I figured it was about time to revisit the coal thesis and my coal positioning, given that sentiment seems to have turned decidedly negative lately.

"Sentiment is just a three-month trailing average of the price action."

-Gerald Minack

Seeing the latest Bull Economist cover reminded me of their cover on coal, which dropped on December 5th, 2020.

"Coal Making History" would have been a more appropriate title, given Newcastle prices went up six times 18 months later.

It's always important to acknowledge when we get lucky on a thesis; if you read the piece I wrote in early 2021 on coals moat, you will know that I expected a long, slow grind higher, not the prices we saw after the Russian Invasion of Ukraine.

“Thinking in bets starts with recognising that there are exactly two things that determine how our lives turn out: the quality of our decisions and luck. Learning to recognise the difference between the two is what thinking in bets is all about.”

-Annie Duke

So, having acknowledged the role luck played in the outcome of the coal thesis to date, the question is where do things now stand, and how attractive is the trade here?

To answer this I’ll break it down between short, medium and long term time frames.

Short term (6-12months)

Investing in short time frames usually goes in my too-hard basket. The vast majority of all my performance has occurred three years after I've taken positions hence my idea that asymmetry is "backloaded".

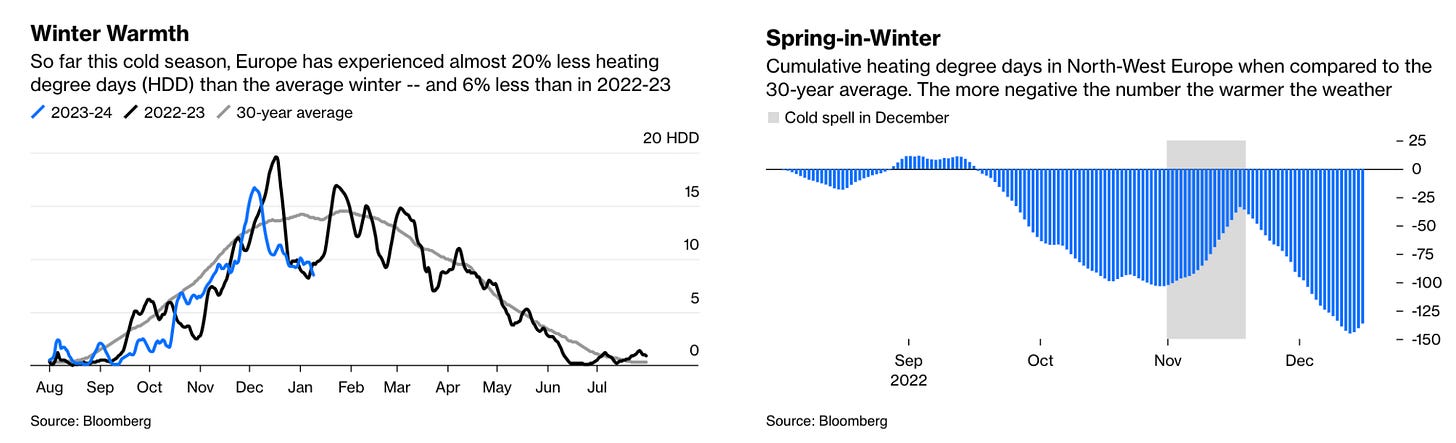

With thermal coal, the last two winters, I saw set-ups where if temperatures came in at or below recent averages, Europe would work through its storage quickly, TTF would take off, and seaborne coal would take with it. Alexander Stahel walked me through this prior to the 2023-24 winter.

Going into the 23-24 winter, I thought long thermal coal names were a free option on a cold winter with limited downside. This was essentially a mean reversion trade. The 2022-23 winter was the warmest in recent history, so chances are it would revert to the average.

This didn't play out, with 2023-24 being similar to 2022-23 winter temperatures.

Europe Is Winning the Winter War by Sheer Luck By Javier Blas

Unlucky? Maybe, but if you blame luck for bad outcomes, then the game of investing isn't going to be kind to you.

Ultimately I own thermal coal for the long-term demand-supply imbalance, and the fact these companies are so cheap makes it hard to screw things up too badly.