I always loved how Howard Marks framed forecasting vs simply observing the present.

"We can make excellent investment decisions on the basis of present observations with no need to make guesses about the future.

We never know where we’re going, but we sure as hell should know where we are."

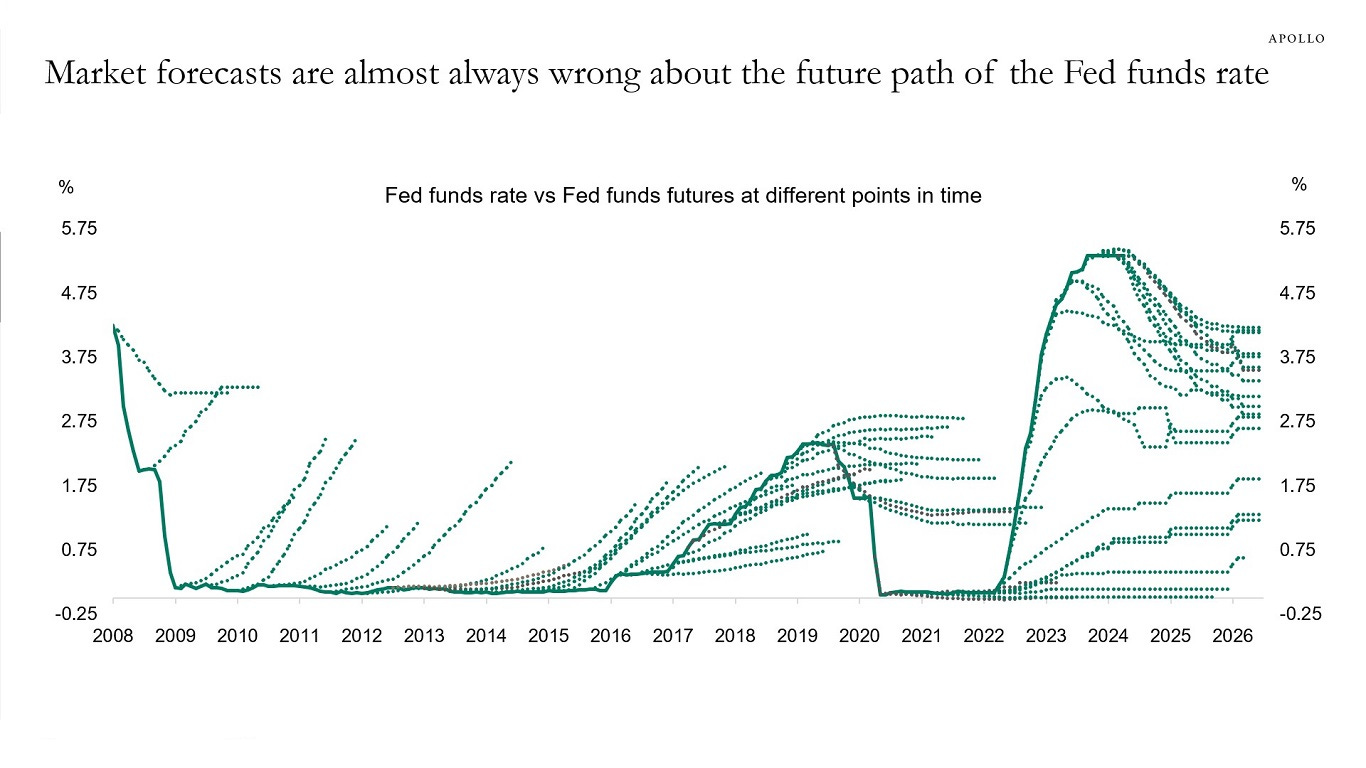

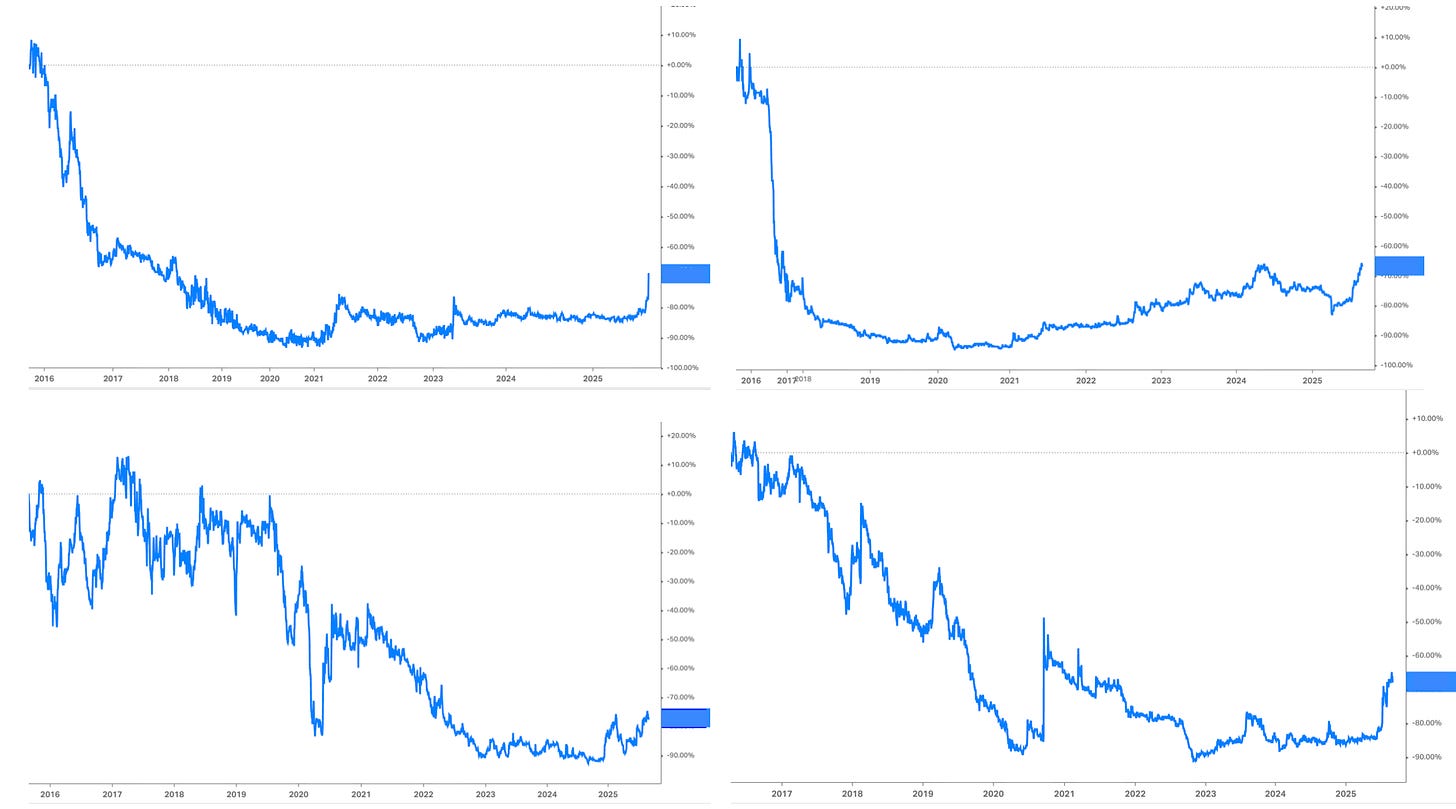

This chart is my favourite on the folly of forecasting (I also could have used the IEA oil demand forecast history…)

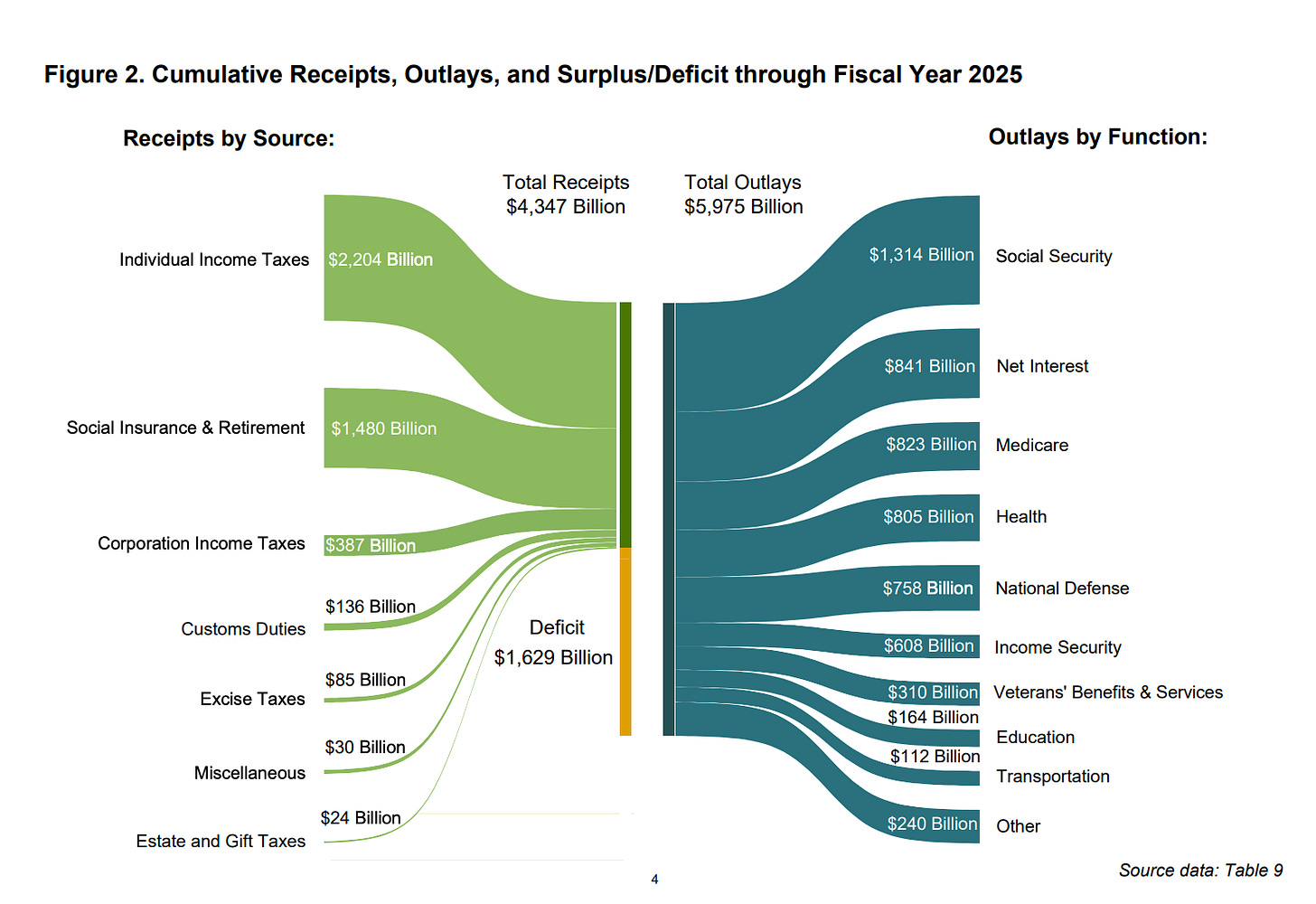

Observing where the US Government finds itself presently has massive ramifications for investors moving forward.

Income/Receipts

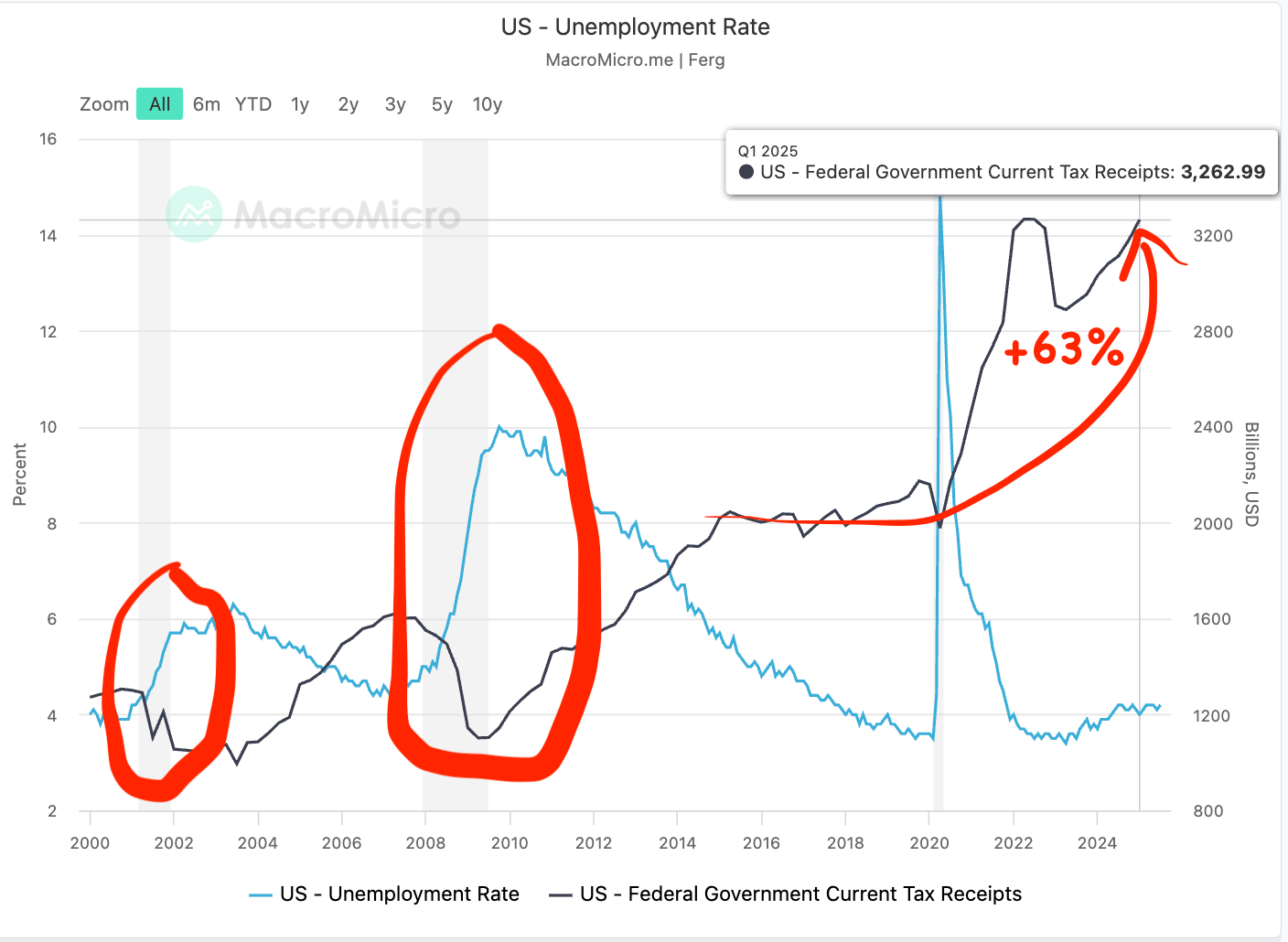

Total tax receipts (income) are at record highs and are highly economically sensitive.

It gets crazier when you realise how narrow the driver of this growth is.

In a similar way to a few companies holding up the U.S. Indexes, the U.S. AI data center spending surpassed consumer spending as the top GDP growth driver in 2025.

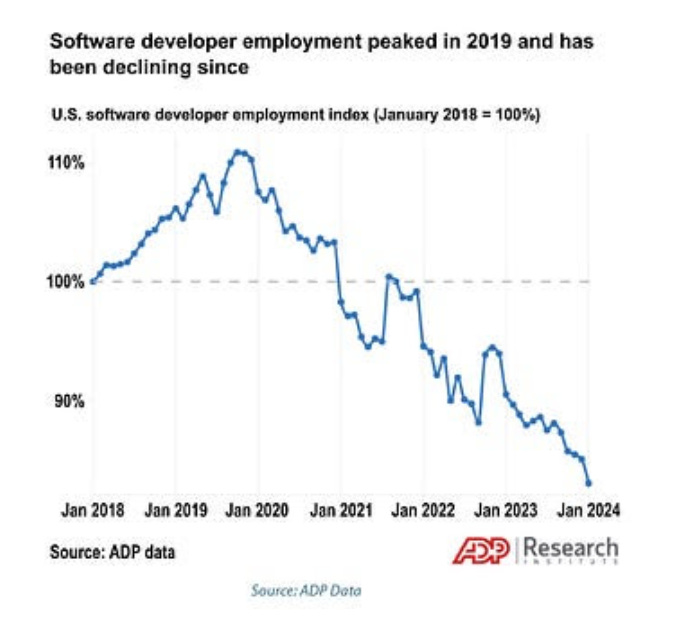

AI spend is propping up the tax receipts side of the equation while increasingly attacking the employment side…

While I doubt AI causes mass unemployment as some pundits predict, due to a combination of regulatory capture (healthcare & education) and poor accessibility of data/information (MIT report: 95% of generative AI pilots at companies are failing).

AI is going to massacre entry level white collar service jobs (tech, legal, accounting, consulting, etc) on a scale similar to what China did to U.S. blue-collar workers. (Goodbye, $165,000 tech jobs. Student coders seek work at Chipotle).

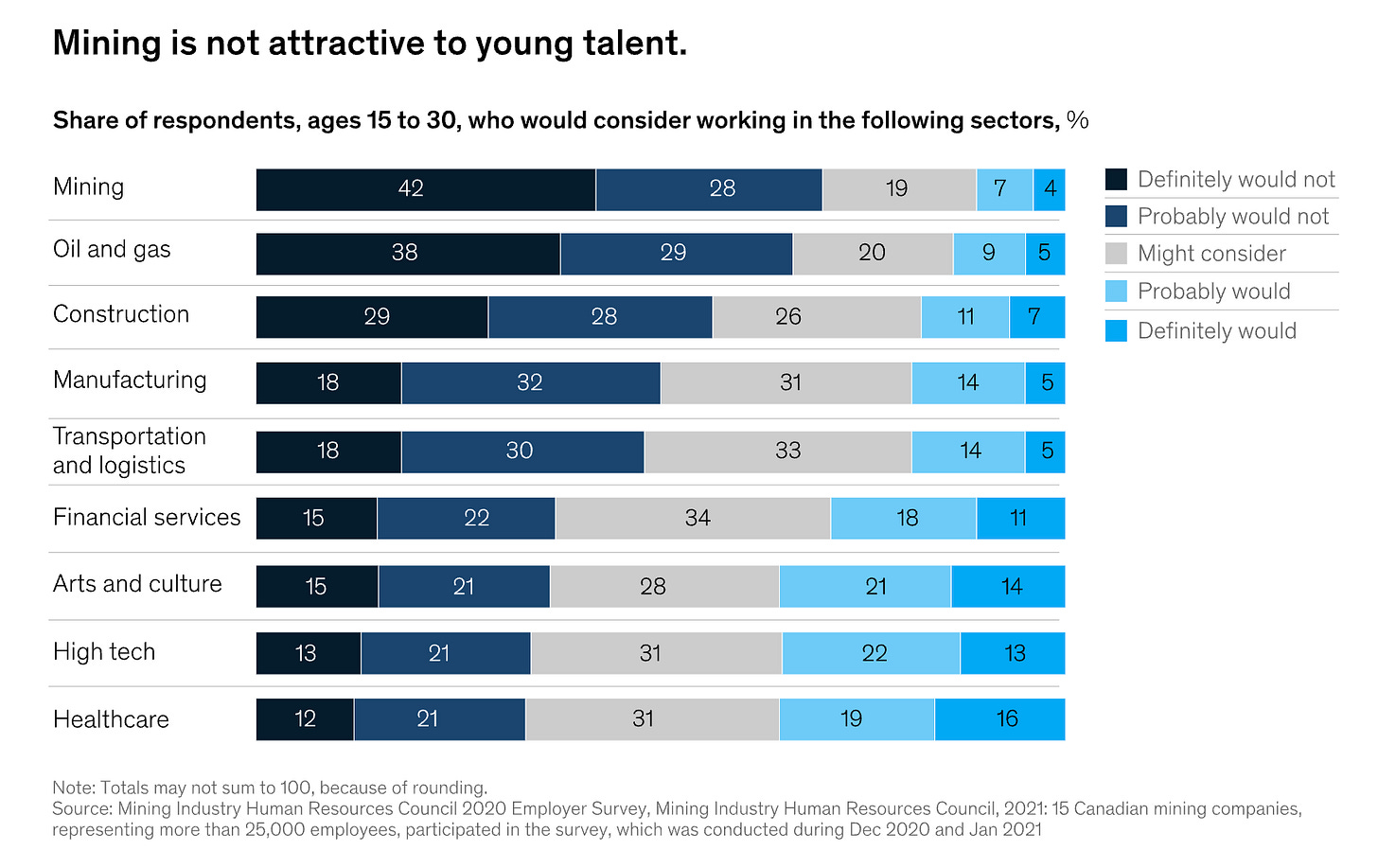

It's cyclicality at its finest: young talent is chasing the safe jobs of the last decade, not those jobs that will pay for the next decade.

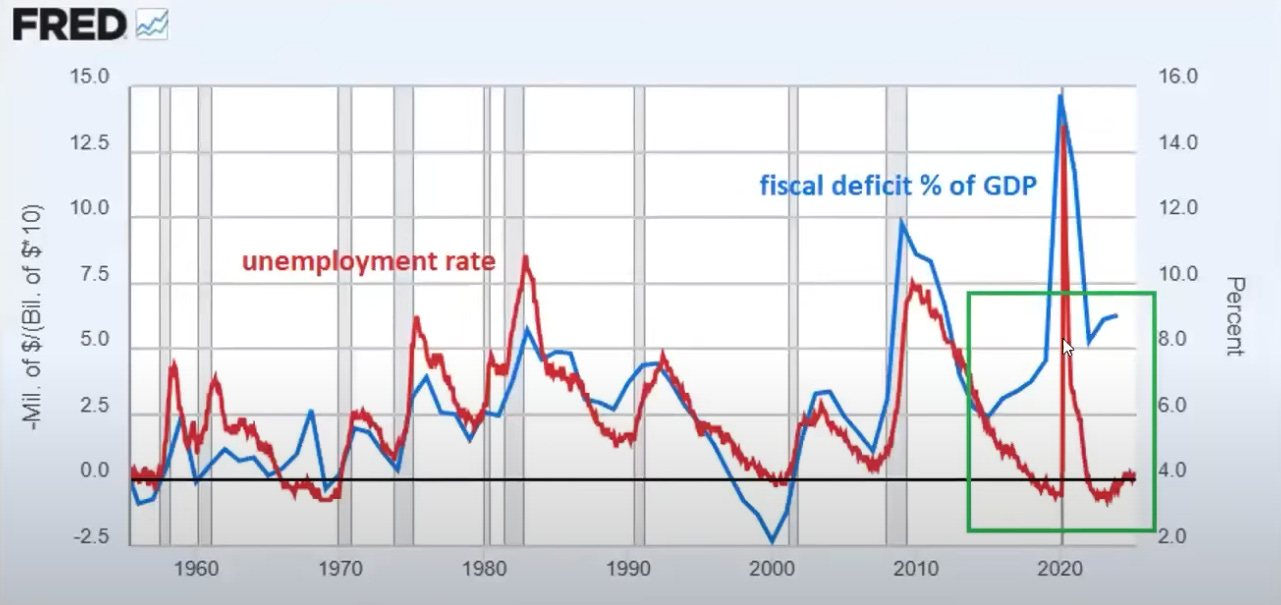

What's scary is that the U.S. is already at a level of deficit that occurs following a spike in unemployment….

Total Outlays

Social security, Medicare, health, national defence, income security, and veterans' benefits are untouchable/political dynamite.

This leaves reducing net interest expense as the only possible lever which Trump is fighting tooth and nail to pull: Trump says he’ll have a Fed ‘majority’ soon to push rates lower after firing Cook.

This move is completely precedented…

Goehring & Rozencwajg do a great job going over the history of Presidents pressuring Fed Chairs and how its now a matter of cut rates or step aside for someone who will.

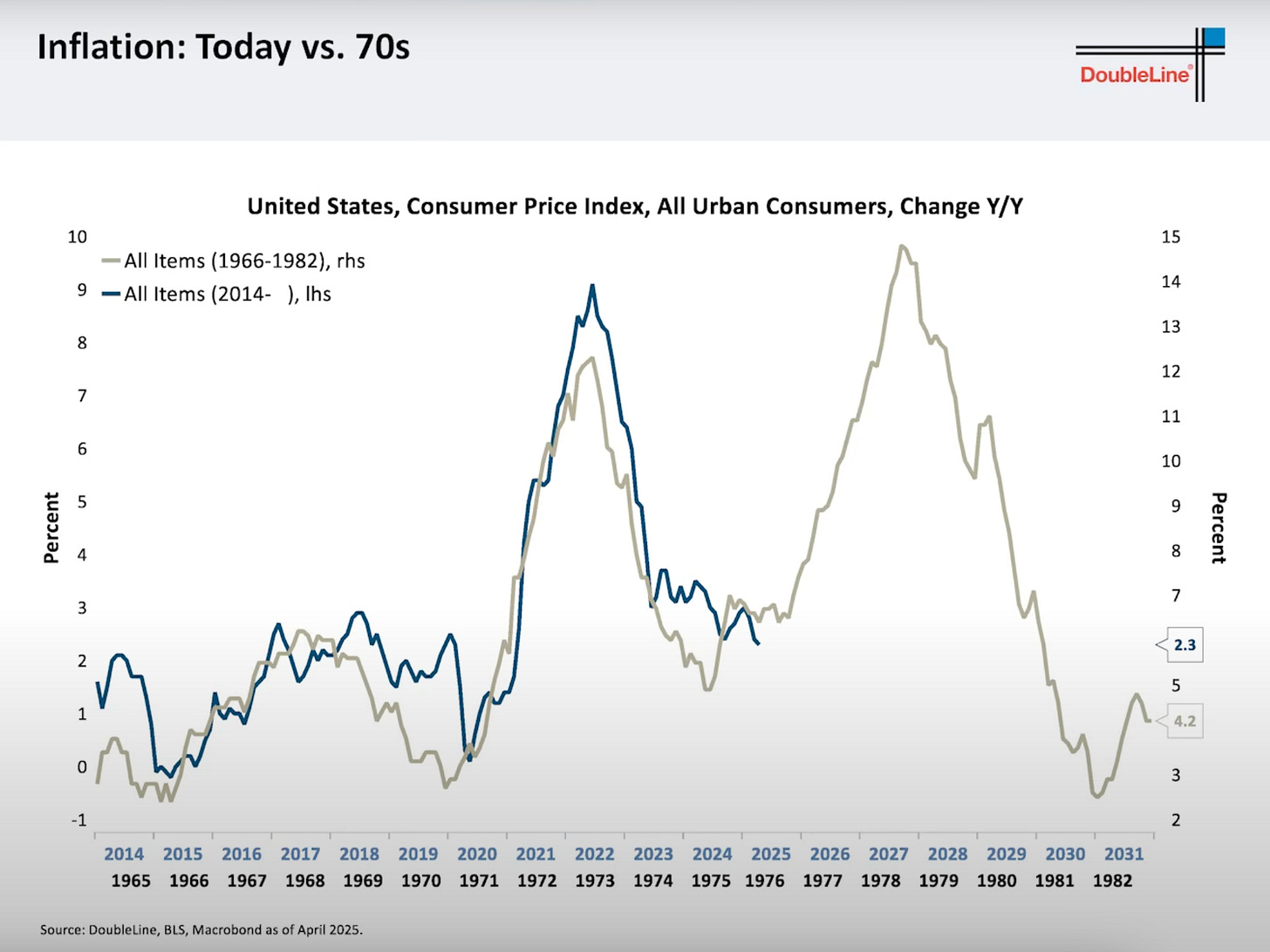

The strain now being applied to Jerome Powell bears an uncomfortable resemblance to the pressure once exerted on Martin and Burns. The tools may be more modern—press conferences and social media rather than ranch house shoving matches or planted newspaper stories—but the intention is unmistakably familiar. If history is any guide, Powell will be faced with the same grim choice: accommodate the president’s wishes by cutting rates, or step aside in favor of someone more compliant. One way or another, the outcome looks poised to rhyme with the past.

Risks be damned.

“In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside—a challenging situation,”

-Powell

It's a matter of time before these risks, be it inflation, unemployment or a reduction in AI spending, materialise.

Or as Goehring & Rozencwajg outlined so well, the outcome looks poised to rhyme with the past.

Equities as an Inflation Hedge?

There seems to be a wide spread view that indexes do fine in inflation. While its true equities act as a inflation hedge if you have depressed valuations, inflation slaughters high valuations or as John Hussman put it:

The first casualty of sustained inflation is valuations. Once you get valuations depressed, yes. The effect of inflation on nominal cash flows, overwhelms any further downward pressure on valuations. And, you finally get stocks doing well.

Or as Kuppy worded it in his recent letter you don’t go straight to Zimbabwification you must first suffer Brazilian phase…

Part of me thinks that we’re into “Project Zimbabwe” and part of me realizes that on the path to the Zimbabwification of equities, you must first suffer through a Brazilian phase where interest rates rise, equity multiples compress, and most businesses can barely cover their debt service costs, much less reinvest for growth. This is then followed by the Turkification of equities where they then trade at low single digit multiples, but the collapse of the currency propels them higher in nominal terms. Only then can equity markets truly hyperinflate.

Or to explain via meme

Adding dynamite to this whole set-up is passive flows.

What the hell happens when just four companies account for over 25.32% of the SP500, and it needs to rebalance or flows turn negative (as I went over here)?

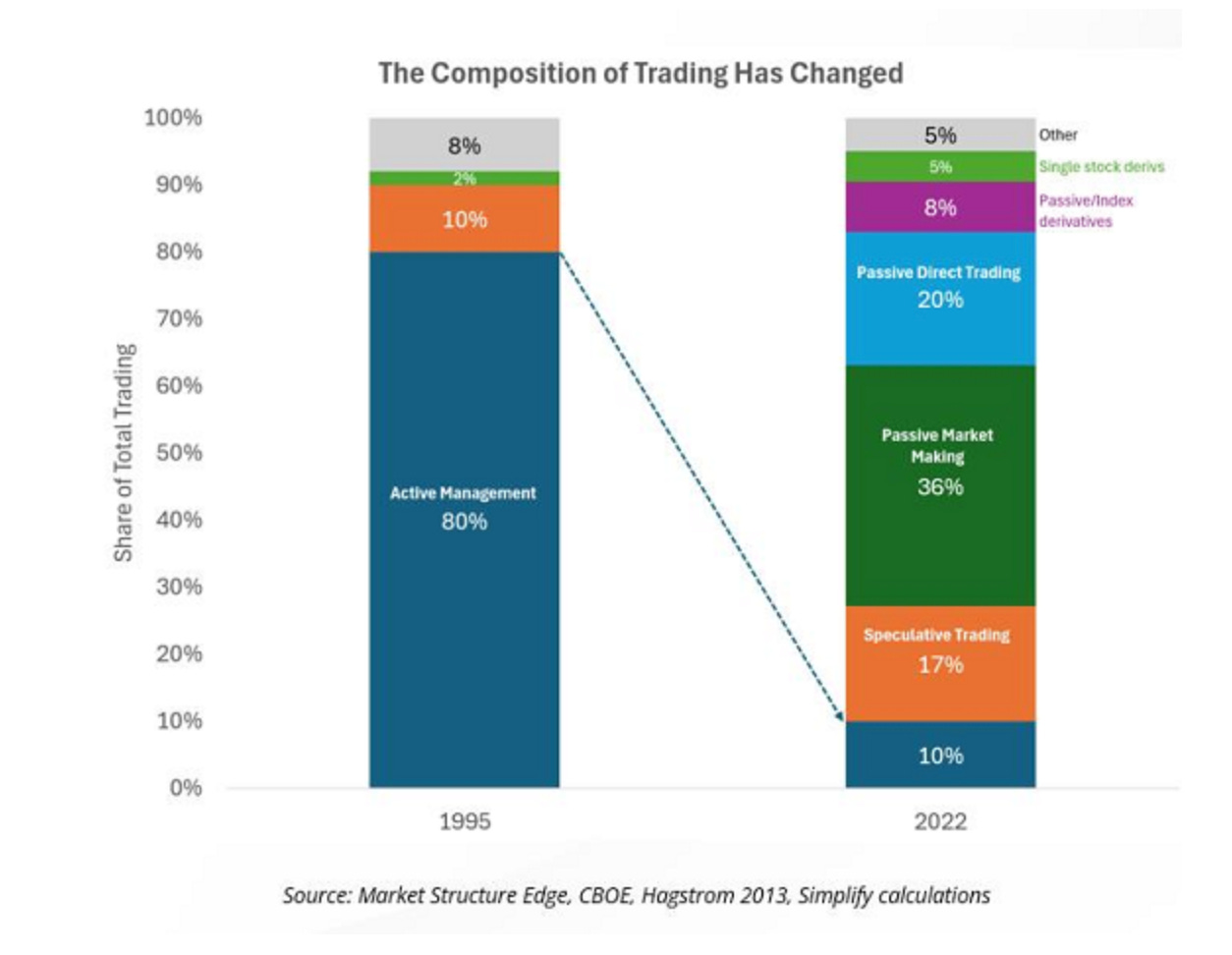

Active management has had an extinction-level event, as the chart below illustrates.

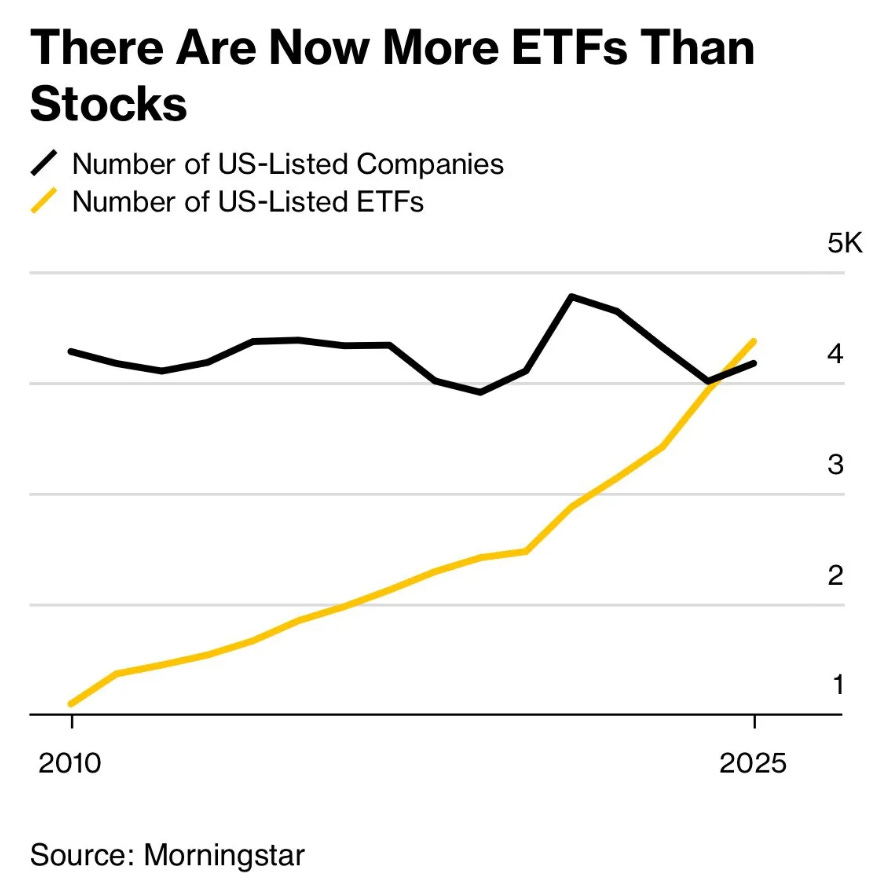

Speculative trading is close to double active management, which shouldn't come as a surprise, given that we now have more US-ETFs than actual U.S. companies…

How the hell to position for the above?

For starters, I'm under zero illusions that I can time when things might come unstuck, as it is the nature of momentum. You won't catch me shorting or thinking I can time when to go majority cash.

I don't feel the need to time the market anyway, as I'm finding lots of interesting sub $100m companies doing great things, which have never benefited from a dollar of passive flows.

I'm buying these sorts of micro cap companies where anyone who is going to sell, already has, and the company's share price is moving higher on the incremental buyer seeing the business fundamentals improve.

I’m also putting a heavy emphasis on owning physical commodities. Mining is tough and is likely going to get even tougher with rising input costs and geopolitical risks.

Portfolio speed run

I’m going to comb through the portfolio sector by sector, asking myself, would I be happy owning this asset if I knew there is a coin flip chance of things getting super hairy (March 2020 hairy) or we enter a full Brazilian phase?

Housekeeping: I’ve shifted my Substack payments from my personal Stripe to my company Stripe called Fordell LLC for billing (so there is a chance your bank will flag it on renewal).