Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

Kopernik Global Investors: Mining (Oct 2024) and (their 2020 mining piece).

The magnitude of undervaluation of resource stocks tends to increase meaningfully with exposure to tough geographies, unpopular commodities, and especially with the duration of the expected production profile. As should be the case with all investments, the most important question to ask is: At what price do they become good investments? Fundamentals and history suggest that many mining stocks currently provide extraordinary investment opportunities. Inflation protection is an added bonus.

Podcast/Video

MacroVoices #448 Luke Gromen: Why the Gold Recycling Trade is Accelerating

The attached report was worth a read: FFTT “Tree Rings”: The 10 Most Interesting Things We’ve Read Recently

Quote

“Sentiment is just a 3month trailing average of the price action”

-Gerald Minack

Tweet

Lukes above report lead me to this great tweet by Vincent.

Charts

A breakdown of chemicals produced from fossil fuels in China.

Coal fuels the fertiliser complex, as well as a decent chunk of plastics.

The Chinese are really scaling up their coal to oil capacity as this article explains:

China’s Top Miner to Spend $24 Billion on Coal-to-Oil Project

Hami alone has indicated it will approve 300 billion yuan’s ($42 billion USD) worth of such projects in its five-year plan through 2025, which could consume 152 million tons of coal by the end of the decade.

China’s coal-to-oil capacity rose 24% to 11 million tons in 2023 compared to 2019.

I had to laugh at this section of the article: “As is expected of all such projects, the facility will be powered by renewable energy.”

Something I'm Pondering

I'm pondering how EVs' economics are hitting the wall before we get the next wave of inflation (I spilled some digital ink on it here).

An ICE vehicle only uses half the critical minerals of a PHEV, which in turn only uses a third of the critical minerals of a BEV.

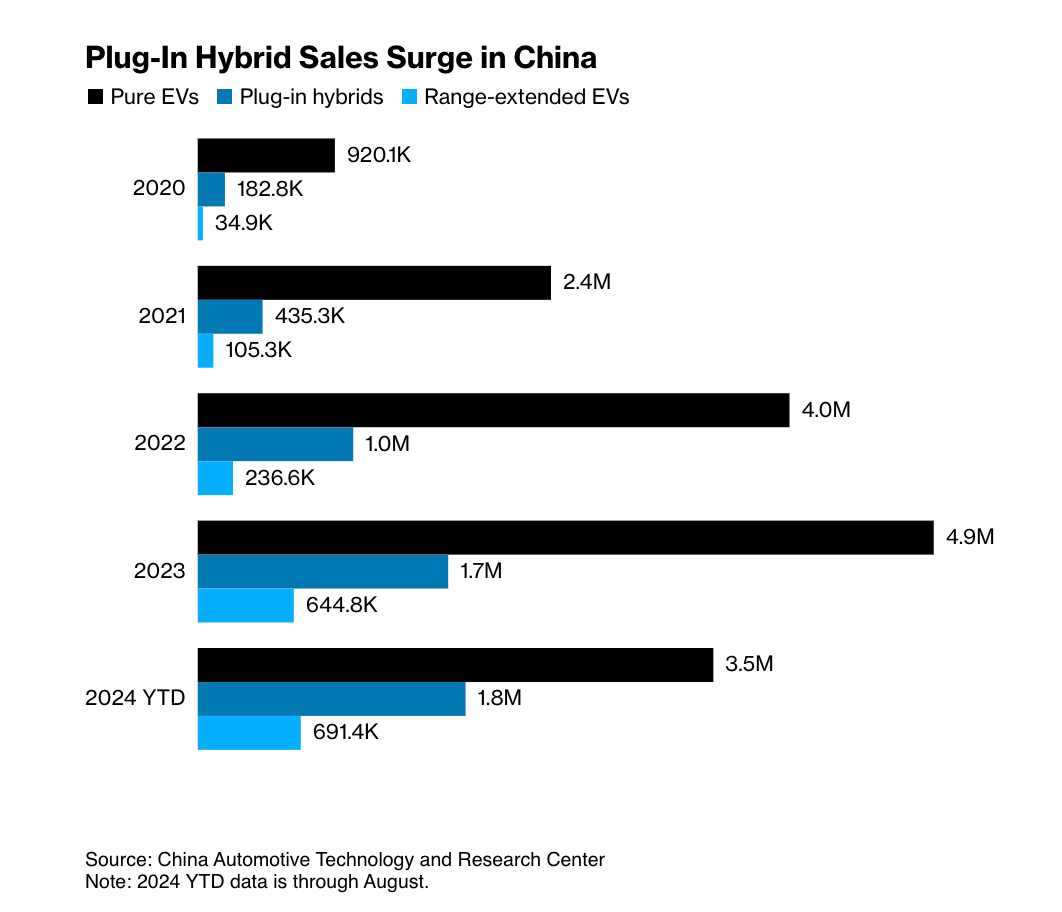

China EV makers are pivoting heavily to hybrids, where the demand and best margins are.

Just look at the ratios of EVs to PHEVs in the last three years.

2022: 25% PHEV/BEV

2023: 35% PHEV/BEV

2024: 51% PHEV/BEV

*The ratios are even higher if we add range-extended EVs to the PHEV category.

I see this trend continuing to accelerate from here.

For some trivia on EVs:

The electric vehicle is nothing new. It will come as a surprise to many readers, but the electric car was invented almost 200 years ago, in 1832. In fact, the first electric vehicle was built 50 years before the first internal combustion engine vehicle (ICEV).

During the 1890s, EVs outnumbered other vehicles 10-to-1, and by 1912 there were 38,842 electric vehicles on the road.

In an era when America’s road system was poor and undeveloped, electric vehicles thrived as the vast majority of driving trips were short-distance, making an EV’s “range” a non-issue. However, some of the early EVs had a mileage range of 180 miles off a single charge!

There was even a star of the EV boom in Electric Vehicle Co.

This will be the 5th attempt at EV adoption.

I hope you’re all having a great week.

Cheers,

Ferg

P.S. I now have a directory for all my articles (free and paid) and a full overview of my portfolio position by position here.

Or if you’re interested in my story and why I started this Substack, you can read the story here.

@LukeGromen is by far one of the best and most independent thinkers out there.