In keeping with my “where will this be in five years” theme today I’m tackling thermal coal, which I started investing in early 2021.

It was a lonely trade when I first wrote and talked about coal.

That said, at least the comments were encouraging.

I remember being emailed this following a piece I did on Peabody Energy for Crux with the title in the email: "This is what the smart money is doing".

You pay a high price for consensus, comfortable investments.

Mentioning coal at a dinner party in 2021 would have got the same reception as a fart.

Coal History

Most aren't aware of this little bit of history.

“From trough to peak, coal equities have been the best-performing sector in every commodity bull market since 1900.”

-Goehring & Rozencwajg

The outperformance of coal has largely been left out of the history books.

While the truly asymmetric section of the coal bull market is now behind us (think Peabody at $1 share or Consol at $3.80 share), it doesn't mean there isn't more to look forward to as the sector is still dirt cheap.

Cheap = lowest expectations wins

Why has coal been the best-performing commodity in each commodity bull market?

I will hazard a guess and say coal achieved the lowest future expectations for each commodity bull market while still being essential to our standard of living.

When the market prices of a sector for death/terminal decline, all it needs to do is not die or even die more slowly than expected, which can lead to massive outperformance.

Thermal coal continues to have the lowest future expectations of any commodity, with regular reports of it peaking or about to peak from IEA, BP, and pretty much every western energy agency/company at this point (not only Net-Zero projections but "current trajectory" which is always about to roll over).

Coal companies trading at 1-2x EV/EBITDA were at the opposite end of the duration spectrum to non-profitable tech. It was no coincidence the only coal ETF available to investors (KOL) threw in the towel and delisted as the non-profitable tech index was topping out and put a bottom in the coal market).

Shrubs piece highlighting the insanity of the multiple given to AI vs coal was brilliant: $724m is worth 35x more in the Metaverse.

Priced for perfection or death?

Nvidia had a clear signal of being priced to perfection in the company beat earnings expectations with "great numbers"; the problem was investors wanted incredible numbers).

Yancoal also got slammed 20% around the same time, although the reason was quite different in that it withheld its dividend to hoard cash for M&A opportunity (probably Anglo's coal assets). The cash is still on its balance sheet and will be paid out if they are unsuccessful!

In summary one got slammed for growing, just not enough to meet nosebleed expectations, while the other got slammed for considering growing via M&A.

The issue with punishing any coal growth plans is the fact there is no transition.

The Big Transition Addition

The world is and will continue to be in an energy "addition", not transition.

We continue to add to ALL energy forms for the foreseeable future.

For example, we burn double the traditional biomass (wood & dung) we did in 1900 (before you consider modern wood & dung biofuels).

Energy history has been the slow progression of a higher energy density source, which has gradually increased its market share over decades.

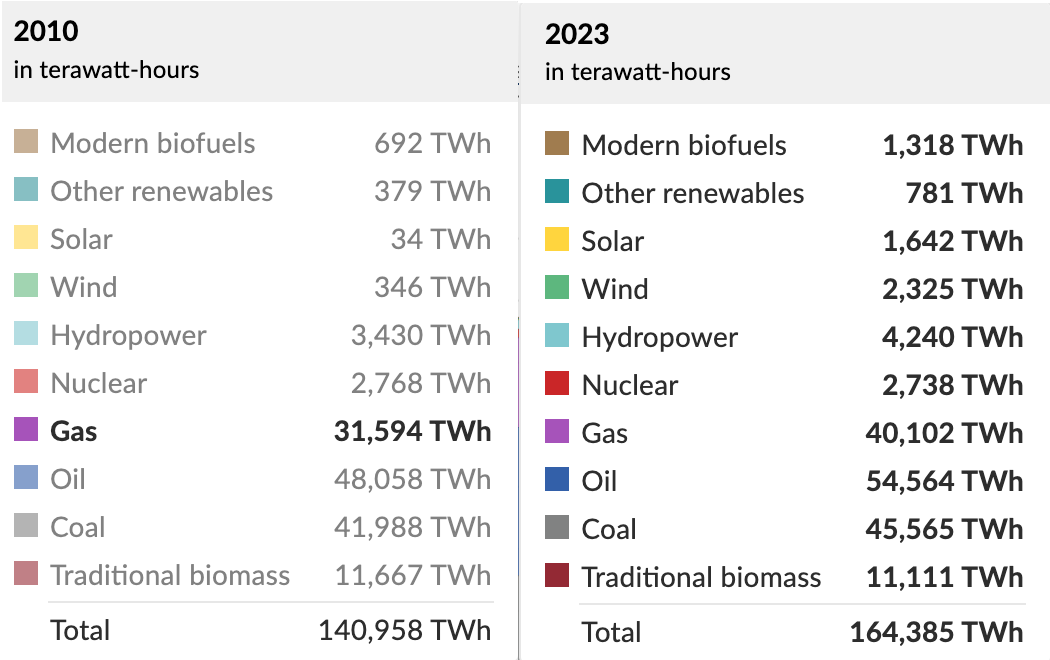

Primary energy consumption grew 17% over the 2010 to 2023 period, when the renewables push really kicked into gear with solar increasing 48x and wind nearly 7x.

While these numbers sound amazing and make all the headlines, coal added roughly the same TWh as wind and solar combined while gas added more than double this amount!

Or if you take it from 2020, when magazine covers like the one below were doing the rounds, coal additions have been more than double wind and solar.

Why is this happening?

A Western-centric view is one reason, with the assumption that developing countries will all follow the West's lead on Net-Zero ambitions when Net-Zero is a luxury you can consider when you reach a certain energy consumption/standard of living.

The OECD's 1.2 billion people (15% of the world population) is largely irrelevant to future population and energy growth.

The below shouldn’t really be all that surprising given Asia Pacific is 60% of global population.

Asia Pacific is nearly half of global energy consumption, and nearly half of that is from coal because it is what China, India and the rest of Asia have access to.

The visualisation that should open your eyes is the where countries sit on the oil consumption per capita (as a proxy for energy consumption).

US is 21.8 B/d per capita

Germany is 9.7 B/d per capita

China is 3.9 B/d per capita

India is 1.2 B/d per capita

Nigeria is 0.9 B/d per capita

Countries sitting below 4 B/d per capita are going to add 2 billion people by 2050 and fight to increase their standard of living. They are going to need to get access to every molecule of energy available to them.

Inconvenient Demand

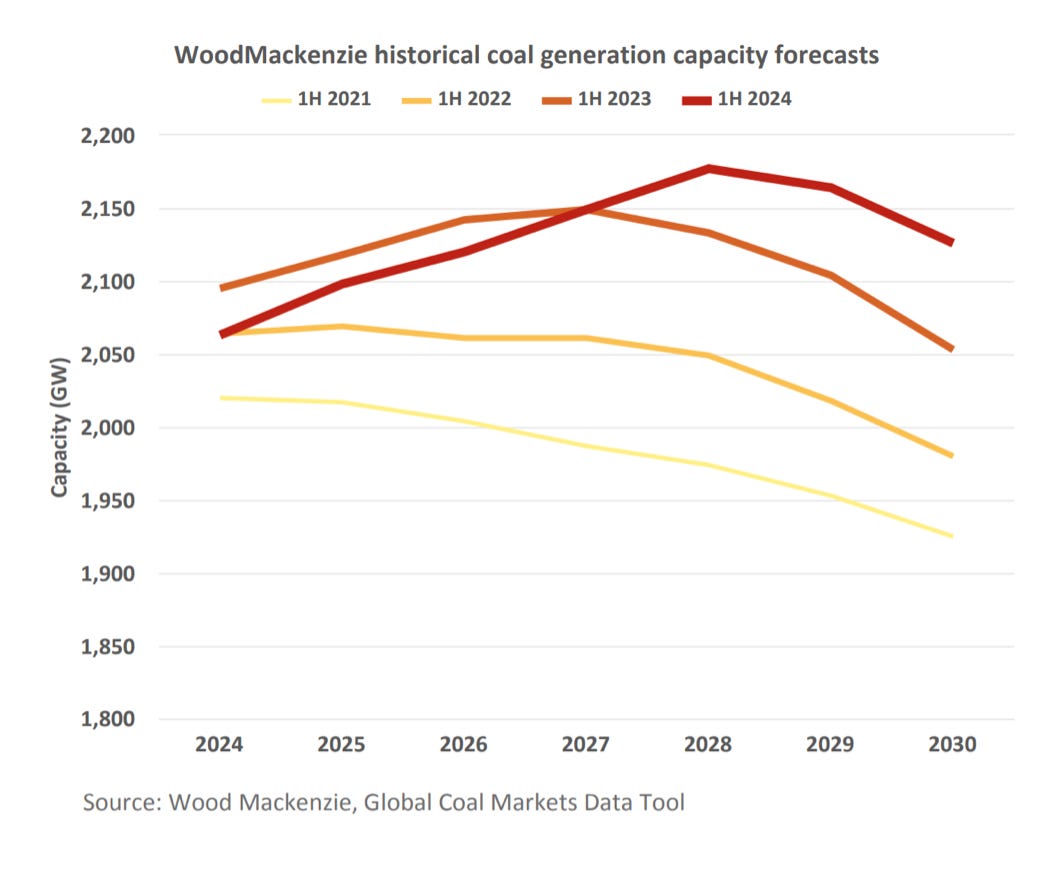

The last decade has been the likes of Wood Mackenzie forecasting coals fucked.

You could have paid them $10,000 for this report (Global thermal coal long-term outlook H2 2018) to tell you global thermal coal demand peaked in 2013.

It’s a forecast track record so unblemished by success it would make a IEA energy analyst blush.

That said, I'm sure they've nailed it this year…

Energy research firm Wood Mackenzie is forecasting 2024 as the year when the world's consumption of coal will hit a final inflection point before decreasing.

2014 was meant to be peak coal, with demand suffering terminal decline, yet here we are in 2024, with coal demand exceeding 2023's record year by 1% YTD.

What am I projecting for demand?

Nothing fancy I’m just adding what India and China have said they plan to add (conservatively).

India is building

53.6 GW,70GW, 88GW of new coal plants by 2032.

India said last year that it plans to add close to 90 gigawatts of coal-fired capacity by 2032, lifting a forecast from just months before by more than half. The country has 28.5 gigawatts of coal power currently being built and more than 50 gigawatts that are planned to be awarded for construction over the next three years, according to the people.

China now has 243 GW of coal power under construction and permitted. When projects currently announced or in the preparation stage but not yet permitted are included, this number rises to 392 GW. This means that coal power capacity could increase by 23% to 33% from 2022 levels

Putting these numbers into context, China and India are adding the entire Europe, North America, Latin America, CIS, Africa and the Middle East in additional coal consumption by 2032 (and this is conservative, using +23% and not +33% for China).

I could go into Africa's future energy needs, the rest of Asia and how even the West's numbers could hold up due to the rapidly growing demand for electricity, but the above examples clearly illustrate coal demand is set to keep growing.

Aren’t I underestimating renewables impact?

I mean, look at what China is achieving; take this article to illustrate.

China’s wind and solar energy additions eclipse coal in historic first

Pay particular attention to the use of capacity (instead of generation).

Thermal power plants (mostly fuelled by coal) accounted for 2,853 gigawatts (GW) of generation capacity or 48% of the total at the end of November 2023, according to the China Electricity Council.

Remaining capacity came from zero-emission sources, including solar (558 GW, 20%), hydro (421 GW, 15%), wind (413 GW, 15%) and nuclear (57 GW, 2%).

But thermal power plants still accounted for a far higher share of actual generation (70% in 2023), compared with lower shares from hydro (13%), wind (9%), nuclear (5%) and solar (3%).Source: John Kemp's free energy email:

Chinese solar capacity stands at 20%, while generation is 3%.

This table, breaks down Chinese generation. Media articles breathlessly report on solar growth of 28% YOY, which I'm sure gets far more clicks than reporting it has gone from 2% to 3% of China's total electricity generation over the past four years.

While coal's percentage of the total has decreased from 75% to 70% over the nine years, its total generation is up 48%.

You then have to consider the growth in electricity demand China has to keep up with as China has been averaging 5.5% electrical demand growth the last five years (so nearly double its entire solar generation needs to be added on an average year!)

It's even more pronounced in India:

Electricity demand in India rose 7% in 2023 and is likely to average growth of 6% a year through 2026 on higher economic activity.

Lastly, before I move on to supply, I wasn't aware of how seasonal Chinese hydro is, with winter averaging half the output of peak summer.

Chinese solar also follows this seasonality, granted it is less variable than I would have guessed, with only a quarter lower output during winter months.

What ramps to meet winter demand.. yip coal, it also steps in the case of drought effecting hydro.

This chartbook from John Kemp illustrates it well.