Pulling the Trigger on Gold & PGMs

I can finally claim to have some gold exposure in the portfolio

Give it a few years; there will be pieces similar to this on 2022.

It’s going to be one of those times in history when expecting historical correlations to hold up will get you killed.

Or to explain it another way.

The below correlations were largely based on a investor being indifferent between holding risk free* treasuries vs risk free gold.

Real return = hold treasuries

Negative real return = hold gold

*The issue for anyone paying attention has been the risk free assumption in that equation: US proposal to tap frozen Russian asset revenues for Ukraine gains ground, G7 officials say

Yellen said Washington remained convinced that outright seizure of the Russian assets was justifiable under international law, but said other approaches would likely be more acceptable to some of its G7 partners.

The game changed in 2022.

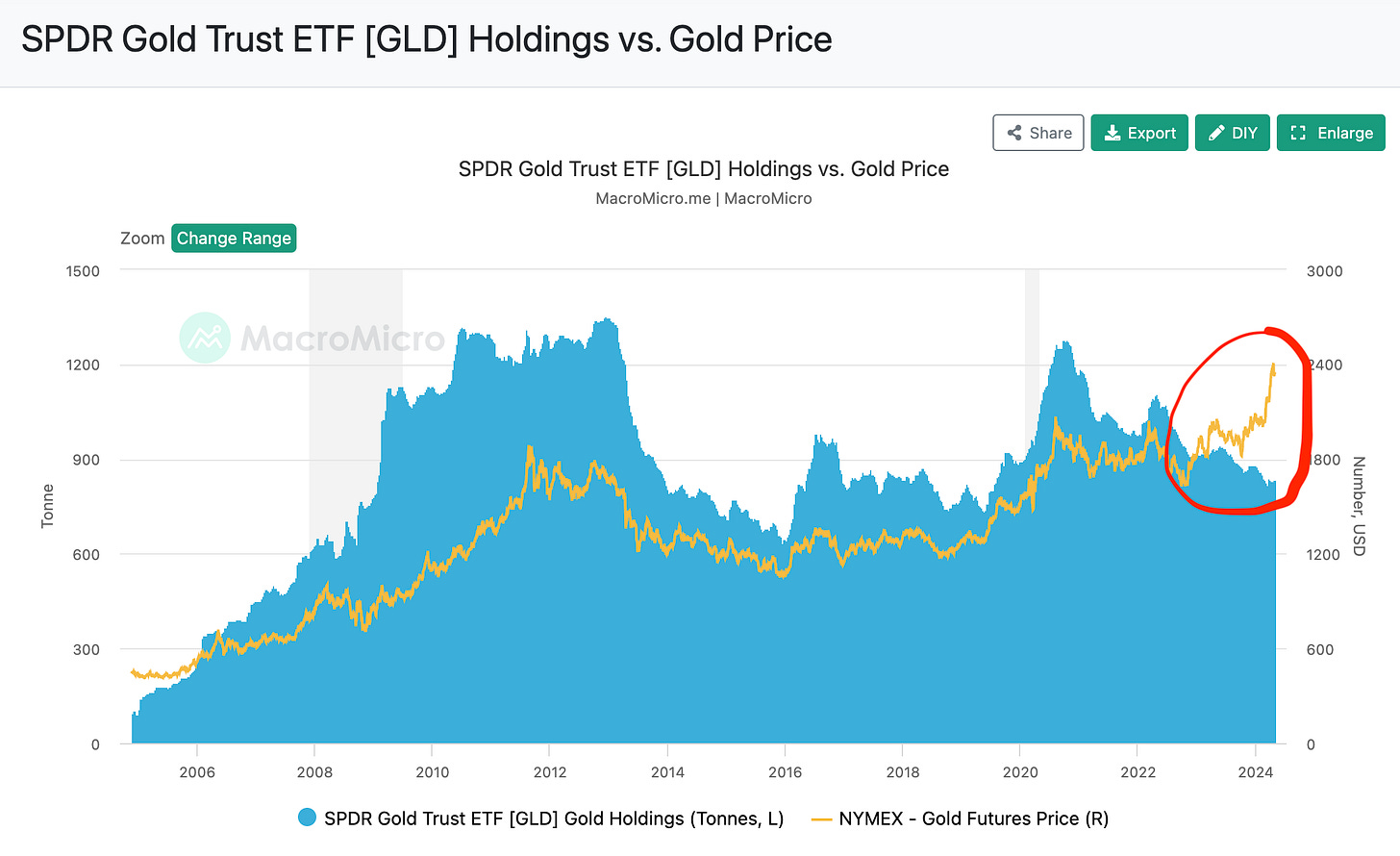

It can be illustrated with GLD ETF holdings since normally, when gold rallies, Western investors buy more GLD, and its holdings rise, and vice versa. So, gold rallying while GLD holdings drop means someone else is doing all the buying.

This is no mystery either. The consistent premium on the Shanghai Exchange is hoovering up gold from Western exchanges (the Japanese are also buying hand over fist).

It’s this overused cartoon.

The new Bricks currency is gold - Luke Gromen

Ted Oakley - Oxbow Advisors - Interview Series 2024 - Luke Gromen

Luke believes Bricks are turning gold back into an oil currency: “On an annual dollar production basis, the oil market annually in USD dollar terms is 12-15 times the size of the physical gold market.”

Gold is the only asset that fits the role since Central Banks can revalue gold significantly. Gold has no use in industry (well, a tiny amount), so its demand is primarily for ownership.

This conclusion changes a lot of why I’ve steadfastly refused to own gold for the past few years. Specifically, it's a political metal, and the expansion of the gold paper market ensured there was no real price discovery. Now, we have the opposite: price discovery is taking place slowly, and the value needs to head substantially higher.

I want some exposure in case it does something silly.

How to position?

If I see a decent probability of $10,000 per ounce of gold five years from now, how should I implement that view?

Maximum leverage can be achieved via junior miners or playing futures, which goes in my too-hard basket.

The other end of the spectrum is majors and royalty companies which will do well but don’t give me the sort of upside I’m after.

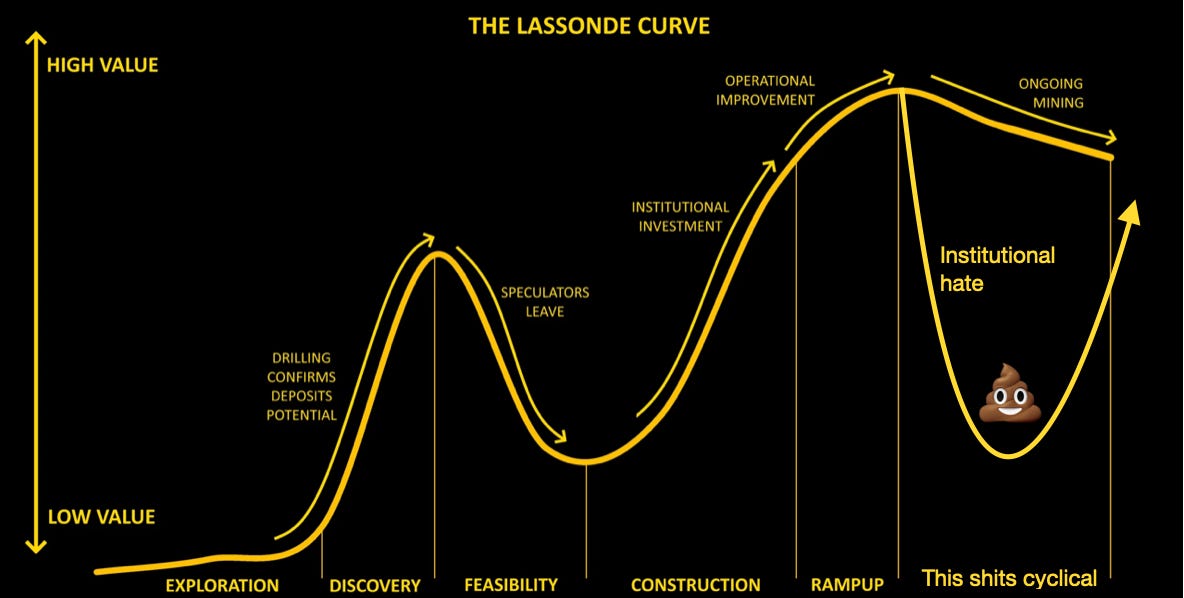

My sweet spot has always been finding a miner with history of production that happens to be viewed as road kill i.e. Paladin 2020 or Peabody 2021. Do the work to be comfortable holding said roadkill through volatility (size it right in case it does in fact turn out to be roadkill!).

You could call it falling off the right-hand side of the Lassonde Curve.