Fergs Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

JP Morgan: The Deep End By Michael Cembalest (December 2nd, 2025).

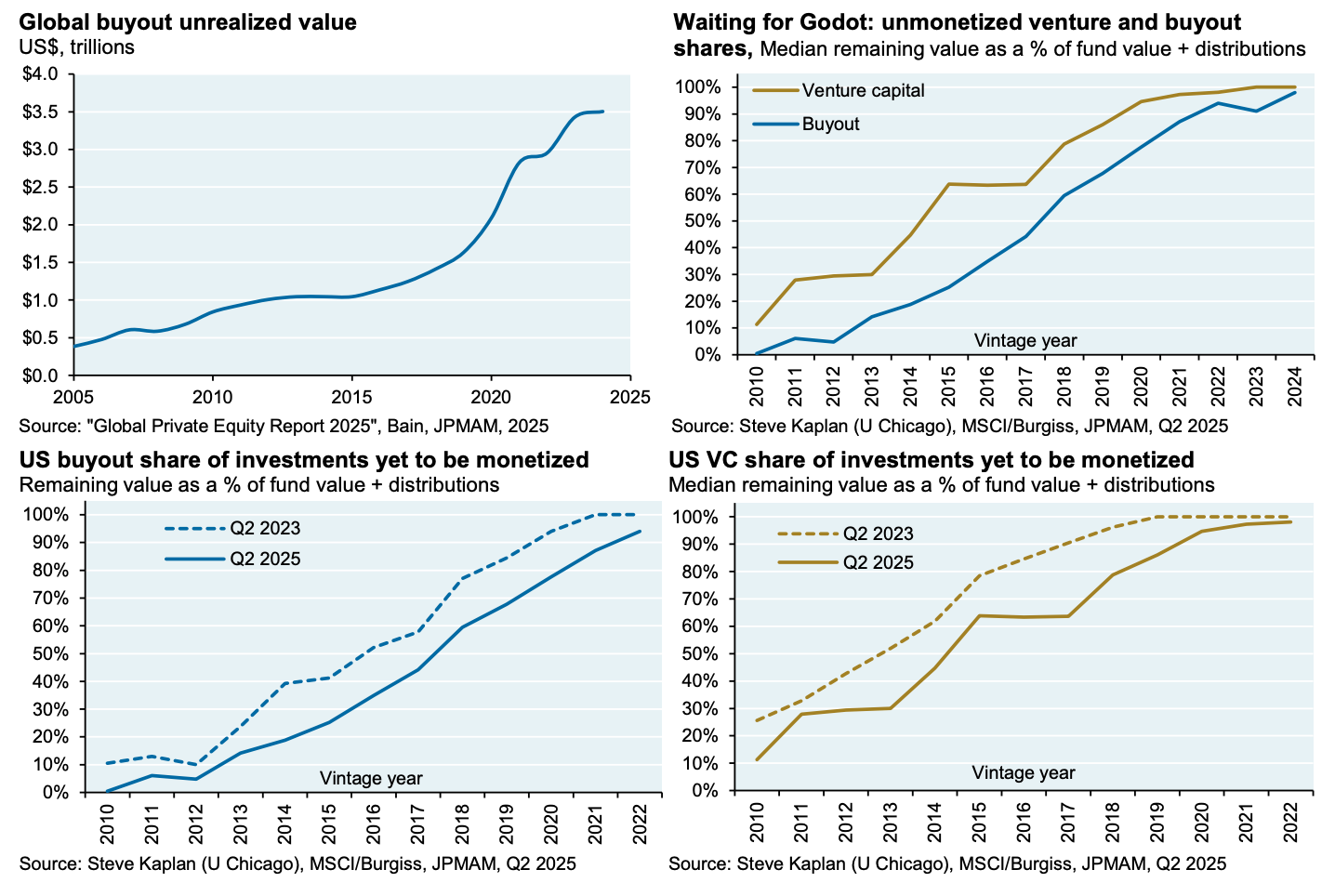

If you don’t have time to read it (it’s 56 pages), these charts tell the story (there is a lot of “trapped” paper/fantasy gains in PE and VC).

It also referenced this older piece, which I enjoyed:

JP Morgan: It’s Mostly a Paper Moon By Michael Cembalest (December 5, 2023)

Podcast/Video(s)

The above has me thinking about this observation from Mike Green that wealth creation is a mirage if it can’t be liquidated: The ‘everything bubble’ presents a bigger risk than AI: $11 billion strategist | Mike Green Simplify (timestamped).

“Now the question is can they actually get that money out? That’s an entirely different question. So when you again you know the phrase Ponzi is often used right Ponzi’s work great as long as money is being put in... if that’s being pushed higher that creates wealth for you feel richer than you actually are because when the marginal buying shifts to selling there’s really nobody underneath... We’ve gotten rid of all the short sellers. We’ve got rid of the value managers... Passive investing works in both directions.”

As to what to do about it? This was a great conversation on why Steven is getting back into the volatility game (no paywall): Listen: Grant Williams’ Interview with Steve Diggle.

Quote(s)

“Robots won’t trade well at inflection points. They will be fine at momentum but not at being contrarians. It’s called the pain trade for a reason. Investors need the willingness to be wrong for a while.”

-Daniel Bloomgarden, Head of Research, Multi-Asset Solutions

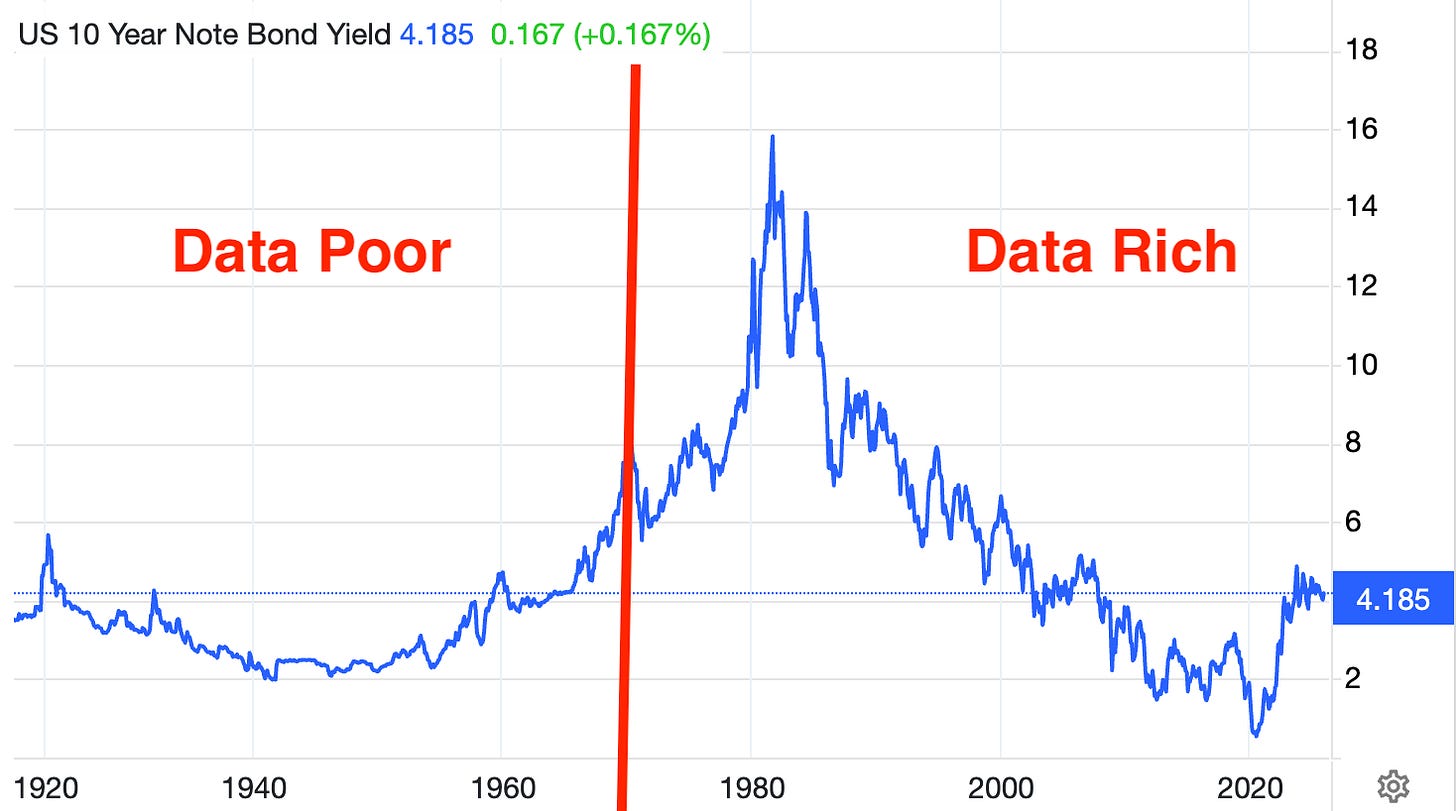

I also wonder how poor data quality will likely undermine AI investment models when you consider then very first digital financial databases was CRSP in the early 1960s (just stock prices), the first electronic stock market came in 1972 with the NASDAQ, the SEC’s EDGAR started in 1993 while the The Global Emerging Markets Database (GEMS) was only established in 2000.

The majority of the data-rich period has occurred under a single market regime, which exacerbates the issue: developed-market equities and large-cap securities are where data history is richest. In emerging markets, smaller companies, and commodity markets, data constraints could significantly limit AI’s effectiveness.

Tweet/notes

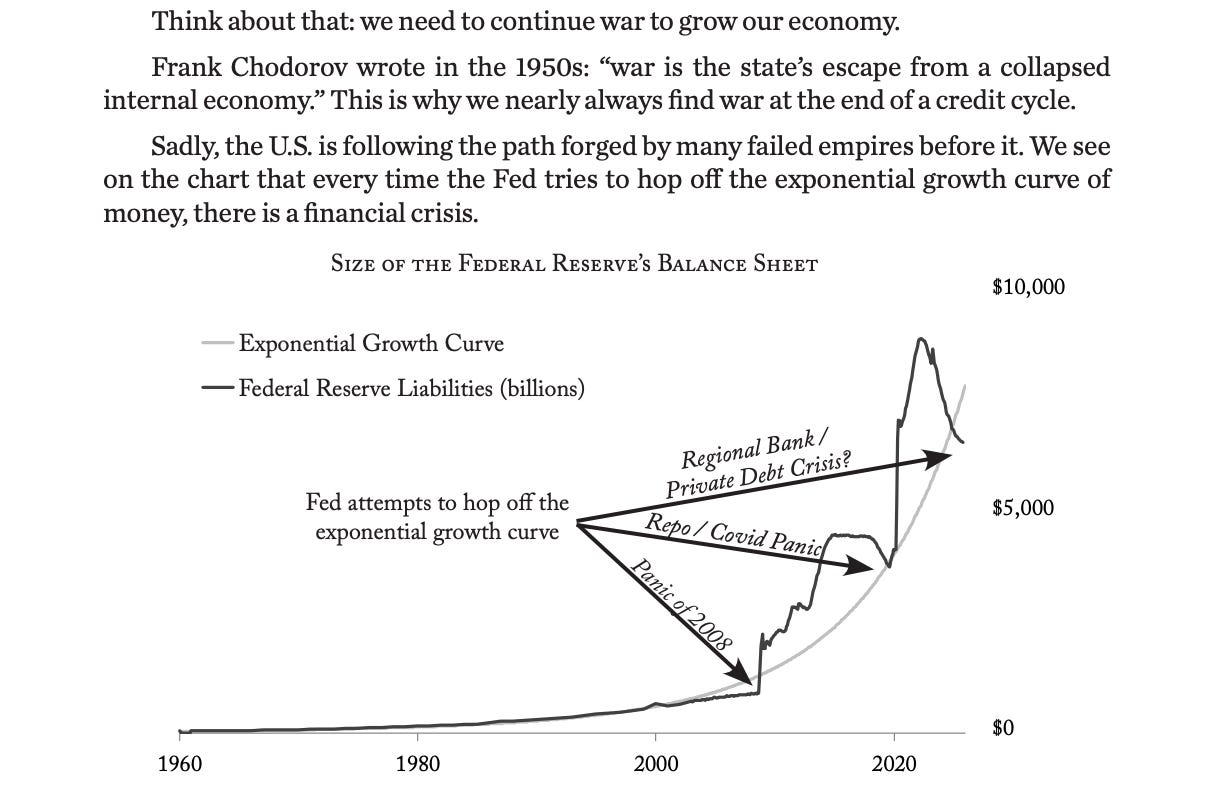

Myrmikan Research: This Time It’s the Same

This was a depressing observation.

Charts

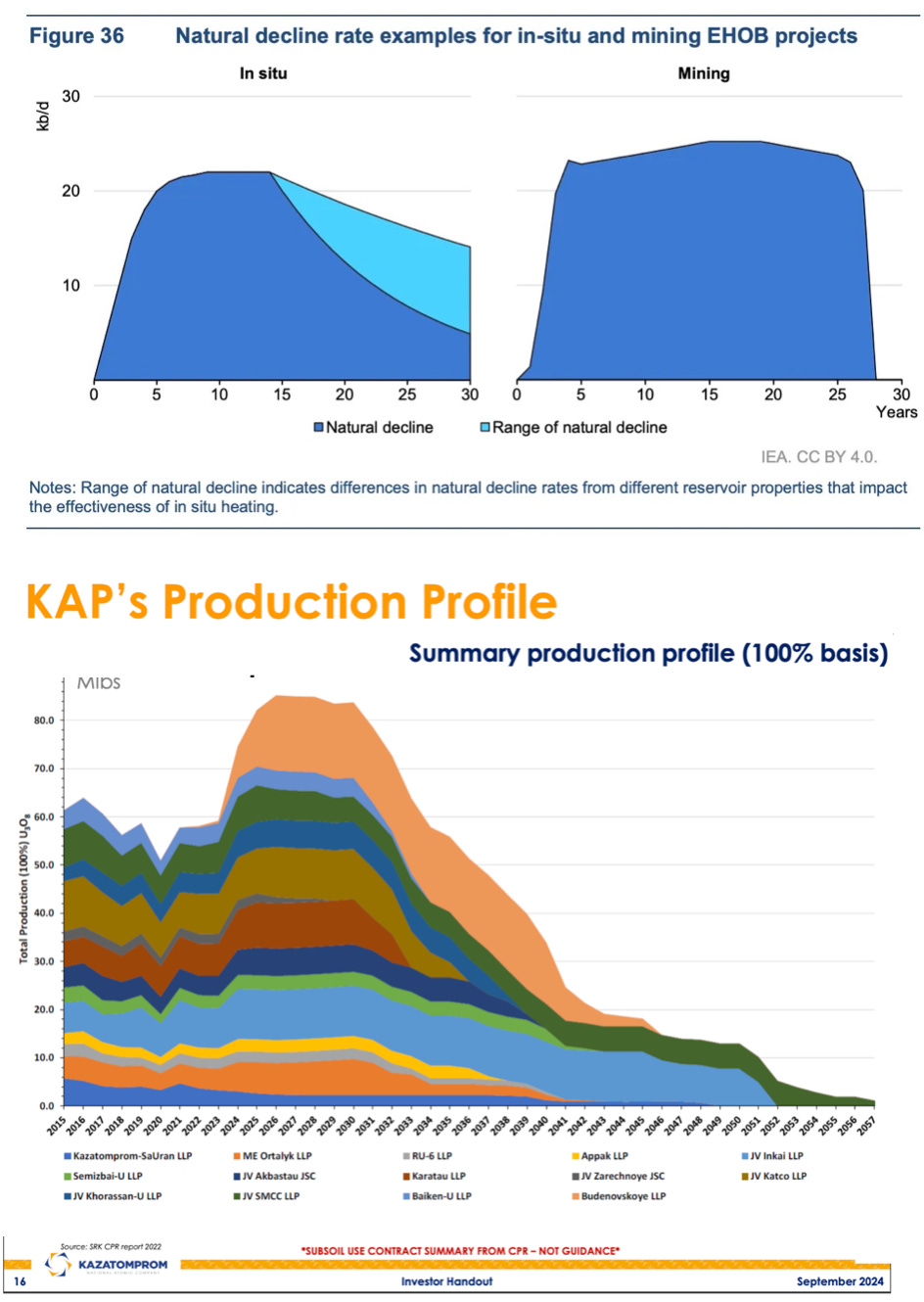

This chart caught my attention, as most are aware of the high decline rates of fracking/tight oil, which represents ~10% of global oil production. Kazakhstan accounted for 41% of global uranium production in 2025 (25,750 tonnes). Now consider their production profile in the chart below.

Something I’m Pondering

Having searched the Fuck you money clip on YouTube, the algorithm suggested a clip of the concept of “fuck you family”. Chris Williamson had outlined the idea in this piece: Freedom, Liberals & Love.

Similarly, “fuck-you freedom” is kind of downstream from fuck-you money, but also can be achieved through cultivating a lack of reliance on other groups.

But I’ve recently learned about another type of fuck-you liberation.

One which is significantly cheaper, more accessible, more common and maybe even more powerful.

The “fuck-you family”.

Many fathers I’ve spoken to have told me about how their priorities were completely changed upon starting a family.

All the previous status games they played seemed petty.

The admiration and gamesmanship they used to play in an attempt to impress people in power or those with status seemed juvenile and shallow.

Much of their anxiety around whether different people liked them or thought they were cool evaporated.

The only people they needed to care about impressing were now asleep in their house.

Maybe it’s just the stage of life I’m in, but this observation hit the nail on the head for me. The only time I feel a pang of envy isn’t seeing the flash car or the big house, it’s when the happy family with four kids sits across from us in our local cafe.

They just make life so fun and fulfilling.

Cheers,

Ferg

P.S. I wrote this piece to outline a few of the rules I stick to religiously to protect myself from a dose of FOMO…

Thanks! I needed the comment about that 4 kid envy! .. I have 6 kids, and will be home H1 with the 1yr old.. in the middle of it all, it's easy to lose sight of what you described, the bright side of having (many) kids.

I'm single and just went 38. By personality a lone wolf, always have been. In the last few years the impact of living alone hits harder with each year. If you're younger, in your 20s or just went 30, time to get a partner. Don't overthink what freedoms you will loose. I have them all and they don't matter when you see your peers carrying their kids around. Then you know you're a failure. Even if having a family was never your objective you will feel that way, its biologically imprinted. And instead of having time with your kid, actually you will start to procrastinate or work even more because you don't know what to do else.