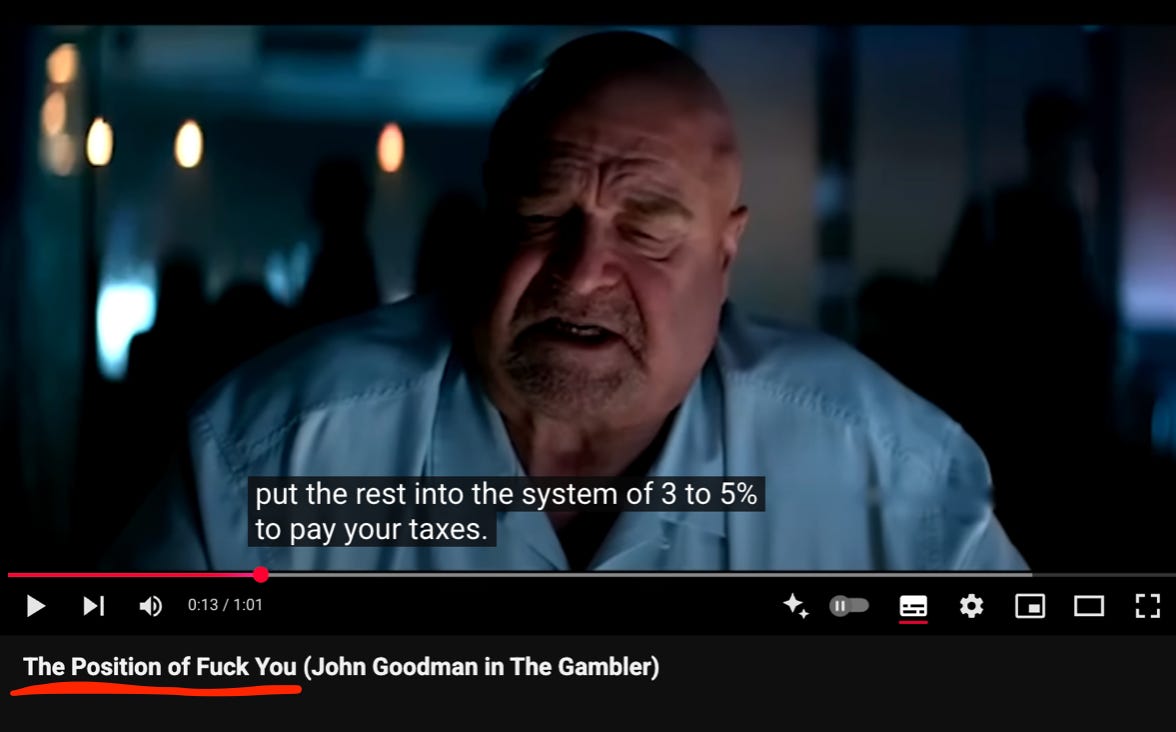

I've always loved this clip as the majority of people don't actually want to be rich; they just want independence to choose what to do with their days and not put up with meaningless bullshit.

House, car and a pile of capital that pays you 3-5%:

“Thats your base, your fortress of f#cking solitude.”

Leaving the house and car aside I’m going to discuss the requirements to put you in a position of f#ck you…

Or as Buffet said:

"Don't risk what you have and need to get what you don't have and don't need."

I'll base it on a target income of $100k per year. If you live cheap, you can cut the require down; if you live somewhere expensive and the tax man takes a big bite, multiply it by your actual requirement.

Similar to how I use a hurdle rate to evaluate my capital gains investments (currently physical platinum), I'll discuss my hurdle rate for income, focusing on the best income-producing asset with the best long-term risk-reward ratio (protection against inflation being a huge part, remember “the first casualty of sustained inflation is valuations”).

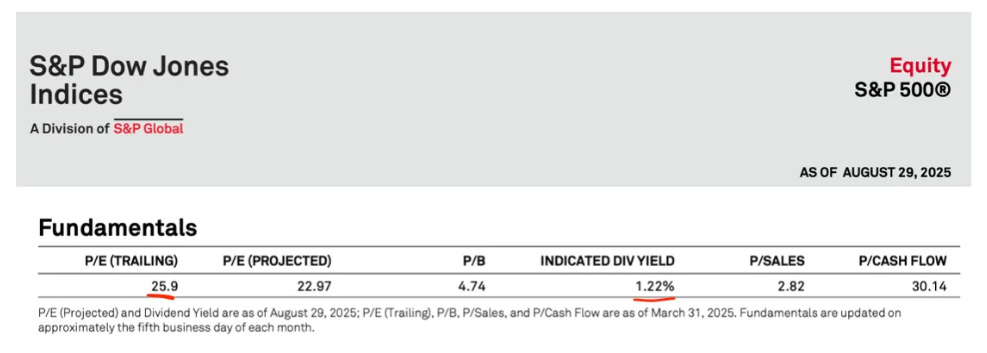

When it comes to stable income, most people think of an index with a dividend and bonds, such as the 60/40 with S&P500 and 10-year treasuries. However, the current indicated dividend yield is 1.22%, and I believe you get killed on a real return basis in long dated Treasuries.

While just four companies account for over 25.32% of the SP500 as I touched on in my last piece.

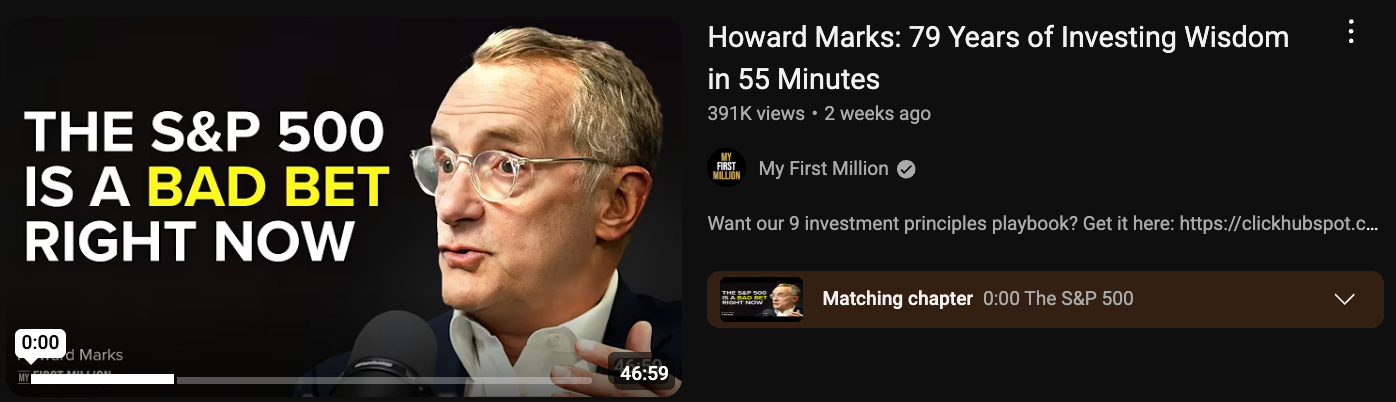

The first 10 minutes of this interview are well worth watching as few bring more experience to the game than Howard Marks.

"JP Morgan published a chart around the end of 2024 it showed that historically, if you bought the S&P500 when the PE ratio was 23 in every case, there were no exceptions. In every case, your annualized return over the next 10 years was between 2 and minus 2."

Not really a promising 10 year outlook for the S&P500 is it!

Whats a good alternative?

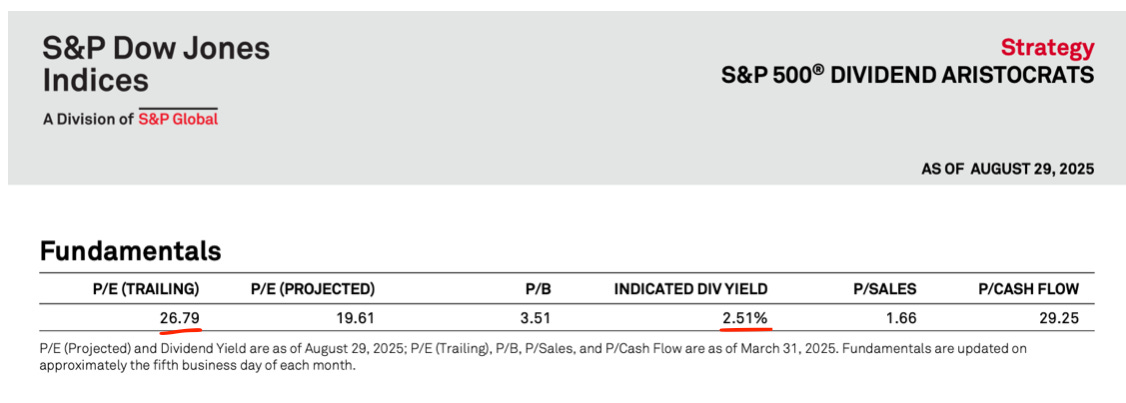

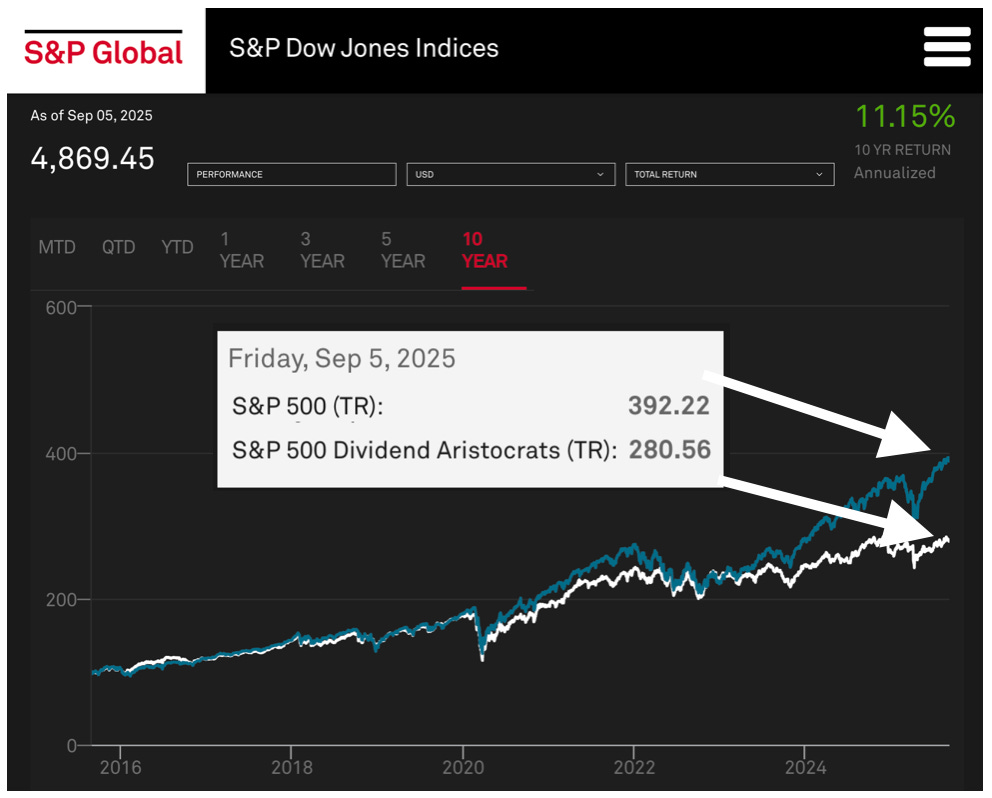

I've talked about the Dividend Aristocrats in the past, which selects for quality companies within the S&P 500.

The S&P 500 Dividend Aristocrats is a stock market index composed of the companies in the S&P 500 index that have increased their dividends in each of the past 25 consecutive years.

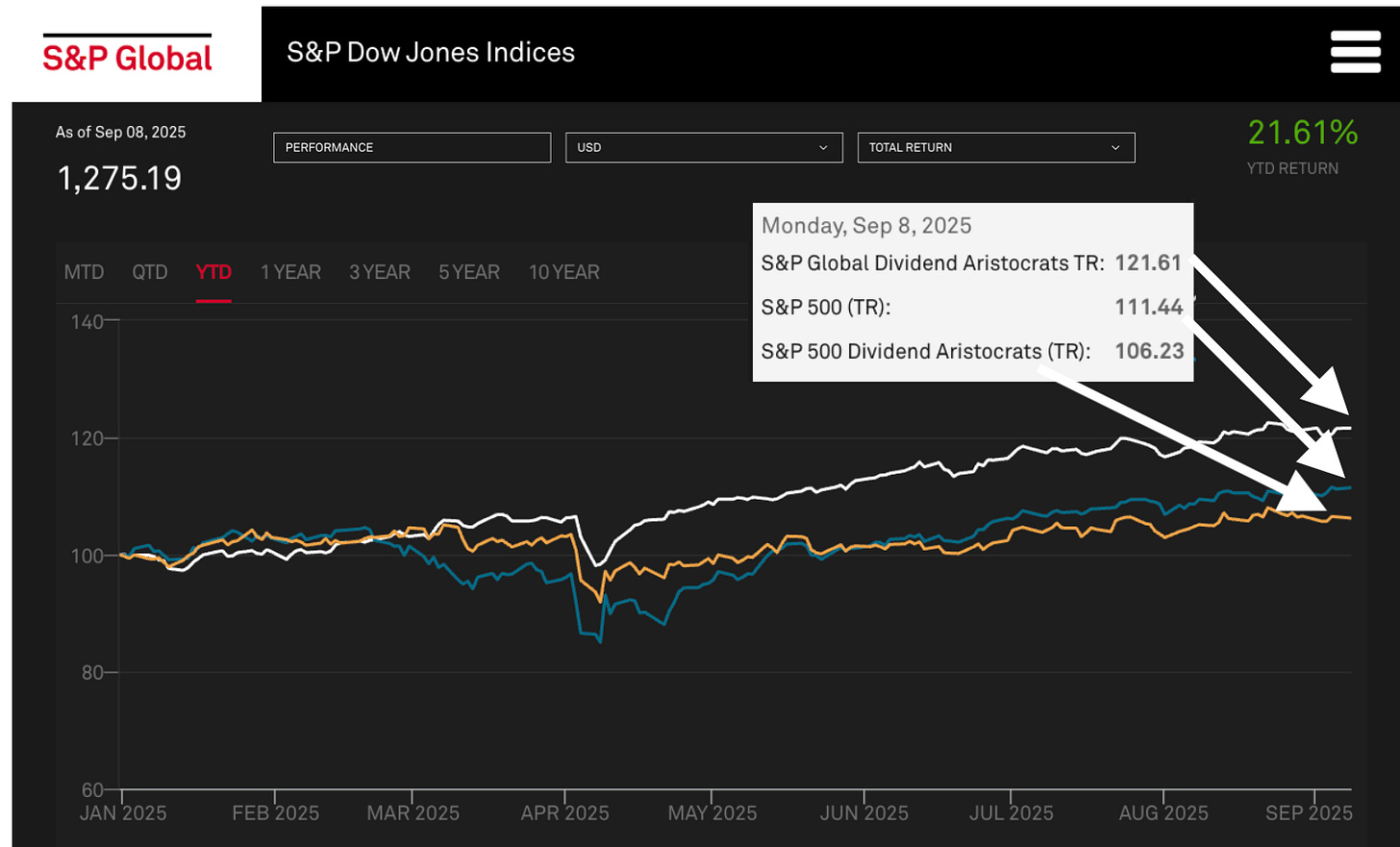

Granted, it is surprisingly more expensive than the S&P500 on a P/E basis, 26.79 vs 25.9. It does have roughly twice the dividend, which, when you run total return, kept up with the S&P500 until the last year and a half.

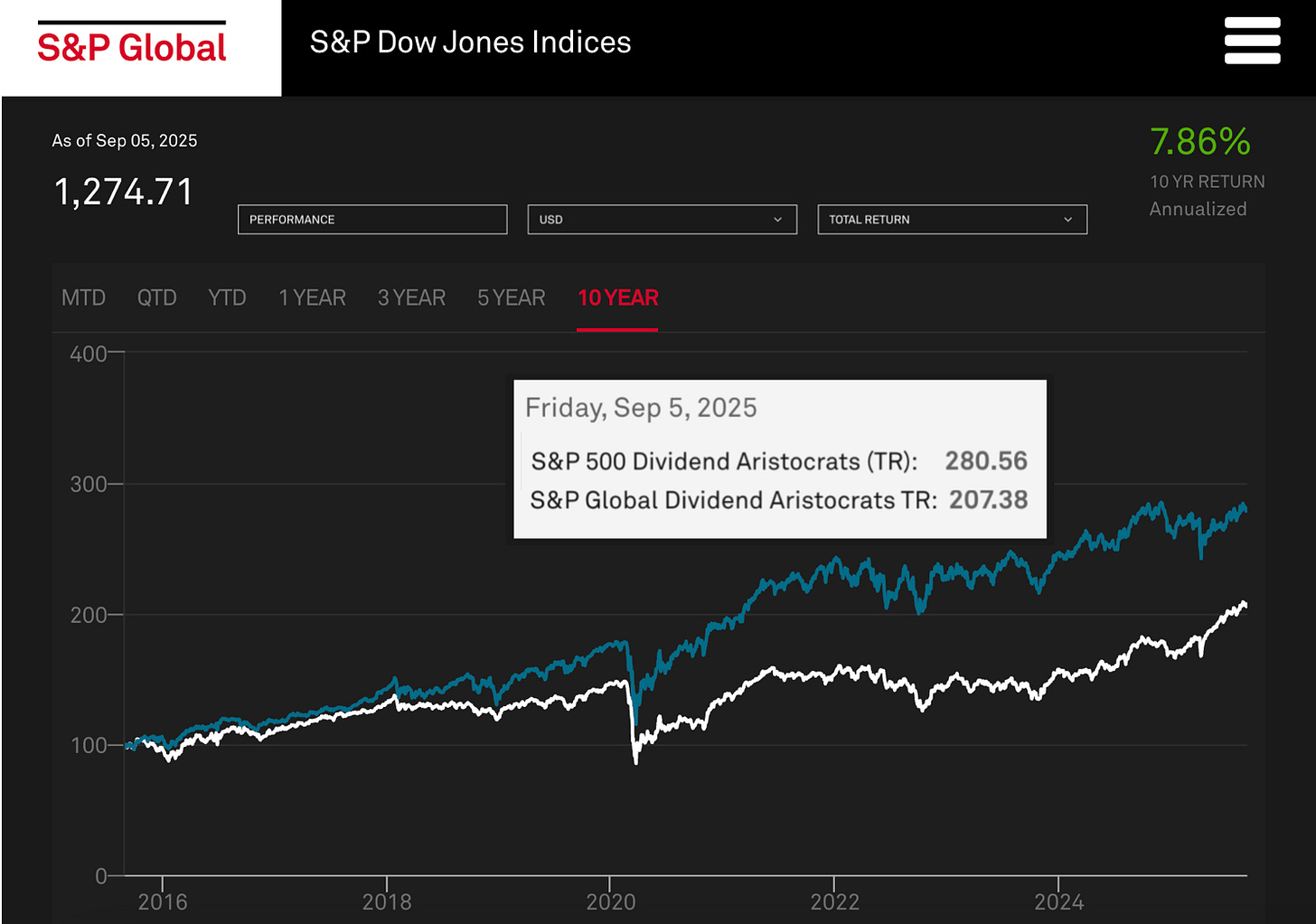

This brings me to my hurdle rate for income, which is the Global Dividend Aristocrats. If my time were cut short, I'd be happy to invest it in a forever portfolio for my toddler, Hugo.

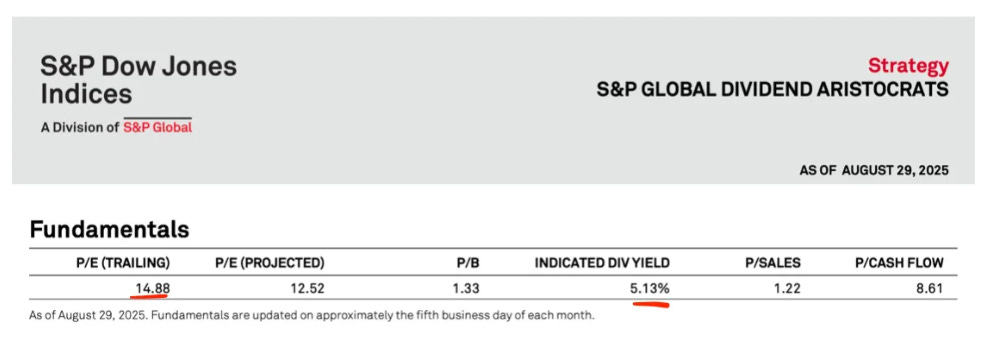

The S&P Global Dividend Aristocrats is designed to measure the performance of the highest dividend yielding companies within the S&P Global Broad Market Index (BMI) that have followed a policy of increasing or stable dividends for at least 10 consecutive years.

It's trading at close to half the PE ratio of S&P 500 Dividend Aristocrats and over twice the dividend ("theoretical yield" which doesn't include withholding tax and management fees).

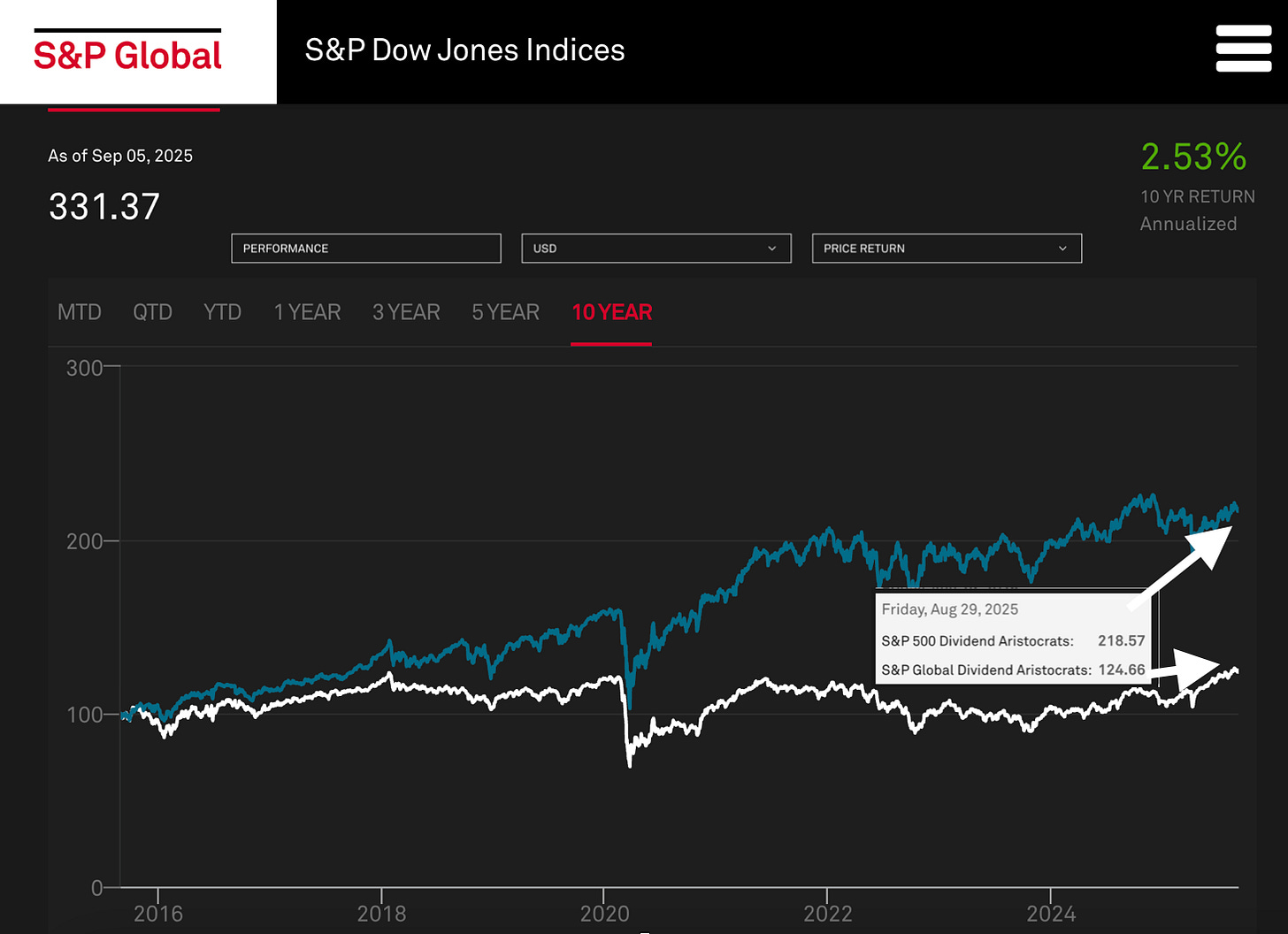

If you check price return between the S&P 500 Dividend Aristocrats and Global Dividend Aristocrats you’d wouldn’t be blamed for calling this a crappy index at 2.53% return the last 10 years.

Run total return and you get up to 7.86% for 10 years vs 10.86% S&P 500 Dividend Aristocrats and 14.68% for S&P500.

The last 5 years, Global Dividend Aristocrats and S&P 500 Dividend Aristocrats have been neck and neck until recently.

Things have really started to diverge year to date, with Global Dividend Aristocrat sitting on 21.61% YTD against 11.44% for S&P500 and 6.23% for S&P500 Dividend Aristocrats.

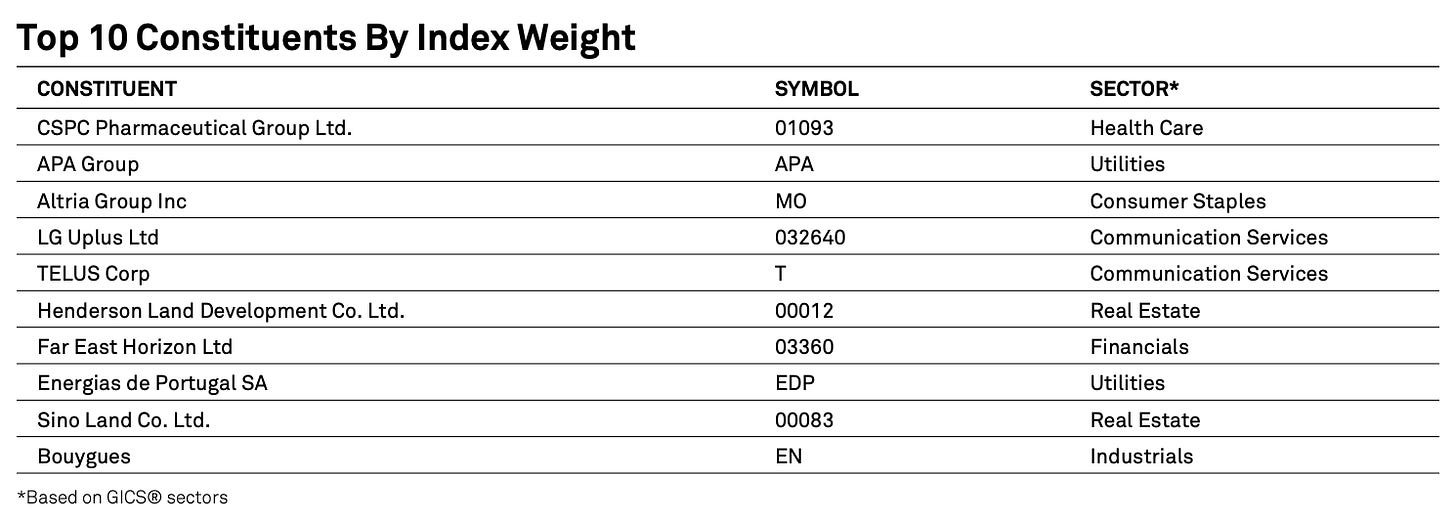

It consists of 96 holdings, of which the largest is 2.5% and the weight of the top 10 is 17.5% of which, if you are similar to me, you probably only recognise the likes of Altria and LG; the rest are companies I'm not familiar with or looked at (compare this to Mag 7 darling on magazine covers…)

Financials 24.9%, materials 4.6% and energy 3.6% total a third of the portfolio, while 0.8% is in information technology (compared to 33.5% in the S&P500).

Net Yield

The S&P 500 Dividend Aristocrats is an index, which means the Index Dividend Yield 5.15% is a theoretical yield based on the weighted average dividend yields of the constituents, assuming perfect reinvestment and no costs. In reality, you have withholding taxes on dividends in certain countries and management fees/expense ratios eating into the yield.

For the best ETF: WDIV SPDR S&P Global Dividend Aristocrats UCITS ETF (USD) (0.40% p.a management fees).

The Fund Distribution Yield is 4.06% is the sum of the distributions within the past 365 days divided by Net Asset Value per share.

30 Day SEC Yield is 4.47% an annualised yield that is calculated by dividing the net investment income earned by the fund over the most recent 30-day period

This is my huddle rate for income, for (pre-tax) $100k per annum for my fortress of solitude to sit on a beach and drink coconuts, I'd need $2.5m (SEC yield - management fee) before considering "a house with a 25 year roof and indestructible jap shitbox."

Now, what if I want to be more active in generating income, on a biannual, monthly, or weekly basis?

What is are the potential income levels that are achievable?

Passive Income, Dividends Semi-active or Active.

I’m going to split this into four sections:

Buying Global Dividend Aristocrats and letting it do its thing is about as passive as you get (It’s easily my number one multi-decade hold).

Dividend investing targeting a balance of income and capital gains.

Semi-active, focusing on slightly out-of-the-money monthly covered calls with a preference, where possible, for dividend payers.

Active with the purpose of the account being purely to generate income (the opportunity cost of capital gains is to be banished from your mind).