Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

I always look forward to John Kemp's chart books hitting my email.

I'm two-thirds through writing a piece on an opportunity presented by "new energy vehicles."

One should always be on the lookout for when narratives are adjusted.

An example was the shift from 100% renewables to zero carbon (to include nuclear and carbon capture).

New energy vehicles will be a way to maintain the 100% EV narrative as BEV adoption stalls out over time.

Podcast/Video

This was brilliant (granted, I'm biased as an oil bull: Haymaker Webinar - Marshall Adkins (10/16/24)

I found Marshall's view around OPEC+ reported excess capacity particularly interesting.

Quote

“Garvey said the PGM situation had some parallels to coal, which is being phased out as governments slash carbon emissions, but will still be needed for years until more renewable energy is rolled out.”

Tweet

Sanctioning 40% of world palladium production with the market in a deficit is something only a Western policymaker could think would work.

Palladium prices will spike, and China and others will pick it up at a discount (ignoring the sanctions), with the G-7 paying the new palladium market price and dealing with shortages.

Charts

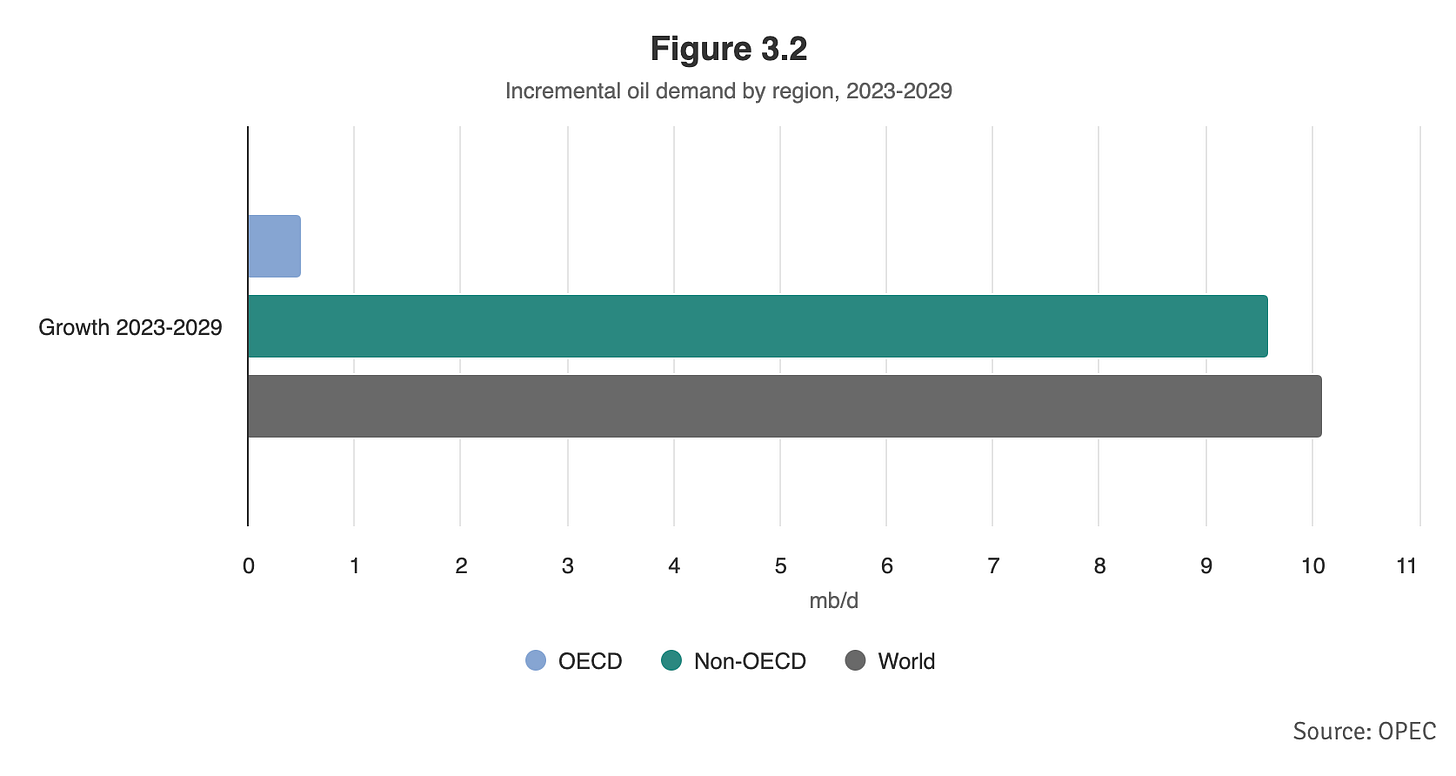

Whenever I hear oil demand destruction, I think of this chart. The global financial crisis reduced YOY oil demand by 2%, locking the world in their homes during COVID reduced oil demand by -8.5% (not the estimated -30% at the time).

This is why you need to be cautious in betting against oil demand growth if you take off the G7; 7.3 billion people are looking to increase their standard of living, which means increasing their yearly consumption of oil.

Hell, if China is to match Thailand or Mexico's consumption, that's double its current consumption, while with India, it is 5x.

Global energy policy (Net-Zero) is based on what the OECD wants.

In reality, it doesn't matter, as all the growth is non-OECD

Something I'm Pondering

Some of my best trades are when there is a consensus belief and positioning that a trend is just starting, yet if you look at the data it's clear it isn't playing out.

Coal is the prime example, with forecasts of its terminal decline, yet actual consumption continues to hit all-time highs.

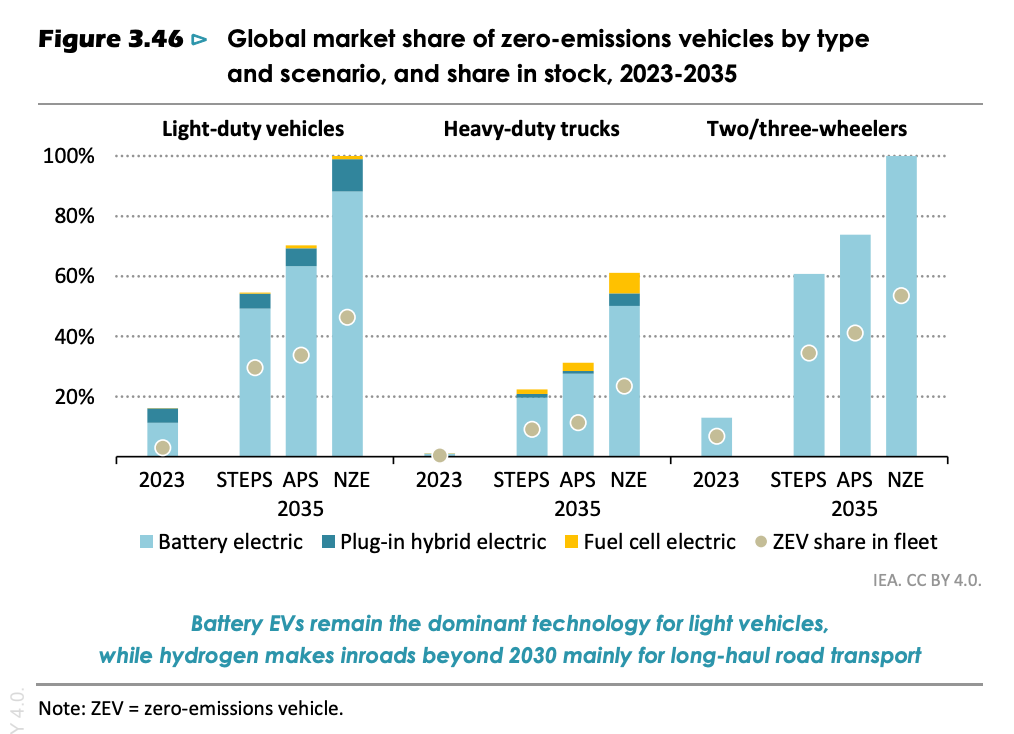

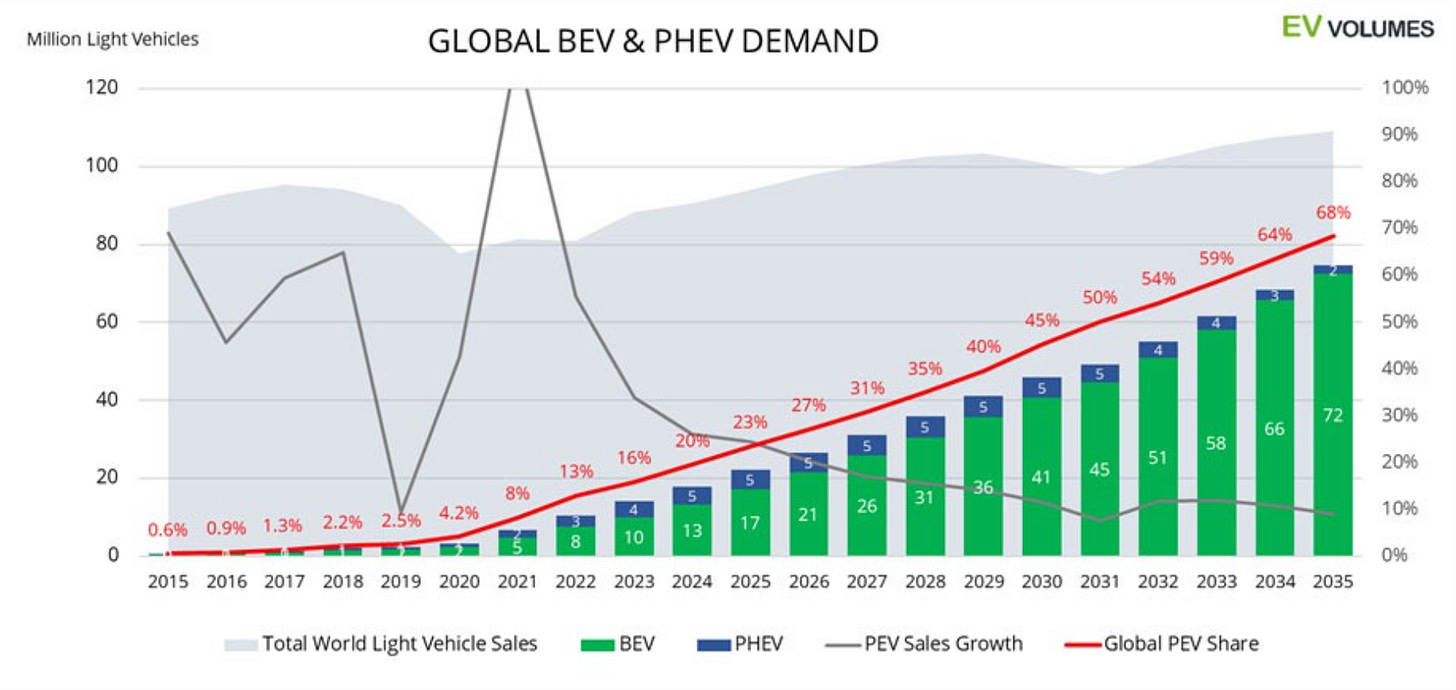

New energy vehicles have my attention as I believe the EV forecasts are completely wrong (IEA forecasts between 50-90% BEVs by 2035).

This forecast is close to IEA STEPS scenario, where PHEVs hit a maximum market share of around a third before fading.

I posted this in a previous Ferg’s Finds

Just look at the ratios of EVs to PHEVs in the last three years.

2022: 25% PHEV/BEV

2023: 35% PHEV/BEV

2024: 51% PHEV/BEV

The main driver of the Chinese PHEV numbers is BYD with Sept YTD production of 2.76m “New energy vehicles” 57% are PHEV (BYD produces ~90% of China’s PHEV).

I've found a great angle to play this now, and it no longer requires buying miners. I should have the writeup out early next week.

I hope you’re all having a great week.

Cheers,

Ferg

If you’re interested in my story and why I started this Substack, you can read the story here.

Excellent work Ferg , i need the common sense slap from your self on a regular basis to get my thinking back on track and take zero notice of the bull shit peddlers ...........cheers and thanks again ,Let common sense prevail .....cheers

No miners? Say less, and take my money.