Fergs Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

China’s coal-fired power generation declines for the first time since 2015

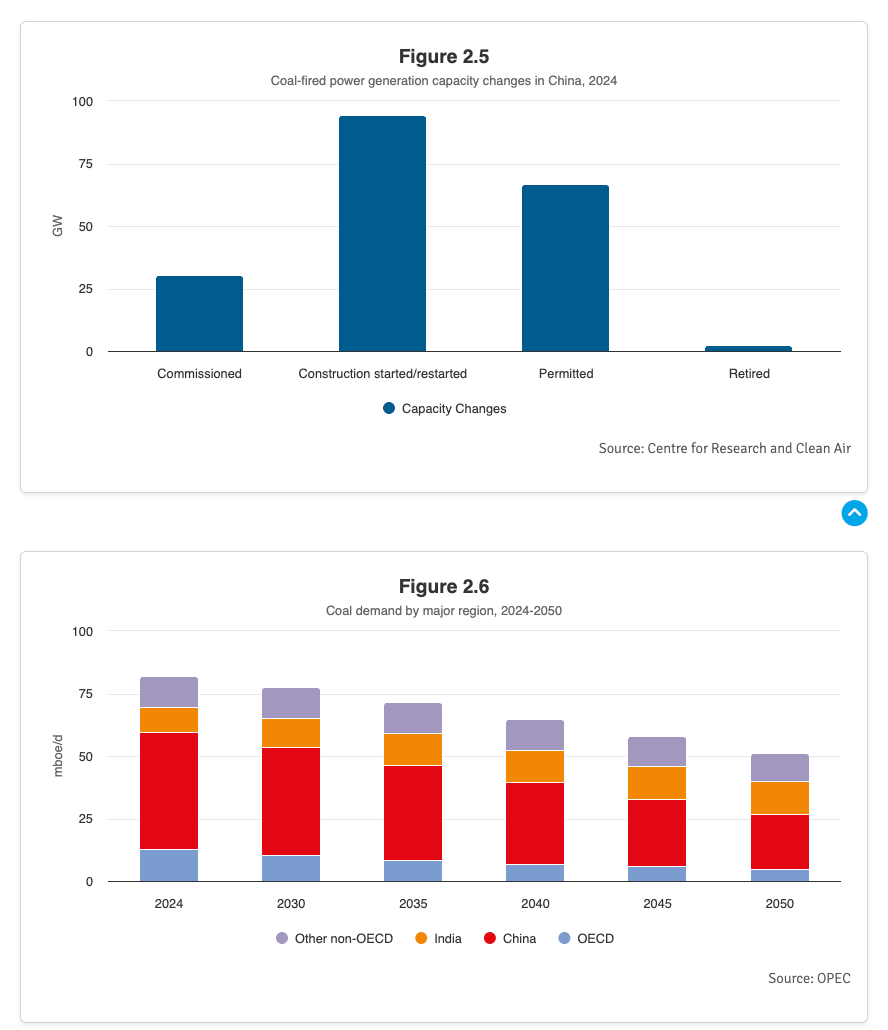

I landed on the above article while trying to understand how China is building coal plants at a rapid pace, yet coal demand is forecast to decline in a linear fashion as they are being built.

According to Wood Mackenzie, coal-fired power capacity factors were as high as 60% in 2011, then declined to 52% in 2024 and 48.2% in 2025. Wood Mackenzie expects the utilization to further decline to 32% by 2035 as portions of the fleet transition to reserve status.

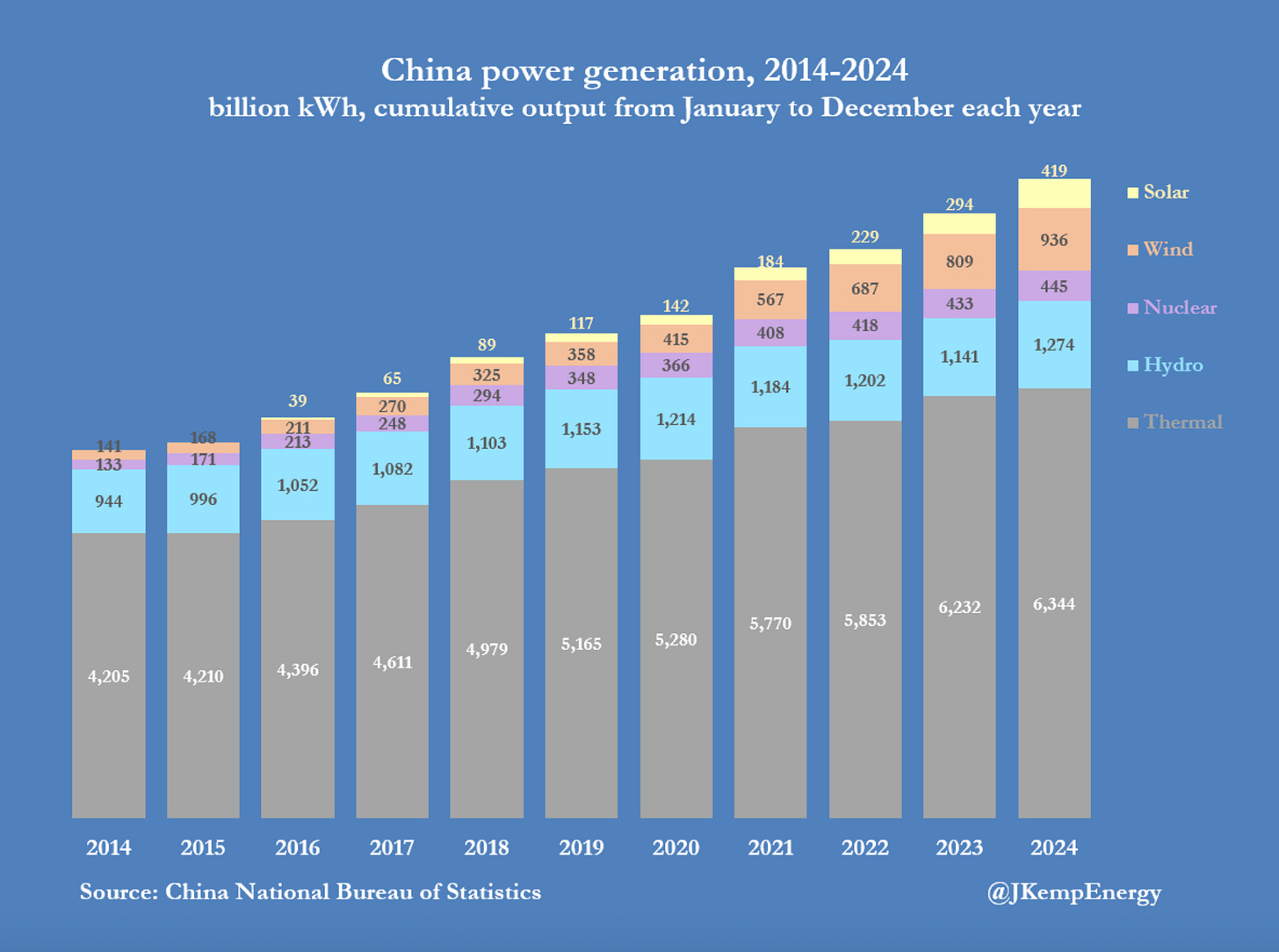

So the assumption is that China’s coal fleet will keep expanding while its utilisation rates will plummet, and demand will fall with it. It’s certainly dropped substantially from peak utilisation in 2011 of 60%, but has fluctuated around the ~50% capacity factor the last decade, granted its share of electricity has dropped from 79% to 58% as of 2024 (2025 still an estimate).

The idea being that coal’s role is structurally shifting from baseload to flexibility provider, which is true, as roughly 600 GW of China’s coal fleet is undergoing flexibility retrofits to ramp up and down in response to variable renewable output.

The questionable part of all this is what if electricity demand picks up?

For example, the explosive growth of artificial intelligence and data centres in China could drive unexpected spikes in electricity demand. While China is investing heavily in renewable capacity, rapid demand growth may force continued reliance on existing coal-fired power plants to meet immediate needs.

According to Wood Mackenzie, the aggregate capacity of data centres will reach 78 GW by 2030—a 105% increase from 38 GW in 2024. Since a large proportion of this new demand will concentrate in densely populated urban centres, coal-fired power may remain indispensable for maintaining grid reliability.

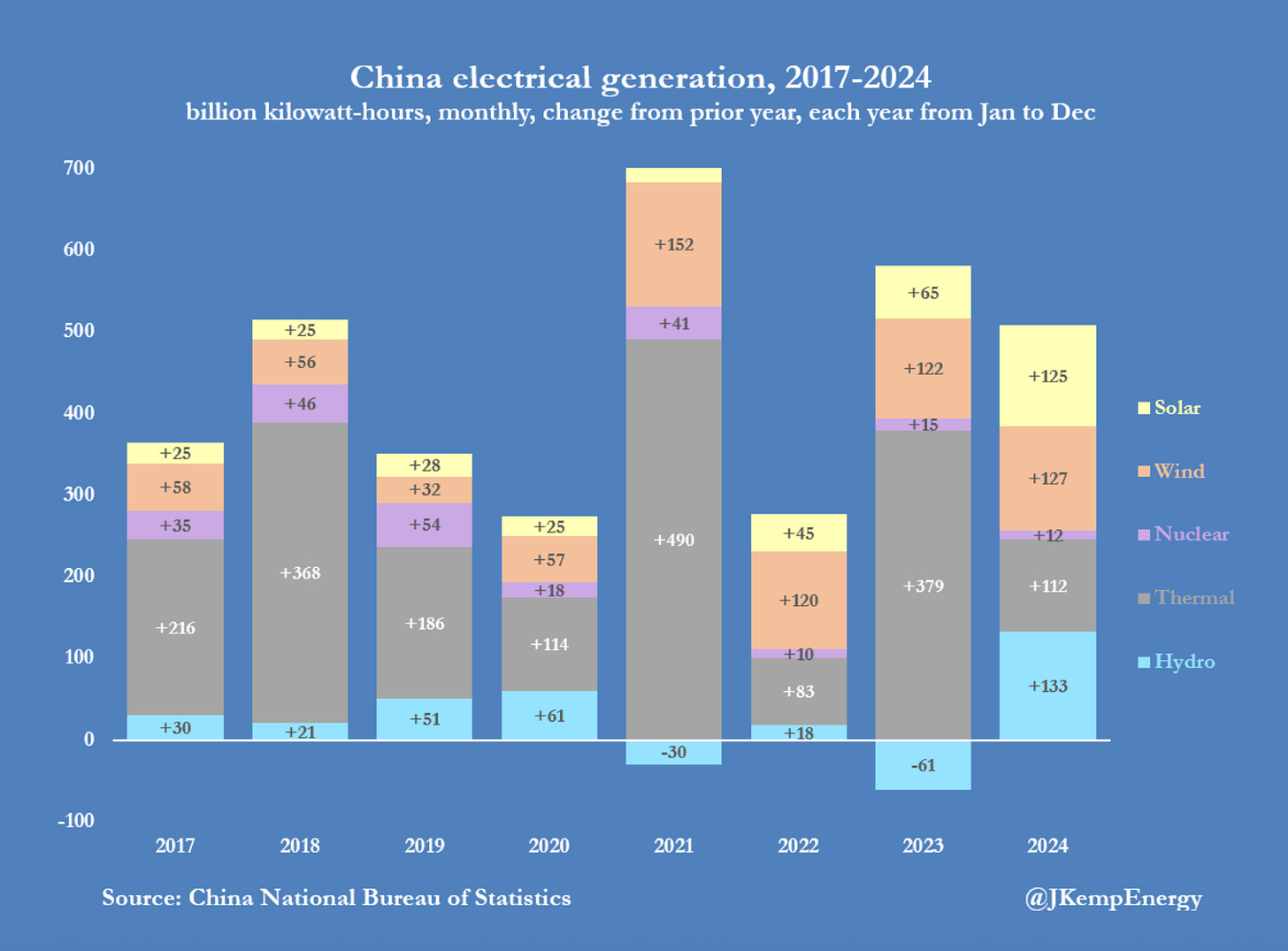

The chart below is a perfect example, as in 2022, you’ll get headlines of;

“66% of electrical growth was renewables in 2022”.

Yet when demand surprises like 2021 & 2023 you don’t see headlines;

“Coal was 72% of electricity growth in 2021”.

If you look at China’s power generation instead of installed capacity, it paints a clear picture.

Podcast/Video

I really enjoy Kevin Walmsley’s channel: China's top universities are opening to foreign students. That's a big problem for US schools.

Quote

‘The AI race is our Chinese against their Chinese.’

-Naval Ravikant

No American grads on Meta’s top AI team, all 11 hires are immigrants

Meta created a new Superintelligence Lab with an initial team of 11 senior AI researchers.

All 11 of these researchers are immigrants, i.e., none completed their undergraduate education in the United States.

Seven of the 11 were born in China or did their undergraduate studies at top Chinese universities such as Tsinghua, Peking, Zhejiang, and USTC.

Tweet

AI can optimise capital-intensive systems, such as manufacturing, robotics, and commodity processing. While in a capital-light system, AI “optimises” by eating profit margins (along with the valuations assigned to them).

Just watch what Musk is doing, not what he’s saying:

“With about 50 to 70 per cent of manufacturing and core component production expertise residing in China, we expect Chinese players to take on greater roles in the global humanoid robot supply chain,” said Cheng Xin, a partner at US consultancy Bain & Co.

It’s just drop-shipping when 70% of the supply chain is outsourced to China, which is responsible for the majority of the progress in the field (China has issued five times the number of patents related to humanoid robots than the US).

Drop-shipping is a great business model until your drop-shipper decides they will compete with you and eat your margins.

It’s humorous that the answer to Tesla having its lunch eaten by Chinese EVs (with an estimated ~40-50% reliance on the Chinese supply chain) is to pivot to robots with 70% reliance on the Chinese supply chain.

Charts

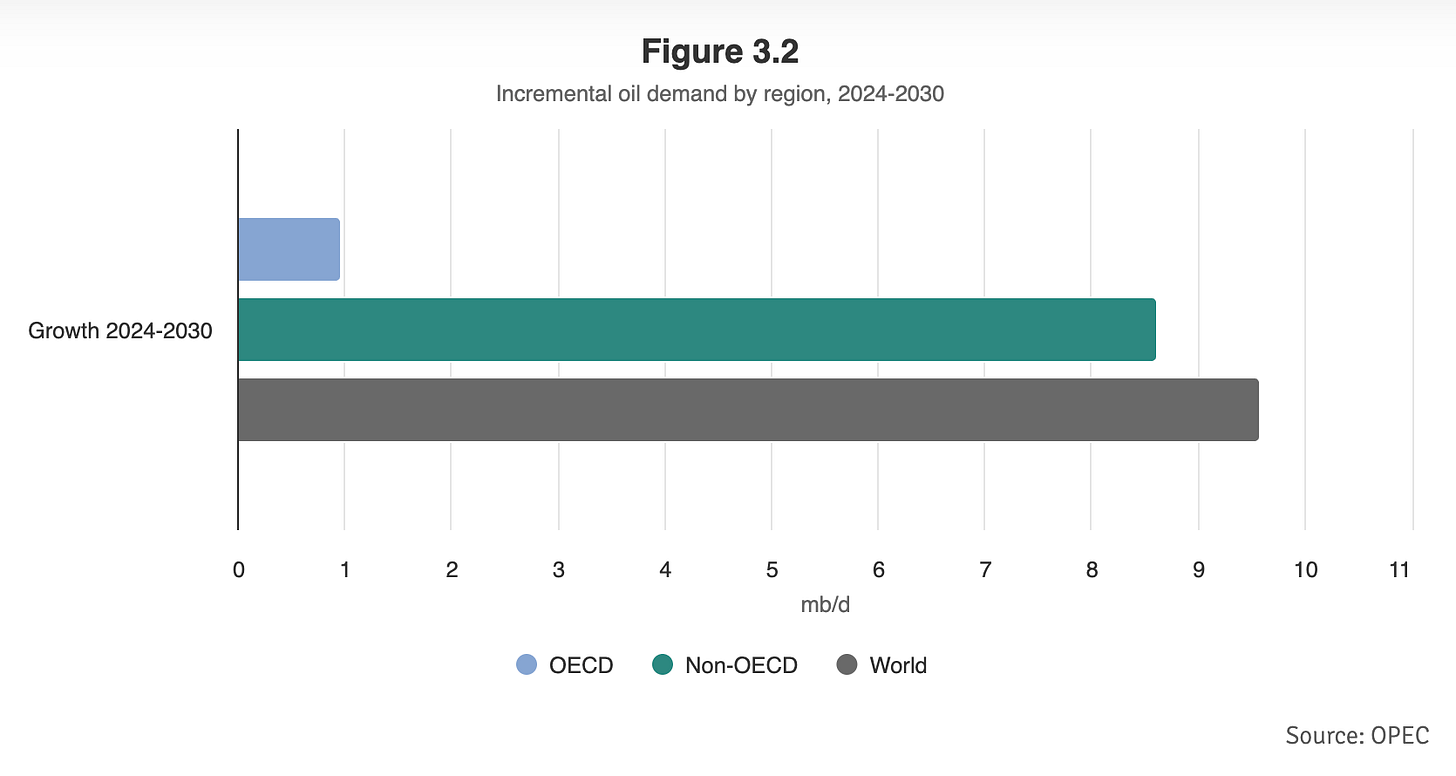

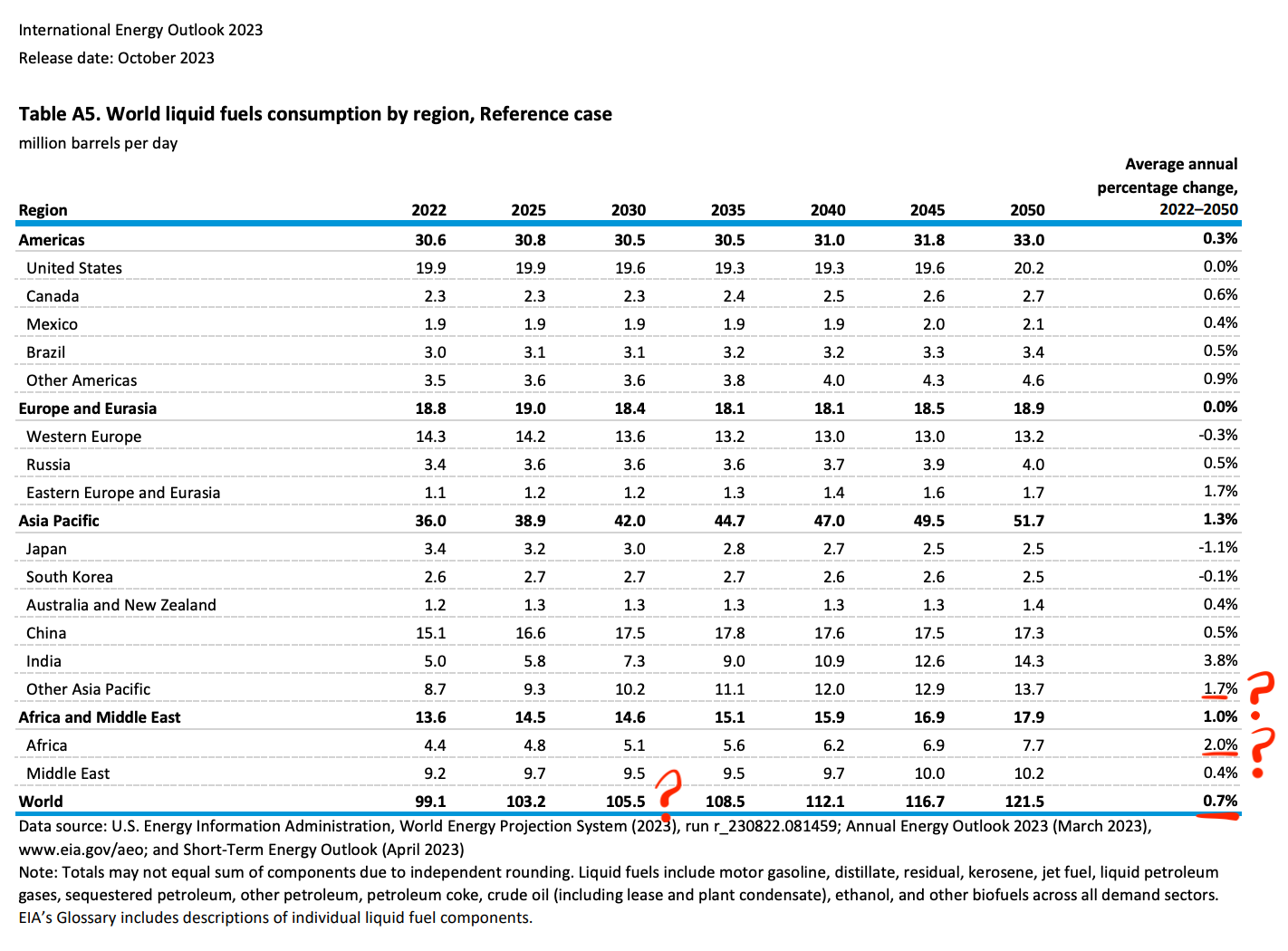

Oil demand growth forecasts hinge on non-OECD growth assumptions.

Take the below International Energy Outlook 2023 (from EIA, as they didn’t publish 2024 or 2025). As of 2026, we are already going to exceed the 105.5million barrels a day (taking the midpoint of IEA 105mbd and OPEC 106.5mbd).

Something I’m Pondering

I’m pondering the different approaches of the Chinese and Americans to software monetisation.

The US model was built on strong IP protection, high-margin software licensing, and decades of consumer conditioning from Microsoft, Adobe, and SaaS pioneers, who treat software as a standalone product commanding fat margins of 70%+.

The Chinese model was forged by widespread piracy, intense price competition, and a cultural acceptance of near-zero margins.

It’s funny when you consider decades of piracy have positioned the Chinese businesses well to deal with a world of AI piracy.

Chinese software piracy rates exceeded 90% from 1994 to 2004, dropping to 78% by 2010, according to the China National Intellectual Property Administration. Or consider Microsoft’s revenue in China, the world’s second-largest PC market, which was once less than 1% of its global total. MIT research found Chinese students would switch to internet piracy even if street piracy were eradicated. This has led to a generation of consumers who are conditioned to view software as fundamentally free.

I’ve used a Tesla vs BYD example a few times in Tesla charged USD$8000 for its self-driving while BYD threw it in for free on cars that cost as little as USD$9600.

China treats software as infrastructure that enables hardware sales, ecosystem lock-in, and downstream service monetisation.

Because for some insane reason, the Chinese companies don’t focus on “maximising returns to shareholders” but “minimising profits so you can kill your competitors.”

Talking of killing competitors open source Chinese models like Kimi and Qwen are currently 90% cheaper then leading edge US models and have access to all that coal capacity….

Kimi K2.5 and Qwen-Max charge around $0.15–$1.20 per million input tokens, while Claude Sonnet 4.5 costs $3–$15 per million tokens; that's savings of up to ~90–95%.

I’m having a lot of fun sorting through Chinese companies, as I feel many sectors are mispriced for the next decade.

I hope you’re all having a great weekend.

Cheers,

Ferg

P.S. It’s always fascinated me the idea of perceived safety, i.e. Nifty fifty (they are such high quality companies you can’t lose money…) to the Pristine Collectral of Treasury bonds. Compared to a Chinese industrial with close to its entire balance sheet in cash, a decent dividend and a highly competitive business on a global scale, yet is perceived as extremely risky…

I'll take the other side of Musks big predictions almost always. He said we would have full self driving every year for the last ten years. His Tesla forecasts were always wrong. AI will be a flop in the near term imo. Mostly hype. Better at some things compared to others. I often ask Grok questions about various companies that I know what the answer is or roughly know what the answer is and its wrong more often that right. I have to press it with 4 or 5 questions before it finally gives me the one thats true. Is that the same for ChatGP and others too? I mean it's basic shit that it cant get right. I cant imagine how it can replace doctors, engineers etc. I sure as shit wouldn't be relying on it but perhaps its far more advanced at government/military levels than we are being told

China, a country that’s structurally positioned to capture a big chunk of the upside from capital‑intensive AI and robotics, while Western narratives still frame it as background risk.