Bottleneck + Catalyst

Going over the tin risk-reward in light of the Myanmar & Alphamin news

For once, I'm the beneficiary of African mining risk.

I last discussed the tin bull case and my position in April last year, but since then, we have had a number of headlines, from Myanmar resuming production to Alphamin temporarily ceasing production. Combine this with questions over how a downturn in AI/semiconductors could hurt demand; there is a lot to dig into.

If you're new to tin, definitely read this first, as I'm going to assume you understand the basics of the thesis from this piece: Revisiting Tin

Let's look at how the tin market risk-reward stacks up today.

2024 saw global refined tin production of 371,200 t, representing a supply decline of 2.7% from 2023.

Not that this mattered, as the decline in tin demand (-3.9%) more than offset the decline in supply of -2.7%.

Refined tin usage contracted by 3.9% year-on-year to 357,100 metric tons in 2023, according to a survey of 80 companies accounting for some 42% of global demand.

This was a much weaker outcome than anticipated this time last year, when surveyed companies expected a relatively mild 1.6% year-on-year dip.

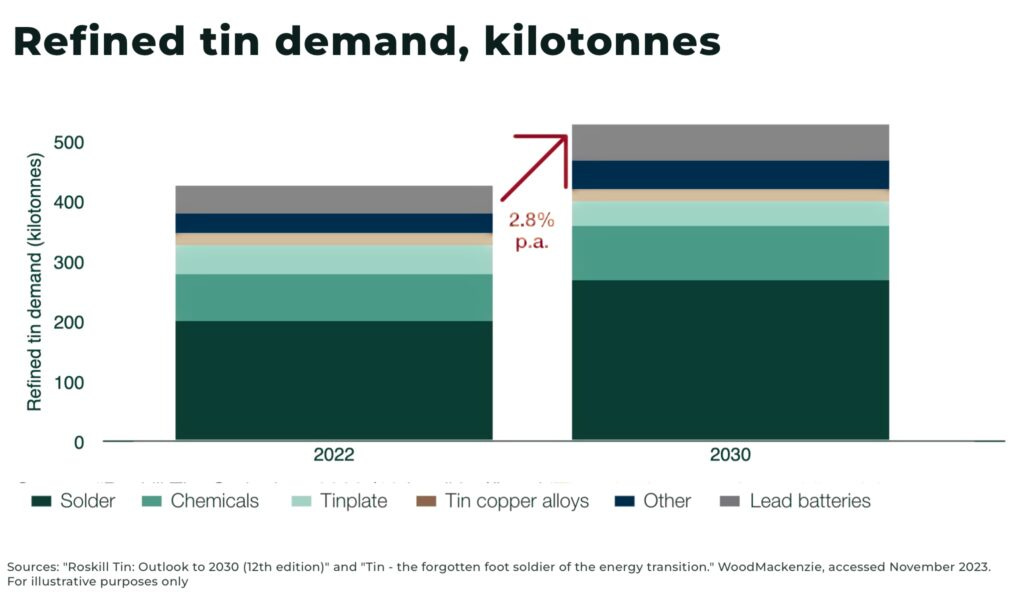

Putting a 3.9% contraction in demand in context, most forecasts have refined tin growing to 500 kt by 2030, or around ~2-3% growth per year. You can see the cyclicality in the chart below; demand looks set for a rebound (bar a nasty global recession).

This contraction caused tin stocks to build to record levels in the SHFE (Shanghai Futures Exchange) and the LME (London Metals Exchange) to a lesser extent.

These are now being worked through, with China's imports of tin down 30% YOY.

As Massif Capital illustrates with this chart, low stock levels are needed before the price can gain traction, and based on Chinese imports, we will continue to see stock drawdowns.

Tin Supply

So, with demand starting to rebound and supply remaining restricted globally, things looked mildly positive earlier this year.

That was until news of Myanmar production ramping back up started circulating (it was 15% of global supply at one point).

I don't see this as a big issue, as production has been in steady decline for years now due to extensive high grading.

Company and government officials said several large open pits had been depleted and most of the remaining mining was underground, pushing up costs for miners.

The quality of the ore now mined had also declined sharply, they said, with most deposits containing around 2-3 percent tin by weight, compared with an unusually high-grade of more than 10 percent two years ago.

-Production slowing fast at Myanmar mine that rattled tin market (Oct, 2016)

The downward trend has been in place for years now, as you can track via their imports to China.

Could they get back to early 2024 levels?

Sure, but the new licensing process will take time (estimates range between Q2 and Q3 2025).

Wa State announces new licensing process Feb 27, 2025

While this step represents progress towards a restart to mining at Man Maw, a resumption to production will not be immediate. A delay of a few months could be expected as workers—mainly from China—will need to re-apply for work permits and move back to Wa, and only then can mines and processing plants ramp back up to usual volumes. Additionally, due to the long shutdown at Man Maw, dewatering will likely be required before mining can resume on a significant scale.

The impact on China of Man Maw ceasing production has been significant.

Imports: According to customs data, China's tin ore imports in November were 12,000 mt (equivalent to approximately 5,021 mt metal content), down 19.18% MoM and 56.46% YoY. The cumulative imports from January to November were 150,000 mt, down 29.68% YoY

Interestingly, the primary beneficiary of Myanmar's decline in tin concentrate exports to China has been the DRC, which made a record 50% of Chinese tin imports in September 2024.

You can probably guess where I’m going with this…

The news that Alphamin is temporarily halting its mining operation in the DRC could potentially damage annual tin production by 6% as demand rebounds.

Sudden Supply Shock: DRC Bisie tin Mine Halts Production: The Bisie mine, owned by Alphamin Resources, with an annual output of 17,000 mt, has suspended operations due to security concerns, accounting for approximately 6% of global supply and intensifying expectations of a global tin ore shortage.

*Bisie has planned production of around 20,000 mt in 2025.

Now I’ve got zero insight into how long this can drag on and no one does really…

I do know Alphamin was where the majority of future global tin supply was supposed to come from unless the assumption for the 2030 double in existing African mines is based on small/artisanal mining ramping, which I highly doubt.