Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

These are interesting articles to read one after another.

Why Measuring the Clean Energy Economy Is a Game of Catch-Up

“But as many Bloomberg Green readers will know, costs for renewable power assets have been steadily and significantly declining for almost that whole time. The big buildout of renewables means costs ought to be going down, not up.”

“The revisions, Politano said, “allow official GDP data to reflect a reality we’ve known for a long time — renewables are getting cheaper and more efficient while becoming a larger share of America’s economy.”

New York Rejects Offshore Wind’s Request to Raise Rates

“The New York decision is a blow to developers that have said they may not be able to complete projects under existing contract terms. Many of those projects were modeled years ago, before a run-up in interest rates and material costs.”

“To remain viable, they (Equinor, and BP), asked the state to approve a 54% price increase.”

“Orsted Chief Executive Officer Mads Nipper has said that the company is prepared to walk away from its US developments if it doesn’t receive more government aid. Orsted’s request to New York state was for a 27% bump.”

Podcast/Video

How to Profit in a Crash or a Boom ft. Harris Kupperman

Quote

“It’s impossible to please everyone. The question is whether you’re disappointing the right people.”

- Adam Grant

Tweet

Nobel laureate…

Charts

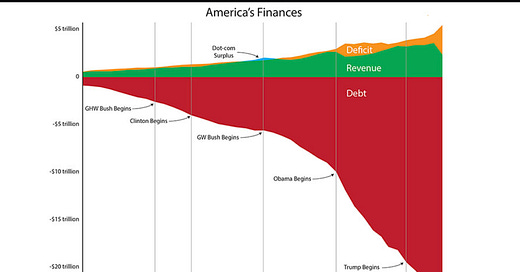

Great visualisation of the issue by @exjon

Something I'm Pondering

I’m pondering the lack of understanding of the role metallurgical coal plays in society. After reading this recent Bloomberg piece: Deutsche Bank Places New Restrictions on Financing of Coal

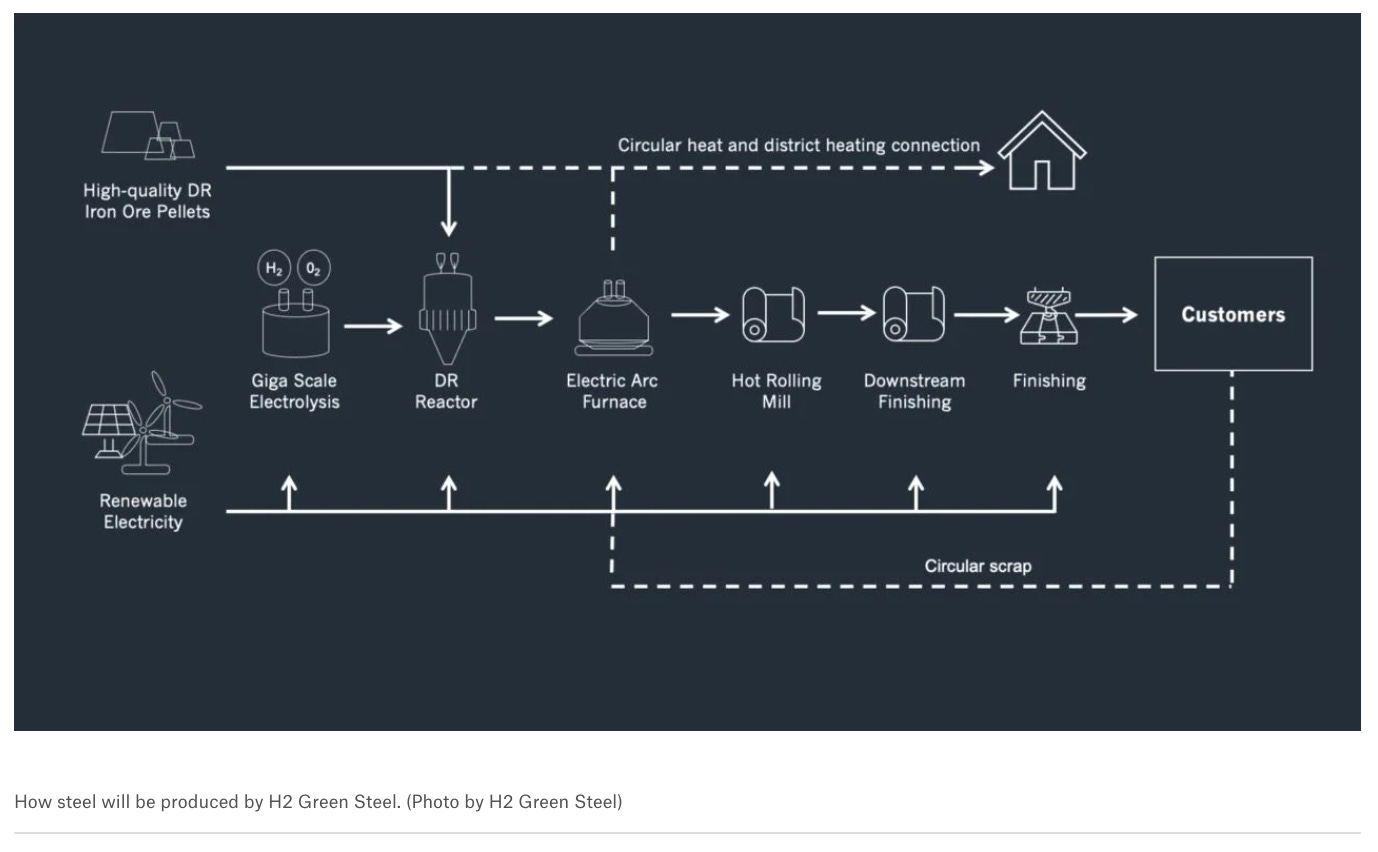

If they plan to cut met coal they’re going to have to replace it with a combination of increased electric arc furnace steel recycling and green steel.

H2 Green Steel hopes the factory will produce five million tonnes of steel by 2030. According to the World Steel Association, global crude steel production in 2021 was 1,951 million tonnes (so potentially 0.002% of global steel production by 2030)

Green steel is hugely electricity intensive as it requires electrolysis to produce hydrogen, which can be used to create sponge iron, which is then run through an electric arc furnace.

To replace met coal with this process would require a rapid expansion of both electricity production and grid infrastruture ( joining the queue with EVs and heat pumps).

Cutting out thermal coal doesn't aid the "rapid expansion of electricity production", and the idea renewables can fill the gap is taking this game of make-believe to new heights.

Hope you’ve had a great weekend.

Cheers,

Ferg

P.S. I had a great time chatting with Emanuel Datt about the opportunities he is seeing in Australian markets.

If you’re interested in my story and why I started this Substack, you can read the story here.

Thoughts on Nuscale? With share price nosediving are you adding to your position, selling, or waiting for the stock to reverse trend before adding? I personally added more today @ $3.50

"Green Steel". I'd never heard that one before.