Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

A bit of housekeeping: Everything should now be back to normal with payments (apologies that the new Stripe is bouncing a lot of subscribers; I’m trying to get it sorted!).

Article(s)

I always get a lot out of these: Kopernik: Q2 2025 Conference Call | Presentation

Podcast/Video(s)

I know, offshore drilling is a niche, but the fact that Esgian breaks down the sector on their YouTube channel and gets a total of 435 views over a month goes to show how hated this sector is.

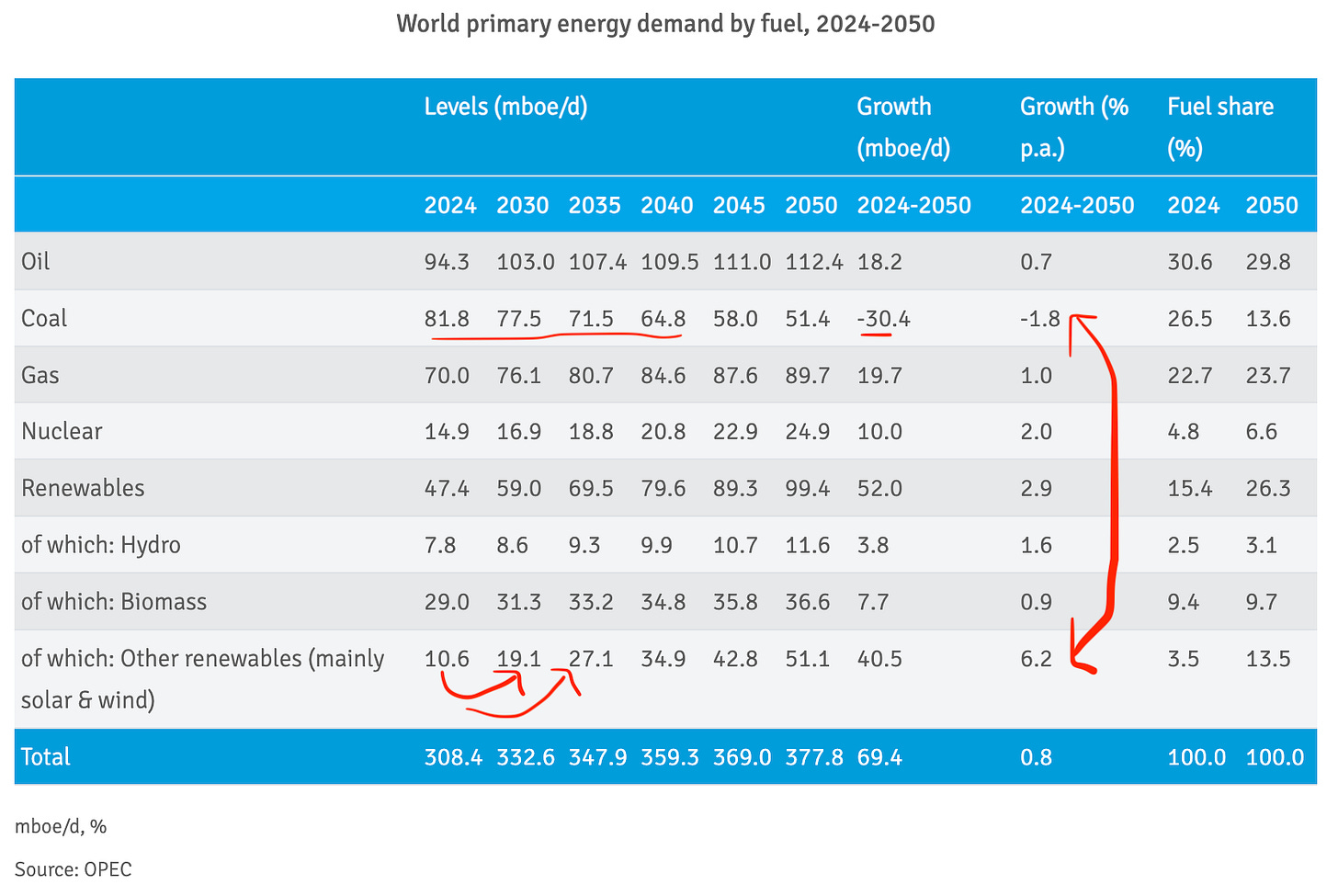

Their base case energy demand is way too conservative for all the reasons I outlined here: The Coming Asian Boom.

OPEC, which has historically been the closest to reality, is now forecasting oil demand at nearly half the historic demand growth rate (ignoring their fairy tale coal and renewable assumptions).

Quote(s)

“The trick of successful investors is to sell when they want to, not when they have to.”

-Seth Klarman

I’d add, selling well feels wrong, in much the same way as buying well does.

Tweet/notes/wife

Mia read this somewhere and showed me how to customise my ChatGPT, which has boosted its usefulness.

Charts

Global energy demand: false ceiling?

Developed countries' emissions reductions largely disappear when the emissions outsourced to China, embedded in imports, are added back to energy consumption.

-Prof Michael Kelly

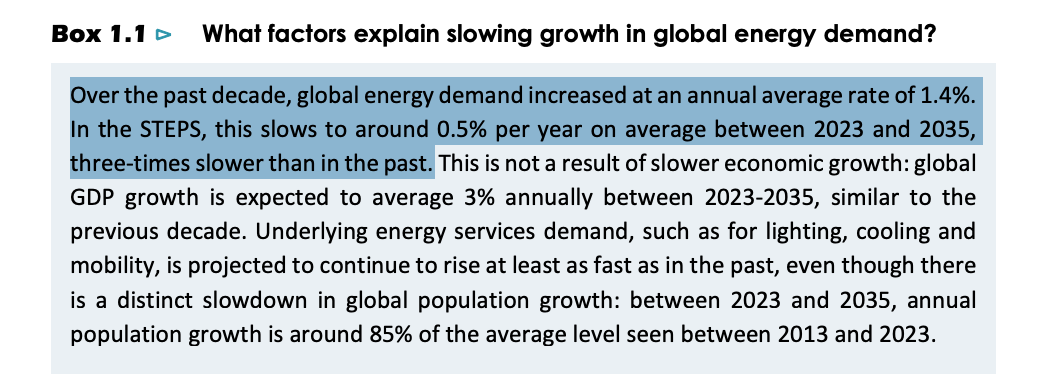

The IEA is in denial of this reality (global energy demand is running at 2.2% p.a vs their forecast of 0.5% p.a).

Something I'm Pondering

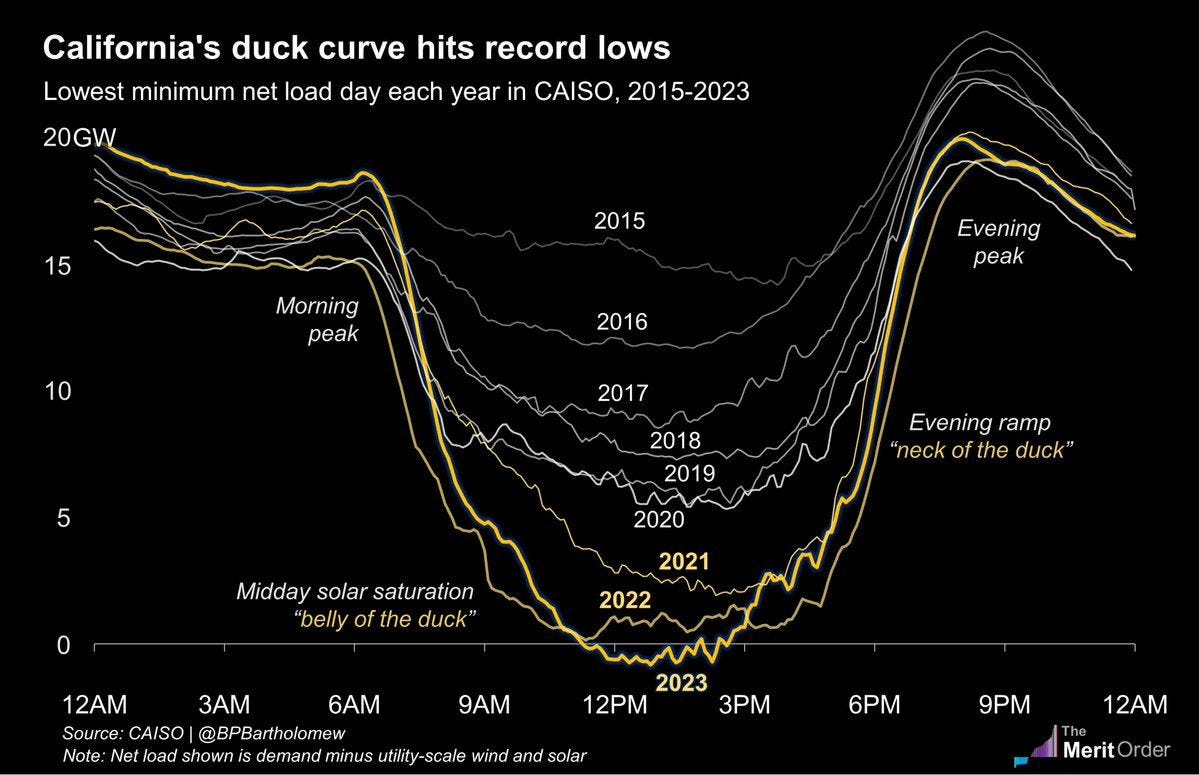

How much will China's solar capacity grow from here now that pricing protections are being removed? The Chinese are pragmatic with their energy policy and not driven by Net-Zero ideology (like California below), so when they hit the saturation point (solar deflation), solar installations will grind to a halt unless grid storage proves economic. Currently, coal generation is used to balance the intermittency, which is ironic since renewables are "supposedly replacing coal."

China’s June Solar Installations Plummet as New Rules Take Hold

Installations in China typically surge in December, but the peak activity period was brought forward this year by a pair of new policies. One rule change that went into effect May 1 made it more difficult to connect rooftop panels to the grid, while another that started June 1 removed pricing protections that had all but guaranteed profit for wind and solar projects.

China's blistering solar power growth runs into grid blocks

Renewable generators previously enjoyed a guarantee that grid operators would buy nearly all of their power at a rate tied to the coal index. That guarantee was lifted on April 1 and took effect earlier in some places, three industry experts said.

Now, renewable generation is increasingly subject to less favourable market pricing.

Shenhua Energy, a state-run coal and power firm, said in its first-quarter report that prices for its solar power fell 34.2% year-on-year to 283 yuan per megawatt-hour (MWh), while its coal power prices fell just 2.4% to 406 yuan per MWh.

Wang Xiuqiang, a researcher at consultancy Beijing Linghang, attributed the lower solar prices and profitability to a higher proportion of market-based pricing.

At the same time, grid companies are dialling back the 5% curtailment limit, "creating the risk for project owners that their generation might not be bought", said David Fishman of Shanghai-based energy consultancy the Lantau Group.

This will have a huge effect on renewable forecasts, given that China is forecast to provide the bulk of solar additions moving forward.

I hope you’ve all been having a great week.

Cheers,

Ferg

P.S. I recently put together this free post, which outlines my Rules of Thumb for how I approach the markets.

Repeating myself in case you missed it!

A bit of housekeeping: Everything should now be back to normal with payments (apologies that the new Stripe is bouncing a lot of subscribers; I’m trying to get it sorted!).

Great to have you back, Ferg. Honestly, I didn’t realise how much I’d missed your weekly dose of sanity until this one landed. The reminder that the West’s energy policy is built on wishful thinking and ESG theatre — while China quietly gets on with being pragmatic — was much needed. I was starting to feel like I was losing the plot… but nope, it’s just the world that’s upside down. Appreciate the clarity (and the slap of reality).

Projecting out to 2050 is a necessary exercise but one that should be treated with caution. Think back 25 years to the year 2000. Potential disruption going forward to 2050 includes geologic hydrogen, geothermal, nuclear fusion, maybe fission. But, the biggest changes are batteries where prices have been dropping sharply and perhaps superconducting materials. Things that are changing geometrically are difficult for people to appreciate/ comprehend. Thanks for a great post.