Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

Housel has a way with words: The Dumber Side of Smart People

Podcast/Video

I went down the semiconductor rabbit hole and found these podcasts/pieces insightful.

New Era for the Chinese Semiconductor Industry,

ASML: Competing with Moore’s Law - [Business Breakdowns, EP.117]

Semiconductors: Everything You Wanted to Know

Quote(s)

"The biggest risk to an evolving system is that you become bogged down by experts from a world that no longer exists. The more evolution you have, the more you should expect that expertise has a shelf life. And those most susceptible to that risk are the people you’d least suspect: The smartest and most intelligent, who at one point flashed their brilliance but struggled to admit that it can’t be repeated."

-Morgan Housel.

Tweet

Charts

Relying on luck is a strategy that meets a predictable outcome in a long enough timeframe.

Europe gets lucky with a mild, windy winter

The most recent winter has been predominantly mild, wet and windy across Northwest Europe, slashing heating demand while causing a surge in wind farm generation, a double saving on gas.

There have been relatively few episodes of “dunkelflaute”, the German word describing cloudy, windless and very cold weather, which zero-out solar and wind generation, forcing the grid to rely on gas to keep meet demand.

Something I'm Pondering

When you price companies to perfection, you need the projections to materialise and justify the valuation.

Two assumptions going into semiconductor projections already look shakey to me.

One being EV/autonomous driving projections as EVs need twice the chips of a ICE vehicle.

How much of this $147B market are we actually going to see given we are seeing EV demand collapse (see prior Ferg’s Finds where I’ve hammered the point).

It amounts to 14% of the projected $1.06T semiconductor market.

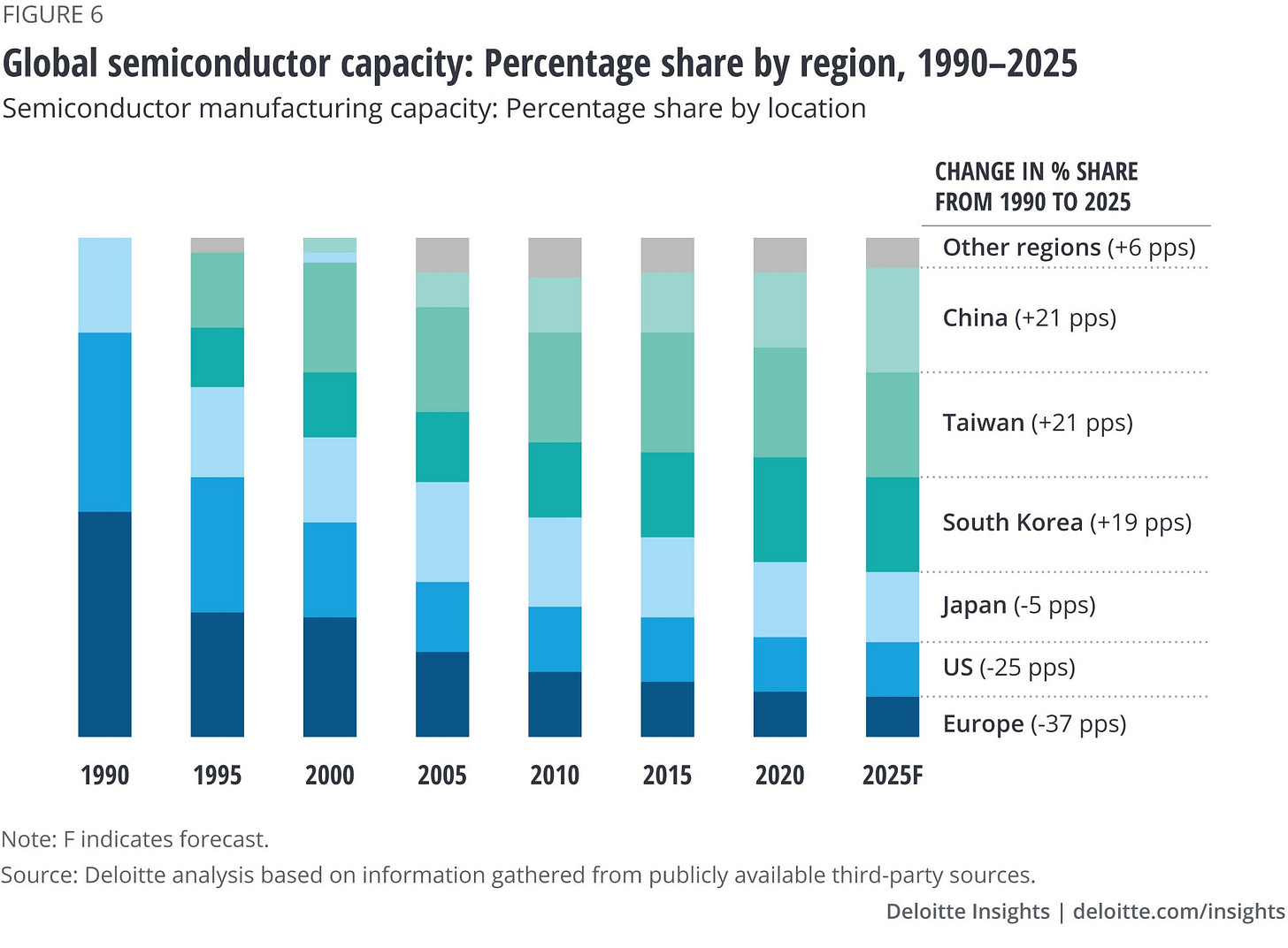

The assumption behind the above growth is that the West will continue to be the dominant producer of semiconductors. This completely ignores China's rapid increase in the manufacturing capacity of semiconductors.

US' crackdown efforts on more Chinese tech firms will backfire on itself: expert

Huawei's chip developer HiSilicon is making steady progress in the field. HiSilicon's chip shipments in the fourth quarter of 2023 reached 6.8 million units, up more than 50 times year-on-year, media reports said, citing data from Canalys.

The Biden administration's efforts to curb China's high-tech industry have failed to halt the advancement of China's chip sector. Instead, they have only accelerated the drive for independent research and domestic substitution, pushing China further toward self-reliance in the area, Ma said.

Howard Marks words it best: over-extrapolation gets you killed in the investing game.

“As usual they extrapolated it rather than question its durability. As in so many of the examples in this book, for most people, psychology-driven extrapolation took the place of an understanding of and belief in cyclicality.”

I hope you're all having a great week.

Cheers,

Ferg

P.S. If you’re interested in my story and why I started this Substack, you can read the story here.

Hi Ferg,

Do you think China is investable in some way?

I just think there is an unnecessary amount of negative press about it.

About EVs and semiconductors: it used to be that cars used 10-year-old chips because they had known, solid reliability specs. I don't know what the proportion these days is for new v.s. middle-aged v.s. old technology. These "technology levels" are manufactured by very different facilities in different countries.