Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

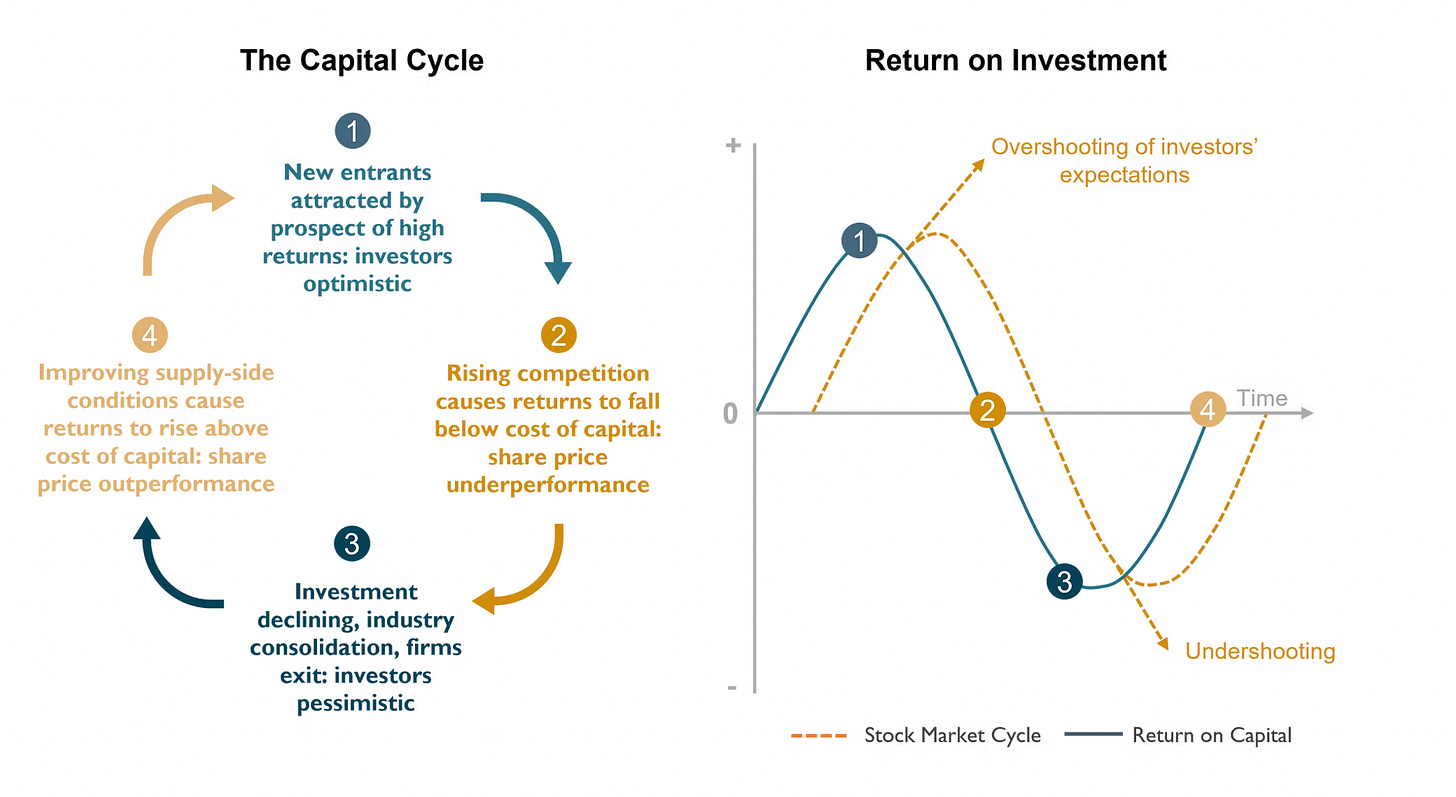

The Capital Cycle Way: Portfolio Manager Omar Malik's speech at the Value Investor Conference.

(H/T: Ben Kelleran)

Podcast/Video(s)

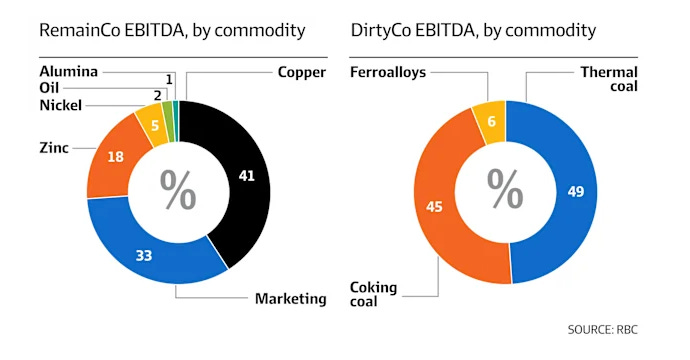

This potential mega-merger has my attention with my recent position in Glencore: Why GlenTinto is Back On (with Koala)

Glencore primes its Australian DirtyCo for local sharemarket listing

Brokers say Glencore’s decision to quietly shift $30 billion in coal mines and other unattractive assets into an Australian subsidiary opens the way for a local listing and a mega-merger with one of the resource giant’s rivals.

Quote

“Past experience, to the extent that it is part of memory at all, is dismissed as the primitive refuge of those who do not have the insight to appreciate the incredible wonders of the present.”

— John Kenneth Galbraith

Tweet/notes

I make time to listen to Dr. Alhajji and subscribe to his Daily Energy Report, which features numerous energy articles, their key points, and his take on them. He repeatedly points out how the majority of IEA and Western media conclusions on energy are often incorrect (a large proportion of Bloomberg and Reuters energy articles get the fake news treatment!)

It's a sad state of affairs when, even if you are trying to keep up with energy news via the likes of Bloomberg and Reuters, you are being fed false narratives.

"If you don't read the newspaper, you're uninformed. If you read the newspaper, you're mis-informed."

-Mark Twain

We have a world in which the IEA (created after the 1970s Arab oil embargo to improve energy security) promotes Net-Zero fairy tales and must be pressured to include its current policy trajectory again. Meanwhile, the EIA, which produces quality data on energy, is facing substantial employee reductions (potentially as much as 40%).

There has to be a reckoning on these fantasy outlooks; take BloombergNEF New Energy Outlook 2025, where oil demand is likely to exceed the 2032 oil demand forecast this year….

Oil demand in the report’s base-case ‘Economic Transition Scenario’ peaks in 2032 at 104 million barrels per day, with road fuel peaking a few years earlier. Demand ultimately drops to 88 million barrels per day by 2050 – a significant decline from today, but far from the drop required to get on track for net zero.

Charts

I need to have a closer look at some cement companies…

Something I'm Pondering

I’m pondering, could this “time really be different”?

It suggests that in multi-currency commodity markets with net gold settlement options, the release valve of global inflationary pressures will continue to be the gold/commodity ratio rather than the price of commodities.

Most western market participants continue to prefer commodities as their preferred inflation trade expression, trained by 40+ years of experience in a USD commodity monopoly world…which no longer exists.

We continue to believe that gold and BTC should outperform commodities as an inflation hedge in coming years (i.e., “gold and BTC are the new oil”).

-Luke Gromen

Could gold and bitcoin ratios blow out to new highs against the whole commodity complex?

Owning junior gold miners is my way of benefiting from this potential outcome.

Additionally, I see a lot of value in playing whack-a-mole (as Kevin Bambrough referred to it) with commodities that have the most acute supply-demand imbalances (even if it is to roll the proceeds into gold to maintain purchasing power).

Take the platinum setup; with my most recent piece, I struggle to see how the gap doesn’t narrow at the very least.

I hope you’ve all been having a great week.

Cheers,

Ferg

P.S. This is coming to you from the garden in Mia’s parents’ house in Montenegro. Hugo has been put to work picking cherries in the orchard.

I suggest you look at Eagle Materials (EXP) for a healthy and relatively cheap cement company

Cute picture. Hope Mia has recovered well