Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

Podcast/Video(s)

Two great interviews coming at the market from different angles:

Investing in a World of Permanent Stimulus | Vincent Deluard

The Bull Case: Real Growth Beyond "Project Zimbabwe" | With Erik @YWR

Quote(s)

“The maturation of every investor starts with absorbing almost everything and ends with filtering almost everything.”

-Ian Cassel

Tweet/notes

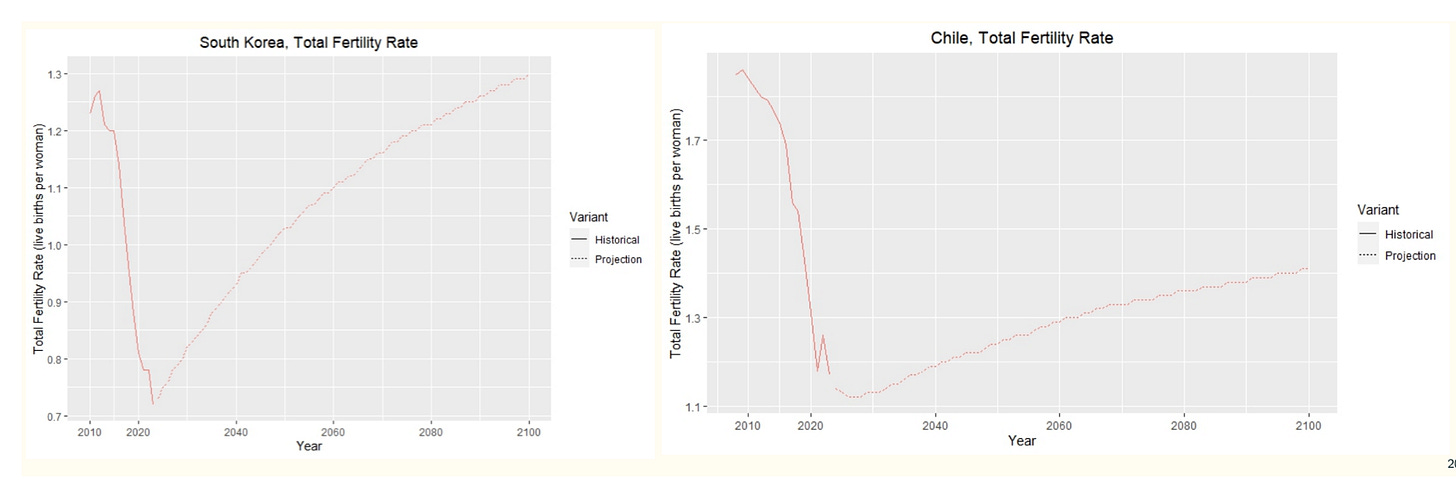

I've often quoted the UN demographic projections. Following reading JesusFerna7026's work, I'm rethinking that position, as there are a number of assumptions by the UN that make little sense.

The Demographic Future of Humanity: Facts and Consequences

Consider these examples that compare historical fertility rates to projections.

Charts

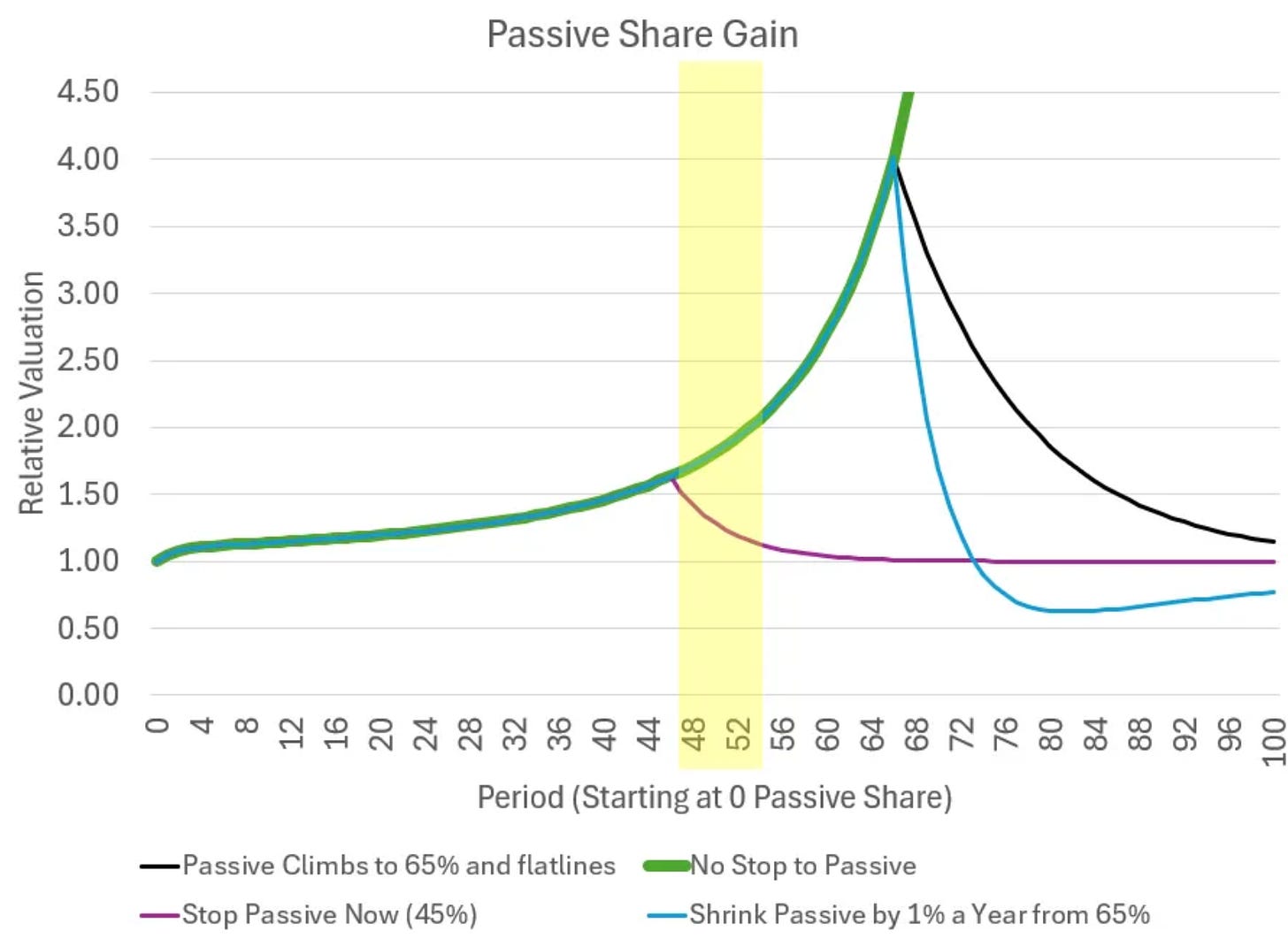

This is a wild chart from Michael Green that maps out possible outcomes as passive continues to gain market share.

You Said "JUST!" Michael Green

Suddenly, I was everywhere — “the crazy ‘bullish’ guy who thinks markets go up because of the flow of passive.” My work was originally targeted at regulators. In Q3-2018, I met with the BIS to share my analysis. I was shocked when they responded:

BIS: “We agree with you.”

MWG: “Oh, thank heavens! How can I help?”

BIS: “You misunderstand — there is nothing we can do. Blackrock and Vanguard control the regulatory apparatus. If we raise the alarm we get our boss fired and then we get fired. The only thing we can do is wait for the event and then try to clean up afterwards.”

Something I'm Pondering

I’m pondering how tough the investing game is.

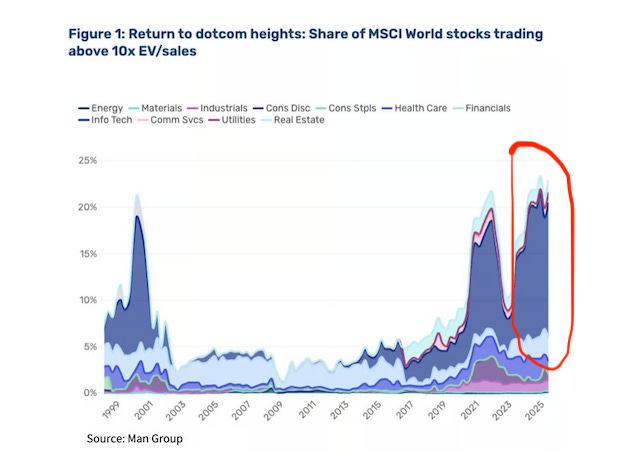

I loved Kevin Muirs's piece on the dot-com bubble: The ugly truth about market bubbles is that everyone loses

“From 1995 to 2000, I watched some of the shrewdest managers get annihilated shorting the dot-com bubble,” he said. “By the end, they all went out of business. I then watched the next five years destroy all the long managers who had ridden the euphoria to the upside, until most of the aggressive ones were also sent packing.”

It feels like we're currently experiencing something even more extreme, marked by the first peak in craziness in 2021, followed by a collapse, only to rebound to an even higher high with AI.

Cheers,

Ferg

P.S. I recently put together this free post, which outlines my Rules of Thumb for how I approach the markets.

I found the 'How Social Media Shortens your Life' really valuable, I'm going to incorporate more 'right angles' into my days and life! Get out of the maze!

Wow TDW up 23% so far today, looks like the TIDE (water) is turning!