What Goes up Must... Rebalance

Revisiting the issues with indexation being taken to extremes.

More than three years have passed since I first listened to The End Game Ep. 3 - Mike Green and read the Horizon Kinetics 2nd Quarter Commentary in July 2020.

It was Mike Greens' observation that was the light bulb moment for me.

Passive being ‘buy and hold’ is misleading as they are actually systematic active investors at any price.

Positive flows = buy at any price

Negative flows = sell at any price

Passive is based on the idea that you never sell. Underperformers get dropped, while outperformers keep outperforming.

What this fails to control is growth-based reversals, which will be brutal, let alone when passive flows have inflated them to nosebleed levels.

These nosebleed levels have been aided by passive cornering stocks float.

Take Amazon Market cap minus inside ownership Bezos and management (15%) =$1.2T Passive holds ~$910B, which isn't for sale and is increasing with positive inflows.

This means the available float is only ~$290B which index funds are in the process of cornering as an increasingly large proportion is “sequestered” by passive.

Pointing out how extreme things had got in 2020 now seems silly with hindsight, as COVID and the resulting stimulus has massively exacerbated the situation.

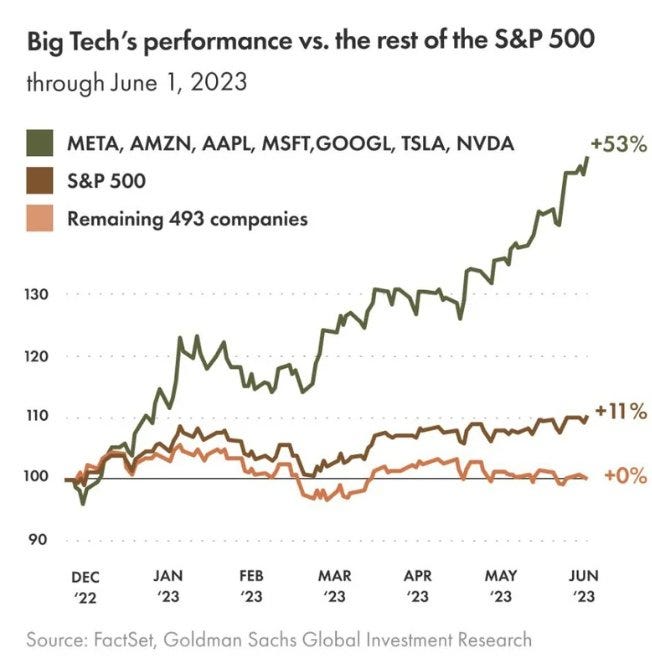

Passive and, in particular, the ‘magnificent seven’ continue to attract the majority of the flows. If you haven’t had exposure to these names, you’ve massively underperformed (unless you were prepared to go off the beaten track and outperform, which is tough).

Gavekal Research also pointed out the dangers of indexing in this piece: The Guiding Principle Of Our Time (page 4).

We have also argued that indexing is the new in-vogue form of socialism. Capital is not allocated according to its marginal return—the foundation on which capitalism rests. Instead, capital is allocated according to the size of companies. Just as in the days of the old Soviet Union or Maoist China, the bigger you are, the more capital you get. It is hard to think of a stupider way to allocate one of the key resources on which future growth relies.

In the 20th century, the goal of every socialist experiment was for everybody to earn the same salary. In the 21st century, it seems that the goal of indexing is for everybody to earn the same return. As we now know, fixing everyone’s return on labor at the same price was a disaster. People stopped working, and economic growth plummeted. Fast forward to today, and why should we expect a different outcome if the end-goal of our investment strategy is to ensure that everyone gets the same return, not on the their labor but on their capital? Isn’t the entire world of money management now oriented towards delivering this remarkable ambition?

“Indexes have managed to undiversify and undo the very logic of their creation.”

There is no better example of this lunacy than Apple and Microsoft hitting 14% of the S&P500. It gets even crazier when you consider the career risk of not being in these companies as an active fund (85% of active funds now own Microsoft).

It was easy to justify owning these names as their earnings continued to climb until a point in late 2021 when there was a realisation across a number of sectors that inflation is here to stay, and a lot of things (alternative energy, long duration bonds, non-profitable tech) don’t make sense at their current pricing/multiples.

The common retort is that they are highly profitable, unlike the Dot Com Bubble.

Apple, Amazon, Microsoft, Google and Facebook now make up around 18% of the overall U.S. stock market in terms of market cap but nearly 25% in terms of profit.

This was valid, as seen in the below ramp in earnings from 2020 to late 2021. From late 2021 on, the market cap and weight of these stocks have hit a record high, yet earnings have rolled over.

It’s even more pronounced if you look at the top six companies and their free cash yield.

This underperformance will eventually lead to rebalancing, especially as another sector starts to outperform.