Spotting cyclicality in markets isn't that hard. What makes things difficult are our expectations of the timeframes in which cyclicality will play out.

It reminds me of this scene in Austin Powers where the you think the guy is about to get run over by the steamroller, until it zooms out and you realise it’s going to take a while.

Illustrating this idea via charts. I shared the below on Twitter in June 2021, implying that US valuations were extremely stretched.

Zooming out as of November 2024, the only thing that changed was the scale on the Y-axis (and we got this Economist cover).

Living up to Growth Expectations

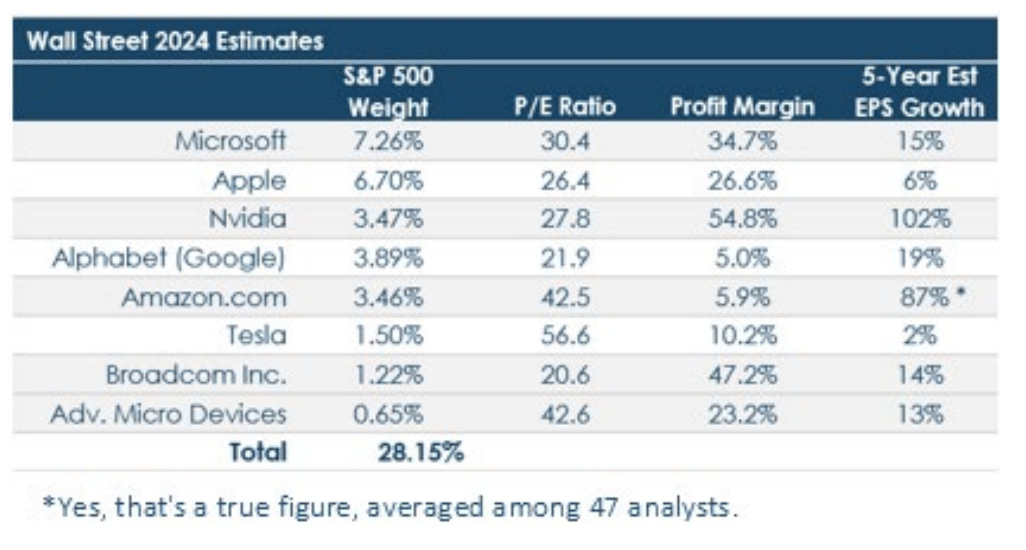

In Horizon Kinetics' 4th Quarter Commentary (January 2024), they included the table below illustrating how difficult it was going to be for the likes of Nvidia and Amazon to live up to the growth implied in their valuations. Yet here we are a year later, with Nvidia up 201% YTD and Amazon up 48% YTD (and the MAGS ETF up 65% for good measure).

YTD Nvidias market cap has increased from $1.18T to $3.55T while its forward P/E has increased from 27.8 to 36.8x and the average analyst estimate is Nvidia will grow EBITDA 144% in FY 2025 and 53% FY 2026.

Growing a $3.55T company's earnings by 144% is hard.

It's hard when investors' expectations have reached a level when just beating earnings isn't enough: Nvidia shares fall despite earnings beating estimates

It’s harder still when the country responsible for 17% of your revenue is probing you: China probes US chip giant Nvidia for ‘violating’ anti-monopoly law.

Lastly it’s really hard when China has a national champion (Huawei) which is undercutting Nvidia and competing with it in China and developing markets which represent a third of Nvidia earnings.

"Nvidia is walking a fine line and working on a balancing act between maintaining the Chinese market and navigating U.S. tensions," said Hebe Chen, a market analyst at IG. "Nvidia is definitely preparing for the worst in the long term."

How does a company prepare for the worst when passive flows and career risk drive it to nosebleed valuations?

When indexes try to rebalance, who is going to be there to take Nvidia off them at a $3.55T valuation?

It won't be active investors as they will be busy buying the thing that is outperforming that the index needs to rebalance into (likely because inflations back).

For now none of this matters…

I outlined it in this piece a year ago: What Goes up Must... Rebalance, following which things have just got more extreme and will probably continue for some time, but this is not a game I want to play.

Egregiously Underweight?

The game I want to play is figuring out what is egregiously underrepresented in indexes, and stands to benefit when the tides turn.

Take a "World Index," such as the MSCI ACWI Index, which covers "85% of the global investable equity opportunity set."

You get a 2.61% weighting in China and a 66.76% weighting in the United States.

The MAG7 represent 20% of the index. Apple, Nvidia, and Microsoft all have heavier weights than China.

Apple, Nvidia, Microsoft and Amazon's weightings are the equivalent of nearly 6 Chinas…

Tesla has nearly half the weight of China, which is beyond absurd when you consider how competitive the Chinese auto sector is.

You have to perform mental gymnastics to justify Tesla's valuation (P/E: 101) when BYD (P/E 24) leads innovation at a fraction of the price.

China's BYD shows off SUV that can also float (do 360s and park sideways..)

BYD launches next-gen plug-in hybrid system with 2100km range

It's not just vehicles, either.

If you want to see innovation now, look at Huawei's latest products (The Tri Folding Phone Impressions).

Chinese tech giant Huawei has garnered more than 3 million pre-orders for its triple-folding smartphone, its website showed on Monday, which comes just hours before Apples debut of its new generation of iPhones.

Whether it's Nuclear power plants, 5G, phones, tablets, "new energy vehicles," etc., it's clear Chinese tech is set to dominate global market share. (The US and Europe will continue to shrink on the back of tariffs and retaliation tariffs.)

The “CCP Put”

Similar to the "Fed put" after the Global Financial Crisis, any weakness in Chinese economic data will be met with more stimulus.

Weakness = more stimulus i.e. QE 1, 2, 3, 4 infinity.

If things improved the Fed would sit back and wait with the gas can.

In China what Xi says goes, if he wants to boost confidence there will be stimulus until he gets it.

Thats what China have just signalled with the moderately loose policy annoucement.

President Xi Jinping’s decision-making Politburo vowed to embrace a “moderately loose” monetary policy in 2025, according to the official Xinhua News Agency, signaling more rate cuts ahead and shifting from a “prudent” strategy that’s held for nearly 14 years.

The Chinese also have a big advantage with low inflation, which allows them to stimulate without it being an issue.

We’ve seen moderately loose policy from China before.

Who Benefits?

Up until recently property was the game in China as you can see from the below composition of household assets.

With the property crash and now the championing of industrial policy, it makes sense that Chinese households could buy equities when they grasp the "CCP Put" (the Chinese love a good momentum trade).

In posting the above Gavekal chart, I would be remiss not to thank Louis Vincent Gave who outlined this thesis to me (if I’d been a little less dense I’d have got on this trade after our interview).

Or to re-use my most over-used meme/ad.

I digress, back to the thesis…

There is a shit-tonne of dry powder on the sidelines in China.

China is the global savings superpower. In the past, in a fast-growing economy with superb investment opportunities, its high savings have been a big asset. But they can also cause huge headaches. Today, with the ending of the property boom, managing these savings has become a challenge. The Chinese government must dare to choose relatively radical remedies.