Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

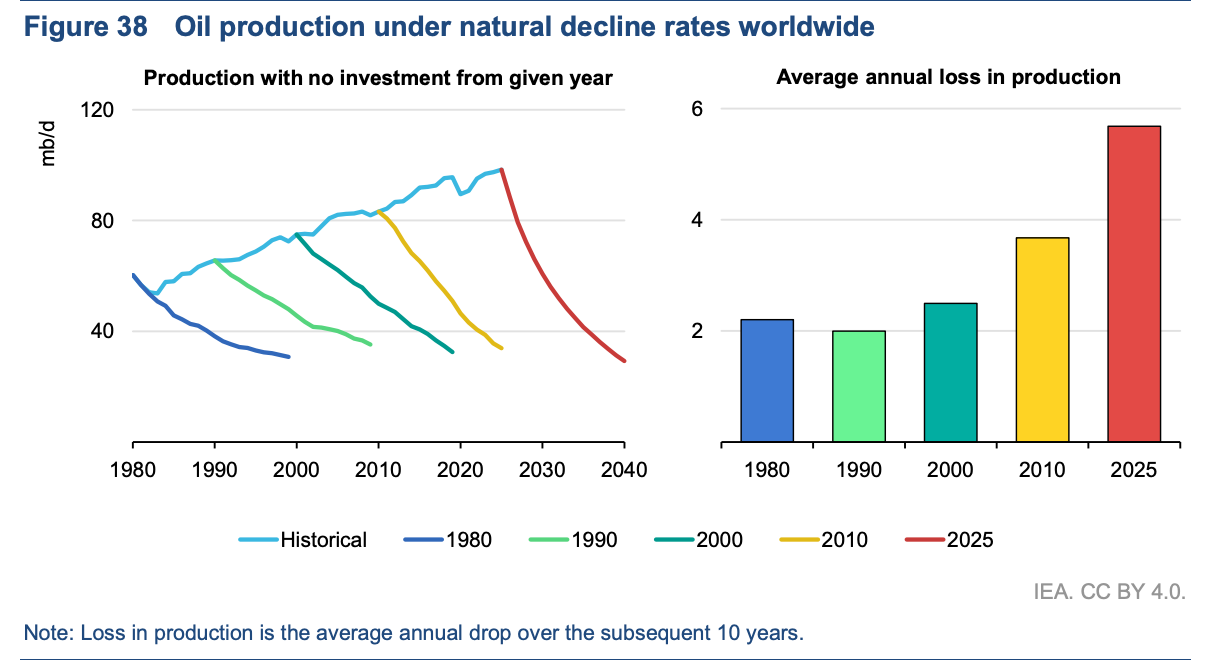

This piece by the IEA surprised me as it is full of interesting charts outlining hard realities, which is quite the departure from the IEA’s usual Net Zero scenarios/fantasies.

IEA: The Implications of Oil and Gas Field Decline Rates

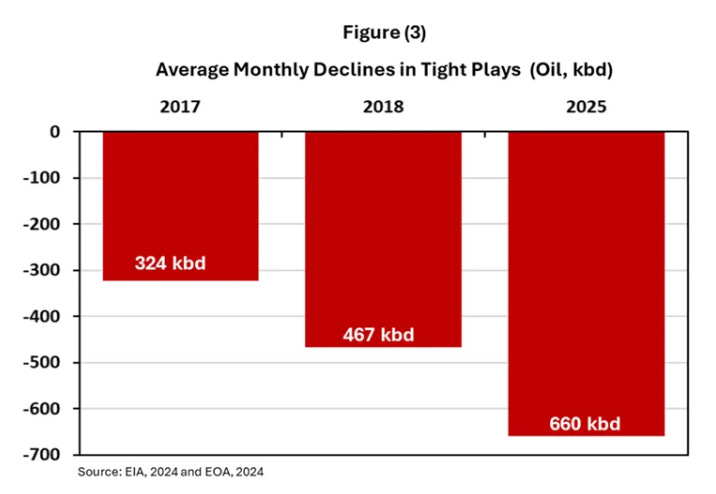

My favourite chart would have to be this one, which illustrates the double-edged sword that is fracking in what ramps quickly can also decline quickly (Exxon pegs declines at 15% p.a.)

Or as Dr Anas Alhajji showed, for tight oil plays to maintain production flat in 2025, you need to find an additional 660,000 barrels/day per month on average….

Podcast/Video(s)

Resource talks: Overlooked Investing Rules for Bull Markets by Ian Cassel

I also had the pleasure of jumping on the show recently.

Quote(s)

"Your actions speak so loudly, I can not hear what you are saying"

-Ralph Waldo Emerson

Tweet/notes

Echoing the below, I have never seen so many screenshots of year-to-date performance.

In my experience, when you take a screenshot of your performance, the market gods usually punish you soon after…

Charts

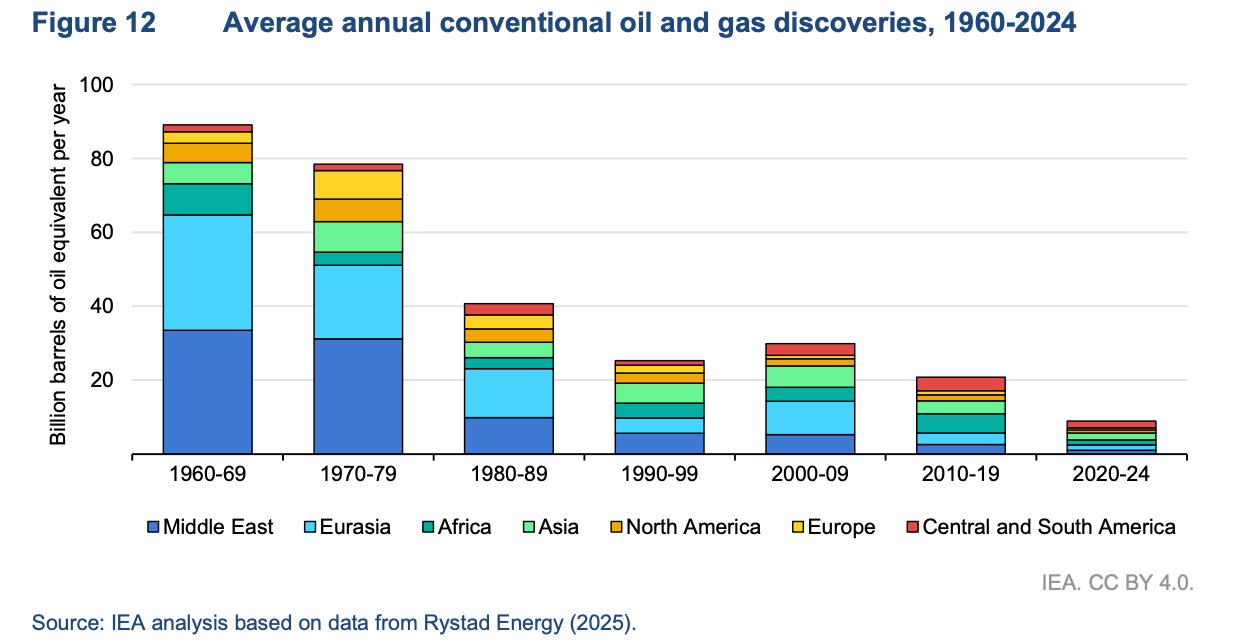

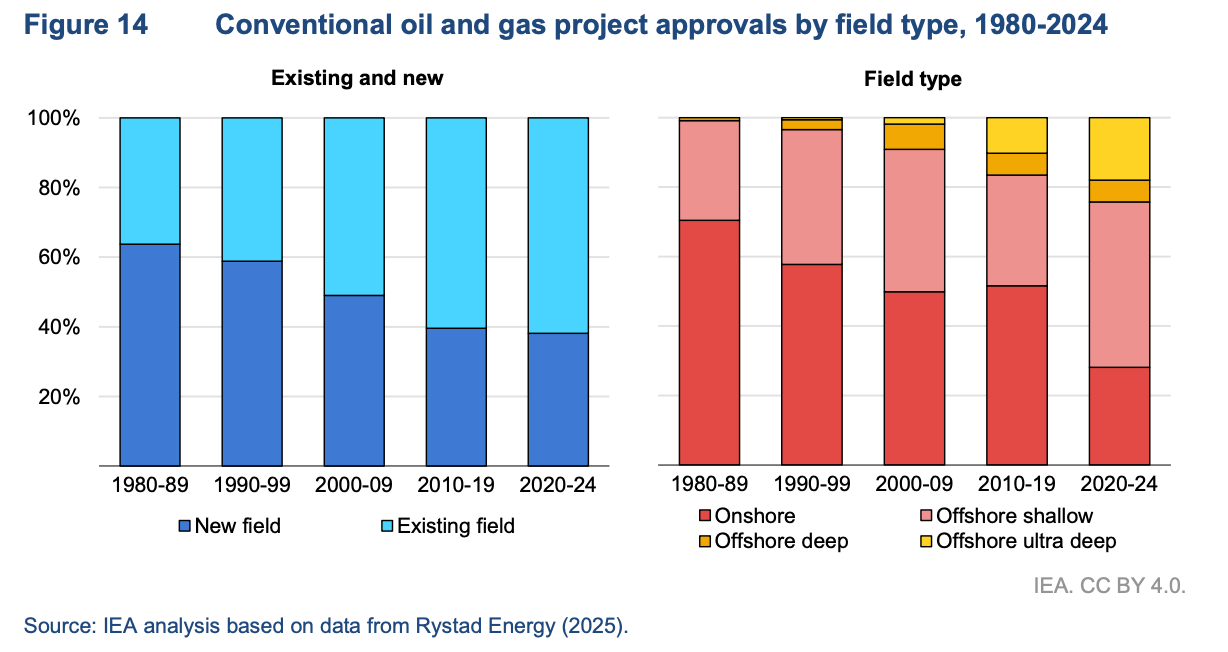

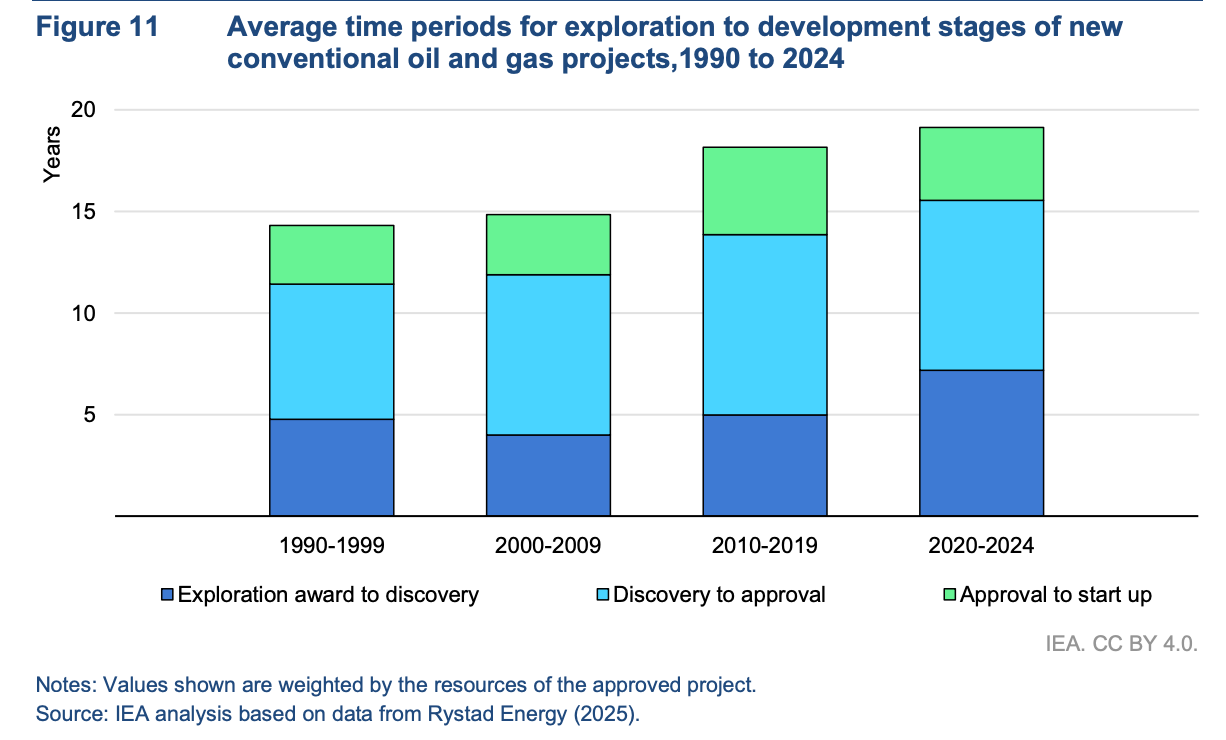

Some more charts from the previous IEA piece:

Conventional discoveries have been in decline for decades.

Offshore is the future of oil supply growth.

Conventional oil and gas projects are averaging nearly 20 years from exploration to startup.

Something I'm Pondering

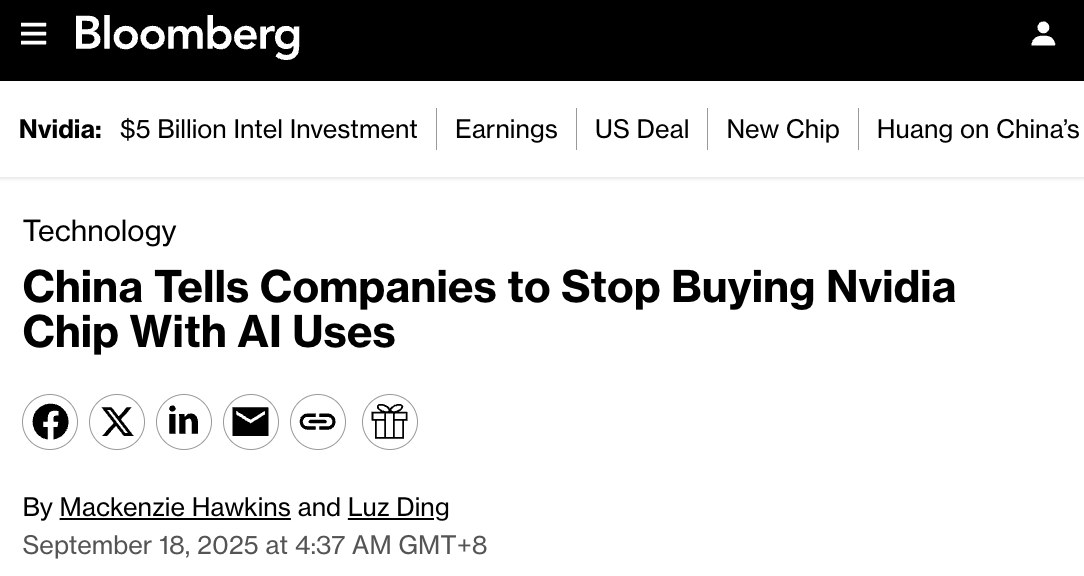

I’m pondering how no one seems to care about this week’s announcement, China is telling its companies to stop buying Nvidia chips…

The Cyberspace Administration of China told companies this week to stop testing the chip and cancel existing orders, according to people familiar with the matter, who asked not to be identified because the decision isn’t public. Several companies had indicated before the directive that they would buy tens of thousands of the semiconductors, which Nvidia designed to avoid triggering US restrictions on sales of advanced AI chips to China, according to an earlier report in the Financial Times.

I don’t think it’s a stretch to assume that the majority of Nvidia orders from Singapore are ultimately for Chinese beneficiaries. So a guesstimate is perhaps a third of Nvidia’s revenues is reliant on China…

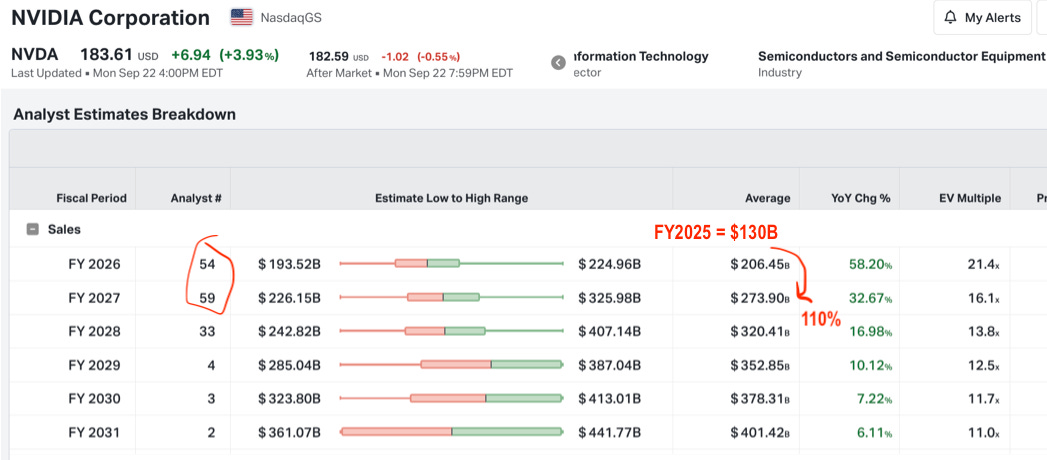

The average analyst estimate has Nvidia growing sales by 110% by FY 2027.

It’s why you are seeing the financial engineering below to keep things on the road for now, but for me, this is a “when” not “if” it all comes unstuck

Not that I’m harbouring any illusions I can time it or short it.

I’m simply hanging out in companies where the expectations are at the opposite end of the spectrum to Nvidia (if they even have analysts which the majority don’t…)

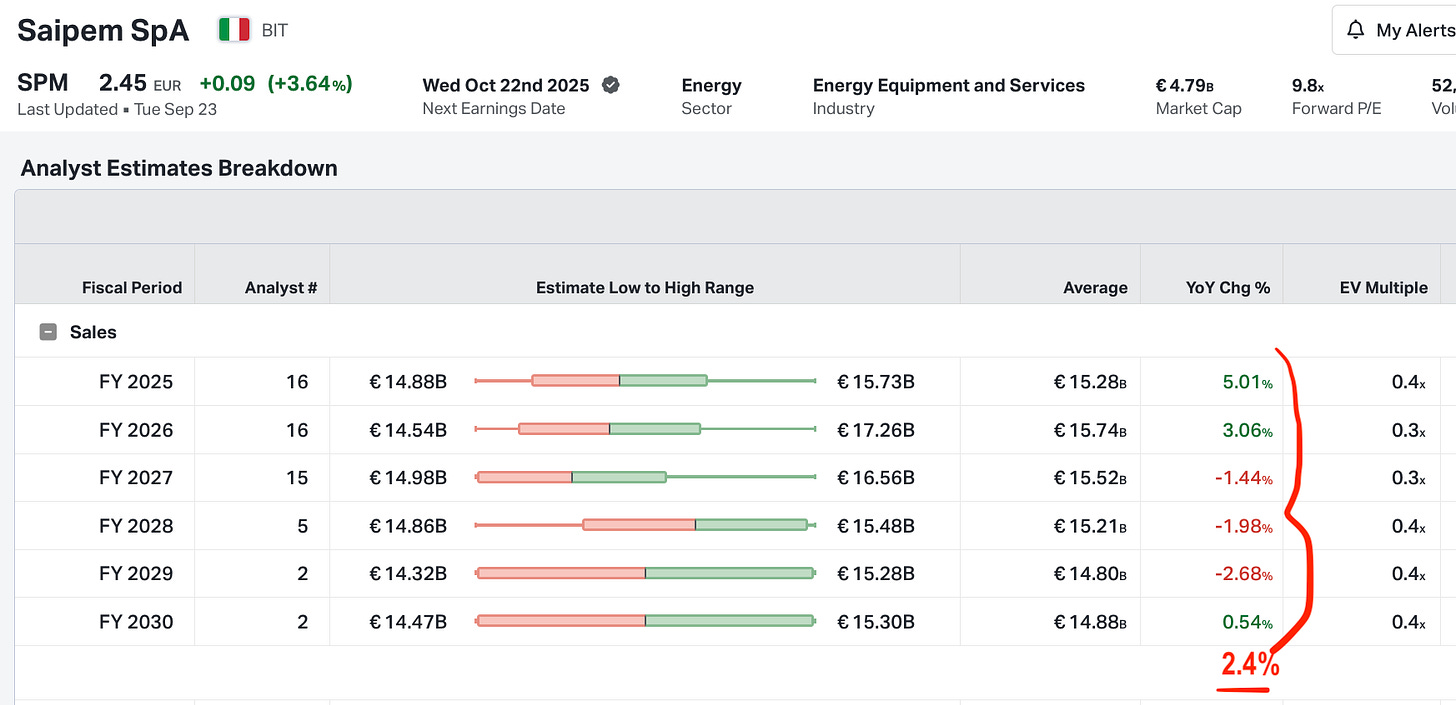

Take one company I own is Saipem, where analysts on average agree the company’s sales will go nowhere in the next 5 years (it’s merging with Subsea 7, where the analysts’ outlook is even worse at -12% to FY2030).

As I wrote in my last Finds, it’s a game of expectations.

When expectations on an asset are low enough (aka roadkill), you can make money on most outcomes.

Conversely, when expectations are high enough (Nvidia), you can lose money on all but the most extreme outcome.

Cheers,

Ferg

P.S In other news Mia and I threw a big party...

Congrats, Ferg!

Lovely pics. Thanks for the invite 😀