The majority of investors are bus chasers; they are forever chasing what’s currently working or has been working.

“If you stand at a bus stop long enough, you’ll eventually catch a bus. If you run from bus stop to bus stop, you may never catch a bus.”

— Howard Marks

My favourite example of this is the Fidelity Magellan Fund managed by Peter Lynch.

Investors want certainty, yet asymmetry is greatly diminished by the time certainty has arrived.

I can split the certainty crowd into two groups currently:

Certainty in what has worked

Reflexively buying the dip in US tech on expectations of the Fed Put.

Retail traders plough $67bn into US stocks while investment giants flee

Retail Traders Rush Into Leveraged Tech ETFs, Betting On Nasdaq Rebound After Sharp Drop

“70 cents of every dollar went to US equities and US equities are driven by very few firms.”

-Nir Bar Dea (Bridgewater CEO)

This game has now changed, and it’s pretty clear who is going on a diet.

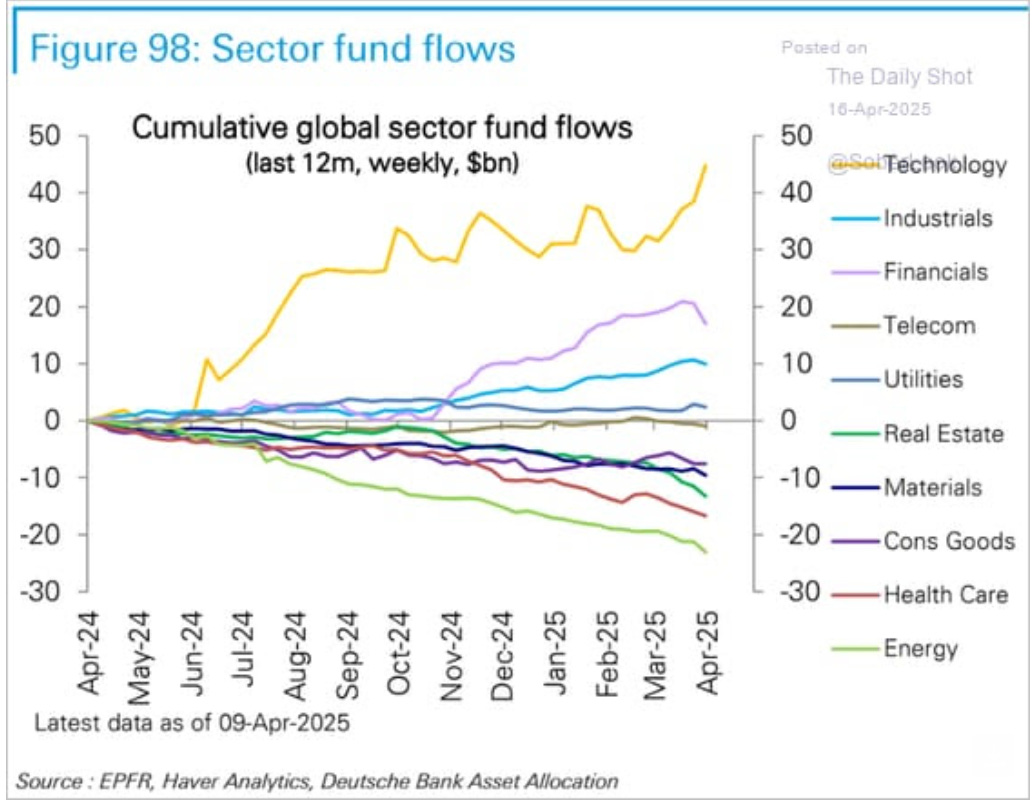

My basic framework is the more capital-starved the asset, the more it stands to benefit from this paradigm change moving forward.

Granted, I’ll be the first to admit that the poor energy pooch has continued to have a rough time the last few months!

Certainty in what is working

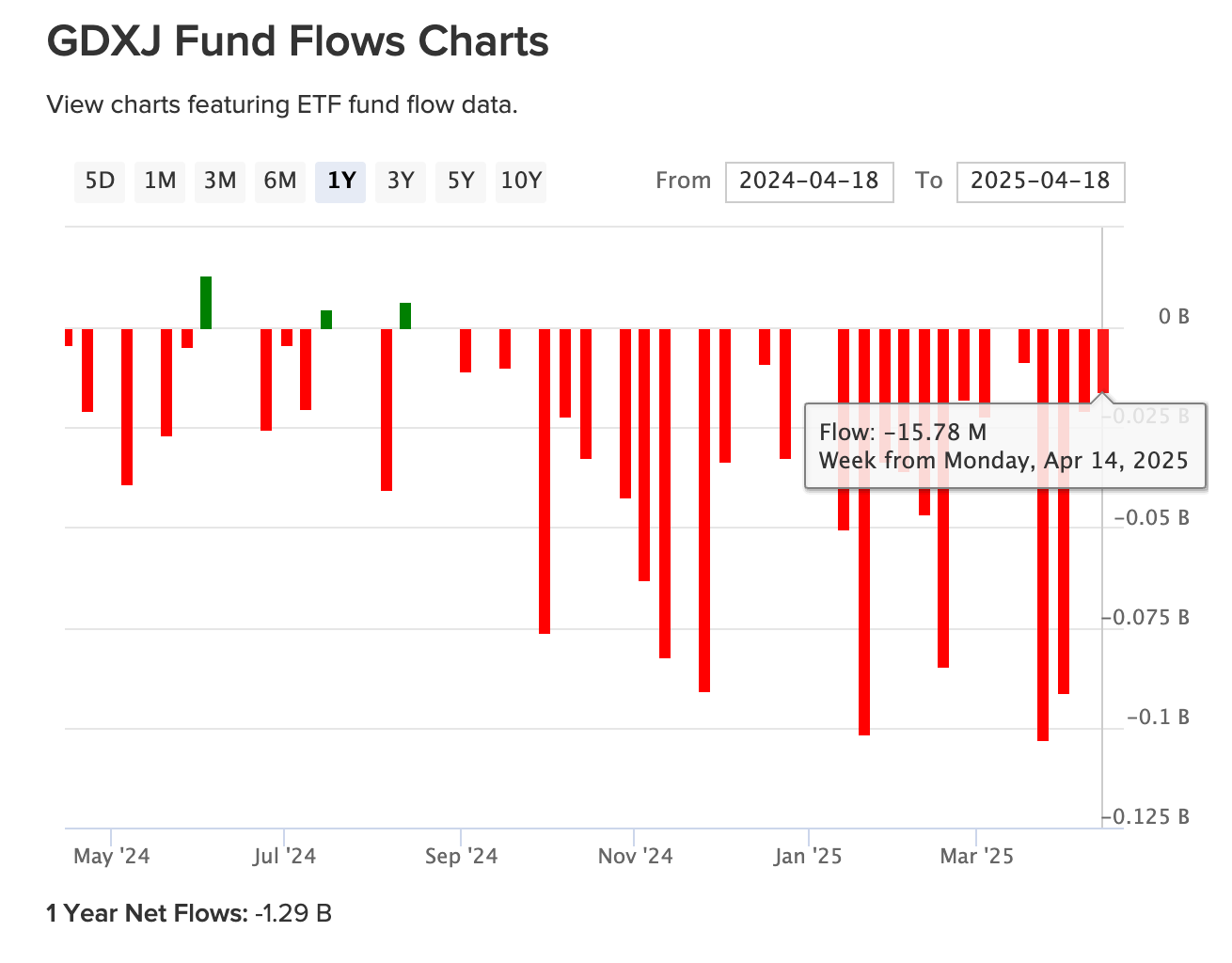

Gold has been the right place to be in the past few months. Which is not to say this positioning is wrong either; I love the gold setup for the long term. GDXJ was my most recent purchase, as I find it crazy gold miners are still so hated.

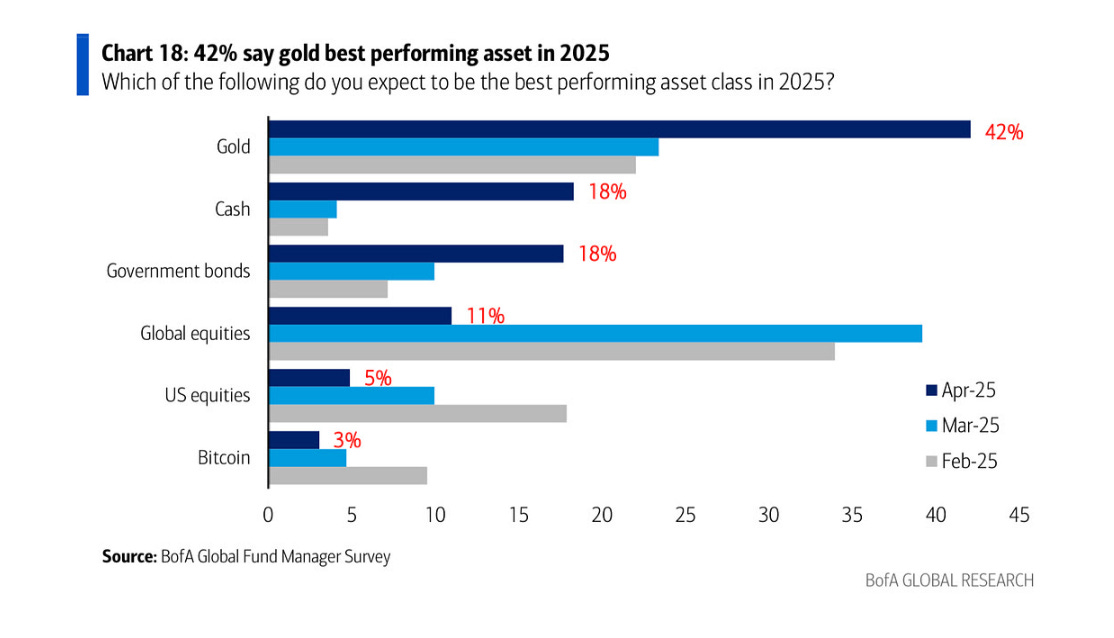

Gold does well from here, but when everyone agrees that something will be the best-performing asset, there is better asymmetry to be found elsewhere.

Gold is expected to be the best performing asset in 2025

However, 49% of investors also said being long gold was the most crowded trade in the market, ending a 24-month run for the Magnificent Seven stocks (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla).

If anything reduces that uncertainty, the asymmetry in a number of commodities is ridiculous here.

My base case is gold probably continues to do well short term before taking a breather as other commodities play catch-up. Yes, there was a big opportunity cost to not having been in gold, to use it to rebalance if we end up with a real capitulation event.

I found Felix Zulauf’s recent interview quite insightful, particularly his views on commodities here (time-stamped).

My favourite bus-stop

My piece on PGMs was titled Signs of Life, while oil’s title could be declared dead…

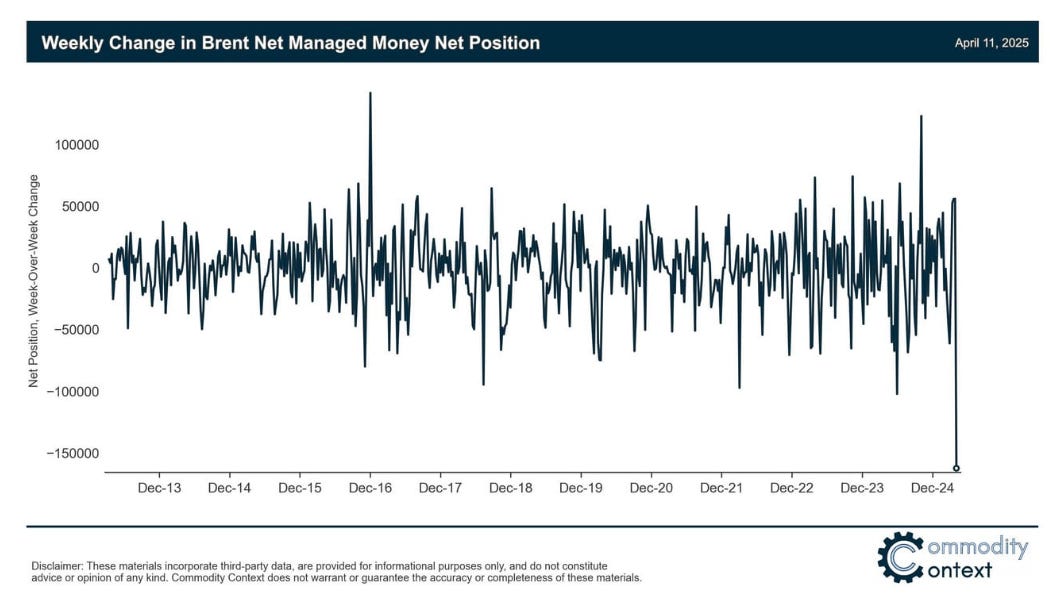

Sentiment has been massacred. I mean, the below chart says it all.

I enjoyed this piece by Roger Lafontaine: Oil bulls have completely capitulated, which points to a number of high-profile oil bulls having now thrown in the towel.

Also, pieces like Say Hello to ‘Nil, Baby, Nil’ in the Oil Patch point out that at these prices, oil firms have already started cutting CAPEX.

The negative asymmetry of shale production

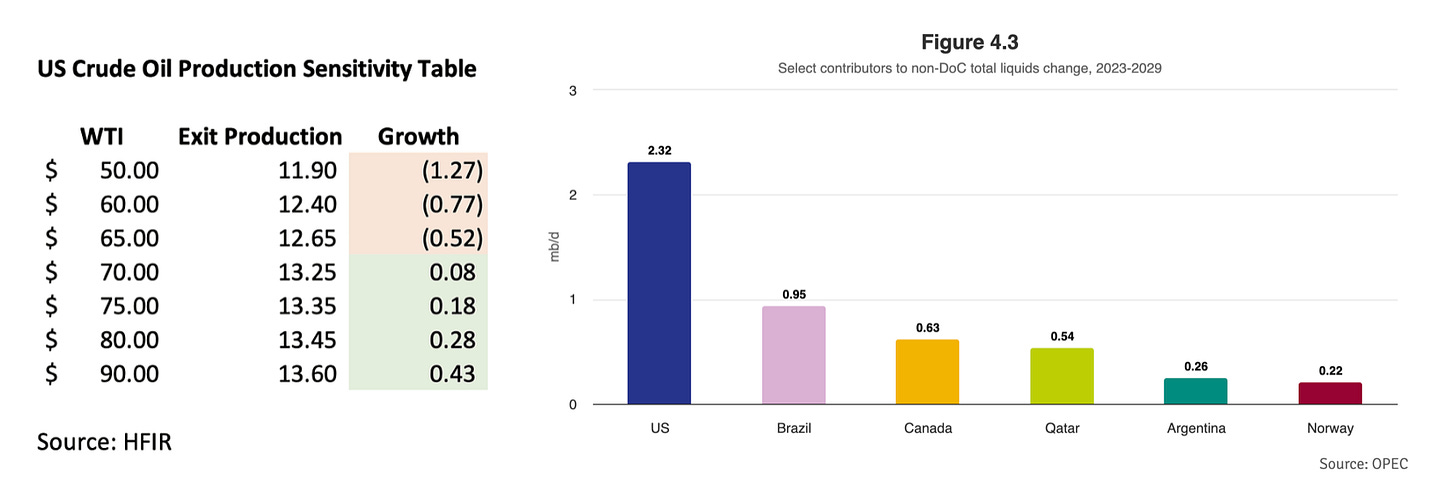

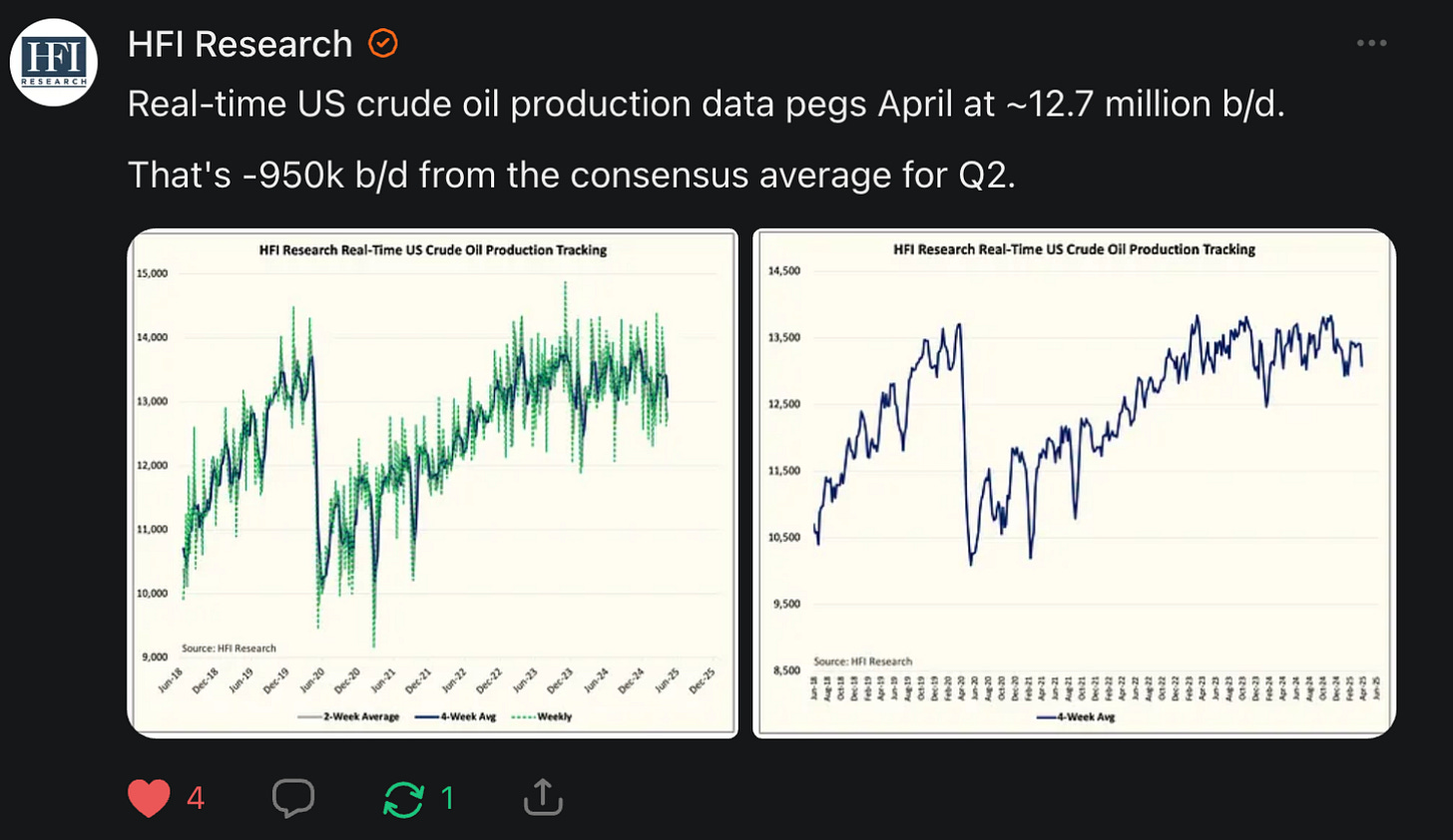

This sensitivity table from HFI Research illustrates it well (I highly recommend their work) in that at today’s oil prices of $60 a barrel, US crude production will cut close to 1 million b/d, while at $90 a barrel, the US won’t even manage to add 500k b/d.

The issue is obvious when compared to the forecast supply contribution of non-OPEC countries out to 2028.

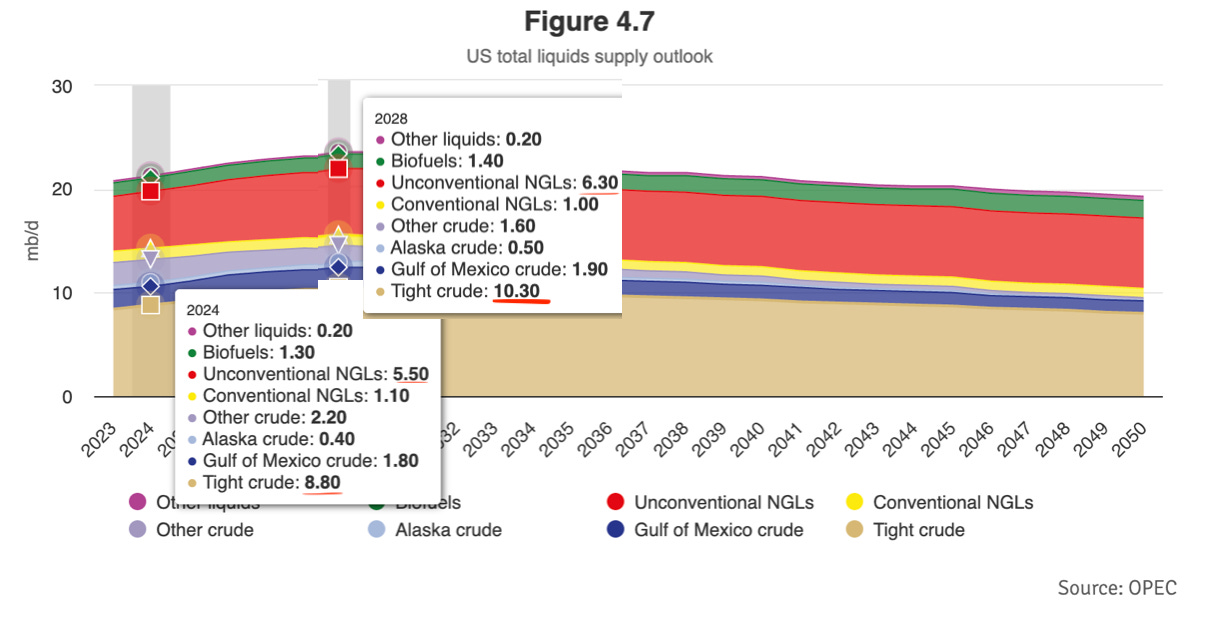

When you look at the breakdown of US supply additions, it’s almost all tight crude and unconventional NGLs.

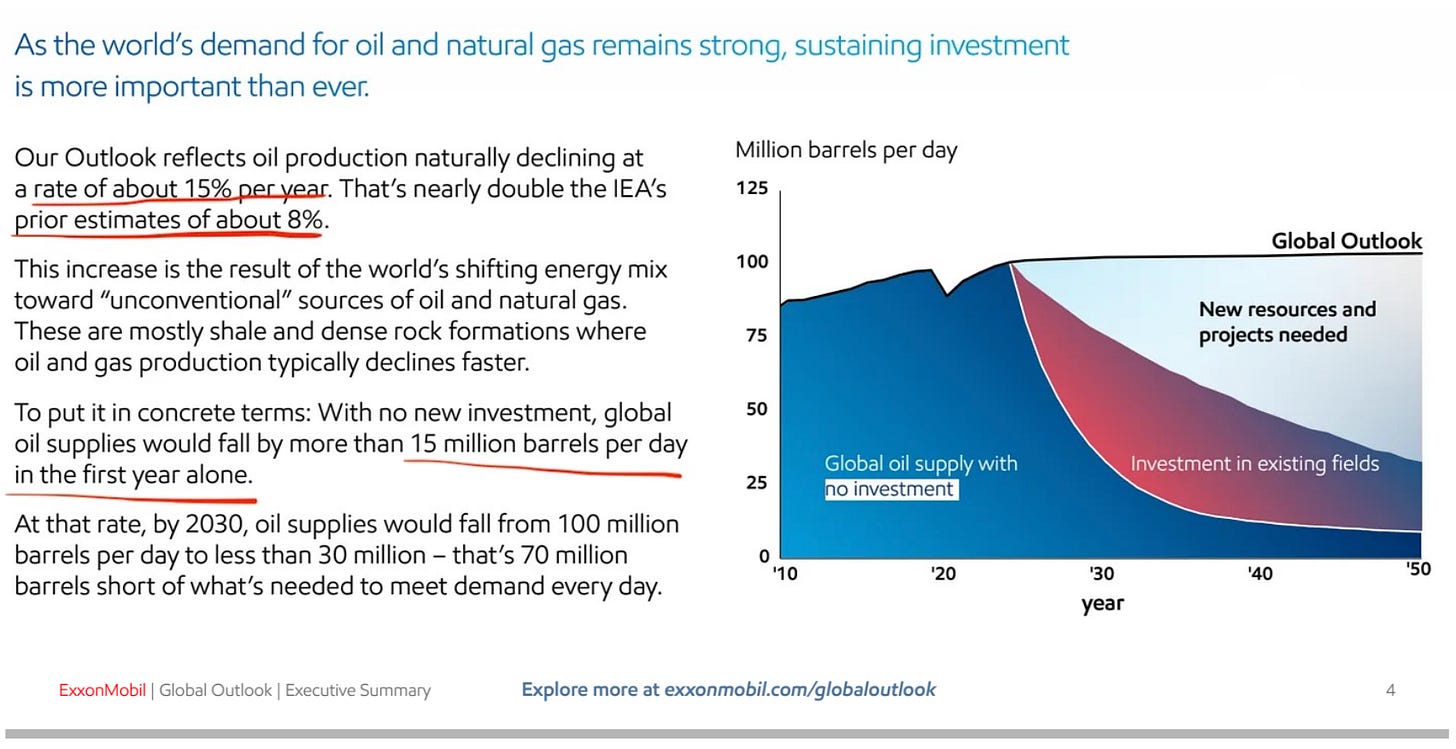

I discussed this in my last oil piece, but I don’t believe the investing world has grasped how steep decline rates have gotten compared to historic 4-5% p.a. decline rates.

The consensus is still that shale production can explode higher when necessary, capping oil prices or, at the very least, living up to the forecast growth trajectory.

Squeezed from all sides

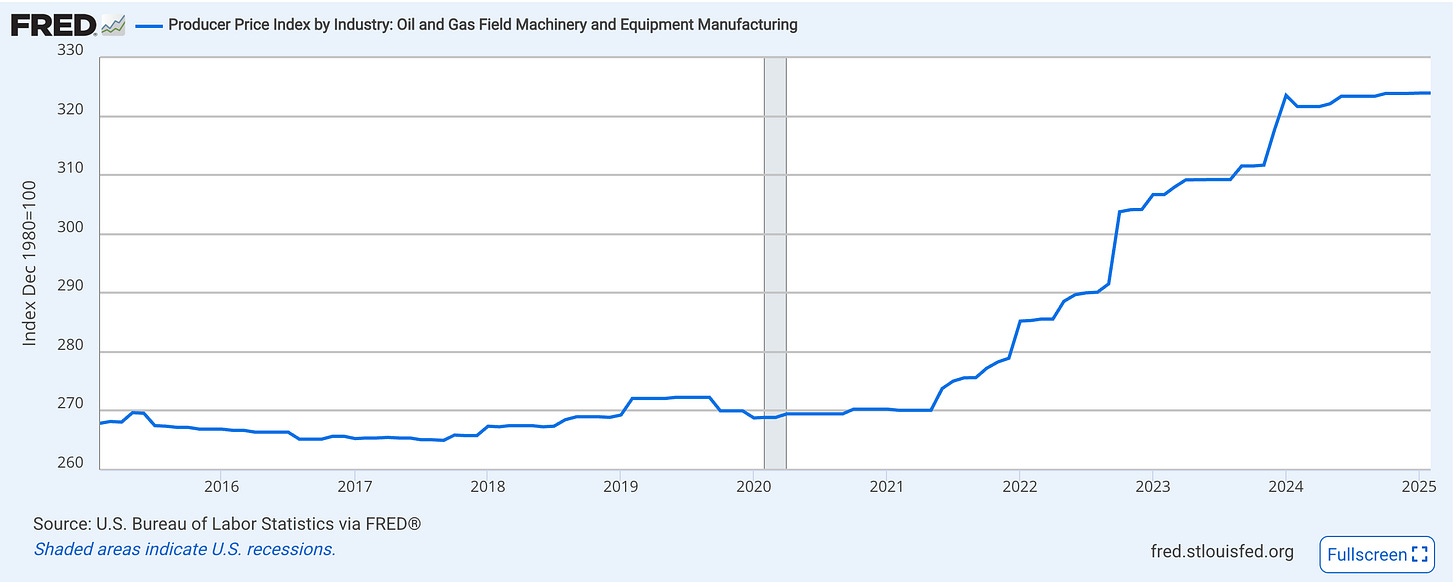

Haag Sherman, CEO of Tectonic Financial, a Houston-based bank, as saying, “You’re going to get squeezed from a production standpoint on prices and input costs,”

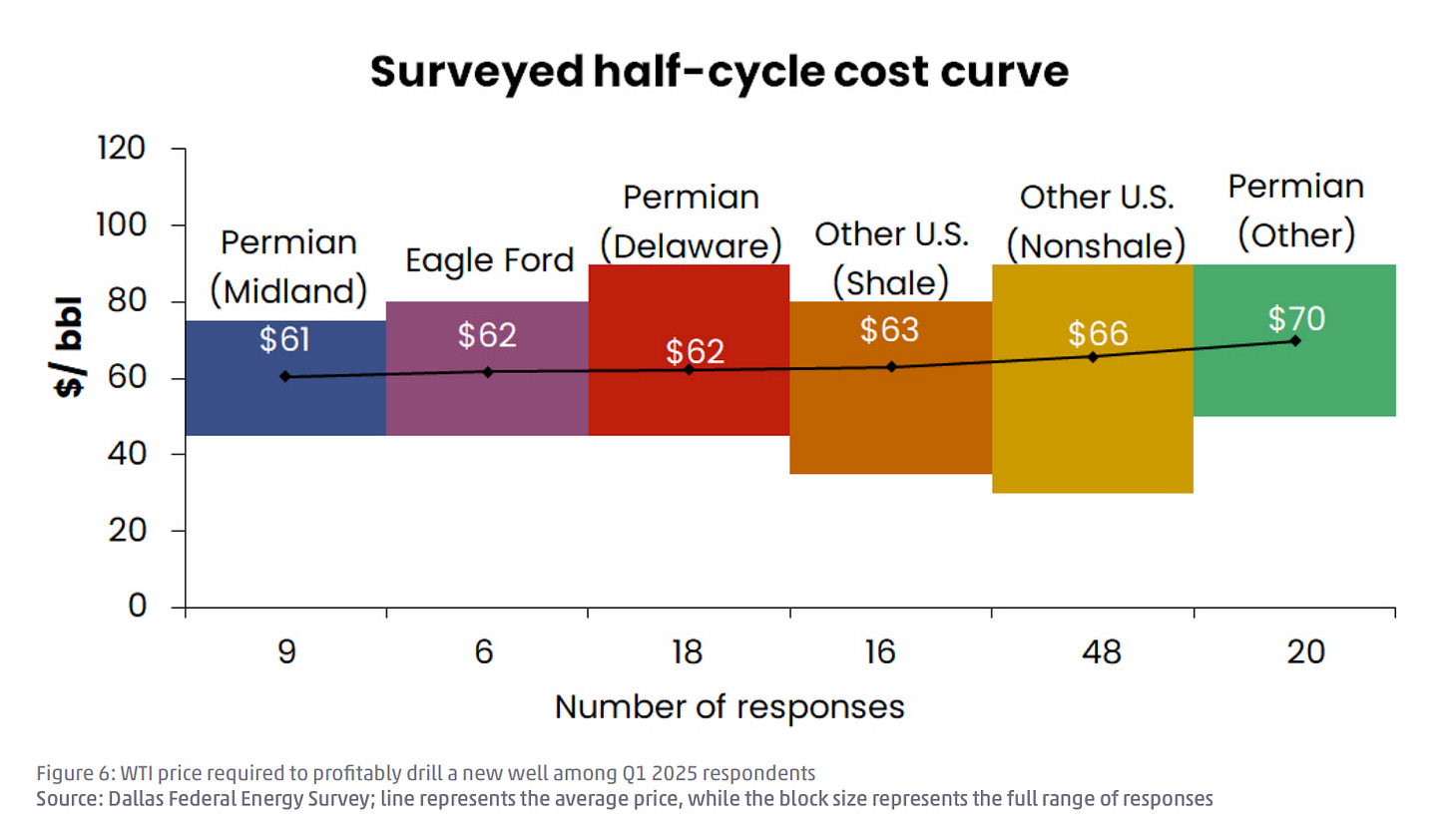

The Dallas Fed Energy Survey is always insightful. Keep in mind this came out March 26, 2025, prior to the tariffs and oil price drop.

Using the past Dallas Fed Energy Surveys data, the minimum profitable drilling price ($/bbl) was fairly flat to 2021 at ~50 per barrel before rapidly climbing to $65 per barrel (prior to the tariffs).

Add the effect of the tariffs on steel, and drilling a well is now closer to $68 a barrel.

The imposition of the 25% steel tariff has led oil and gas companies to estimate a 4% increase in costs for drilling a well, said Kunal Patel, economist at the Federal Reserve Bank of Dallas.

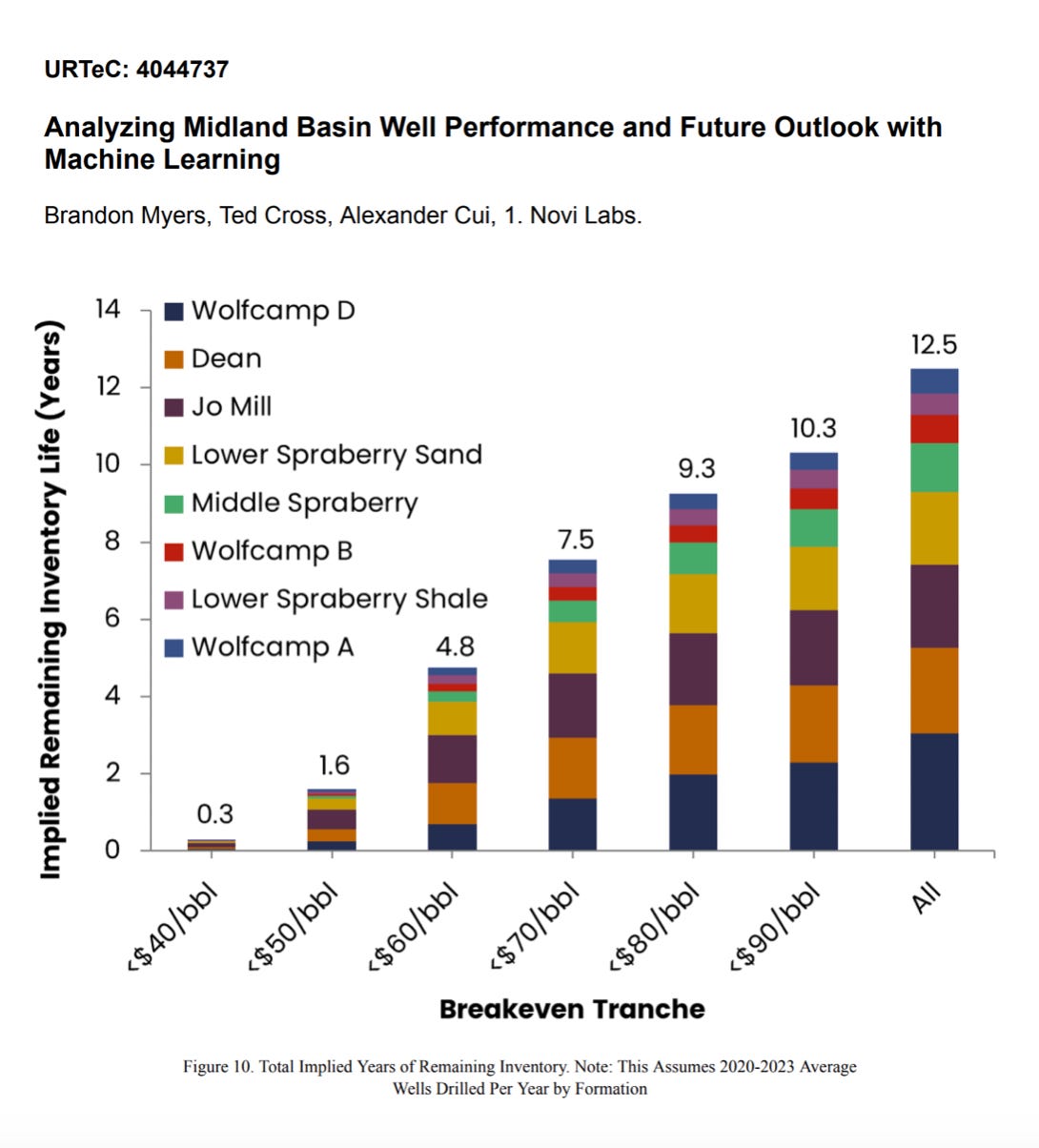

If you take Permian (Midland Basin) by breakeven tranches, as Novi Labs has done here, 60% of its breakeven tranches are above $60 a barrel (before considering this research was done in 2023, which, based on the increase in input costs via tariffs and Dallas Fed Energy Survey, has likely pushed these breakevens into the mid-sixties).

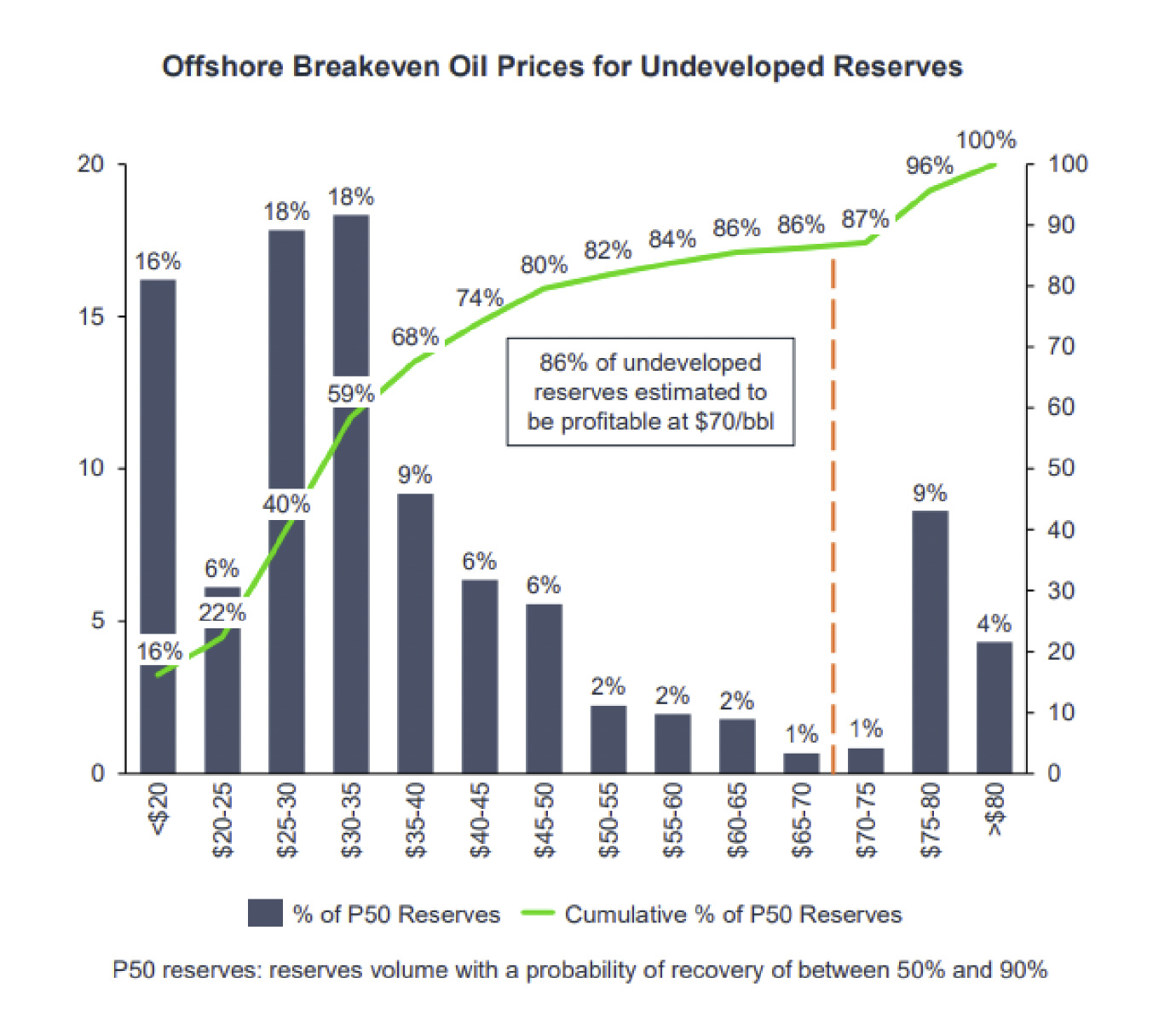

Compare this to offshore breakevens where 80% of undeveloped reserves work under $50 barrel. Offshore stands to benefit from shale growth stalling out.

No DUCs to save the day

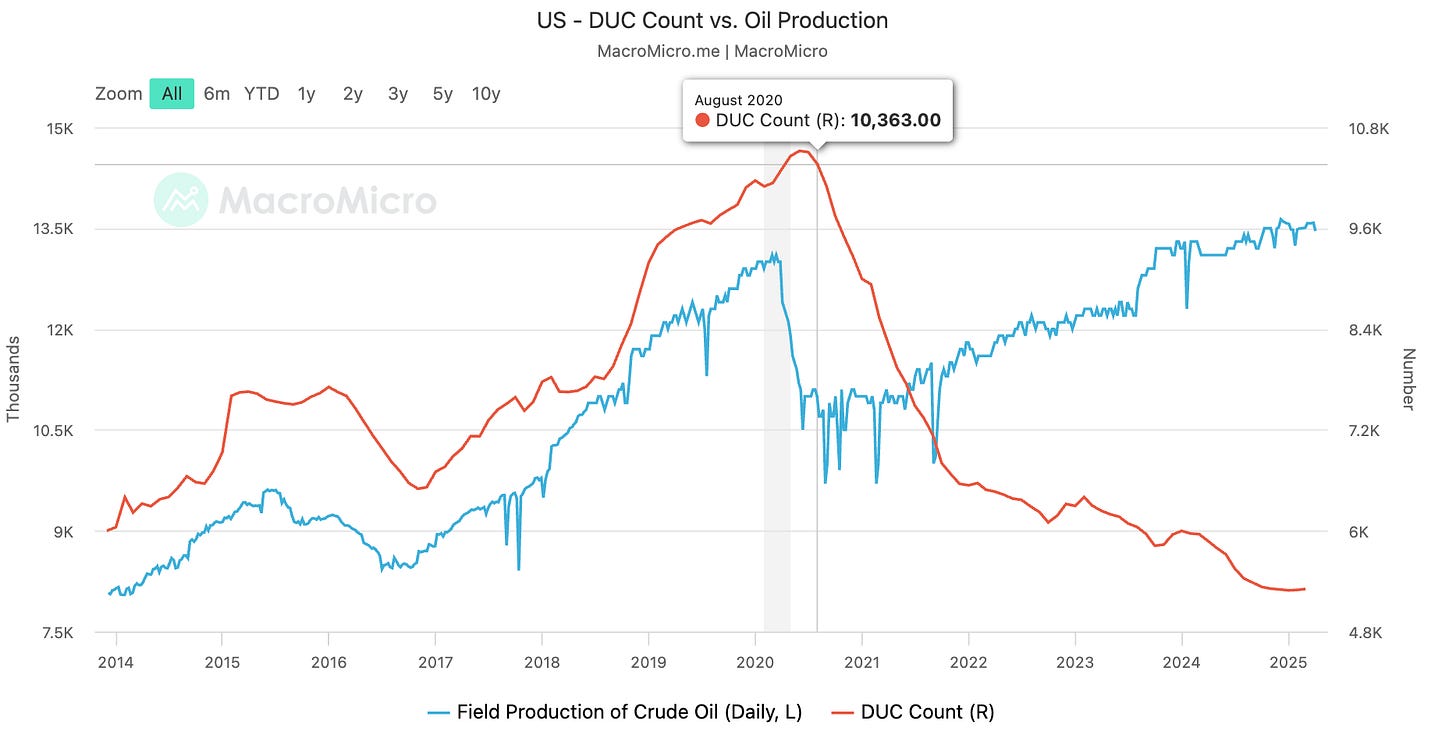

There were over 10,000 DUCs (drilled but uncompleted wells) coming out of the 2020 production collapse. DUCs now sit at less than half that, while production is at an all-time high.

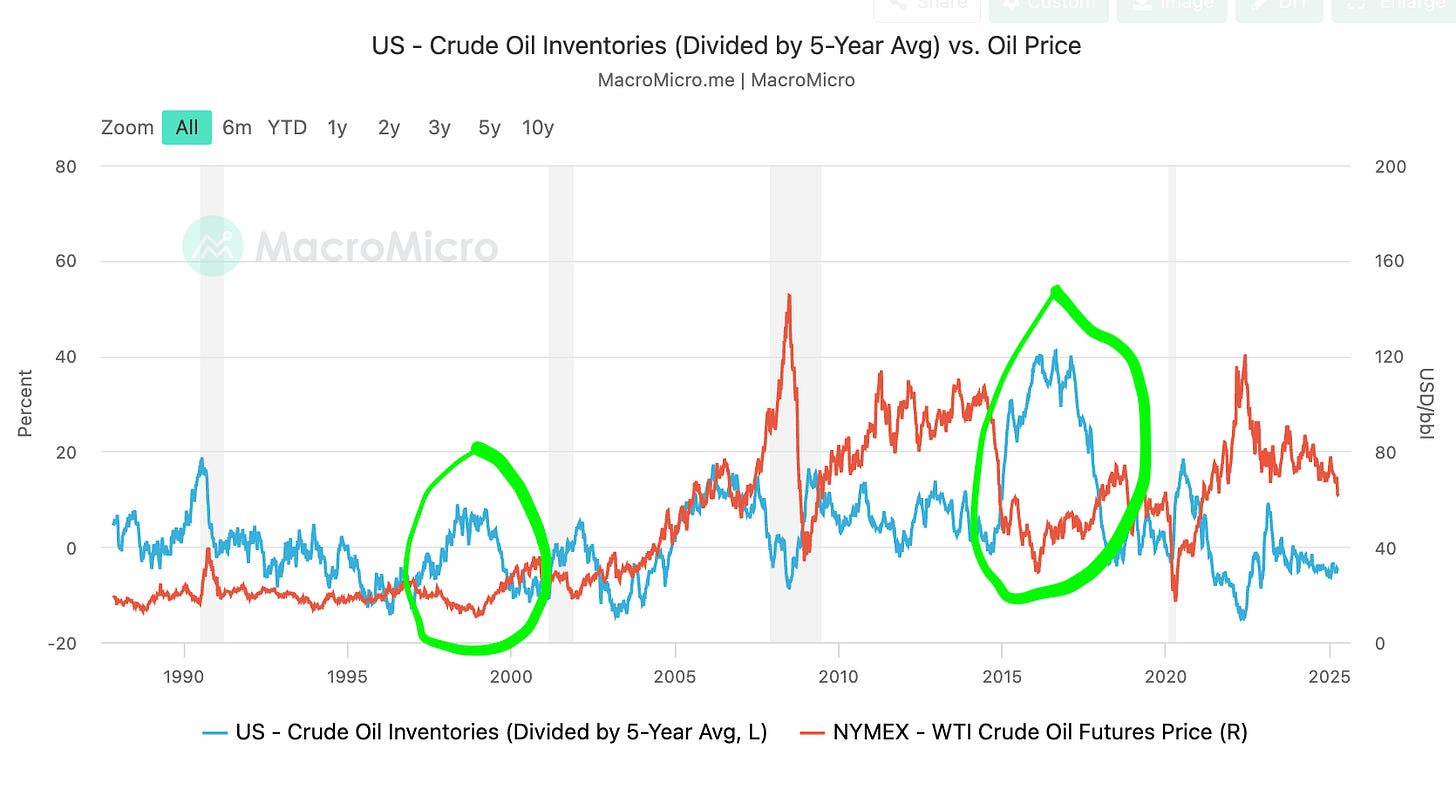

It’s interesting that oil has been dicked with low inventory, which suggests it’s more forward-looking expectations of a nasty recession.

You see this with IEA as their oil glut is based around “robust” non-OPEC supply, acknowledging demand was strong (up-until the trade-war) and oil inventories are low globally.

Oil Glut to Persist Through 2026 as IEA Cuts Demand Forecast

These supply additions will still be more than enough to satisfy the subdued rate of demand, both this year and next. In 2026, production outside OPEC+ will expand by a “robust” 920,000 barrels a day, with growth still dominated by the US, Brazil, Canada and Guyana. The global overhang will balloon to 1.7 million barrels a day during the first quarter of next year, according to the agency’s data.

Amid the gloom, the report showed some lingering signs of strength in the oil market. Demand growth during the first quarter was at its strongest since 2023, and world oil inventories are hovering “near the bottom of the five-year range.”

OPEC

For OPEC, the Saudis are likely to continue on their current trajectory with production increases, as it's tough to believe they aren't fully aware of what this is doing to US shale. Granted, they'll restore voluntary cuts if demand really tanks and inventories build.

Demand slashed on forward-looking expectations

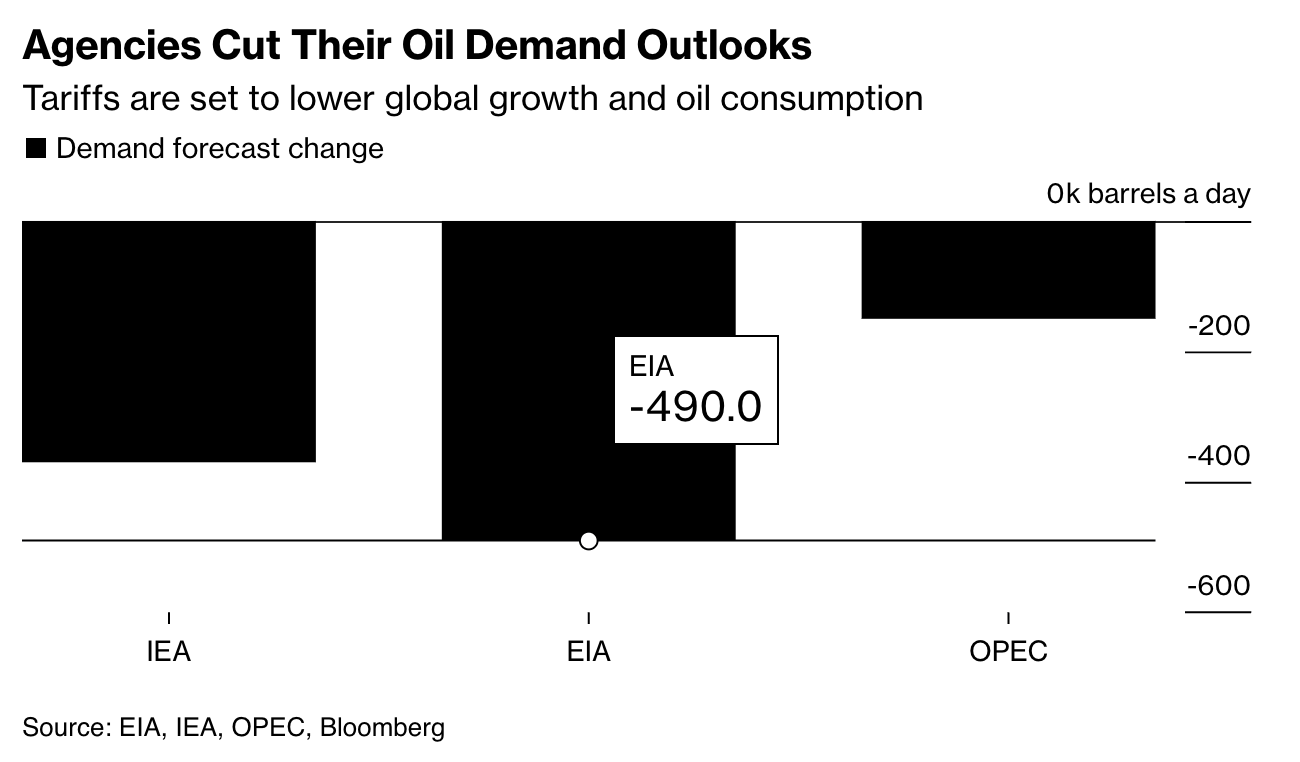

For every 1% drop in GDP, demand will be knocked off by approximately 500k b/d, which is roughly what the EIA is now forecasting.

US Slashes Its Outlook for Global Oil Demand Growth in 2025

Global oil demand is now expected to grow by about 900,000 barrels a day in 2025, according to the Energy Information Administration’s Short-Term Energy Outlook released Thursday. That’s about 400,000 barrels a day lower than last month’s estimate.

Based on HFI Research’s real-time tracking, US production is already -950k b/d below forecasts.

The uncertainty is short-term focused. Even if we get a nasty recession, low prices combined with a global fiscal response will create a rebound.

Uncertainty

Tariffs impact?

Nasty recession?

Certainty

Weaker dollar drives demand

Cheaper oil drives demand (rebound effect)

China and Europe pushing fiscal

US fiscal? Trumps tax cuts?

The big picture is one of fiscal dominance (Lyns Aldens piece is a must), or, as Kuppy put it, They’re Gonna Choose To Run It Hot…

Equities have a reputation as an inflation hedge over long periods, but it comes with an important caveat, as John Hussman outlines here:

“That said, an interesting thing about inflation is that if you look at periods of US inflation, even if you look at the 1970s, one of the things you find is stocks don’t earn their reputation as inflation hedges during periods of rising inflation.

They earn their reputation as inflation hedges after inflation is peaked and heads lower.

So, you’re making up for the losses that you had during periods of high inflation.

So, the first casualty of sustained inflation is valuations.

Once you get valuations depressed, yes. The effect of inflation on nominal cash flows, overwhelms any further downward pressure on valuations. And, you finally get stocks doing well.

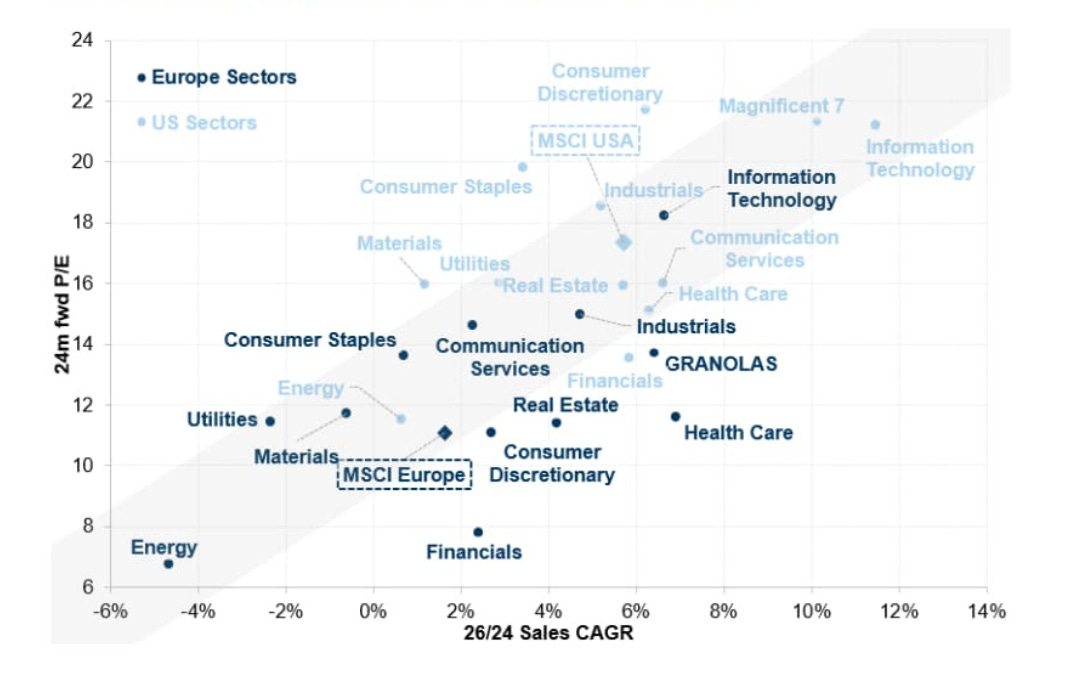

With energy, we are starting out with depressed valuations.

When you’ve gone through the setup, it’s clear this sector is going to be a massive out performer if you hold a 3-5 year timeframe. If you are focused on 1 year, it’s going to continue to be tear-your-hair-out frustrating unless you have a bit of capital to deploy.