Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

Horizon Kinetics 4th Quarter Commentary

This was my favourite takeaway:

The 87% five-year growth rate for Amazon is not a typo; it is the average of 47 analysts. Picking one cherry, the 23% net profit margin and presumed 13% earnings growth rate for Advanced Micro Devices are for a company that – as we covered in a prior Commentary – has not earned a cumulative profit since at least 1987, the earliest data readily available (albeit it had its episodic good years). Its 35-year cumulative loss appears to exceed $100 million. What would happen if a hint of direct Chinese competition were to have a moderate but limited impact on the profitability of these companies? It’s a question that can be tested.

Podcast/Video

Always a great listen: MacroVoices #414 Louis Vincent Gave: Party Like it’s 1999

Quote(s)

“Hard things create meaning in life, anything you’re given you take for granted.”

-Naval Ravikant

Tweet

“Normally this is bad*”

*refer back to Nvidia growth assumptions in above table.

Charts

The volatile history of tankers.

Something I'm Pondering

I'm pondering how crazy things could get when Mag7 inflows turn to outflows.

Following writing my recent piece, Avoiding the Siren Song I'm seeing the capital vacuum of Mag7 show up everywhere.

Take some of these examples:

85% of large-cap long-only active funds are long Microsoft, while Apple is at 70% ownership. Then, consider the two of these companies nearly hit 14% of the S&P500.

Active mutual funds have gone from a low of 32% similarity to S&P500, to 45% today.

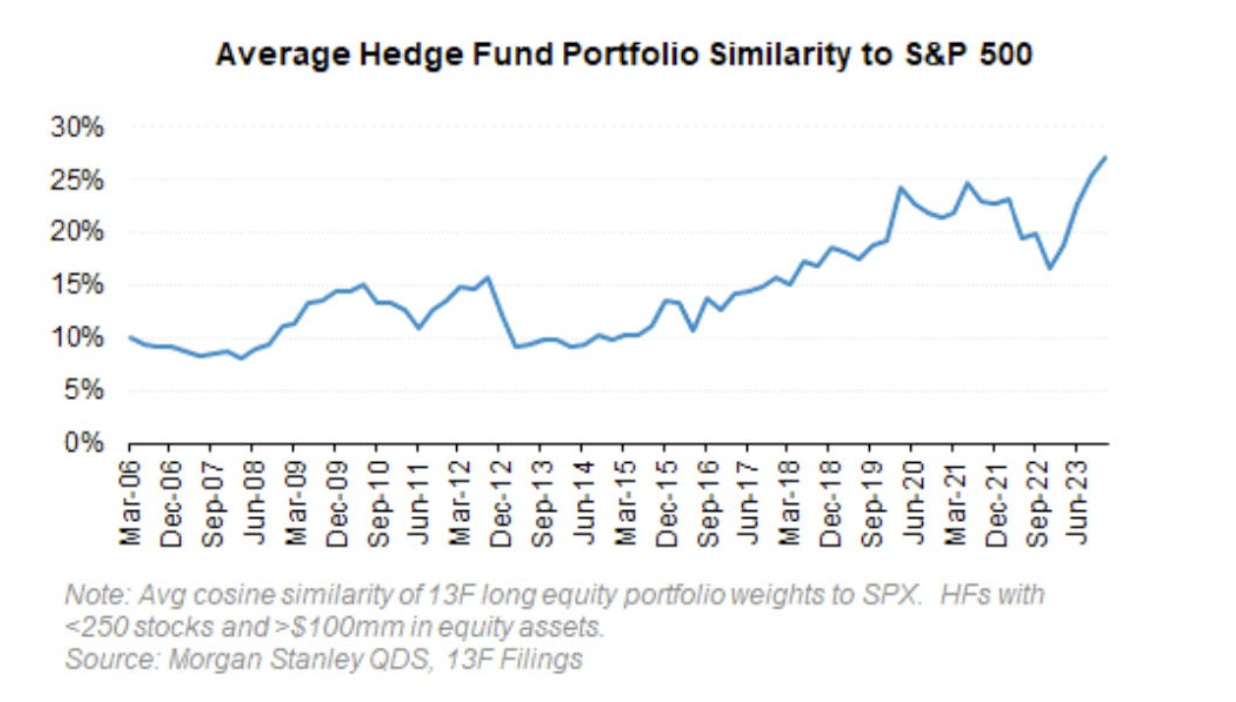

Hedge funds have gone from a 10% similarity to 25%, and it doesn't take a genius to work out where the overlap is….

Fund flows tell the same story.

There simply isn’t enough actively managed capital that isn’t already invested in Mag7 to take this off passive indexes/ETFs in a orderly fashion if they start rebalancing.

I hope you're all having a great week.

Cheers,

Ferg

P.S. If you’re interested in my story and why I started this Substack, you can read the story here.

Thanks Ferg. Re your comments about passive concentration in MAG7, you may enjoy Mike Green’s latest interview with Adam Taggart. Mike states that he is starting to see the first hints of structural outflows (from Boomer retirements) that will reverse this virtuous circle. This is the second time I have heard Mike say this recently (recent Grant Williams interview with Mike Taylor and Mike Green). Cheers John.

A great read, thanks for sharing