Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

I'm always excited for this to hit my inbox; granted, I need a strong coffee and half an hour to absorb it!

Podcast/Video

A Challenging Year Ahead For The S&P = Opportunity For Active Investors | Dave Iben

Kopernik’s quarterly presentations are always full of value.

I particularly enjoy the adds and trims page.

Quote

"Value investing is pain, and the higher the level of pain,

the better the future performance."

-Jean-Marie Eveillard

Tweet

The US shale producers' proven reserves YOY change continues to tell the story for those paying attention.

The consequences of the gasification of U.S. shale production are significant for the global oil market. One important macro consequence is that U.S. crude oil production will be increasingly challenged to remain flat.

Charts

A chart that could have easily ended up in my piece: Don’t Fade the Chinese

I don't see China lagging in internet users for much longer when you look at the charts below and consider their dominance with 5G.

At least the US is now trying to reverse course with industry.

The only dominant global share I see Europe maintaining is virtue signaling.

Take the below "EU Clean Deal" when I thought Europe was already at their quota of dumb shit for the year.

It take a special sort of stupidity to secure a place in a Brussels think-tank…

“Amid the geopolitical shock unleashed by President Trump, the European Commission has reaffirmed its commitment to climate action,” said Simone Tagliapietra, a senior researcher at the Bruegel think-tank. “This is good news for Europe, as decarbonization represents the only structural way to reduce its energy costs and increase its energy security in an increasingly volatile international context.”

Something I'm Pondering

I'm pondering when it goes from reflexive buying to panic selling.

Also, the roll margin has played in all of this and how nasty the unwind could be on the back of it.

I’m pondering the cleanest way to capture this gap (alternatively leaning into PGMs which are deeply hated and production continues to get shuddered: Impala could close Canadian palladium mine early after price rout).

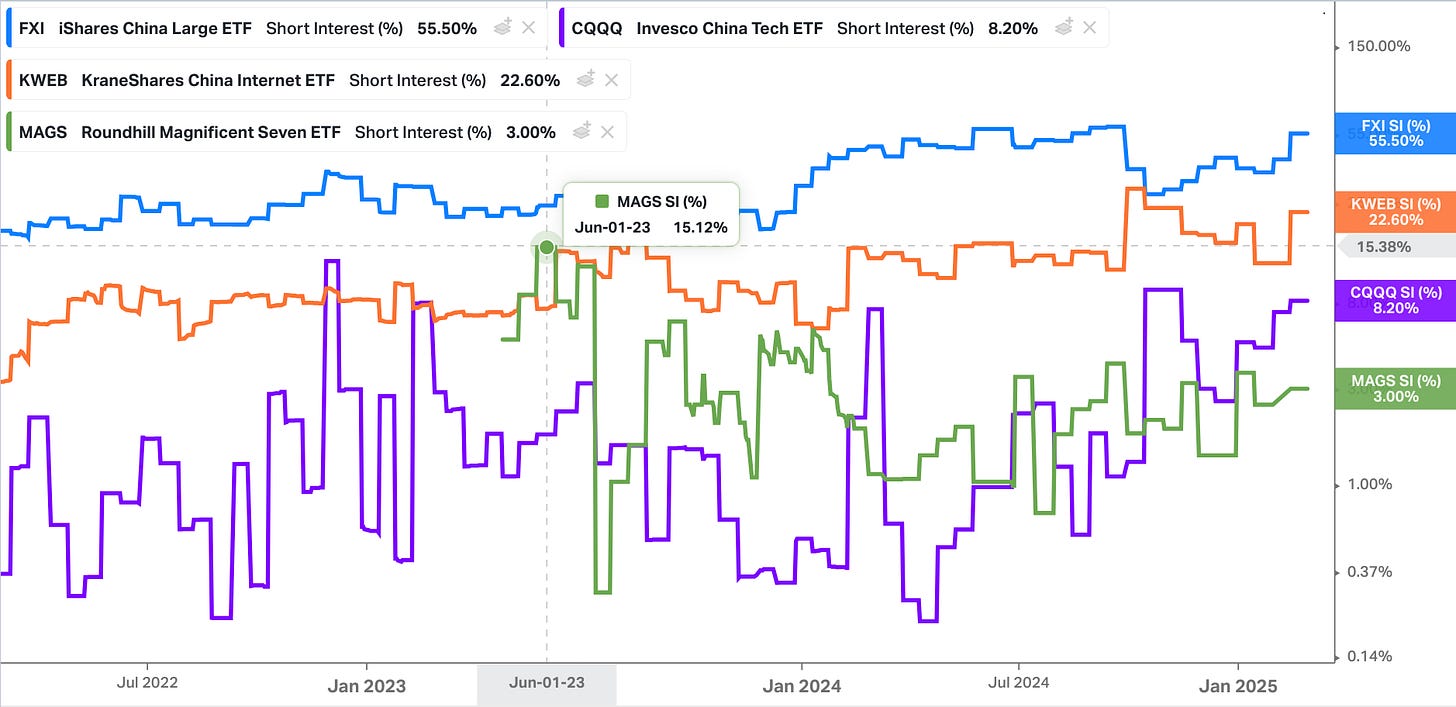

I’m pondering how shorters are all over hated corners of the market, while they have given up on shorting sectors at nosebleed valuations (the Magnificant Seven ETF started with 15% short interest and now sits at 3%).

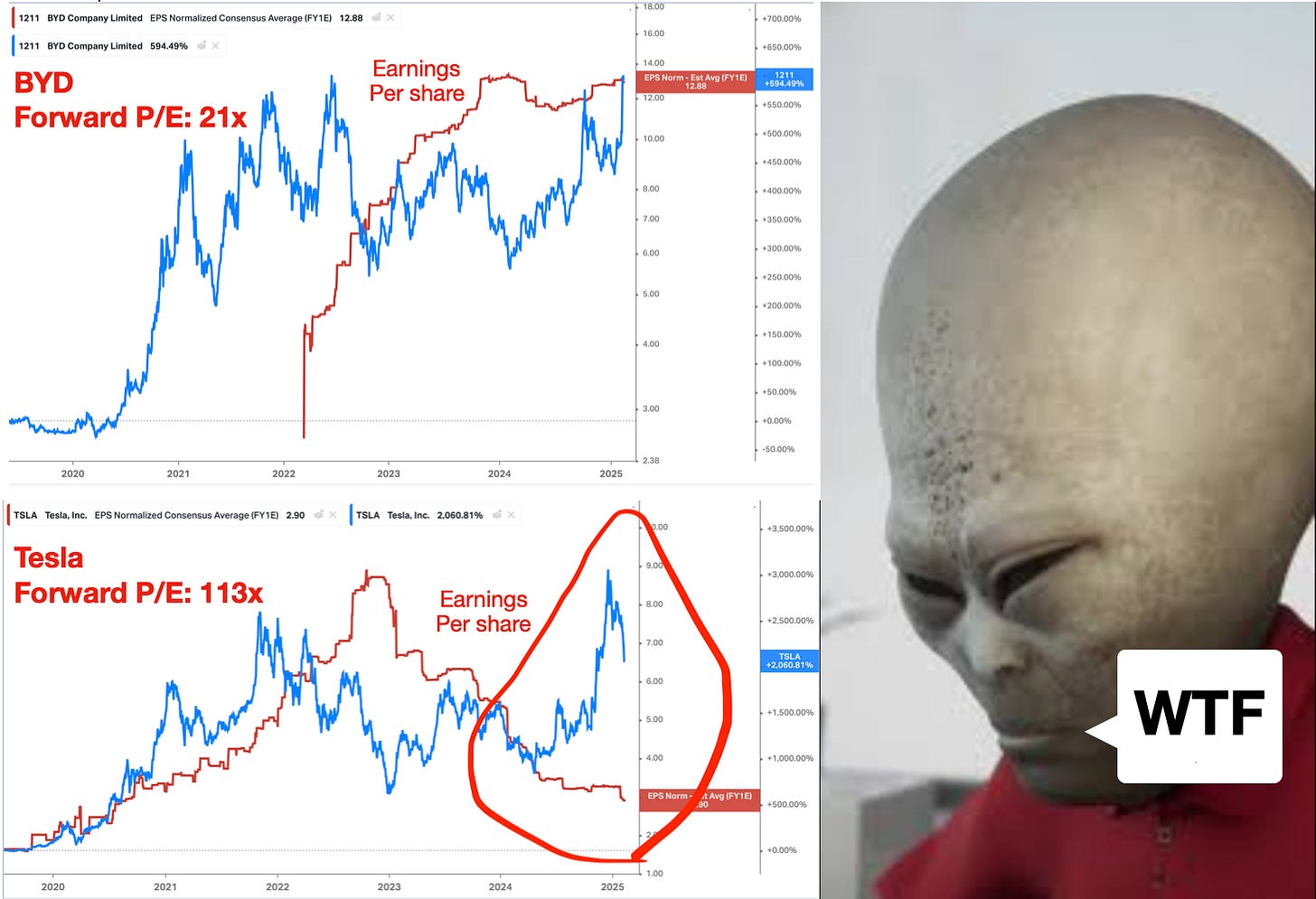

Tesla is the poster child for short-seller PTSD.

This is fascinating when it's clear they are getting eaten alive by Chinese competitors while still sporting a 100x forward P/E.

Or to explain via meme in my recent piece on Chinese Tech.

I hope you’re all having a great week.

Cheers,

Ferg

P.S. If you’re interested in my story and why I started this Substack, you can read the story here.