The Last of the Bottom Crawlers

Some tiny oil service companies I'm buying and some lessons from investing in them.

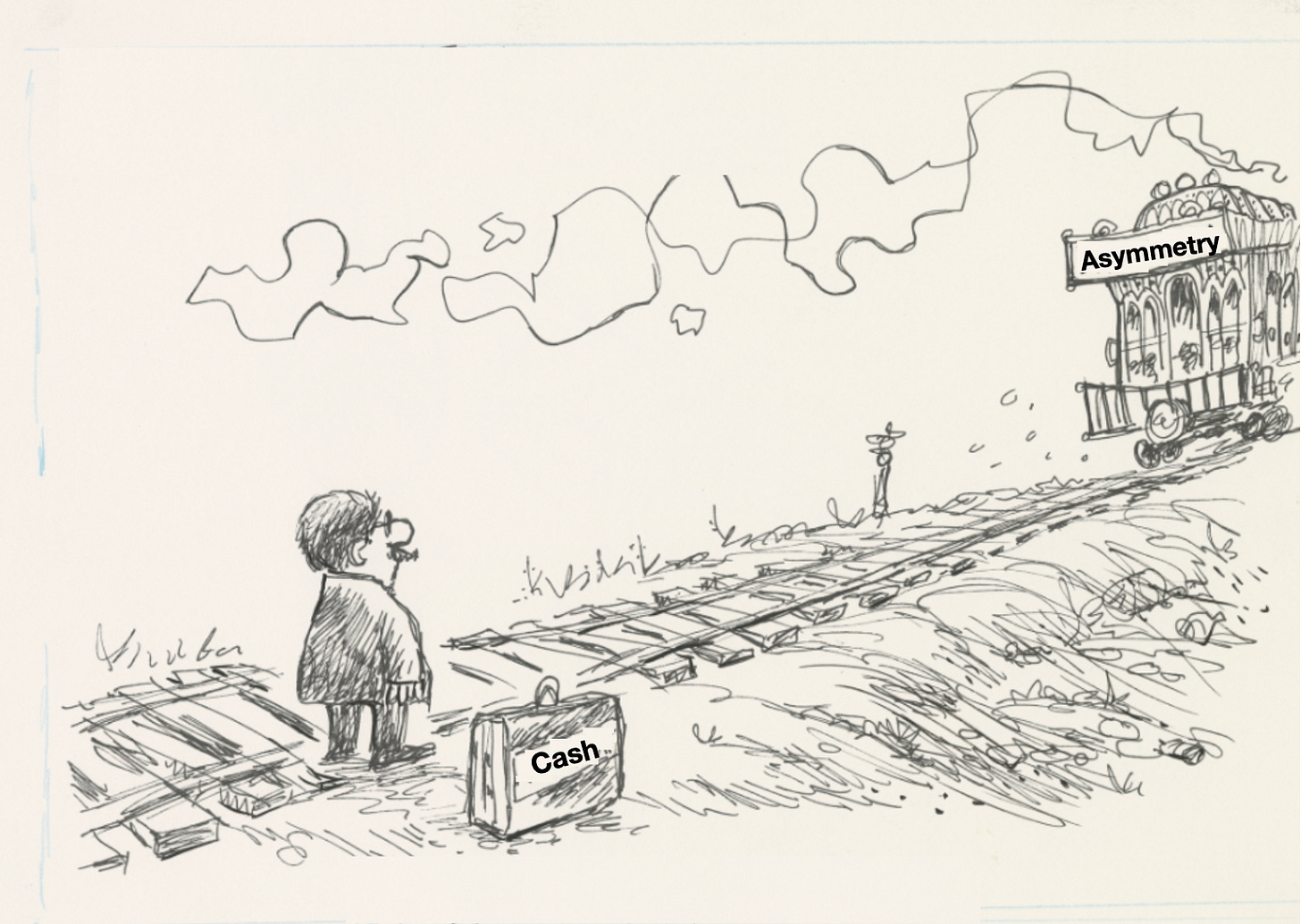

One of the big lessons I learned from Brad years ago was the power of asymmetry, skewed risk-reward, convexity, or whatever you want to call it.

Brad was unfazed by the occasional company implosion as the position sizing protected against these negative surprises. I only saw him get worked up when he had missed something breaking out in a sector he was bullish on.

The math on this is pretty simple: You can have a number of implosions so long as you don’t miss getting on those breakouts that really run nice and early.

Hong Kong and Singapore are the last places I see the below type setups.

Part of the benefit of putting everything out there is that I can revisit my thinking and calls. Take this video from March 2021, for example, as it holds some valuable lessons. In it, I’m pitching Matt on offshore oil services that were all bottom crawling at the time.

I want to revisit this video because half my positions were f#@k-ups lessons.

The four names I discussed were:

Saipem S.P.A (SPM.ml): Re-capped a 100% loss after the company had a massive blowout in offshore wind costs.

CGG now renamed Viridien Société Anonyme (VIRI): €1.25 to €0.539 today. This has turned out to be a value trap, as what took me a while to realise was I had no way to value their data assets, so I was completely out of my circle of competence and beat a hasty retreat with a 10% loss in the end.

MMA Offshore Ltd (MRM.ax): 0.34c to $2.65 today. This worked out, and I’m still pissed it's being taken over.

Tidewater Inc (TDW): $14 to $105 today. This also worked. As a side note, I remember there being a collective feeling that they’d already “missed the trade” with it already being a multi-bagger from the COVID low…

Now, those of you following me at the time know this wasn’t the end of the with a wipeout on Saipem as I licked my wounds and then stubbed up another 1% position 2strike Dec25 options, which cost me 0.11c per option contract and are now sitting at 0.54c with a year and a half to expiry.

Asymmetry in Play

So say I even weighted these names and allocated $1 per position.

$1 in Saipem lost 100%, so exited for $0

$1 in CGG/VIRI exited for $0.90

$1 in MMA Offshore exited for $7.80

$1 in Tidewater currently $7.50

$4 to $16.20

$0.50 back into Saipem options, currently valued at $2.45

$4.50 to $18.65 was the end result.

This is why the magnitude of winners matters so much more than the win/loss rate. On the surface, I picked four companies. One imploded, another got cut in half, and the other two worked.

It doesn’t sound very impressive, does it?

Sure, I like to think I’ve improved at spotting issues, but then again, who am I kidding about the recent example in Boss Energy and Dolphin Drilling (which I’ll get to).

You can only manage risk up until a point, after which it all comes down to position sizing to protect against unforeseeable risks. Also, understand that these opportunities exist because of a lack of information/certainty; otherwise, they won’t be priced the way they are.

Risk is often mixed up with volatility as risk managers need some metric to put into their models. As I’ve quoted Bill Miller often, “Volatility is the price you pay for outperformance.”

It was no different for my little guy when he was learning to walk. There was no preventing the falls/volatility; we just had to accept it (with a bit of padding).

A few recent news items

This news came as no surprise. It was only a matter of time before one of the larger drillers brought out Diamond Offshore, as its overhead to fleet size made little sense. Overall, this was a decent little trade, with 3% allocated at its relisting in April 2022 (I went over the relisting here and here).

A 130% return is nothing to write home about, other than this presented a great risk-return at the time.