Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

India May Boost Coal Power Fleet 25% by 2030 Amid Rising Demand

“My bottom line is I will not compromise with my growth,” Singh said, adding that India will not hesitate to import coal to meet any shortfalls in domestic supply. “Power needs to remain available.”

Podcast/Video

MacroVoices #421 Luke Gromen: More Dollar Liquidity To Come…

This in particular, caught my attention:

ISDA (big banks) requesting a permanent exemption to bank SLRs (supplementary leverage ratio) calculations for treasuries.

It sounds technical here is what it is: It gives the banks to buy an unlimited infinite amount of treasuries with no capital requirements, it is QE done through the banks.

-Luke Gromen

Quote(s)

“Most great investments begin in discomfort. The things most people feel good about – investments where the underlying premise is widely accepted, the recent performance has been positive, and the outlook is rosy – are unlikely to be available at bargain prices. Rather, bargains are usually found among things that are controversial, that people are pessimistic about, and that have been performing badly of late.”

- Howard Marks

Tweet

Maybe because I'm now a Dad, but this struck a chord with me.

Everything is secondary to the health and happiness of these two for me.

Charts

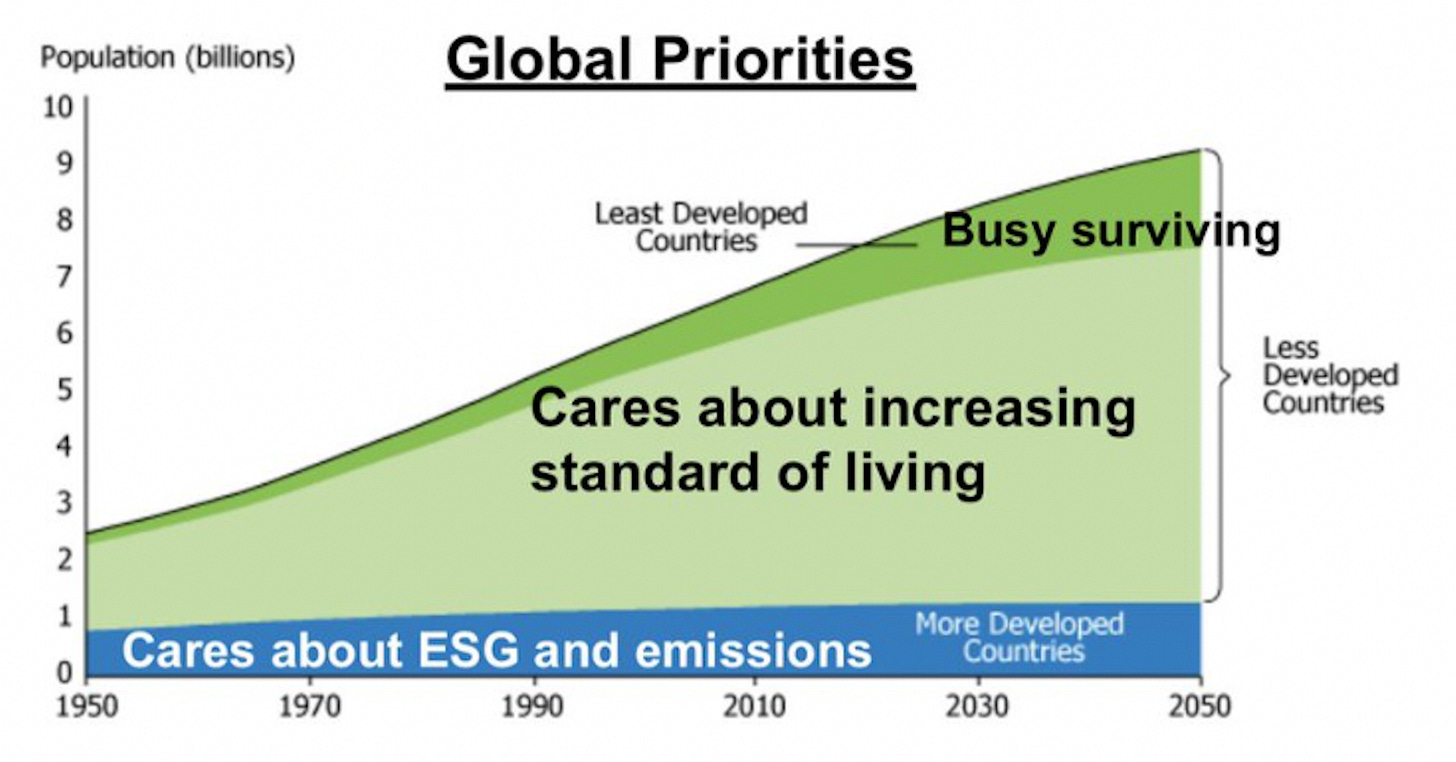

“My bottom line is I will not compromise with my growth (for emissions)”

-Developing countries

Something I'm Pondering

I’m pondering if it’s possible for some of the unloved sectors to continue grinding higher even in a market melt down. In the Global Financial Crisis everything crashed because everything had gotten expensive. While if a sector has been capital starved and received no passive flows like hated corners of the energy market how much downside is there?

Take this very cherry picked example of Cameco bottoming at the peak of the Dot Com Boom and grinding higher as the Nasdaq melted down (I’m not implying this will happen with uranium companies today with a lot more froth in the sector now).

But for a sector like coal I could see a repeat of the below dynamic being possible.

Cheers,

Ferg

P.S. If you’re interested in my story and why I started this Substack, you can read the story here.

Thanks for pointing that out. Banks being able to borrow at no cost to purchase the glut in US debt to provide the needed liquidity is the 'QE' flavour of the day. Regardless of the mechanism, it is QE, therefore Inflation, therefore trade fiat for real stuff and companies that produce it.

PS Great photo of your family

So true about family.

I always liked the saying i heard years ago -

When you are young, you are the picture, when you have a family you become the frame.