Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

I always enjoy reading Kuppies' thoughts and how he is viewing the market: Praetorian Capital Q2 2025 Investor Letter.

Podcast/Video(s)

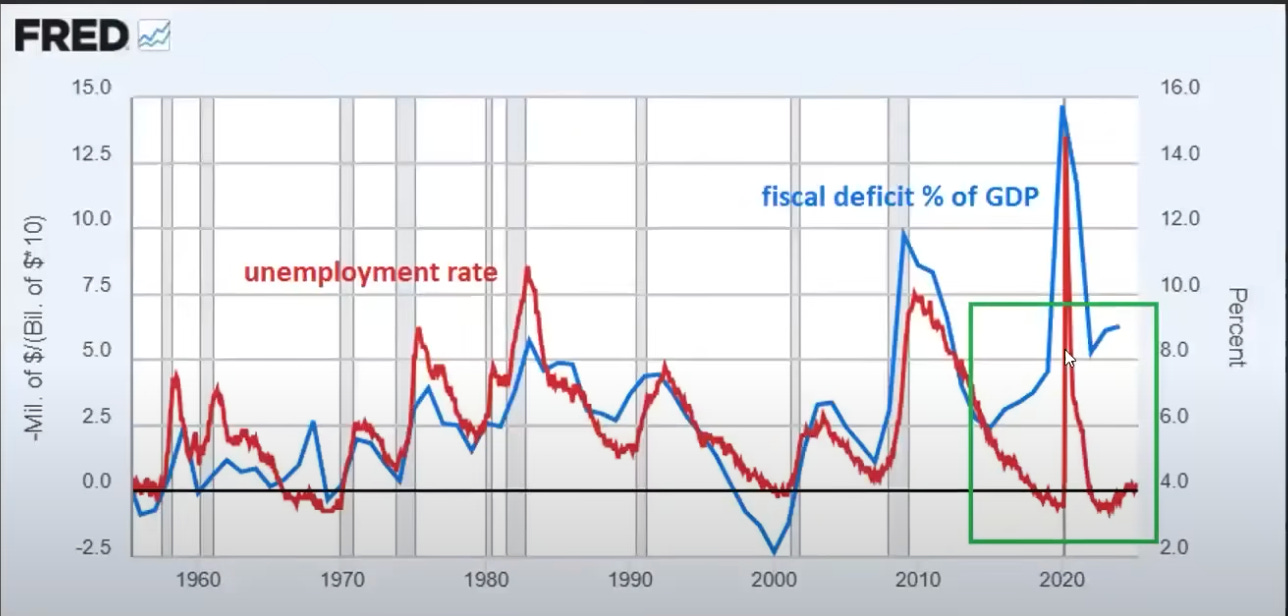

Lyn Alden: The Era of Fiscal Dominance

This chart jumped out at me (where is the deficit going to up if we actually get a recession?)

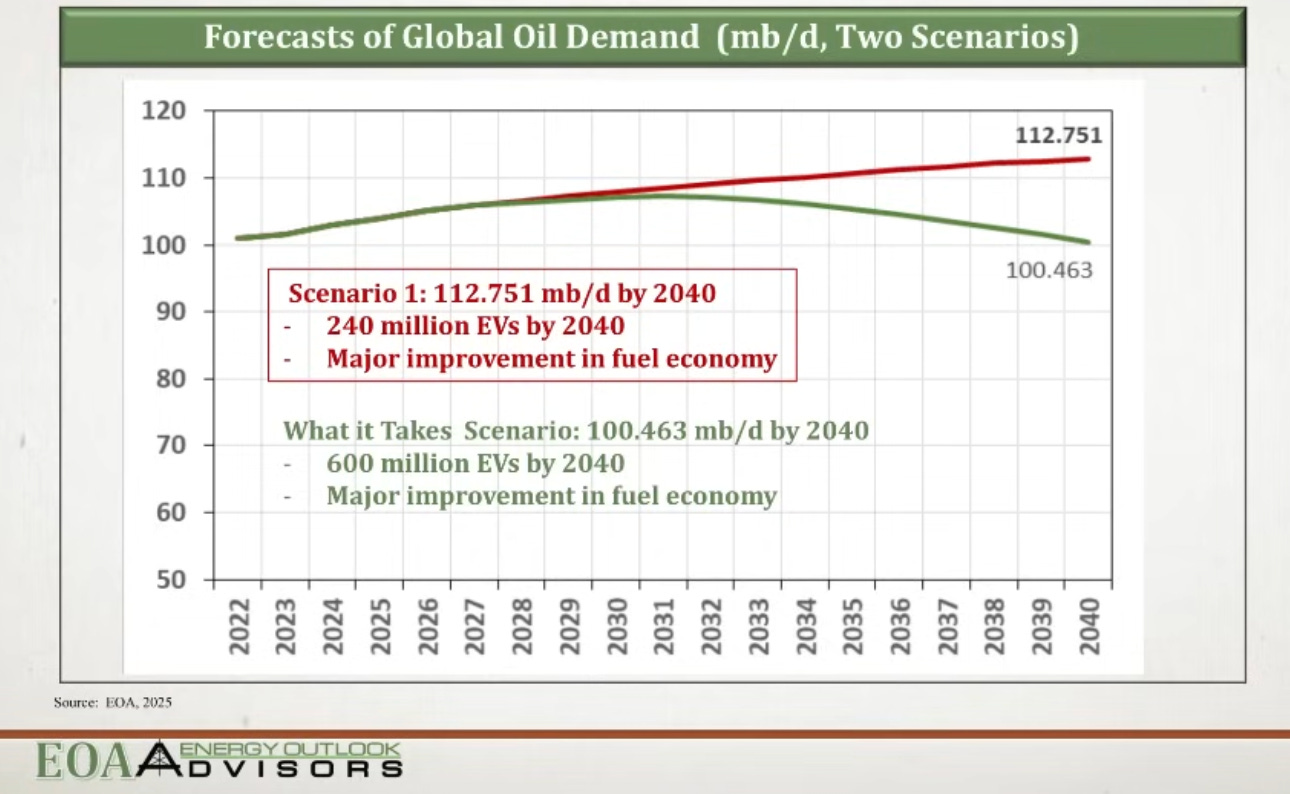

I also enjoyed this presentation from Dr. Anas Alhajji ( if you are short on time I’d just listen to this as I was not aware of the scale of double counting EVs in China to scam subsidies)

What Could Fuel the Next Oil Price Surge? | Dr. Anas Alhajji

This graph of the sheer number of EVs it would take to reduce oil demand is quite telling.

Quote(s)

“Every brilliant macro idea I have ever had took years longer than I had anticipated, and destroyed most facets of my life, before I saw it come to fruition.”

-Jimmy Jude

The market is full of people with a correct long-term macro view that then get chopped up trying to implement the view on a one-year timeframe…

Tweet/notes

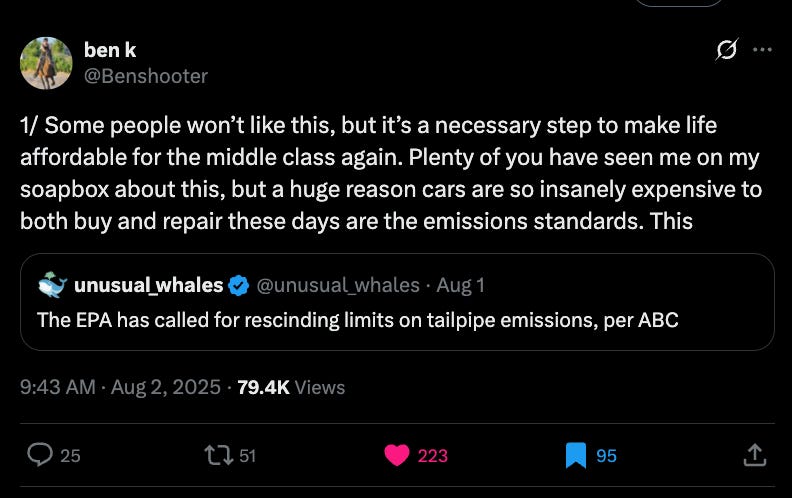

This was a great thread on understanding the cost-benefit analysis of trying to remove that last 1% of emissions from vehicles.

One more tweet for some comedy

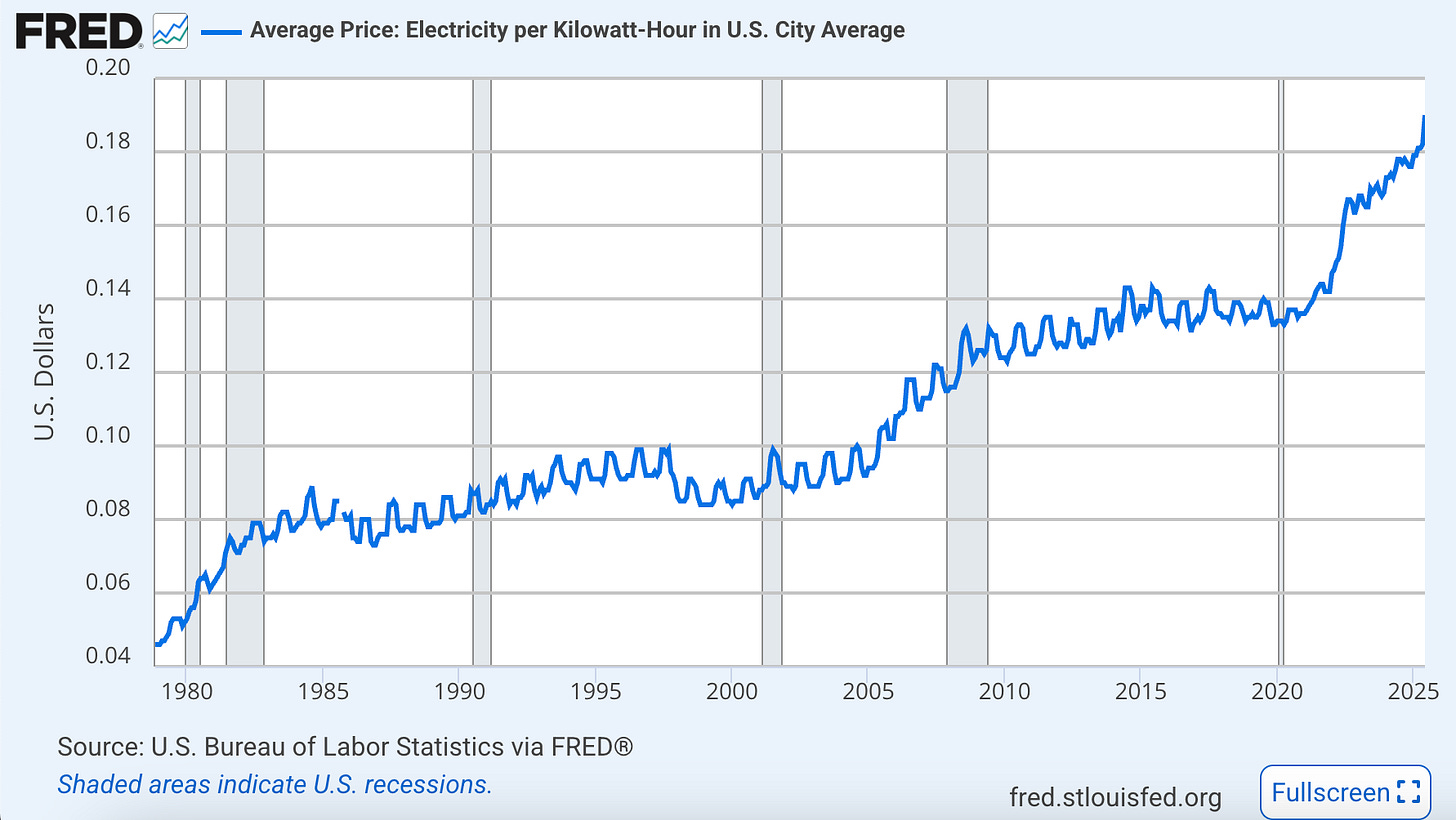

Which leads me to average US electricity prices.

Charts

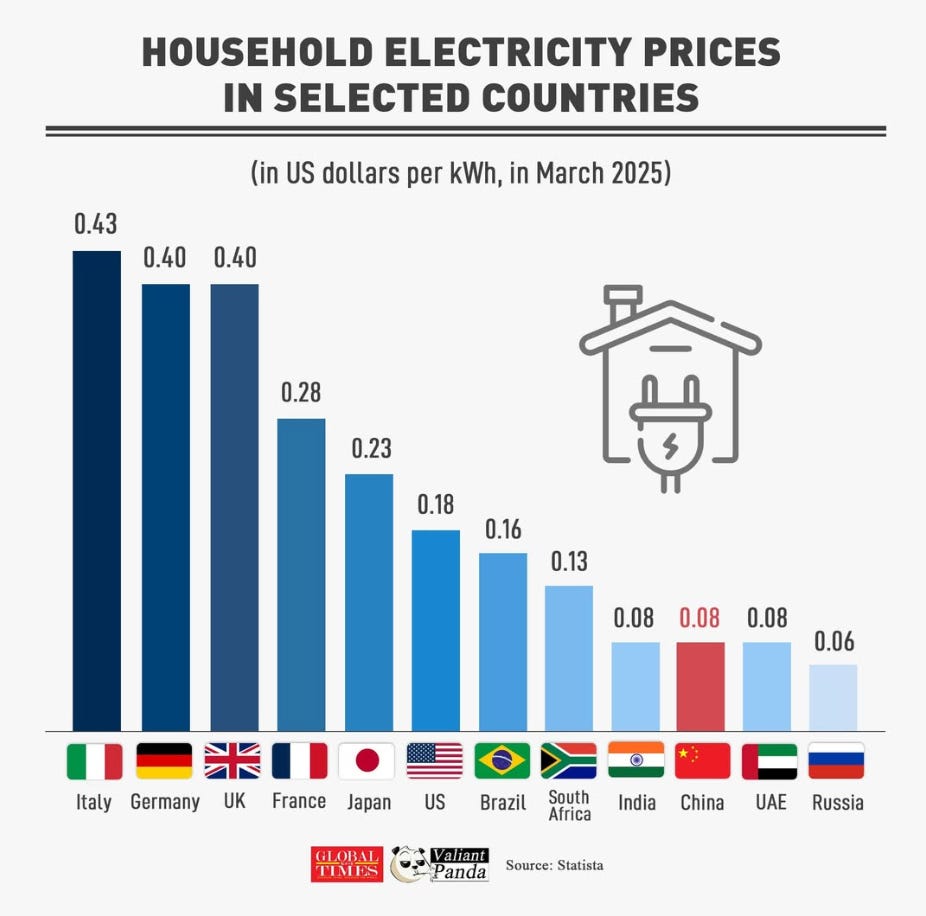

After a decade of sideways trading, the average US price of electricity is up ~30% since 2020.

Granted its still cheap relative to the Europeans.

Something I'm Pondering

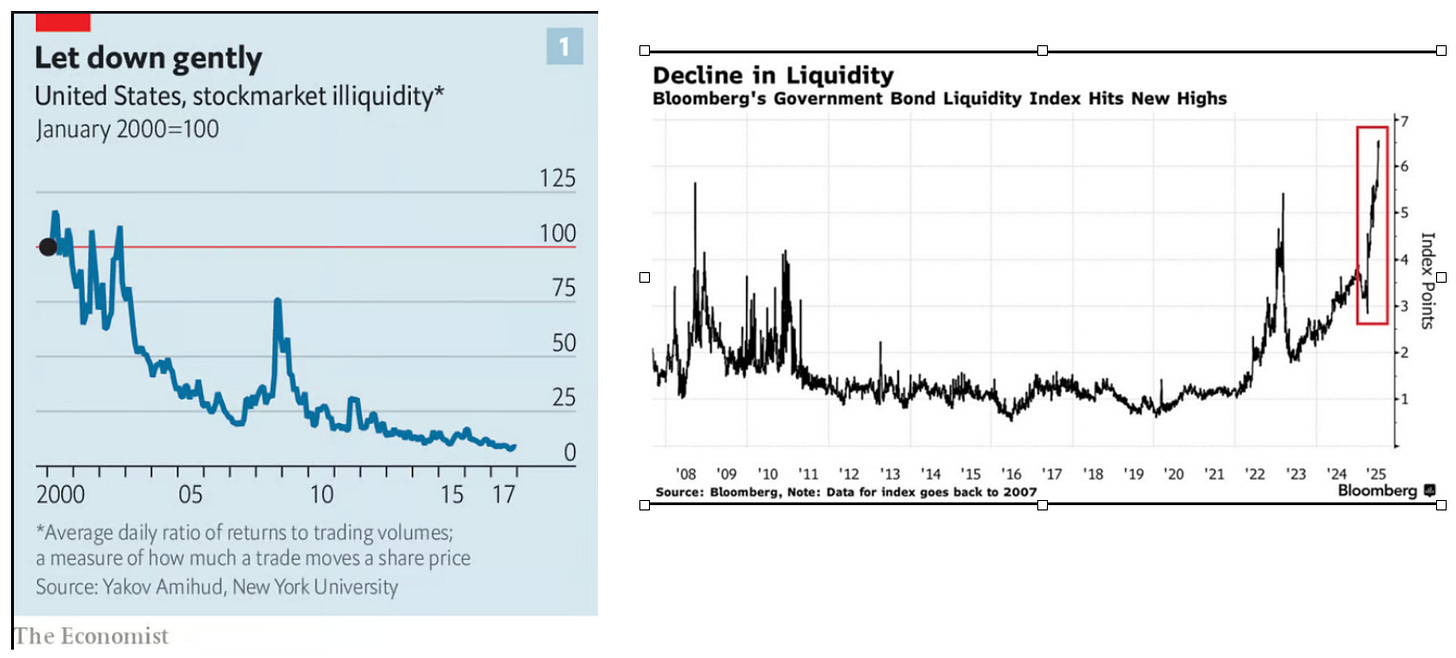

I’m pondering where all the liquidity went.

With headlines like this, it doesn't give much reassurance either: US Treasuries face stablecoin-driven demand surge as supply looms.

It’s all just valueless financial engineering….

Cheers,

Ferg

P.S. I recently put together this free post, which outlines my Rules of Thumb for how I approach the markets.

FWIW: Off-peak electricity rates in California for PG&E customers are higher than Italy's average. Peak rates are well over $0.50 per KwH. I live in a 1,200 sqft home, sit in the dark all day, have wood heat and my electricity bill is somehow over $400 per month.

I like your Frugo thesis and am now an investor despite what might be the worst name for a company I've seen in recent years.