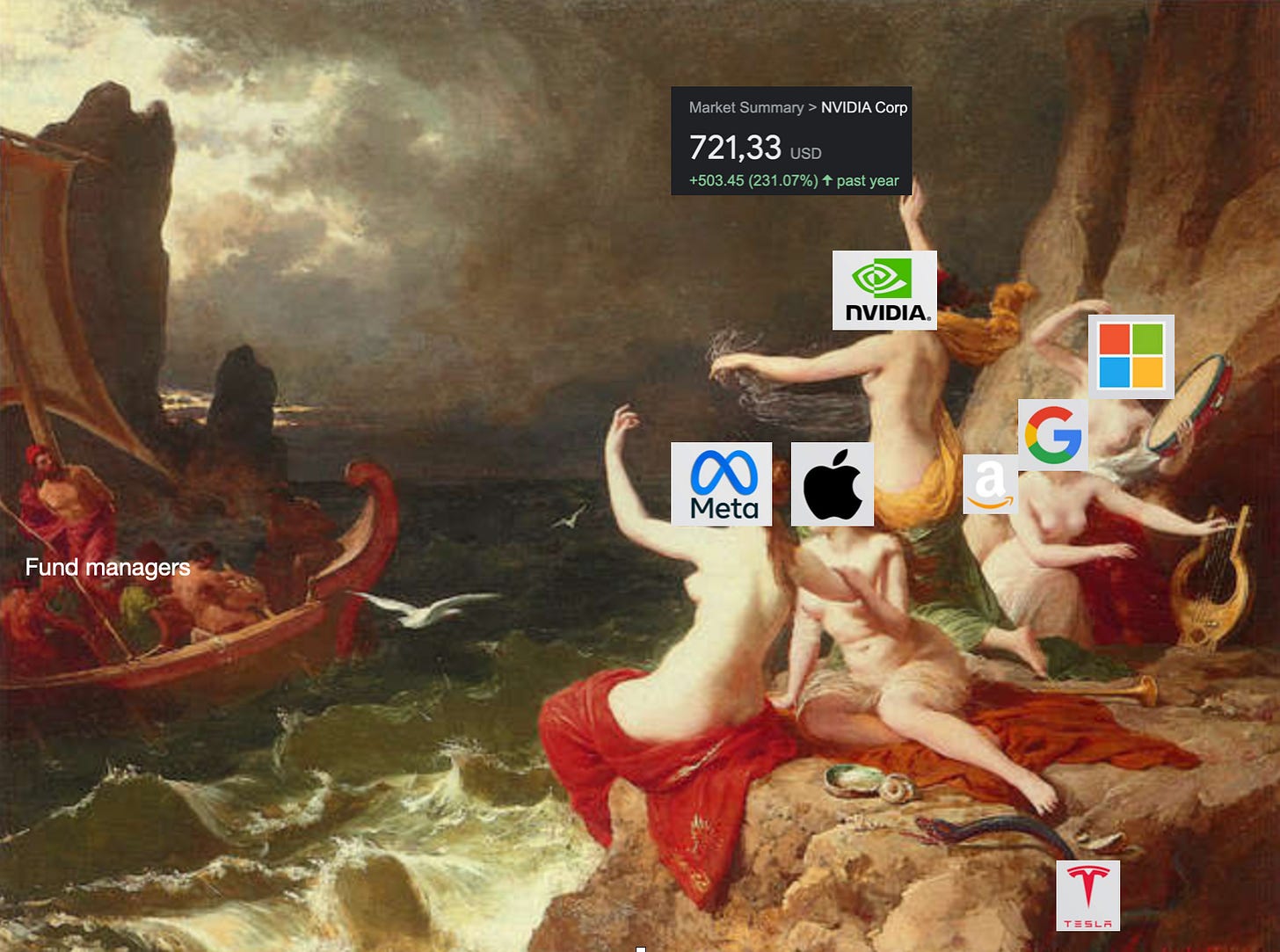

Avoiding the Siren Song

And evaluating the best opportunities in the bottom crawlers

The Siren Song in markets is the pull of chasing performance.

Markets have a way of gradually sucking investors into doing precisely the wrong thing, at precisely the wrong time.

Some is due to career risk; every fund manager that isn’t balls to the wall Mag7 is gradually redeemed for one that is.

Some is due to hindsight bias, “Why own all these other companies when I can just own the ones that provide all the performance.”

As for what causes Mag7 to underperform, both Horizon Kinetics' latest commentary and Koperniks the Nifty Seven are great reads.

Plus, my attempt to tackle that question.

Deep Value Pyramid

Following on from my piece, The Big Roll I'm continuing to plan for a gradual exit of the uranium trade as my exit signals start to get hit over the coming years.

In the next month or two, I'll be working through my short-listed buy targets, starting with offshore oil services today.

This is how I'm currently seeing the opportunity set.

Offshore Oil Services are the obvious first target for capital from exiting the uranium trade for all the reasons I outlined here:

Offshore the Future Oil Supply Story

In summary, we will have to turn to long-cycle offshore projects as it becomes clear the shale miracle can't be repeated.

Offshore drilling will keep attracting capital as it's where some of the lowest breakevens are.