Repositioning in Uranium

Reassessing the best risk rewards following a beating in the markets.

Uranium has been frustrating, as have almost all areas of my portfolio, where I see a widening disconnect between fundamental developments and what the equities reflect. I've used this quote from Bill Miller before, but I feel it's more relevant than ever (he actually said this back in 2017).

"It is easier now to construct portfolios you have confidence will do well over the next 5 years, but more challenging to do the same for a 6-month horizon. In other words, volatility is the price you pay for returns in this market."

Uranium is where this disconnect feels the most acute, with offshore close behind (that piece is up next). I didn't have a number of my main holdings getting cut in half, and hearing a guy brag in the local sauna about how much he made in Dogecoin on my 2024 bingo card.

I had figured this joke coin had faded into nothing by now. Yet when I pulled it up, it's now trading with a market cap of $54.7B, or nearly $2 billion more than the entire market cap of tradable uranium equities (>$100m USD).

Hell even Cathie Woods ARK Innovation ETF is breaking out.

We are back to inflations dead and the place to be is AI, tech, Tesla and crypto.

All this is a way of saying no one cares about uranium despite all the bullish news.

When I wrote this piece, "What I'm Seeing With Uranium in Jan 2024," I thought Kazatomprom's issues were the spark the sector needed for a substantial leg up. Western utilities would see the writing on the wall and start contracting above the replacement rate (~180mlbs p.a), which would drive spot and term higher.

Yet here we are, spitting distance from 2025, and we haven't had a single year of contracting at the replacement rate. In the 2023 term contacting reached 163mlbs, of which the majority were Chinese utilities and Energoatom (Ukrainian utility).

Long-term contracting for this year is currently 90Mlbs, and we are nearly in December.

Western utilities have yet to join the party in size which was central to my whole exit strategies (here and here) where I'd start trimming the positions once we got above replacement rate and uranium incentive price $120lb (why the jump from $90lb in the first piece? Just type $90 into a inflation calculator from 2020-2024).

What went wrong?

Well, it turned out there were a lot more pounds floating around than everyone thought, which delayed the reckoning of Western utilities contracting in size.

This brings me to today when the current pause between utilities and miners is being described as a Mexican standoff.

I view it more like the scene from Dr No, where Bond knows the professor is out of bullets.

Historically, this looks like utilities contracting 130-40% of annual demand, which is where this gets interesting. Last time around (2005-2007), there was a surplus in the market, so utilities could lock in all the uranium they required.

The big appeal of the uranium thesis for me was the fact that utilities have to contract; there is no switching or substituting. With the rest of the commodities, future demand is a guess, which can go very wrong, e.g., battery demand for lithium, nickel, and cobalt.

The thesis really is as simple as 440 operational reactors and another 65 reactors under construction fighting to secure their requirements when 25% of what they require doesn’t exist in the mines aren’t even in the planning/permitting stage.

2030 is tomorrow for a utility that needs the U308 to move through the fuel cycle, a process which takes 18-24 months when things run smoothly (which they are most certainly not with Russia annouced ban).

I could dig into the China reactor buildout and AI boosting demand which are just icing on the cake for the whole thesis as there wasn't enough supply for the demand base case let alone the high demand case.

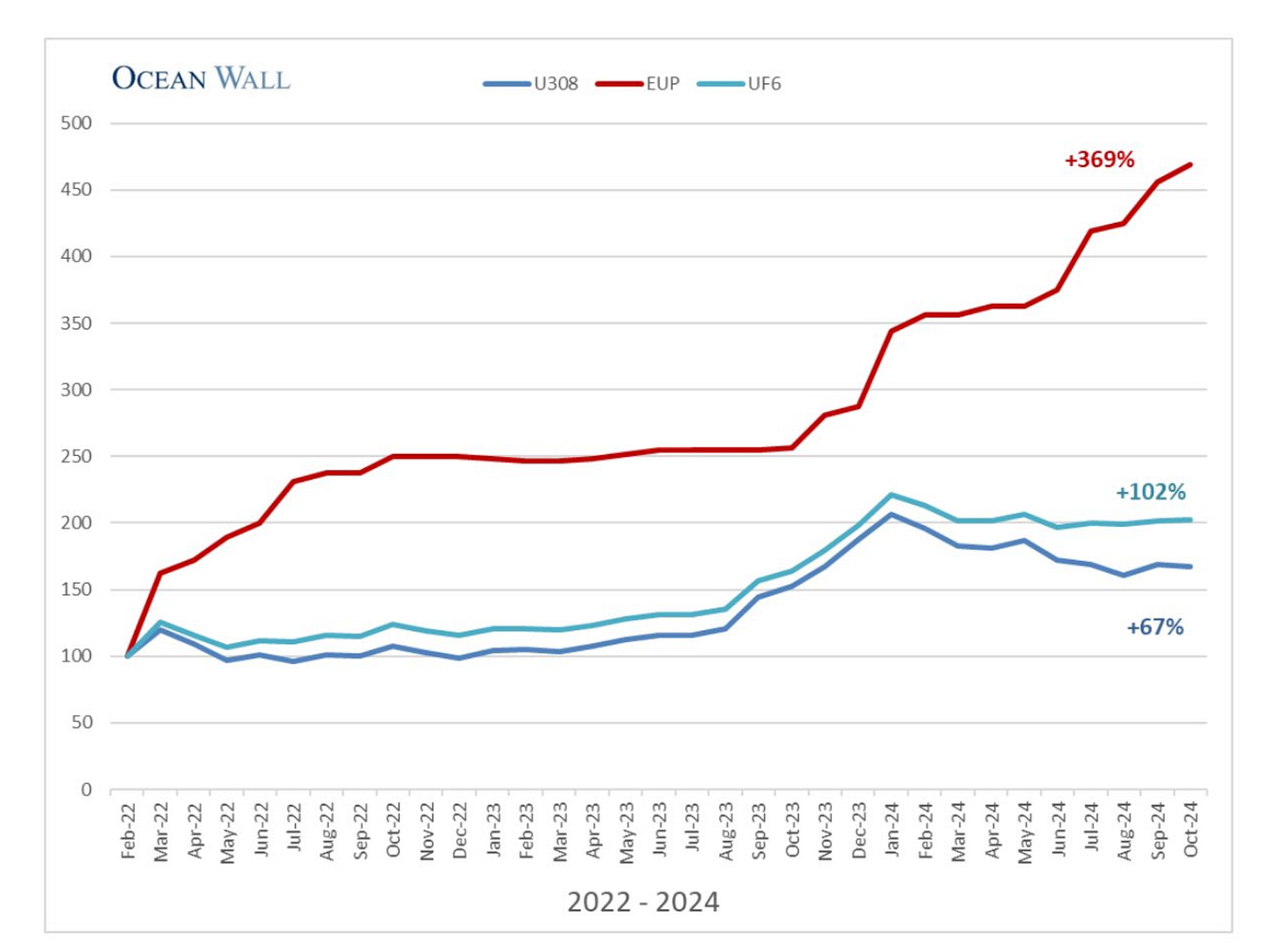

Yes, you probably groan at the below charts. If you've been on this trade a few years, they get pulled out on a bi-annual basis to support the uranium thesis (they just took a few years longer to matter than most thought (myself included).

In addition to the above supply uncertainty is the fact the West is rapidly losing its share of 43% of global primary supply in Kazatomprom: Kazatomprom strikes large uranium sale deal with Chinese buyers.

One look at Kazatomprom’s production profile makes this clear.

Finally, commercial inventories are being worked through. We now have: Uranium prices jump after Russia restricts exports to US

I have to much PTSD from anticipating inflections in uranium to share Nick Lawson and Ben Finegolds view that this is a Cigar lake flooding moment. I thought this breakdown by Mineral Stocks Investor explained it well in that yes EUP will still get into Western hands via the Chinese (risky with Trump) so Western conversion capacity will expand which requires upfront feed.

We will see over the next few months, as it looks to me like western utilities have no more levers to pull and will now be forced to start contracting in size, which will be reflected in the term and spot market kicking off the uranium flywheel again (SPUT getting back to a premium in a tight market will be fun).

Playing it

This is the hard part, and I get more respect for the "just buy physical" argument every day or even a basket approach of URNM or URNJ.

Cost overruns, coups, delays, and revoked mining permits are the norm when you get involved with this group of miners. Kudos to @mineralstocks, @Siev140277, and @mountaingoat672 for creating this uranium spreadsheet.

When you track the near term producers it becomes pretty clear how hard mining is:

EnCore Energy’s Q3 2024 Revenue Can’t Offset Rising Expansion Costs, Posts Steep Losses

Peninsula Energy shares plunge on lower uranium production forecast

Niger / Canada’s Global Atomic Anticipates Dasa Uranium Project Loan In Early 2025

It’s not like the majors are doing any better

I spilled a lot of digital ink on Kazatomprom here, and it's now pretty clear that, at this point, they aren't going to be the saviour of the uranium supply situation.

Their all-in sustaining cash cost is now up 100% in 4 years, while 2025 production is 13 lbs below 2025 guidance. Their inventories have also fallen to 4 months of production, which is a 10-year low.

It’s not hard to see that capital costs for all uranium projects are going to continue to blow out:

NexGen Energy has revised the cost estimates for its Rook I uranium project in Saskatchewan, with expenses now 70% higher than projected in 2021. The updated capital cost is $2.2 billion, up from $1.3 billion. Operating costs are projected to nearly double to $13.86 per pound of uranium oxide (U3O8), compared to $7.58 in the previous estimate.

Or lose the project altogether:

If anyone still owns this I’d advise reading their latest report and checking page 8

Like it or not this group of miners have to close the below gap.

“By 2030, which is tomorrow in uranium years, 23% of required pounds have not been built, permitted, financed. The mines don't exist."

-Mike Alkin

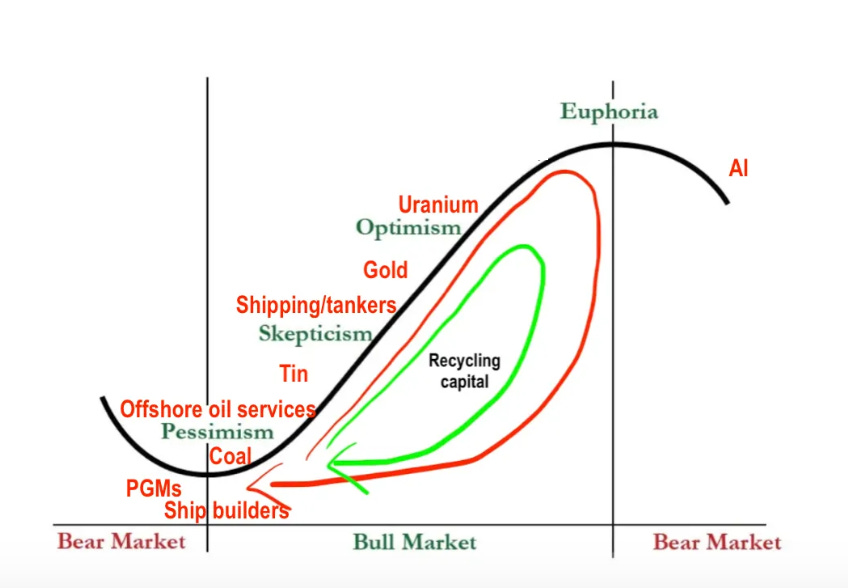

The question for me is how to play moving forward, as the easy money has been made in this sector ($20lb to $80lb). While there is plenty of money to be made to rectify the above gap, the risk-reward of offshore services keeps rising, and I am questioning my allocations (I want the majority of my capital hanging out at the bottom of this chart).