Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

I always find a few great interviews when checking The Market every few months:

We Are Headed Towards a System of National Capitalism—Russel Napier

Interest Rates Are Not Sticking to the Central Banks' Script — Jim Grant

Podcast/Video

Easily my favourite show on Youtube: Money of Mine: 18 Fund Managers on their 2025 Big Bets (Part 1)

Quote

Here is a dose of comedy:

“The more we go for clean energy, the more resistant we are to global conflicts because nobody can take solar or wind as a hostage,”

-Dr Fatih Birol (IEA) told Euronews.

In this episode of The Big Question, executive director of the International Energy Agency (IEA), Dr Fatih Birol sits down with Hannah Brown to discuss how the drive for clean energy will make Europe more resilient to crises.

Tweet

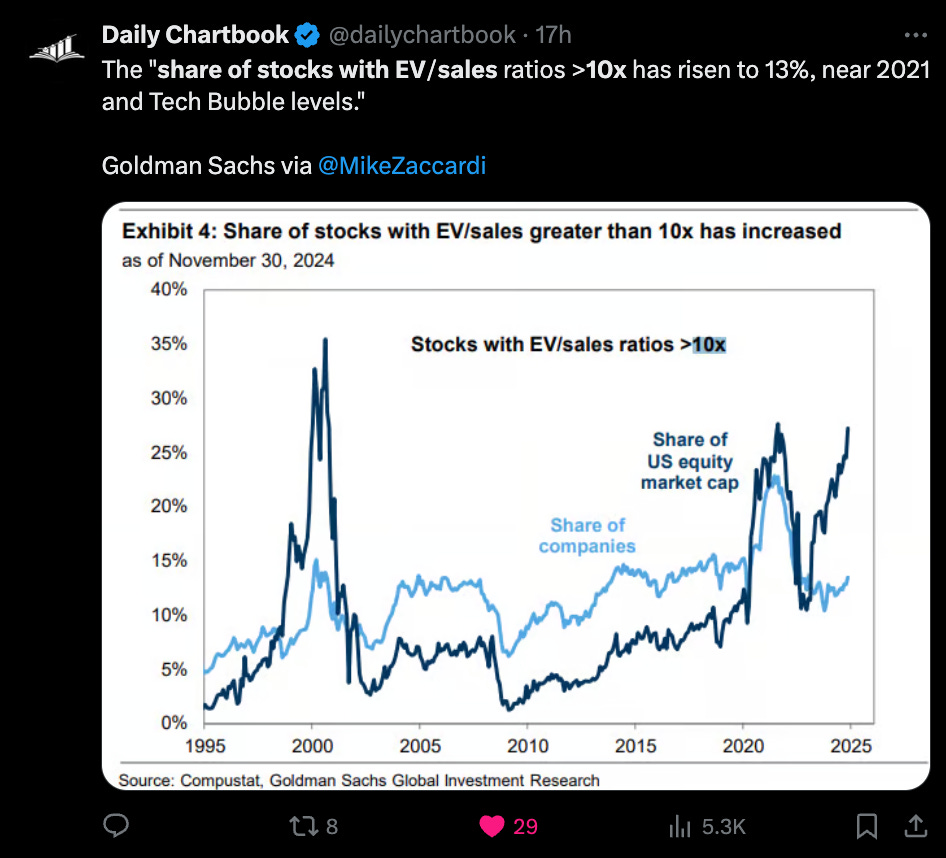

Clue the overused Scott McNealys "What were you thinking?!" speech (not that it's mattered much with the likes of Nvidia hitting 33x EV/sales in November 2021 and trading above 40x EV/sales three times this year!)

Charts

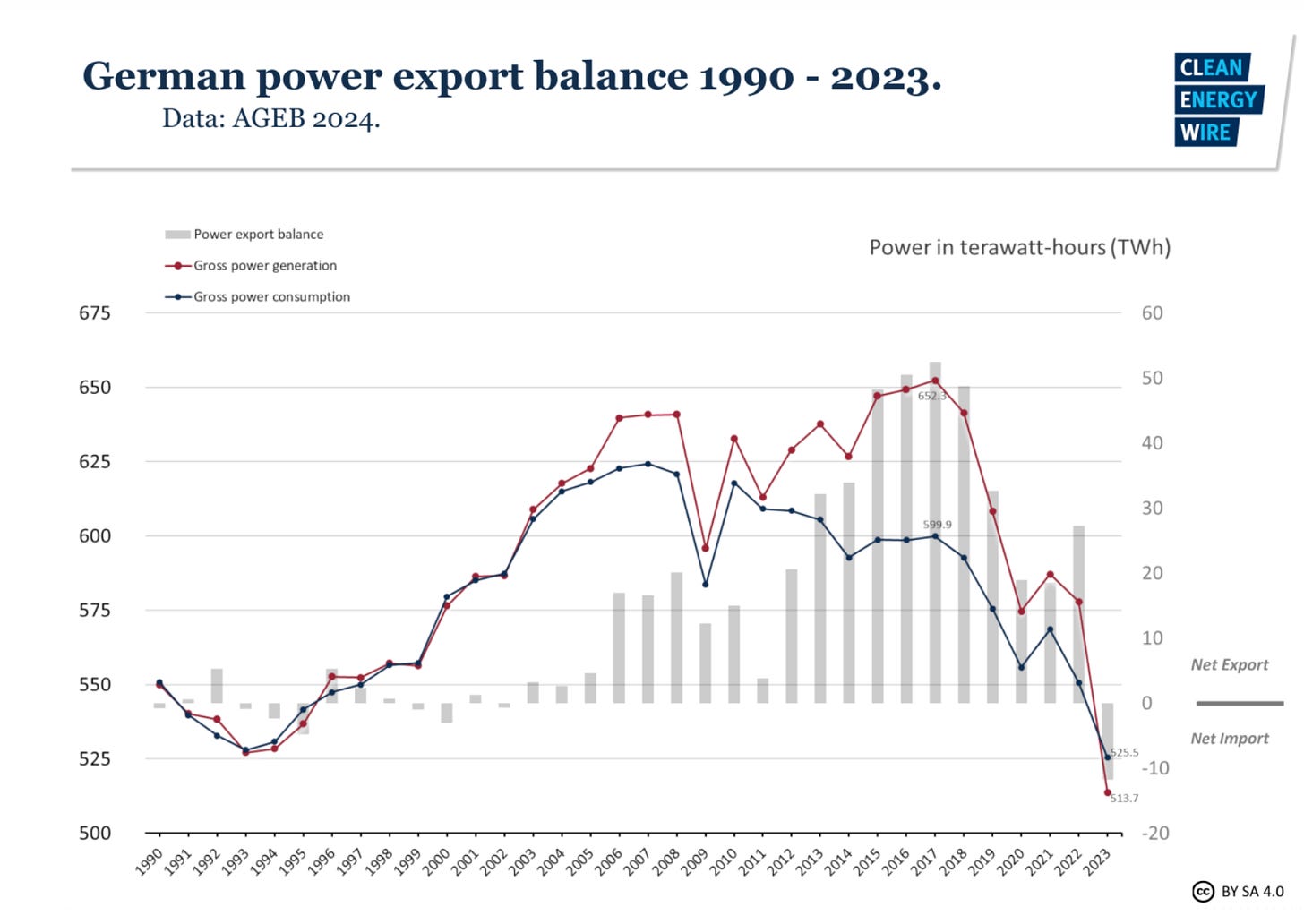

Adding intermittent wind and solar to the grid is fine when countries have additional capacity, which they can trade to help balance their grids.

This was the case with Germany, a substantial net exporter until last year.

The wheels fall off when surrounding countries also chase green goals, adding wind and solar energy, reducing their baseload generation, and leaving them vulnerable to periods of low wind and sun (Europe's Dark, Windless Days Show Risk of Renewables Rollout).

Exporting base load when required in periods of high demand (winter) is very different from exporting power when a country experiences strong wind or sun.

Something I'm Pondering

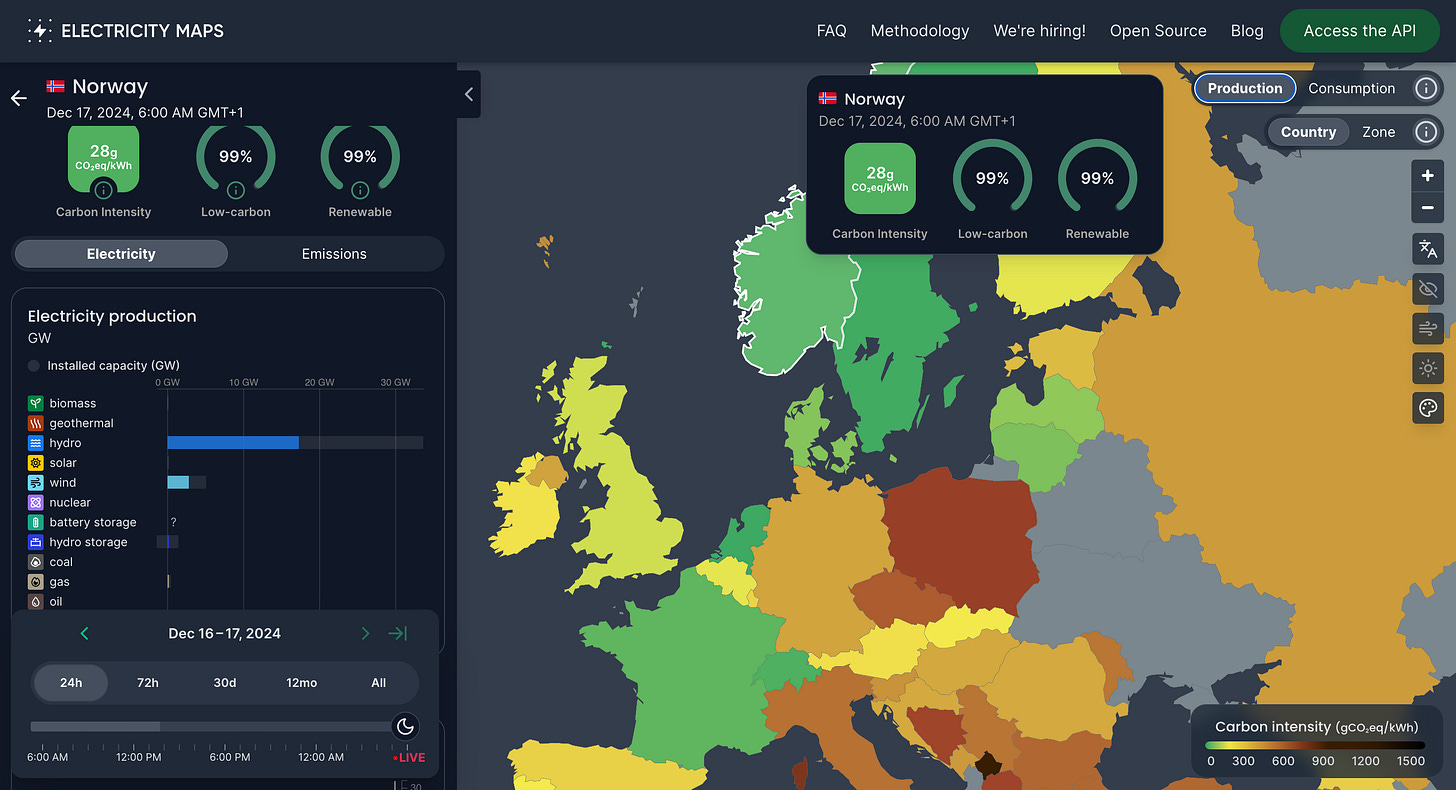

In keeping with the above, Europe has three main sources of clean base load to balance grids.

Norway with massive hydro generation.

Sweden with hydro and nuclear generation

France with nuclear.

What I’m pondering is if Norway potentially cutting interconnectors will put a final nail in the coffin for wind power growth ambitions.

Norway

Norway campaigns to cut energy links to Europe as power prices soar

The issue is also causing deep alarm among EU countries keen to use Norway’s abundant hydroelectric power to help balance energy prices on the continent.

“It’s an absolutely shit situation,” said Norway’s energy minister Terje Aasland.

The ruling centre-left Labour party now says it wants to campaign in next year’s parliamentary election, set for September, to turn off electricity interconnectors to Denmark when they come up for renewal in 2026.

Its junior coalition partner, the Centre party, has long demanded an end to the Danish connection and also wants to renegotiate existing interconnectors with the UK and Germany.

Sweden

Sweden is also questioning the setup: Sweden Pressures Germany to Reform Power Market

Sweden will only reconsider building an interconnector with Germany if the latter reforms its electricity market to make it less reliant on imports.

There is also a problem with wind and solar, which do not generate electricity consistently. This has led to periods of overproduction followed by periods of almost no production—a situation that has significantly increased price volatility on European power markets, causing wild swings from below zero to much higher than average in a matter of days.

Denmark and Germany

It sure is a shit situation for the likes of Denmark and Germany, which have the highest proportions of wind and solar. This makes imports vital, as battery storage and hydrogen aren’t going to save them.

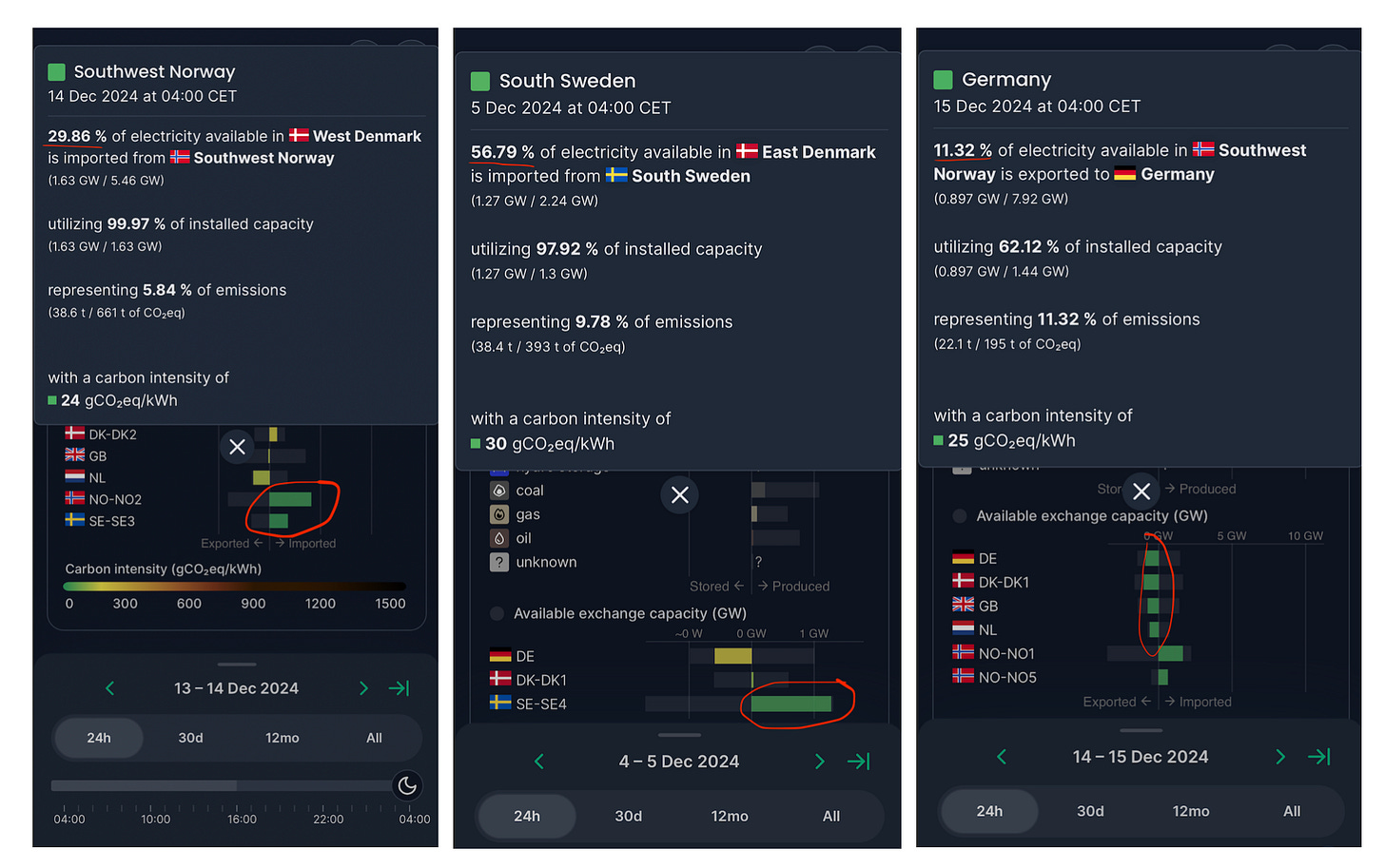

Anyone who wants to see how reliant the likes of Denmark and Germany are on electricity imports should play with energy maps.

Below are a few examples:

West Denmark 13-14th December: 30% of electricity was imported from Norway (a further 10% from Sweden).

East Denmark 4-5th December: 57% of electricity was imported from Sweden.

Norway 14-15th December, 11% of electricity available was exported to Germany.

Denmark is the one to watch as it is the most vulnerable to a reduction in imports with 68% of its power capacity wind.

Denmark Gets No Bids in Largest-Ever Offshore Wind Tender

Denmark received no bids in its largest-ever wind power tender, a major blow to European efforts to boost renewable energy and slash fossil-fuel demand.

The Danish Energy Agency didn’t receive a single offer by Thursday’s deadline in the tender to develop three offshore wind farms, it said in a statement. It will now initiate a dialog with the market to find out why.

Not sure why they need the dialog to find out why…

The tender didn’t offer subsidies or fixed prices like some others in Europe and in the UK. That left developers susceptible to market prices that can hit zero or even turn negative when conditions are windiest.

The wind ramp has run out of stream in Denmark and Sweden with subsidies removed (granted UK and Germany will continue to prop up the industry a little longer).

If you exclude China, we are seeing wind installations stall out.

And outside China, by far the world’s biggest market, wind farm installations may actually fall slightly this year.

How do I play this?

I continue to see high-quality thermal coal winning short-term to medium-term and nuclear/uranium longer-term.

I hope you’re all having a great week.

Cheers,

Ferg

P.S. It was great having Emmanuel Datt back on the show to discuss the usual suspects in coal and tin plus a handful of other resource opportunities he’s seeing.

I’m thinking Norway’s energy minister should either offer his services to the German government or have a broader EU role. Someone with their head screwed on who says it like it is, unlike Fatih Birol who says it how it isn’t.

thanks for the Jim Grant piece...