A smorgasbord of things I won’t get around to writing about otherwise.

Tin

Following this Ferg’s Finds (Tin Special) not much has changed in the tin space other than the tin price that is (H/T OG Tin Baron for the meme).

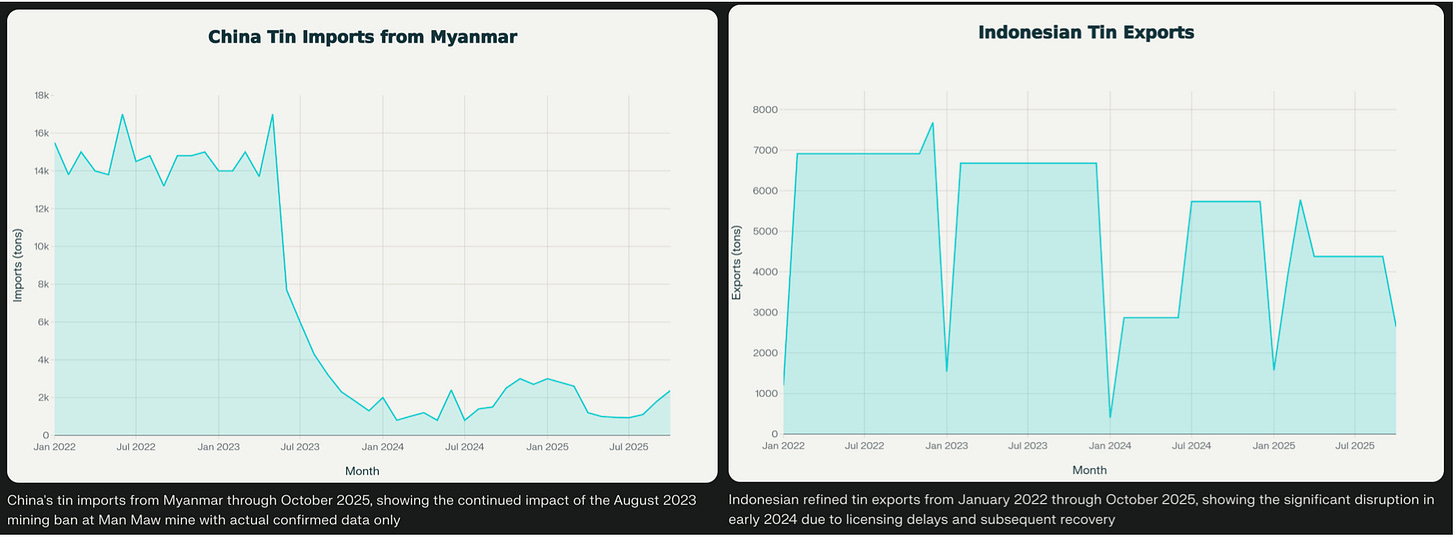

Myanmar and Indonesia continue to disappoint on the tin production. Prabowo continues to make questionable moves following the seizure of tin and nickel mines and palm oil plantations followed by the issuance of Patriot Bonds with a 2% yield (when their functional equivalent bond has a yield of 6.7% aka buy my bonds or I’ll seize your shit).

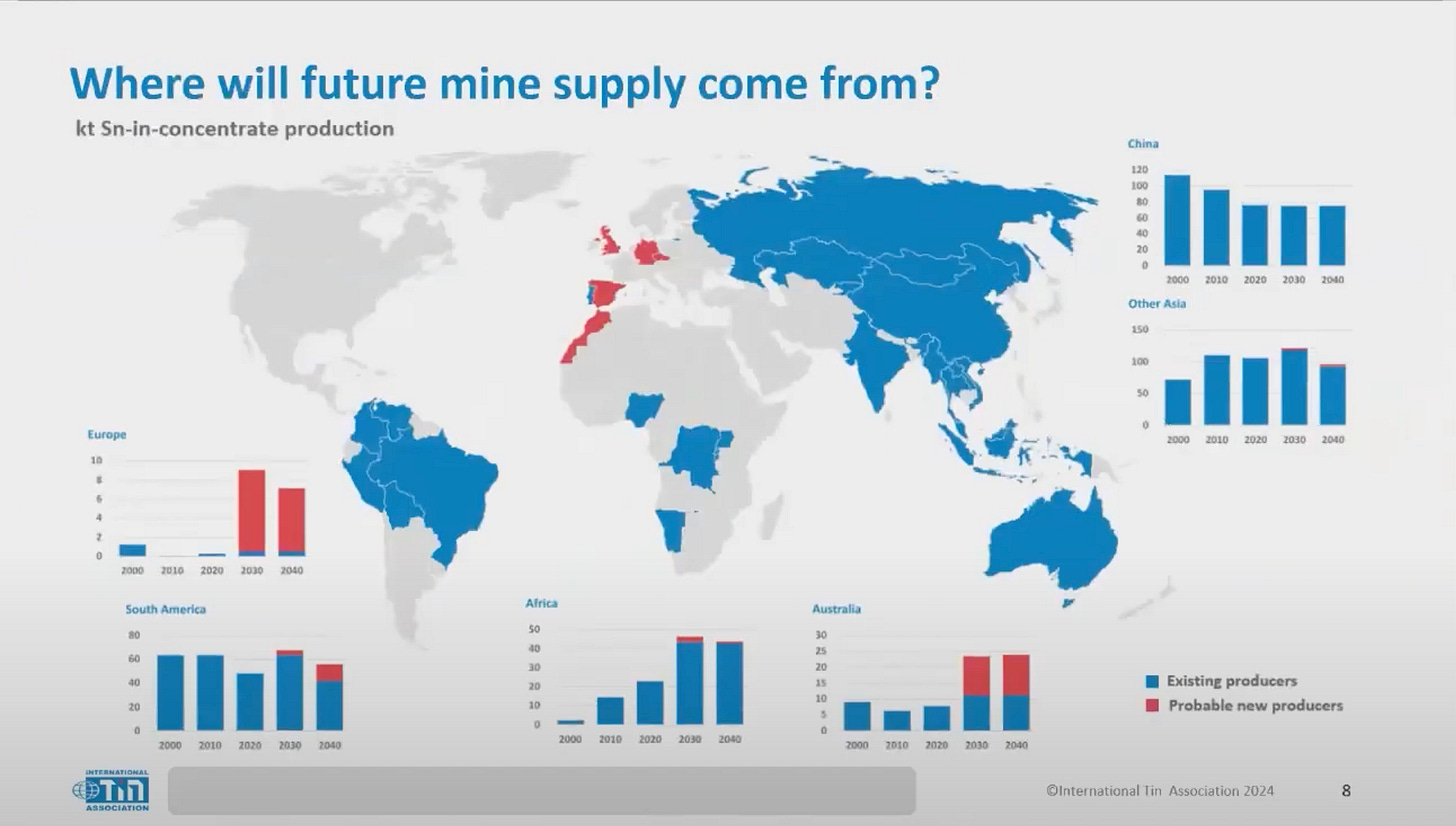

I don’t see where the supply is going to come from, except for Africa, which is already compensating for lost Myanmar production. The “probable new producers” in red below are a long way off.

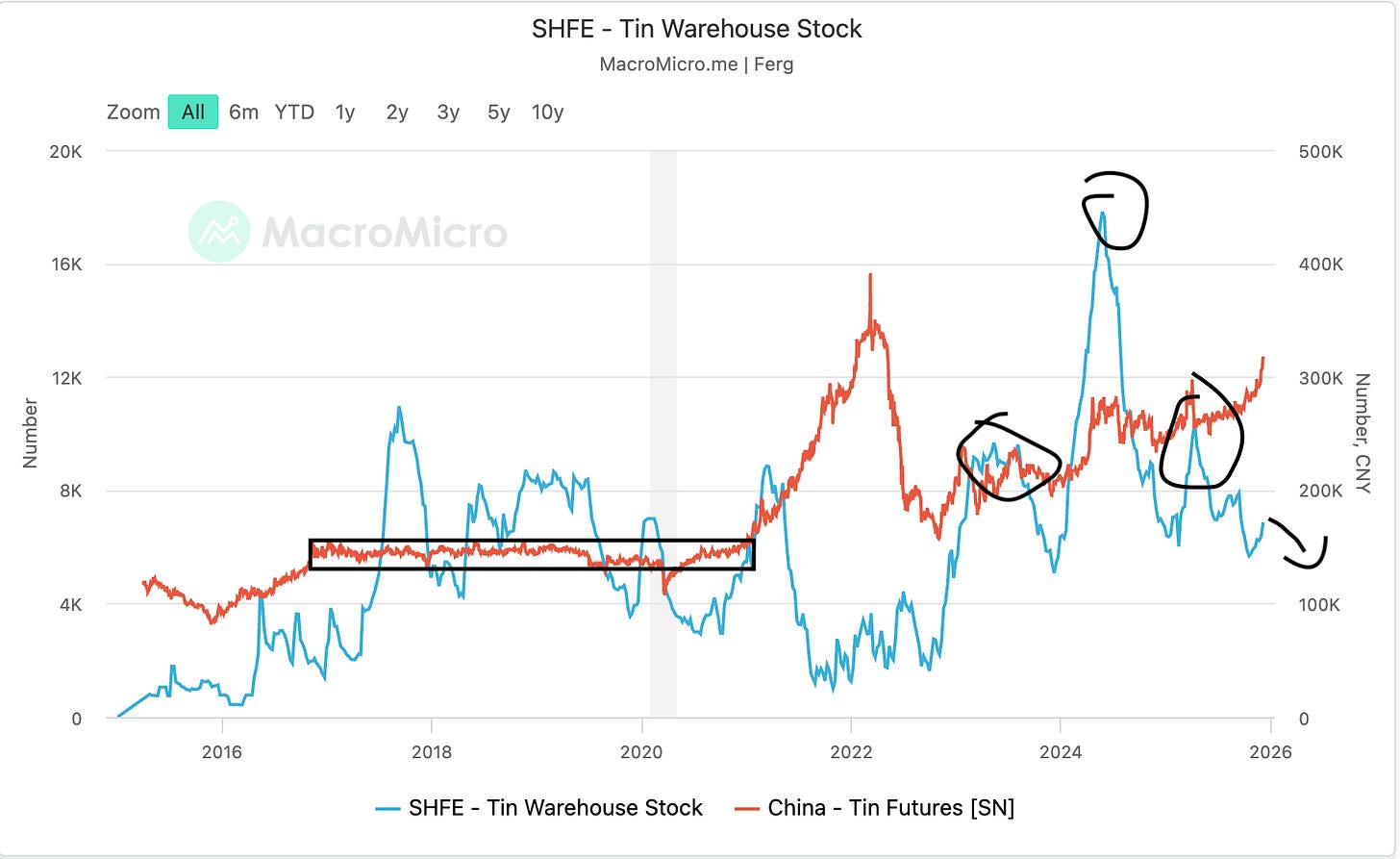

This brings me back to inventories, with Shanghai Futures Exchange tin warehouse stock continuing to draw down. I also drew a head-and-shoulders on the chart to help my confirmation bias…

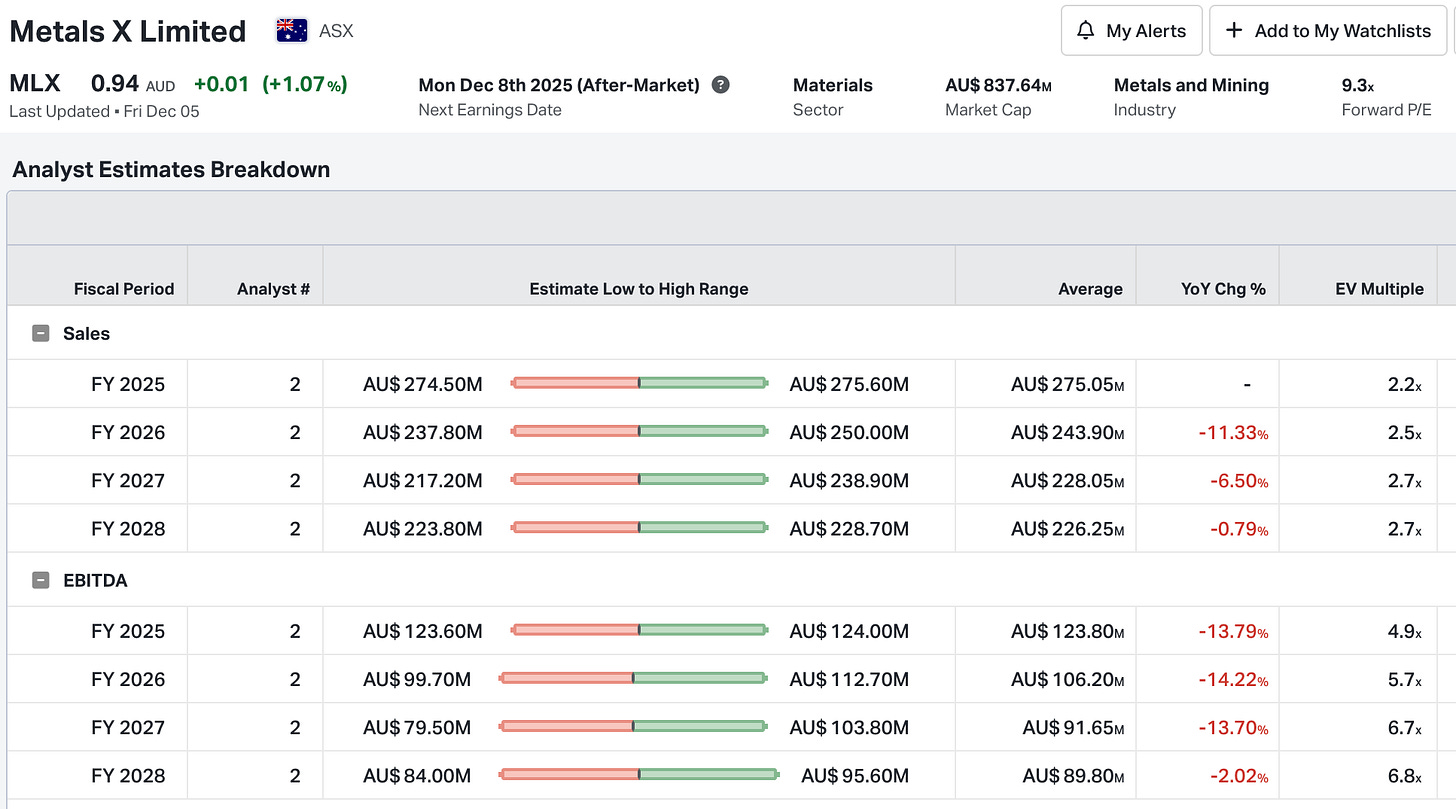

Takeaway: While I’m tempted to add a bit of Alphamin here, especially with it sitting on a 17% forward yield! I sleep better having no exposure to the DRC, and Metals X is doing just fine.

For anyone that missed it, this Money Of mine interview with Brett Smith was insightful: No Spin, Just Tin. Brett Smith on MetalsX and Every Tin Project (I see a lot of optionality in there $230m of cash between the ongoing attempt to get control of the other half of Rension, stakes in tin juniors and potentially buybacks.)

The company is silly cheap anyway you screen it with forward P/E 9x, EV/EBITDA 4.9x, 27% of market cap is cash…. The two analysts who follow the company are negative, which I’m happy to take the other side of all day long.

Platinum and Rhodium

I continue to see a repeat of the early 2000s bull market in platinum (whether or not it includes the 2001 dust up, your guess is as good as mine), which is why I’ll touch on the vol trade again.

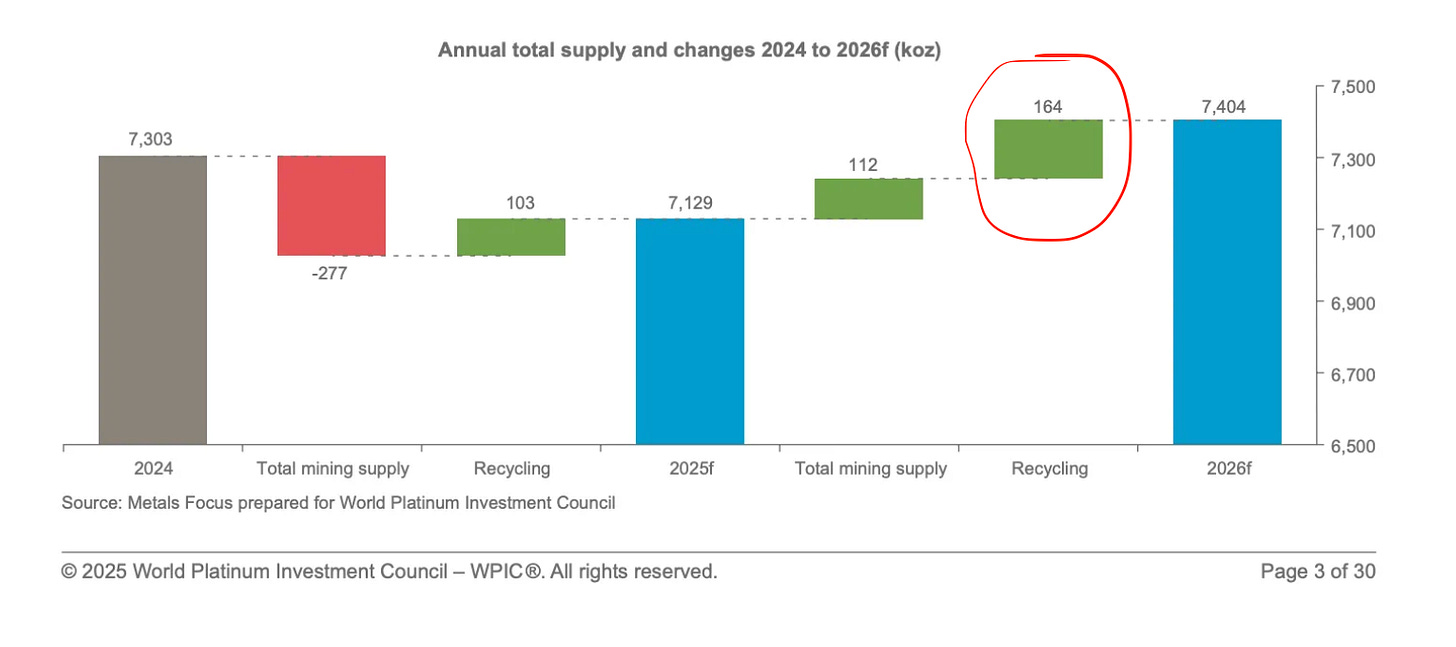

The WPIC PLATINUM QUARTERLY Q3 2025 has been released, forecasting a small 20 koz surplus for 2026f.

The 112Koz mine supply addition makes sense given Ivanhoe Mines’ Platreef ramping up, Implats processing its inventory from the 2025 maintenance period, and Sibanye increasing production 15% YOY.

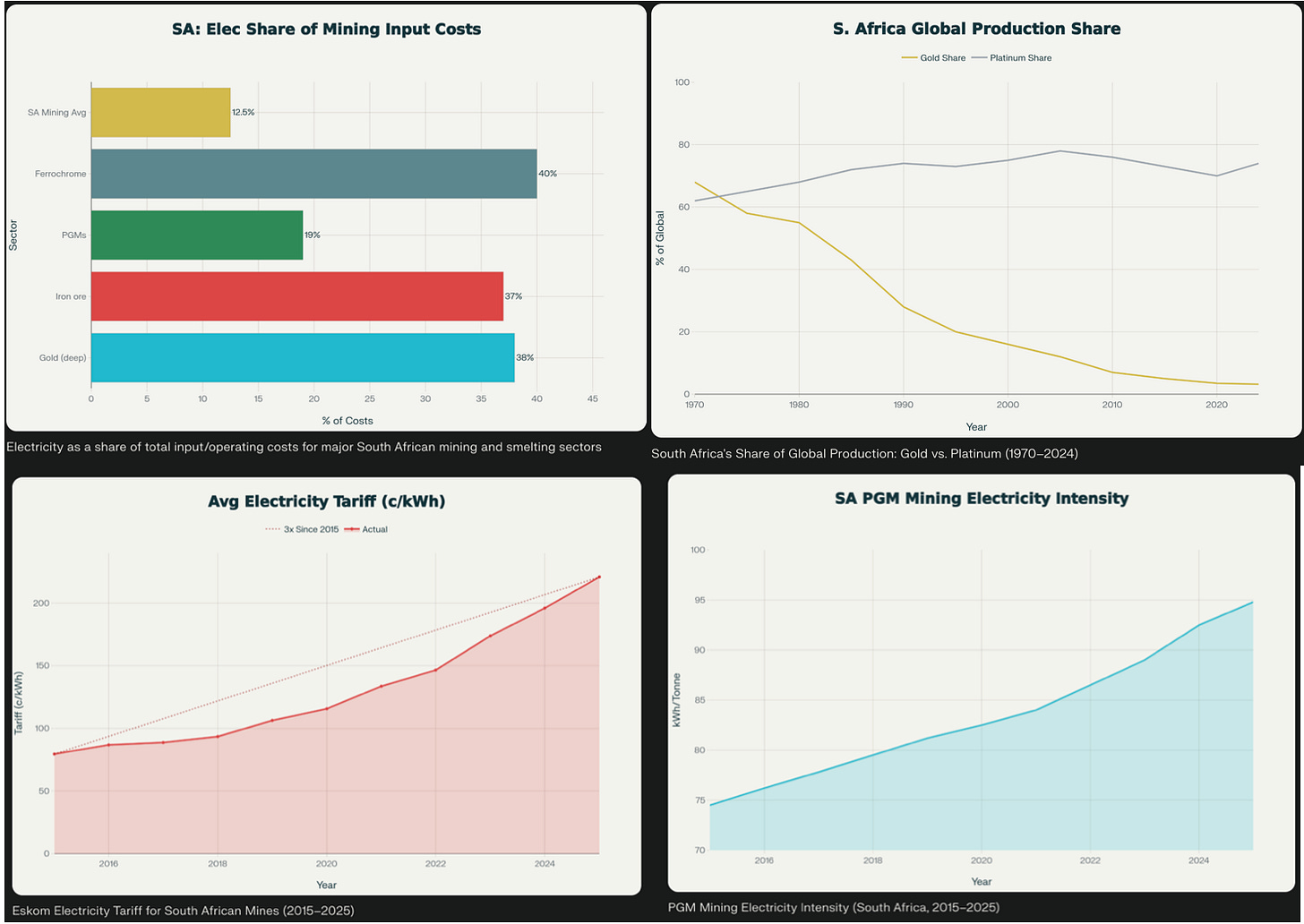

The bigger picture for me is South African PGM input costs rocketing as the mining intensity is ramping.

Over the last 10 years, input costs for PGM miners have doubled. While South African inflation averaged ~5% annually, mining input inflation averaged 10–15% annually, driven primarily by electricity tariffs and above-inflation wage settlements.

Total Unit Cost Rise: The cost to produce an ounce of PGM basket (4E or 6E) has risen from approximately R8,500–R10,000/oz in 2015 to over R19,000–R21,000/oz in 2024/2025.

While other South African commodities are harder hit by rising electricity costs, none have the same global production share as South African platinum and rhodium. It’s still very under-appreciated that 75% of global platinum resources and 90% rhodium reserves are in the Bushveld in South Africa (find me another commodity with this level of concentration).

Recycling

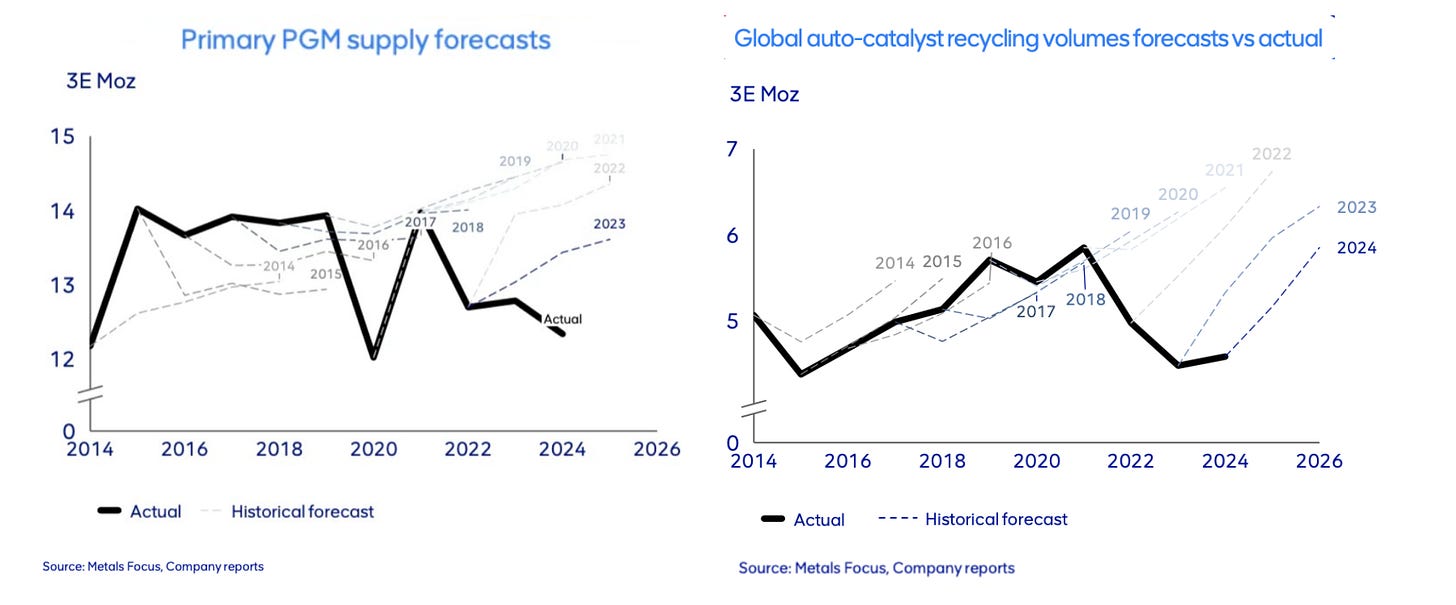

The report forecasts recycling will come to the rescue on the supply side, with there being a lot of solid logic for why autocatalyst recycling should ramp. This is a worthwhile read on the topic: Platinum Group Metals – Automotive Recycling Supply

Supply from recycling is set for growth of 10% year-on-year as higher prices incentivise processing of spent autocatalysts and more selling of jewellery scrap.

That said, I’ve been reading these forecasts since 2022, and the below chart tells the tale. Logically, recycling should have ramped up when PGM prices went vertical in 2022, yet it didn’t.

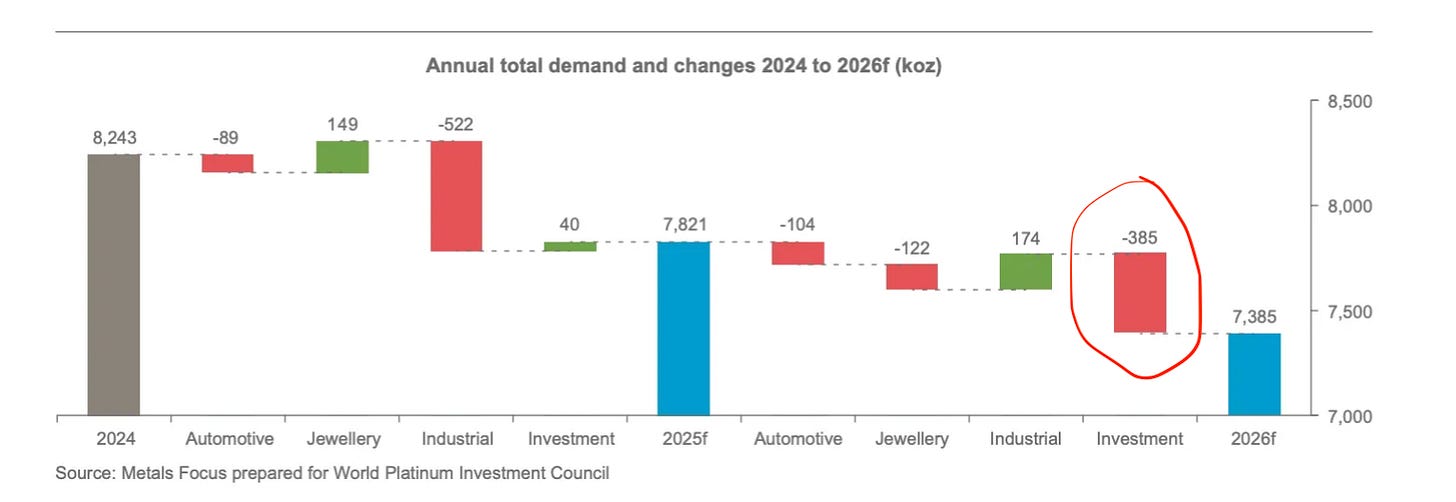

WPIC demand forecasts

The assumption that jumps out at me is investment demand halving in 2026F which was accompanied by headlines like this: Platinum to be in balance next year as investors flee ETFs.

Total platinum demand will decrease by 6% year-on-year largely due to an approximate halving of investment demand – a reduction dependent upon an easing of tariff fears, allowing an outflow from stocks held on exchange, and a higher platinum price prompting ETF profit taking.

For starters, total investment demand (742 koz) was over half Chinese buying bars and coins, not ETFs. It also doesn’t track with what I’m seeing with the launch of China’s first derivatives market for platinum and palladium futures.

Platinum Jumps With New Chinese Futures Seen Aiding Demand

The point that has me thinking platinum could chop wood for a while now is that China Platinum Co. undoubtedly maximised its monopoly position before its tax rebate was removed.

Before the launch, China imported 10.2 tons of platinum in October, more than double the volume a year earlier. In addition to the new contract, flows were also lifted ahead of the Nov. 1 removal of a long-standing tax rebate enjoyed by China Platinum Co., a state-owned trading house.

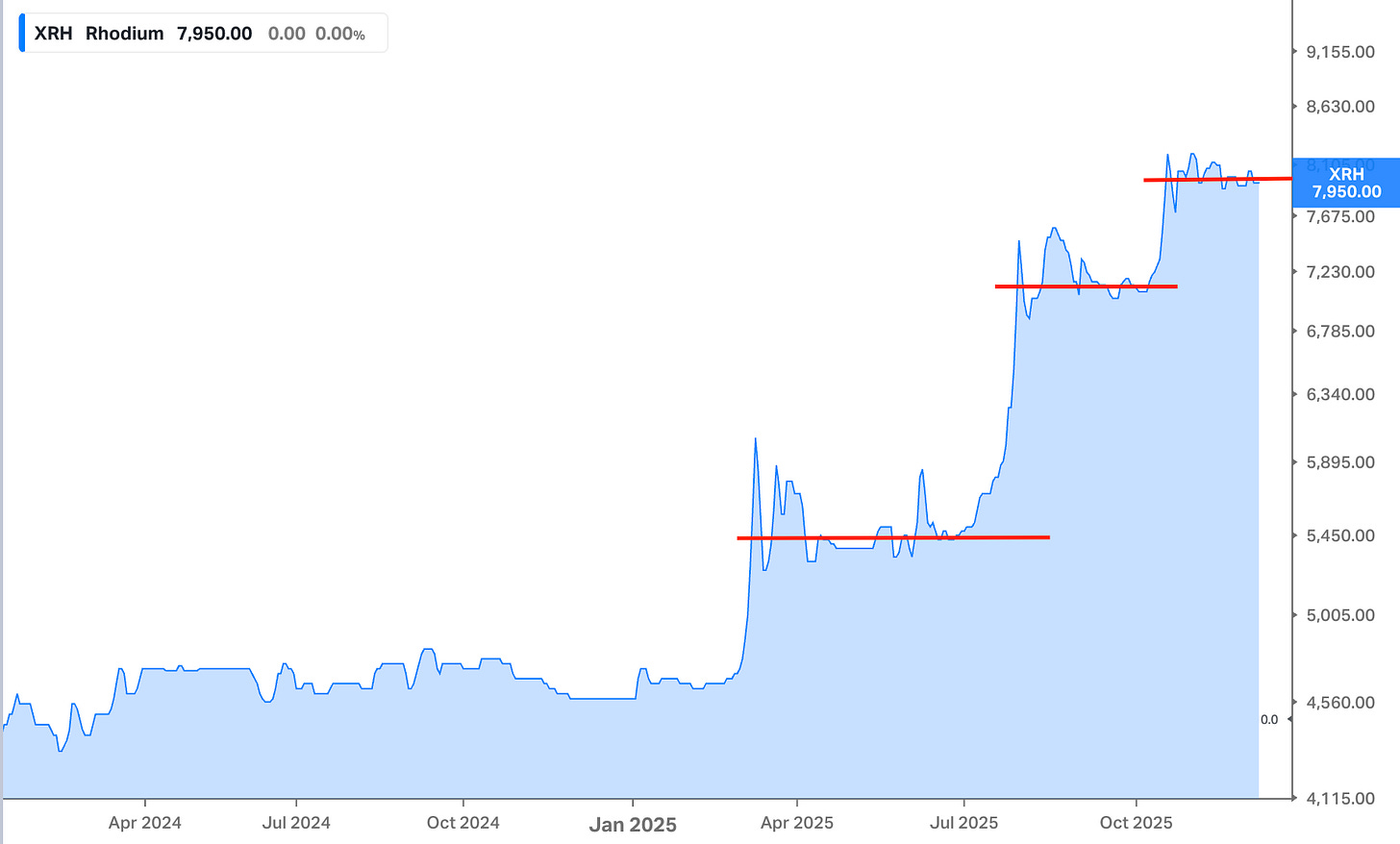

Rhodium is a simpler market with limited investment demand and largely autocatalyst demand vs supply.

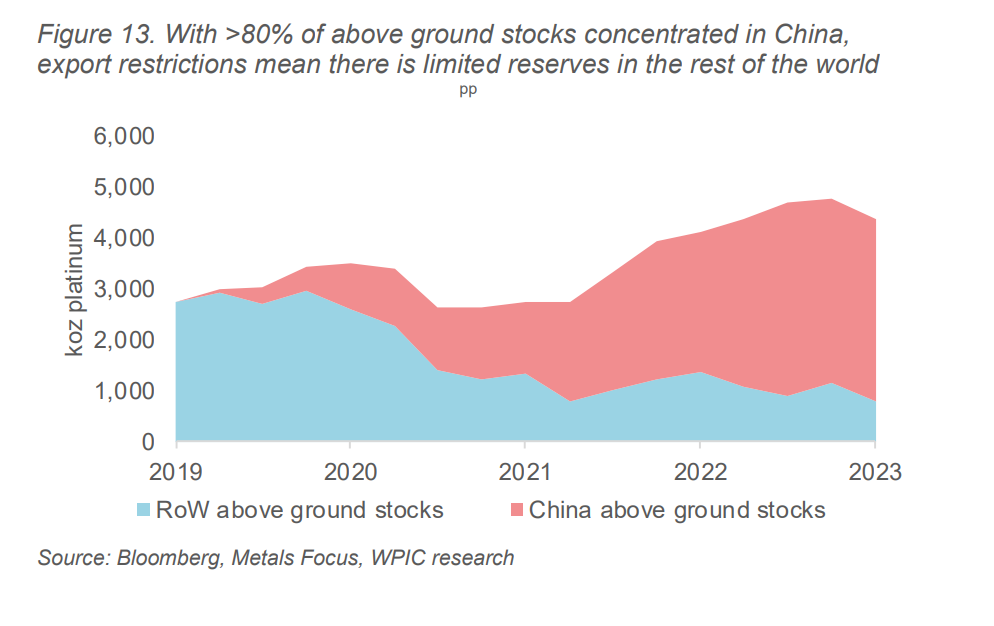

Lastly, with the Chinese having largely cornered the Global Platinum Inventory, the WPIC assumes that at a certain price, it will become liquid for global demand outside China.

However, it is not known what platinum price will be necessary to attract the portion of above ground stocks required to meet the shortfall or indeed what impact having almost 80% of those above ground stocks locked-up in China will have on metal flows and price.

This doesn’t happen, as it’s obviously a strategic metal China can’t produce, with 75% of platinum located in a Geopolitically unstable country. China has never exported raw platinum, and will continue to make it available for domestic manufacturers only.

Foreigners can participate in the new Guangzhou Futures Exchange (GFEX) platinum and palladium contracts indirectly via qualified channels, but physical delivery is in practice, reserved for onshore entities.

A great read on the whole subject is: The Platinum Stock Supply Crisis by Dr. David Davis.

Takeaway: I’m happy to keep riding my physical platinum and rhodium for years to come and PGM miners for now.

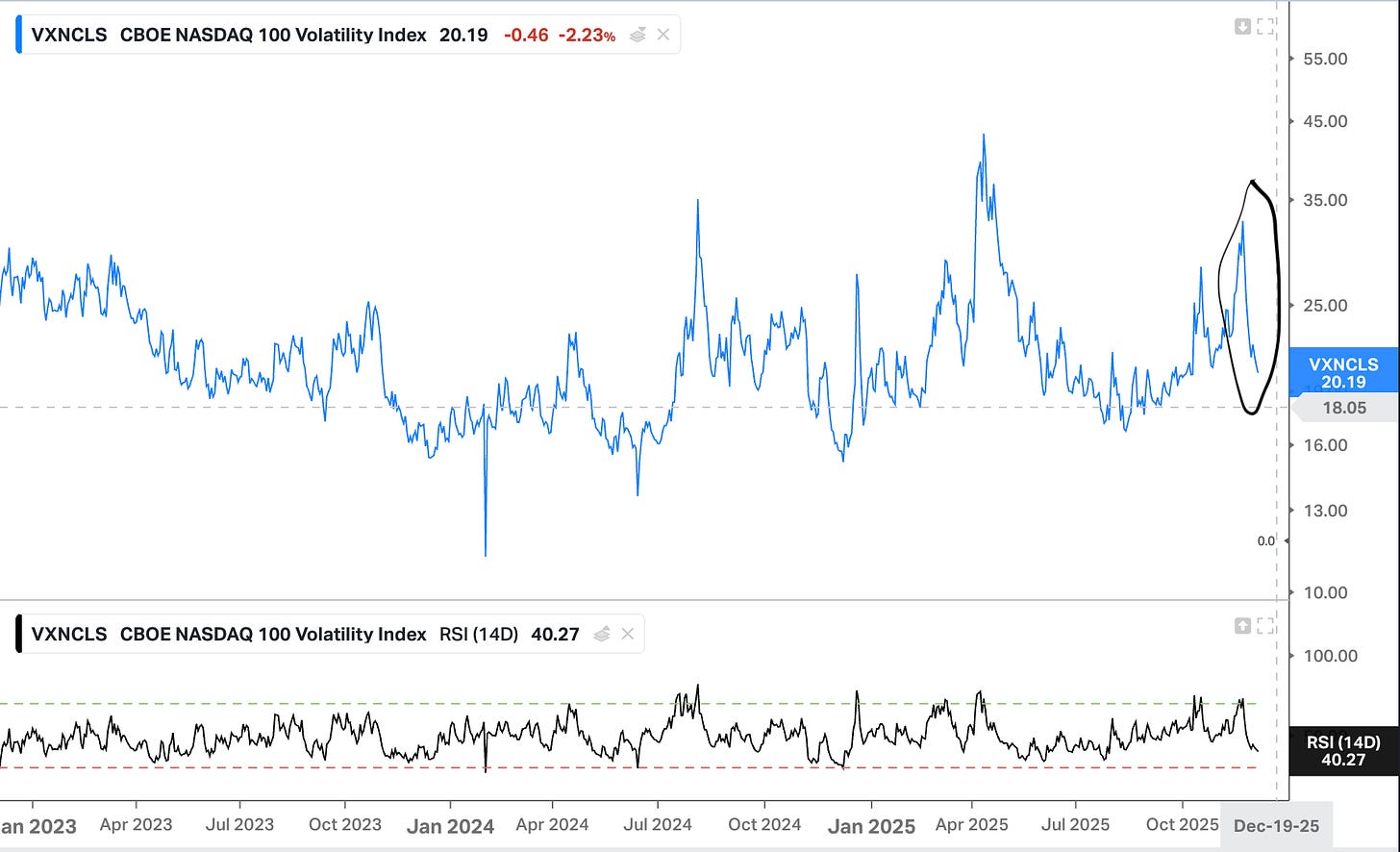

Getting Long Vol

I recently went over this trade in Premature Extrapolation. Granted, volatility jumped, which killed the payoff of the options.

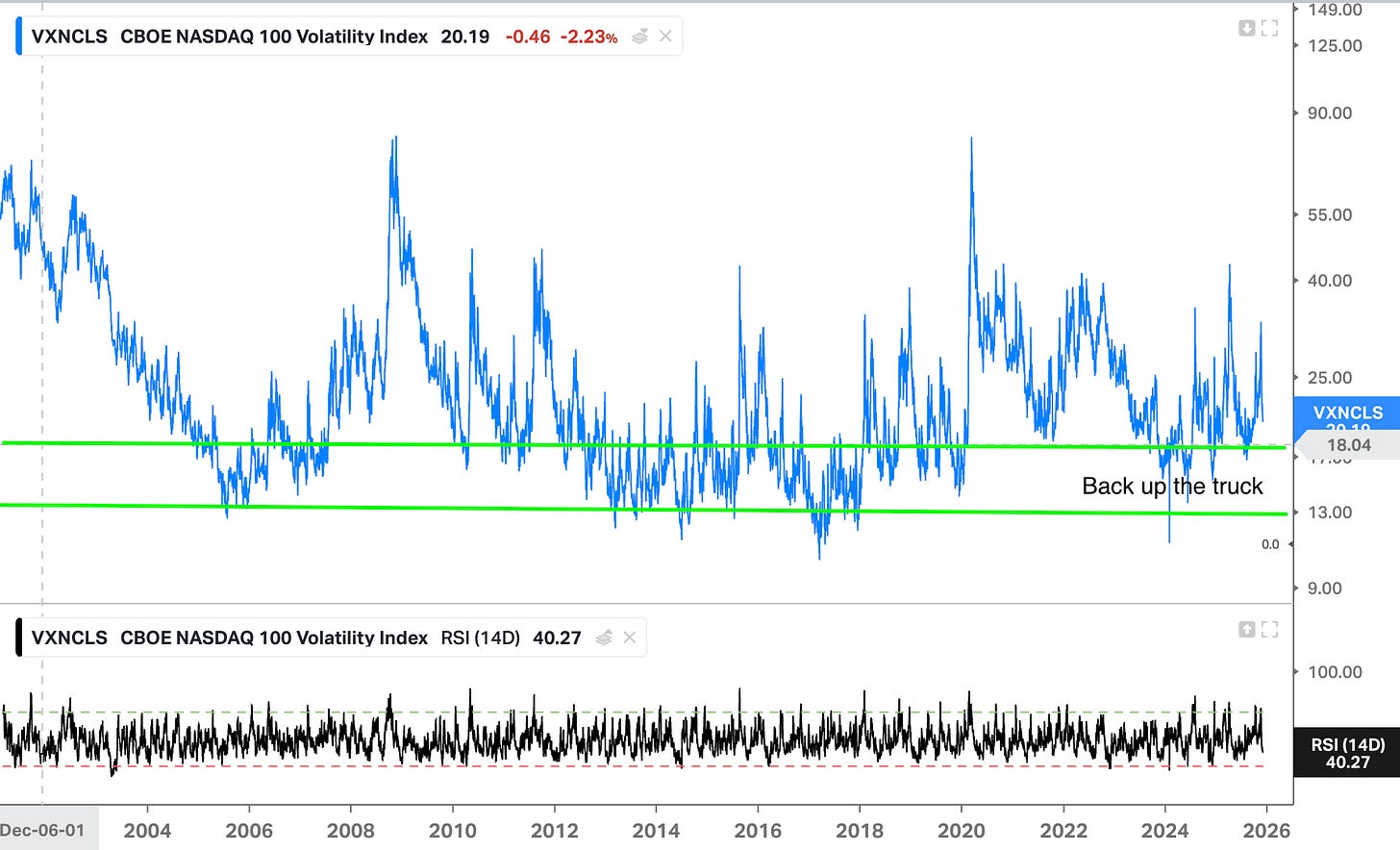

Volatility is declining rapidly, so hopefully some of my limit orders will start getting filled (and I’ll notify everyone).

I’m keen to get this trade on as it feels like there is a awful lot of “dry tinder” around be it Private Credit, AI bubble, US debt situation, recession risks, having 3-4% of the portfolio allocated to long volatility strategy is feels like a non-brainer (the trick is just buying alot of time when vol is dirt cheap!)

For far more articulate views on why we are heading into a more volatile environment, I highly recommend watching/listening to these three interviews with Steven Diggle, who has recently reopened his volatility fund.

Hedgeye Investing: Steve Diggle, Founder & CEO, Vulpes Investment Management

2025 Will Shock Markets, Volatility Surging | Stephen Diggle

Takeaway: Sticking to the Premature Extrapolation game plan.

The GSCI Commodity Index

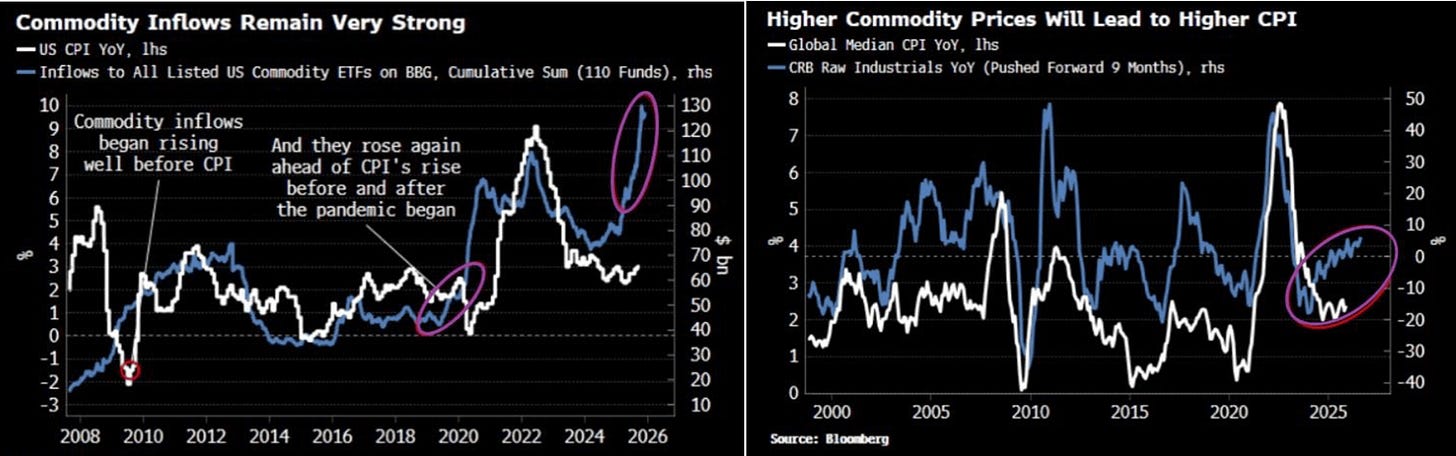

While I’m a crappy technical analyst, I’ve seen this compression pattern enough to know a big move is coming.

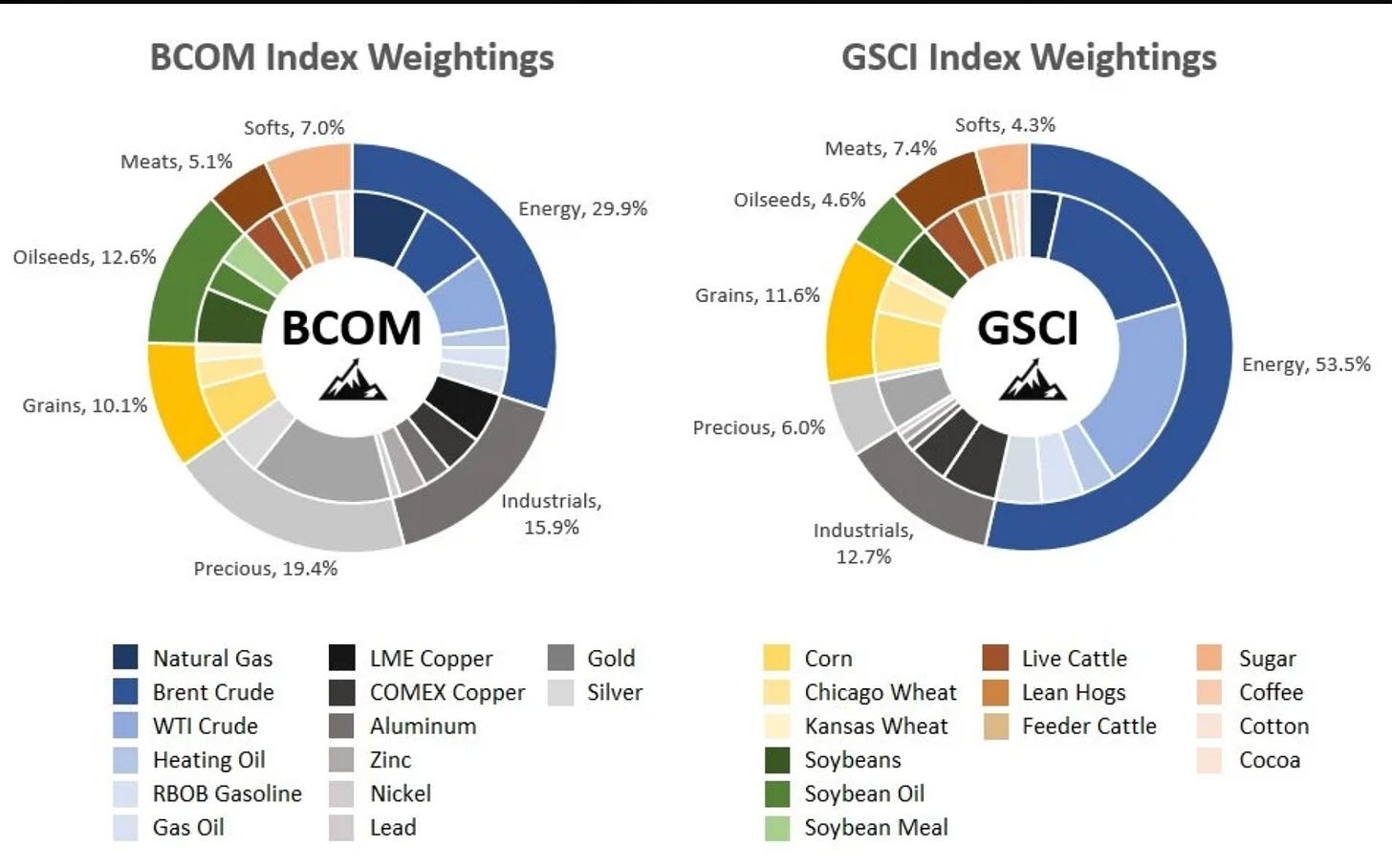

Yes, other commodities indexes have already broken higher due to lighter weighting to energy, of which the GSCI is the heaviest when compared to the CRB Commodity index (39%) and the Bloomberg Commodity index (30%).

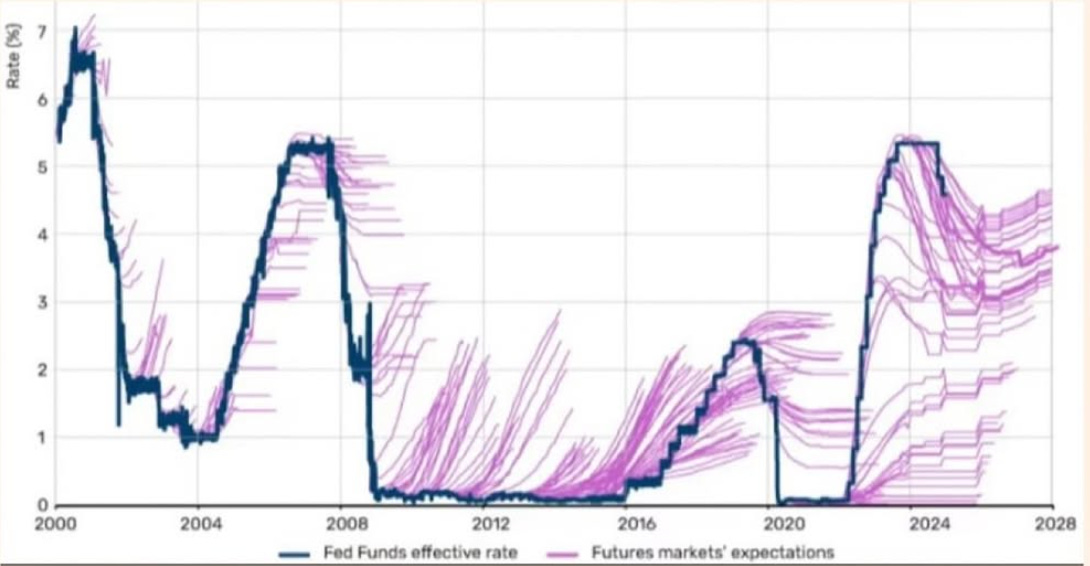

Commodities, particularly energy, heading higher will throw a wrench into market expectations for the Fed to deliver 2-4 rate cuts in 2026.

Takeaway: Next year should be fun as this chart illustrates so well.

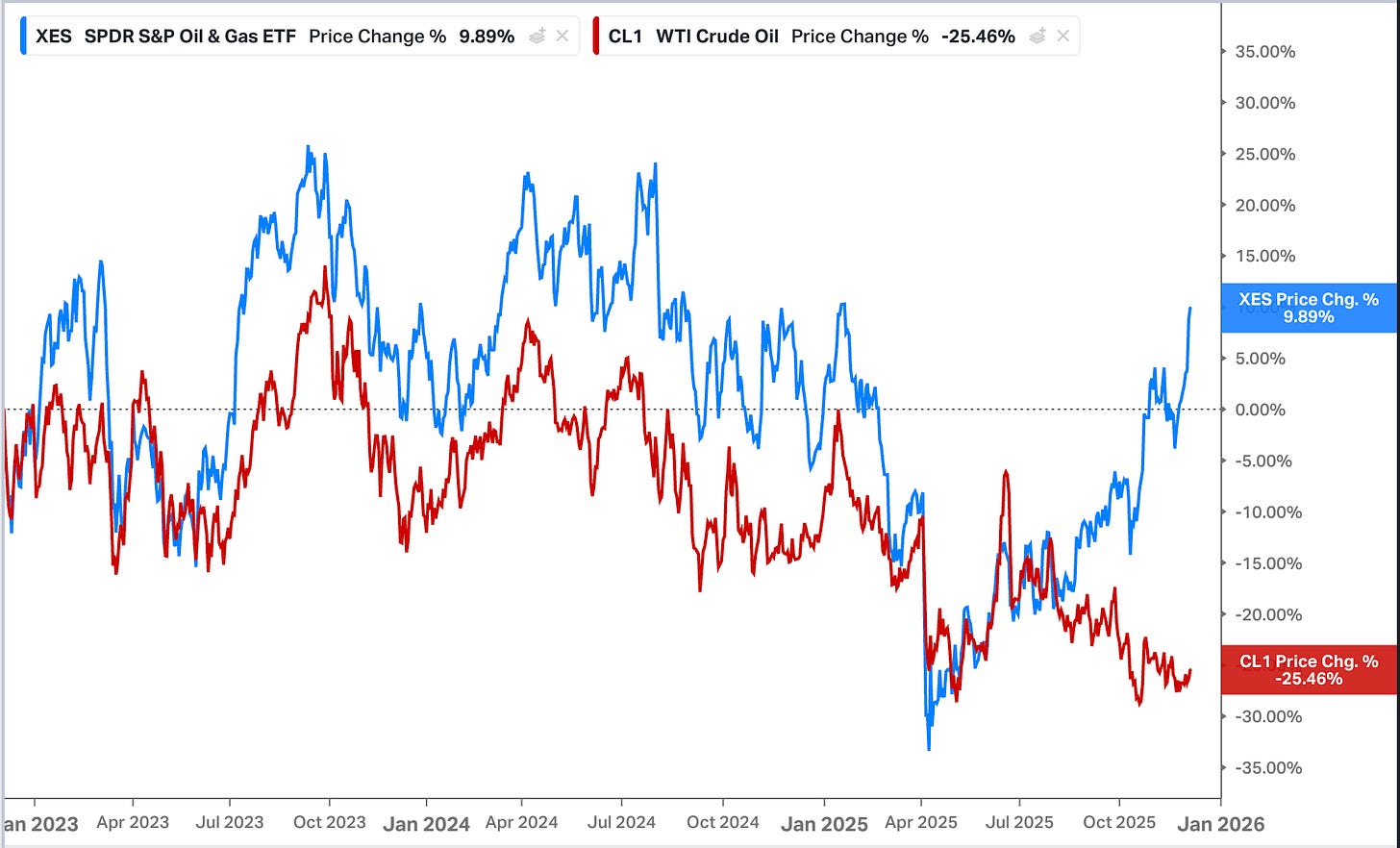

Oil Services vs Oil

Theres no getting around it oil services haven’t been the place to be the last two years.

Sector bottoms are obvious in hindsight, while at the time we keep extrapolating the negative.

Often, the absence of a bullish narrative in a cyclical sector is actually bullish, and vice versa: when everyone and their dog has bought into a bullish narrative, that’s bearish.

Oil services are strongly suggesting the bottom is in, as weakness in the oil is no longer dragging services down with it. I can’t even use the Range Global Offshore Oil Services Index ETF as they liquidated the ETF on the 23rd May 2025…

Put another way, sectors often turn before a bullish narrative can take hold.

Takeaway: Probably confirmation bias, as I’ve got little to show for the last two years in offshore oil services.

A False Narrative

IEA Boosts Forecast of Record Oil Glut for a Sixth Month

World oil supplies will exceed demand in 2026 by just over 4 million barrels a day, the IEA said a monthly report on Thursday, a slight increase from last month.

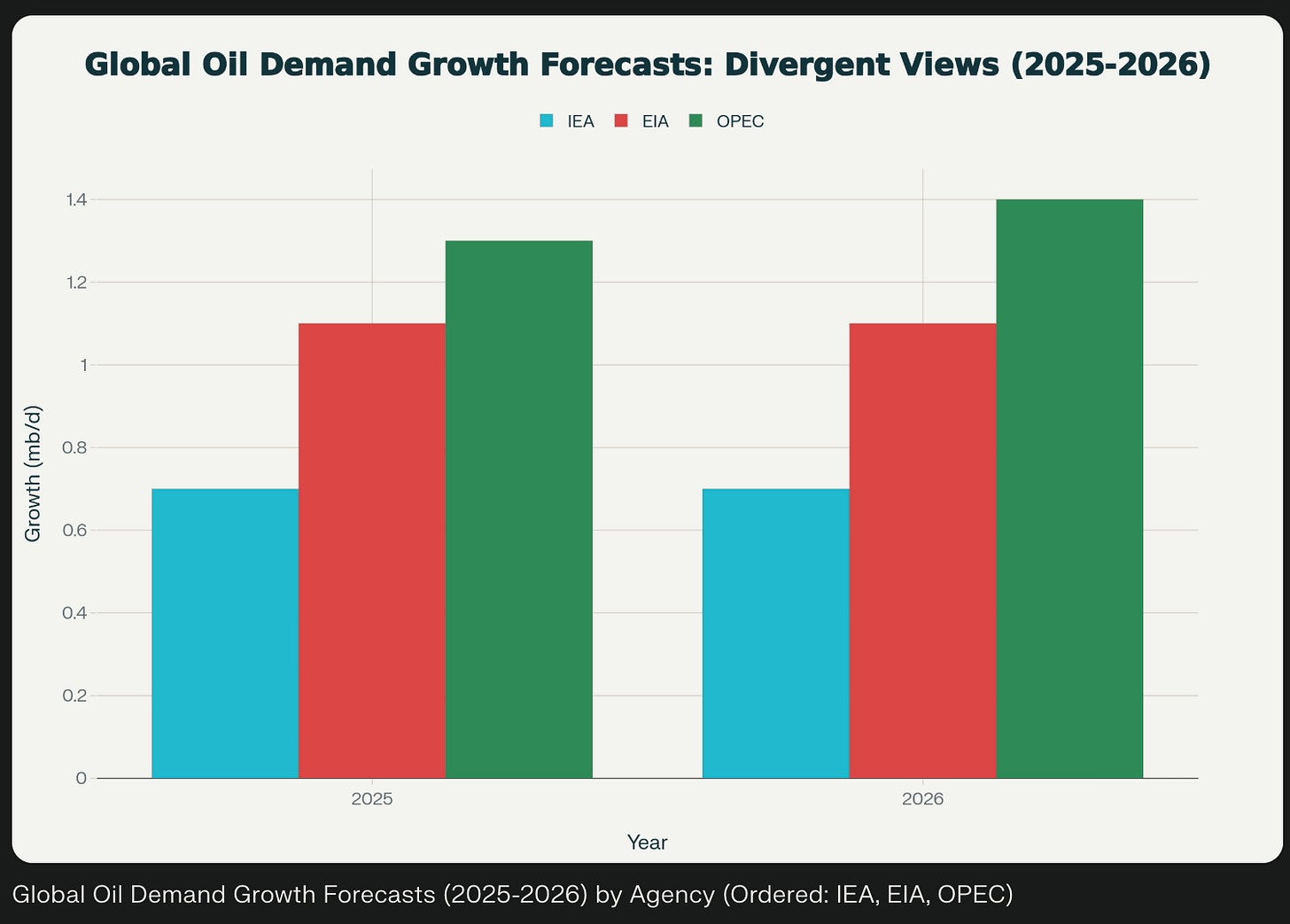

The IEA forecast for 2026 oil demand growth is now half of OPEC’s 1.4m bpd and two thirds of EIA 1.1m bpd.

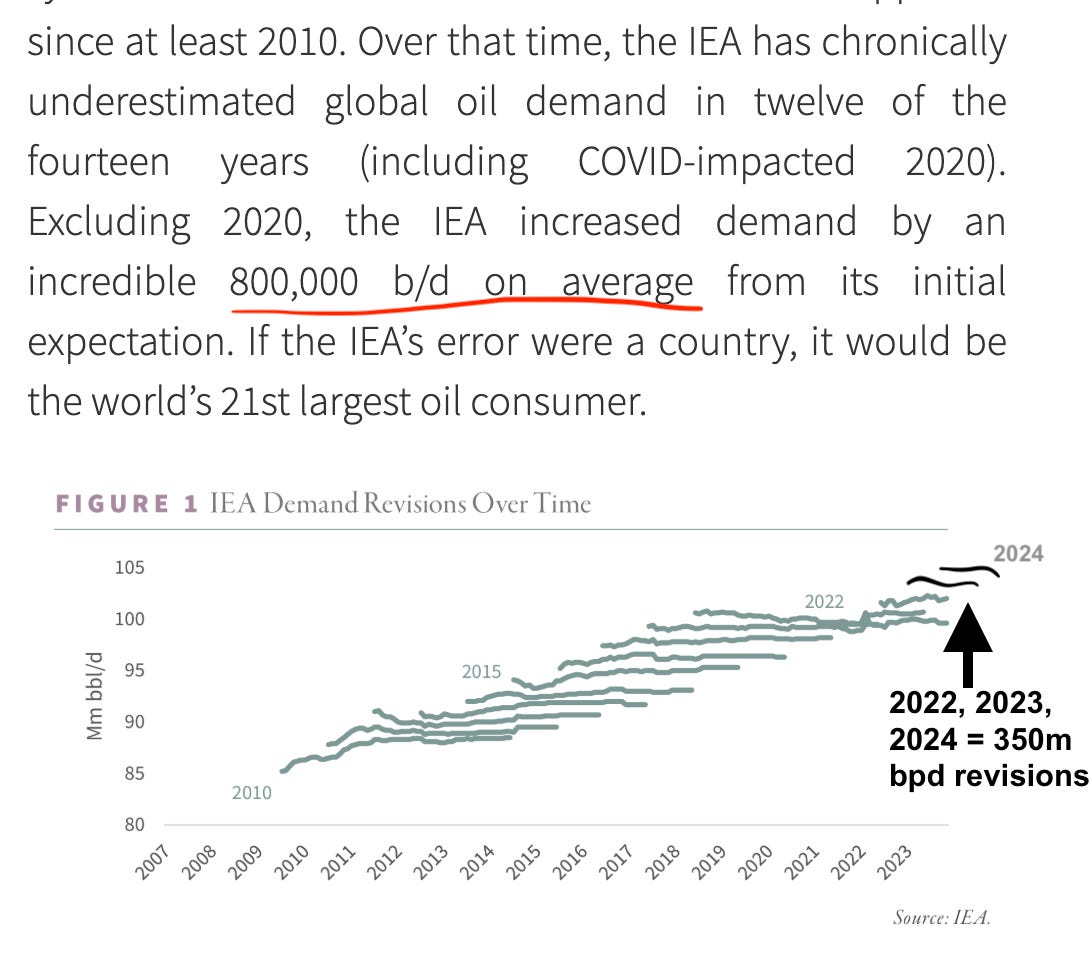

The reality is that the IEA can be relied upon to label developing-market demand growth as “missing barrels,” then quietly revise its numbers, often years after the fact.

A little bit of history on how far back the IEA’s “Missing Barrels” goes.

In the 1997-98 episode, the divergence between supply and demand estimates reached 1.5-1.7 million barrels per day in certain quarters, leaving hundreds of millions of barrels unaccounted for.

The International Energy Agency (IEA) reconciled the 1.5–1.7 million barrels per day (mb/d) divergence from the 1997–1998 episode primarily by identifying unreported stock builds in non-OECD countries and, to a lesser extent, by revising historical demand estimates upward.

Goehring & Rozencwajg hit the nail on the head with this piece in their 2023 commentary of which I’ve taken the liberty to add IEA’s latest upward revision(page 58) of 350 million barrels for 2022, 2023 and 2024.

What’s funnier is that the IEA currently are unable to locate 1.5m bpd of the 4m bpd glut they see coming next year.

MISSING BARRELS

The murky crude picture got even muddier on Tuesday when the IEA report also noted that it was unable to account for 1.47 million bpd of oil in its global balances for August, the equivalent of 1.4% of annual demand. By comparison, the IEA “unaccounted for balance” figure for July was 850,000 bpd, or 370,000 bpd for the second quarter overall.

Takeaway: While there is unquestionably an oil surplus currently, I see it being worked through in the second half of 2026 and with the way oil and, in particular, offshore oil services are priced, I see it as one of the best risk-reward opportunities in the market right now.