Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

Memos from Howard Marks: The Calculus of Value

Now we can start getting current and concrete. Where were we when 2025 began?

The S&P 500 stock index is the most watched barometer of the U.S. stock market. Toward the end of last year, its forward-looking p/e ratio (the ratio of its price to its estimated earnings over the coming year) was around 23, significantly above its historical average.

At the time, J.P. Morgan published a graph showing that if you bought the S&P 500 index at 23 times the coming year’s earnings per share in the period 1987-2014 (the only period for which there’s data on forward-looking p/e ratios and resulting ten-year returns), your average annual return over the subsequent ten years was between plus 2% and minus 2% every time. To the extent this p/e ratio history is relevant, it bodes pretty poorly for the S&P 500.

I concluded in my January memo that this was troublesome but not threatening, again mostly because the temporary mania or “irrational exuberance” that I believe accompanies – or gives rise to – most bubbles wasn’t present.

Podcast/Video(s)

Found this interesting from someone at the coal face of venture capital: Why Venture Capitalists Are Suddenly Terrified Of AI — Kevin Rose

Quote(s)

“There were a couple of decades of what Marc Andreessen famously coined as software eating the world, and now we've kind of transitioned into this world of AI eating the software.”

-Kevin Rose

Tweet/notes

Burn baby burn.

I think we’ll look back on this $1billion job offer as one of many contrary signs.

Charts

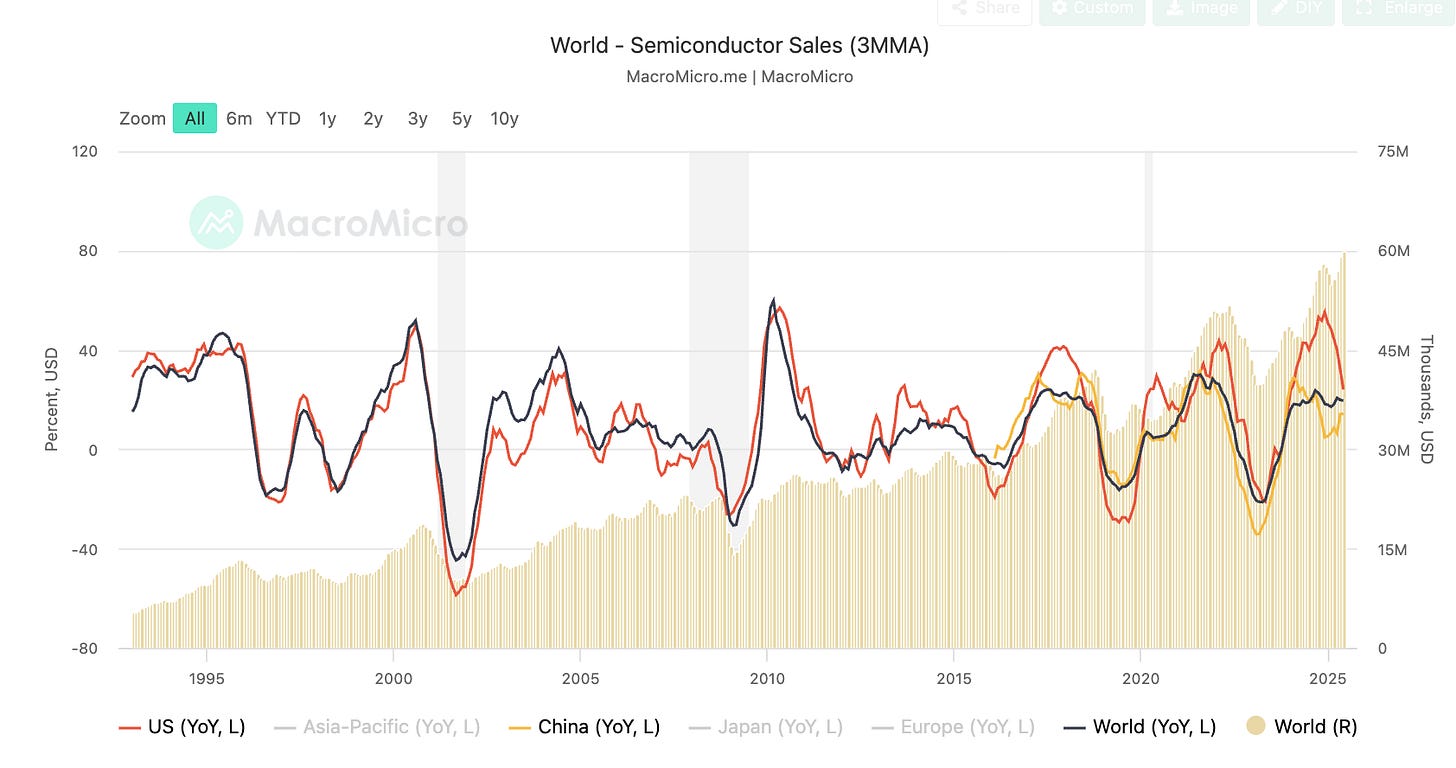

Semiconductor sales are about as cyclical as you get. It’s interesting to note that US YOY sales have already rolled over, which has historically dragged the world index with it.

Something I'm Pondering

I’m pondering how investing is a game of expectations.

When expectations on an asset are low enough (aka roadkill), you can make money on most outcomes.

Conversely, when expectations are high enough (nifty fifty), you can lose money on all but the most extreme outcome.

The art in investing is figuring out where on the spectrum assets lie and having the patience to apply that insight.

Cheers,

Ferg

I recently put together this free post, which outlines my Rules of Thumb for how I approach the markets.

Also a update on my Stripe situation!

I have my Stripe back after a number of you pulled strings/put me in touch the right people within Stripe. Can’t express how grateful I am for all your collective help!

Semi sales rolling over - bad for tin isn't it?

Note that this is a question about methodology, and not a request for "investment advice".

Perhaps this is a stupid question, sir, but I read down the Rules of Thumb and could not find an answer-- or "quiet way" to ask the question. In your risk/regret minimization method... is the 1% your initial position or the appreciated value of the stock at any given time? I take my initial investment out when a stock hits 100% appreciation and am thinking seriously about cutting my winners back harder. (Far too much has been up far too fast for comfort.)