Fantasy Demand vs Real Demand

Discussing coal and in particular Whitehaven.

Sorry for being slow to get this out, as I’ve been travelling for the last ten days. We headed to Perth to celebrate a good mate's birthday with some friends. The plan was to fit some work in, especially when I saw Whitehaven’s acquisition get announced, but Mia got sick and the little guy is relentless (copious beers also impacted productivity).

I’m going to start with treasuries as I continue to be fascinated with the inflows despite them getting crushed: U.S. Treasury bond ETFs draw net inflows this year despite recent market rout.

Investors' eyes are firmly on the rearview mirror.

“We always refer to Treasuries as the world’s safest asset,” says Paul McCulley, the former chief economist for Pacific Investment Management Co.

The “safest” way to light money on fire.

If there was a coal ETF, I could make this point even more pronounced than with XLE.

What have Treasuries got to do with energy?

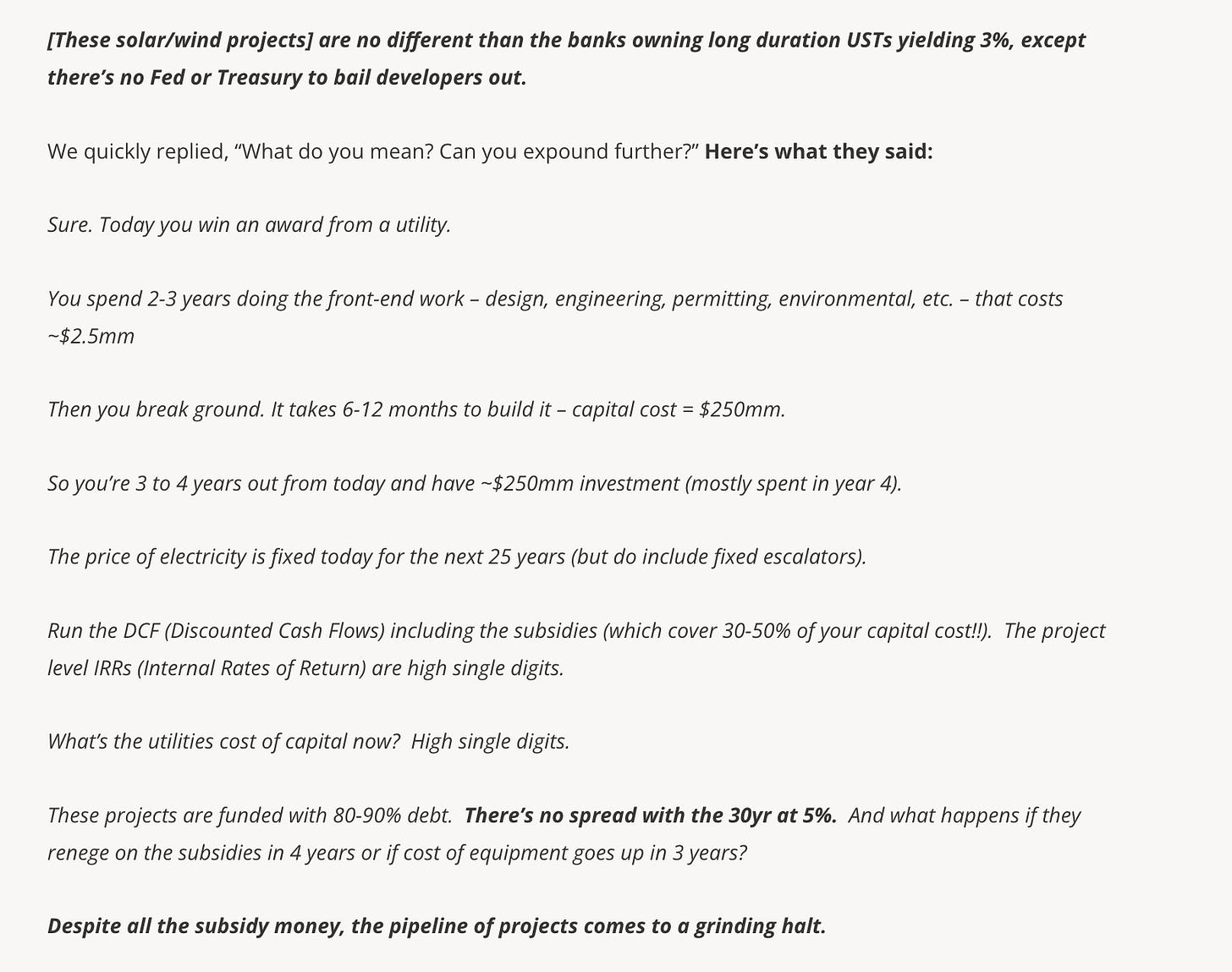

This exchange between Luke Gromen and a former shale energy exec illustrates the point well.

The big opportunity is the realisation that come 2050, wind and solar aren’t going to be 48% of the power mix.

If I had to guess, I’d say they are lower than current levels (good luck finding anyone else forecasting that!)

As explained above, wind and solar only made sense in an easy money, low rate and energy-abundant environment, which is now over.

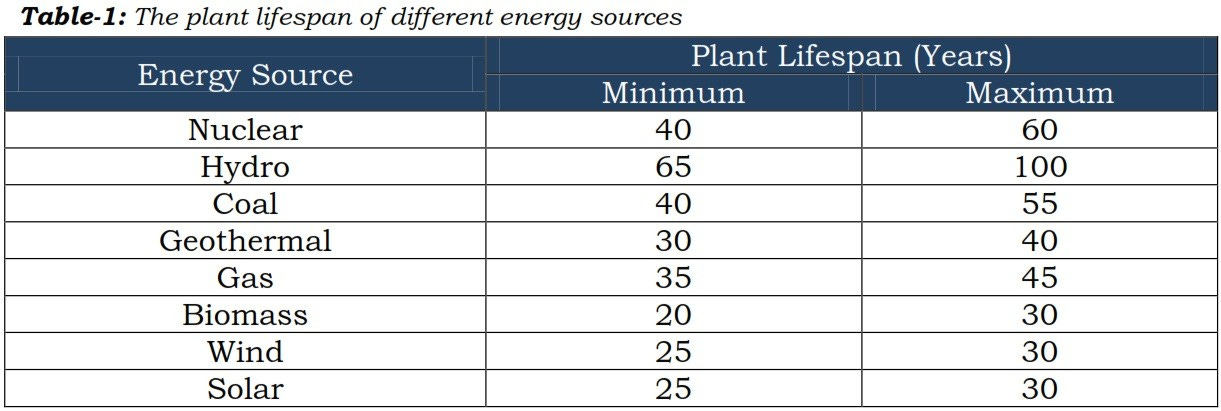

A point rarely mentioned is that in a parallel to shales high declines vs long-cycle projects, renewable energy can disappear quite quickly as few wind turbines are making it to the minimum plant lifespan of 25 years.

Take this study, which granted was published in late 2012 when the technology was developing: Wind farm turbines wear sooner than expected, says study.

The analysis of almost 3,000 onshore wind turbines — the biggest study of its kind —warns that they will continue to generate electricity effectively for just 12 to 15 years. The wind energy industry and the Government base all their calculations on turbines enjoying a lifespan of 20 to 25 years.

The recent headlines haven’t been kind to the argument that the technology is now mature and those issues are now behind us.

Expanding on my analogy to shale, the best wind locations (with the highest capacity factors and closest vicinity to cities) went first (high grading), as well as current projects are constantly battling age-related performance degradation of the turbine (on an average, the efficiency index of the turbine was found to decline by 0.64 per cent every year of its operation).

If 25 years is the minimum assumed lifespan, why does half the European fleet need a “life extension” at 20 years?

34,000 wind turbines in Europe are now 15 years or older, representing 36 GW of capacity. Most of the ageing capacity is in Germany. Spain, France and Italy also have a lot. 9 of the 36 GW are 20-24 years old and around 1 GW are 25 years or older.

WindEurope estimates that half of Europe’s existing wind farms will have their lifetime extended for 5-10 years when they reach 20 years of operation.

This brings me back to my early statement:

If I had to guess, I’d say they are lower than current levels.

The light blue ‘current capacity’ is the trajectory if it becomes untenable for Governments to keep throwing money at these projects. What would make this spending untenable? I’m guessing double digit inflation and triple digit oil.

That said, I’m not holding my breath in the near term with the European wind developers now seeking bailouts: Siemens Energy’s Wind Debacle Prompts Move for State Backing

The ideology hasn’t proved as strong in the US and certainly will not in developing countries that don’t have the ability to fuel this dumpster fire with taxpayers money.

New York Rejects Offshore Wind’s Request to Raise Rates

“To remain viable, they (Equinor, and BP), asked the state to approve a 54% price increase.”

“Orsted Chief Executive Officer Mads Nipper has said that the company is prepared to walk away from its US developments if it doesn’t receive more government aid. Orsted’s request to New York state was for a 27% bump.”

Lastly I thoroughly enjoyed this interview via decouple media on Denmarks wind industry: Gone With the Wind: Denmark’s Stalled Energy Transition. Which is important as Denmark has the best conditions for producing wind energy globally and despite 30 years of subsidies they could never achieved exit velocity and the companies are now in trouble financially.

Fantasy Demand vs Real Demand?

This brings me to my beef with the below type of supply/demand projections.

What are the assumptions going into the demand projection?

How much investment is being thrown at these demand projections? Most big miners have been offloading coal to focus on “transition metals.”

With copper how much of demand projections are green technologies or/and extrapolations of Chinese demand?

In investing the thesis with the least variables to go wrong wins.

Investing is hard enough as it is without having to guess macro outcomes or which tech wins.

Take BYD which is now the largest EV company if you include plug-in hybrid electric vehicles and by far the most cost competitive (the BYD Seagull with 305km range sells for $11,600 USD).

Besides the price, the battery chemistry is also surprising.

A 55-kW (75 hp) electric motor with a 30-kWh sodium-ion battery for 305 km of range

A 75-kW (102 hp) electric motor with a 38-kWh LFP battery for 405 km range.

Sodium-ion with no cobalt, nickel or Lithium.

LFP with no cobalt or nickel.

According to reports, the sodium-ion battery will be mass-produced in Q2 2023, and the first cars to get it will be the BYD Qin, Dolphin, and Seagull. Sodium batteries have been a thing in China recently – Volkswagen’s Chinese joint venture with JAC revealed the Sehol EX10, the first vehicle with a sodium-ion battery, in February 2023. CATL revealed its first sodium-ion battery in 2021 but didn’t announce any car maker who would use it since then.

Which lends me to wonder if they see graphite as the bottle neck: Why China is restricting exports of graphite

I certainly would think twice about betting on the below demand projections.

Don’t get me wrong; I’m by no means bearish battery metals; they probably outperform the majority of sectors moving forward, as will most commodities in a high inflation environment.

Plus if I was going to play this game it would be via tin which to me has the robust demand and bombed out supply setup.

I’m arguing that energy and, in particular, coal and uranium will massively outperform the rest of the commodity space.

Knowable Demand and Ignored/Inconvenient Demand

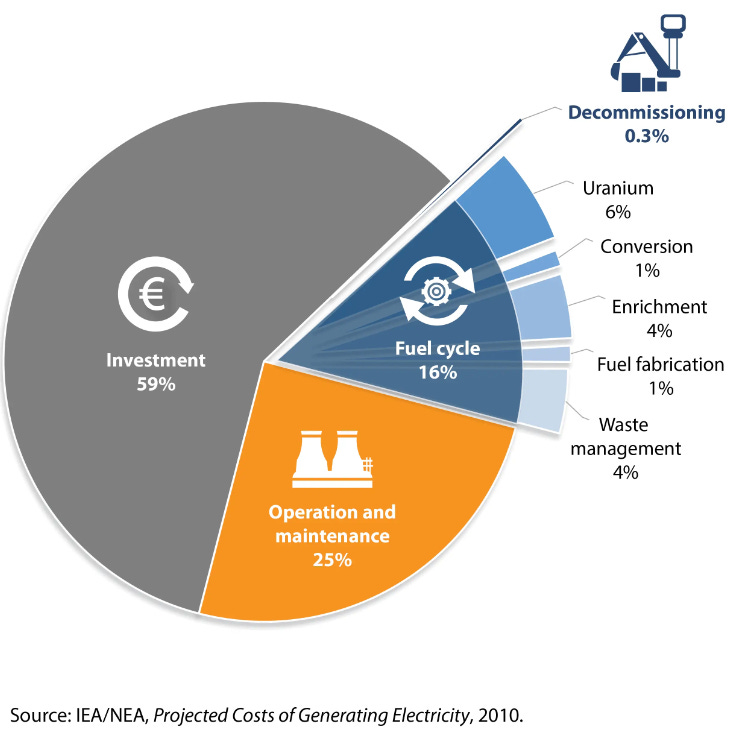

Uranium is one of the only commodities that has no substitute, and demand is reasonably knowable (number of operational reactors plus reactors under construction). Granted, inventories and secondary supply have been underestimated in the last few years.

This is why I am entirely invested in OPEX commodities (uranium, oil and coal) vs CAPEX commodities (steel, copper, tin, battery batteries).

A simple way to think about the difference between the two is principle vs interest on a loan. Principle (CAPEX) is nice to pay back when you have the ability to, while interest (OPEX) is non-negotiable unless you want the bank on your back.

That said, I’m always on the lookout for where I might be wrong and was pretty stunned to read this news from EDF: EDF warns of outages at Cattenom plant to save 6 months of fuel.

I also expect uranium analysts (when they are rehired) to get pumped up, and over-extrapolate demand as the uranium price does something silly as they did last bull market.

But there’s even more to the story... according to a UK study, there will be over 2,600 new reactors by 2030. That’s a 490 percent increase in worldwide nuclear reactors.

Ignored/Inconvenient Demand

The failure of renewables creates coal demand (which no one wants to acknowledge).

All we get are these IEA coal projections, which ignore the reality and revise the ‘make-believe’ another few years out

Coal is the quick fix, LNG is the mid-term expensive fix, and nuclear is the real solution with a long lead time.

I can’t even provide a thermal coal supply-demand projection as it's supposed to be in terminal decline, and each additional year of record coal consumption is a surprise.

Hell, it's what most coal company valuations imply is that the assets will be worthless in 2-3 years.

I’m not going to rehash what I went over here:

To summarise, China is adding a quarter (likely a third) to its coal fleet by 2030, while India is adding a quarter.

This is why I find myself with 2/3rds of my portfolio in uranium and coal. One is knowable demand and the other ignored/inconvenient demand that will keep surprising on the back of renewables failure.