is lead by China more than doubling its EAF proportion of steel production.

Share of EAF route in global steel production likely to rise to 40% in 2030 - BigMint analysis

When you at the pipeline of whats in construction and has been annouced its not really happening with the current ratio looking to remain more or less intact.

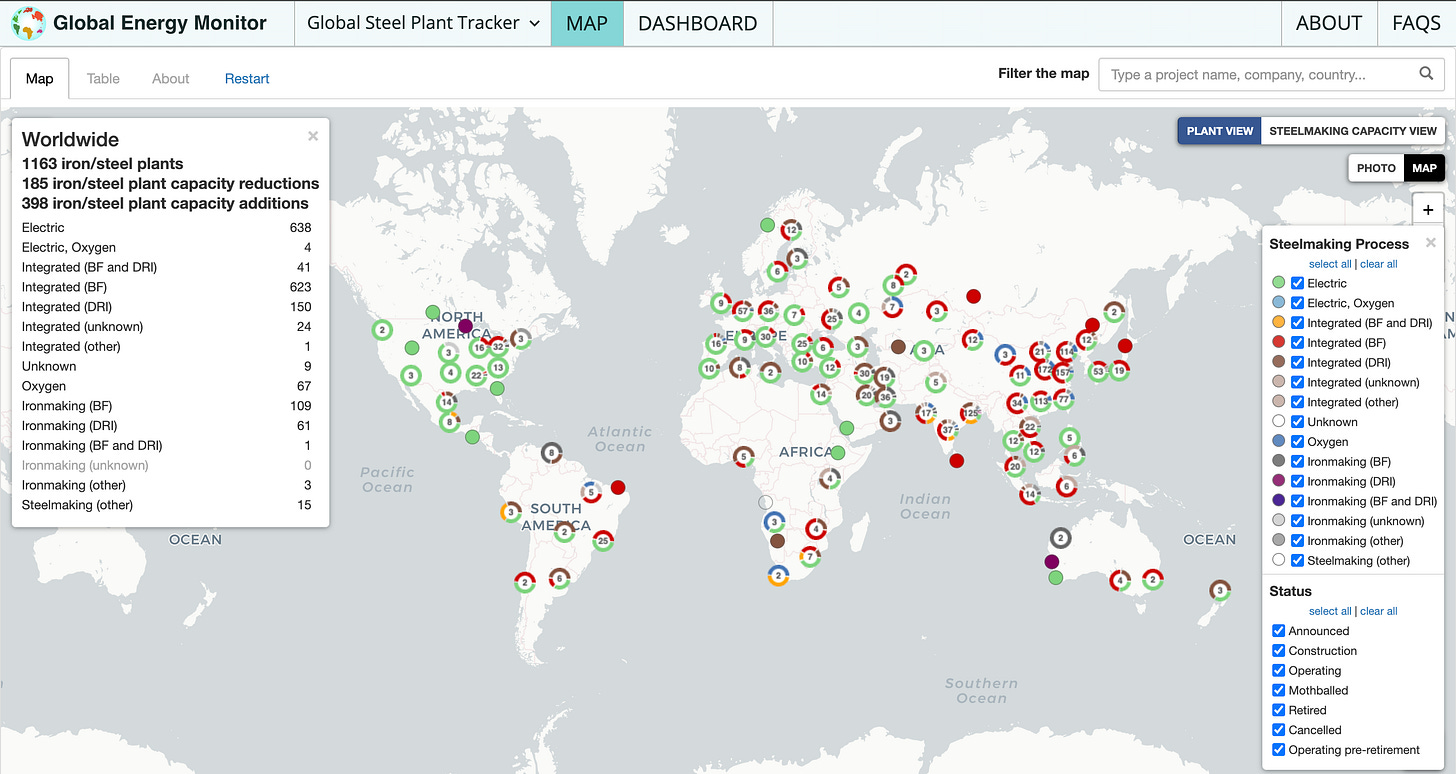

You can track the ratio of BOF to EAF via the Global Steel Plant Tracker, so it pays to check this from time to time.

SMRs producing hydrogen

SMRs are also a possibility for reducing met coal requirements: Tata Steel wants to go nuclear for green steel, mulling 200 BSRs

Tata Steel, one of the world’s largest steel producers, is examining the option of going nuclear for producing green steel. According to sources in the atomic energy sector, the company is looking at the feasibility of putting up about 200 Bharat Small Reactors (BSRs), of 220 MW each, totalling about 45 GW of capacity.

Yes, very early stages, but worth keeping an eye on.

Politicians pillaging profits

Lastly, there is the risk that if Australian coal companies start printing cash, politicians won’t be able to keep their hands off the profits, and a repeat of the Queensland Royalty hike could occur.