Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

I really enjoyed this interview, which touched on a few points I’ve been pondering: "The gold bull market has only just entered the second half." - Ronald-Peter Stöferle

The above also leads nicely into this piece: When will platinum regain its rightful place as the most valuable precious metal?

Platinum looks to me to be in the process of closing that gap.

Podcast/Video(s)

This is a classic that I try to rewatch regularly: Modern-Day Asset Management Business w/ Anthony Deden

Quote(s)

“In a democracy, we have always had to worry about the ignorance of the uneducated. Today we have to worry about the ignorance of people with college degrees.”

– Thomas Sowell

Tweet/notes

I’m lucky to call Asymmetry a friend and have enjoyed his Tweets, particularly this one, as I think a lot about how to educate Hugo in a way that sets him up for success.

Charts

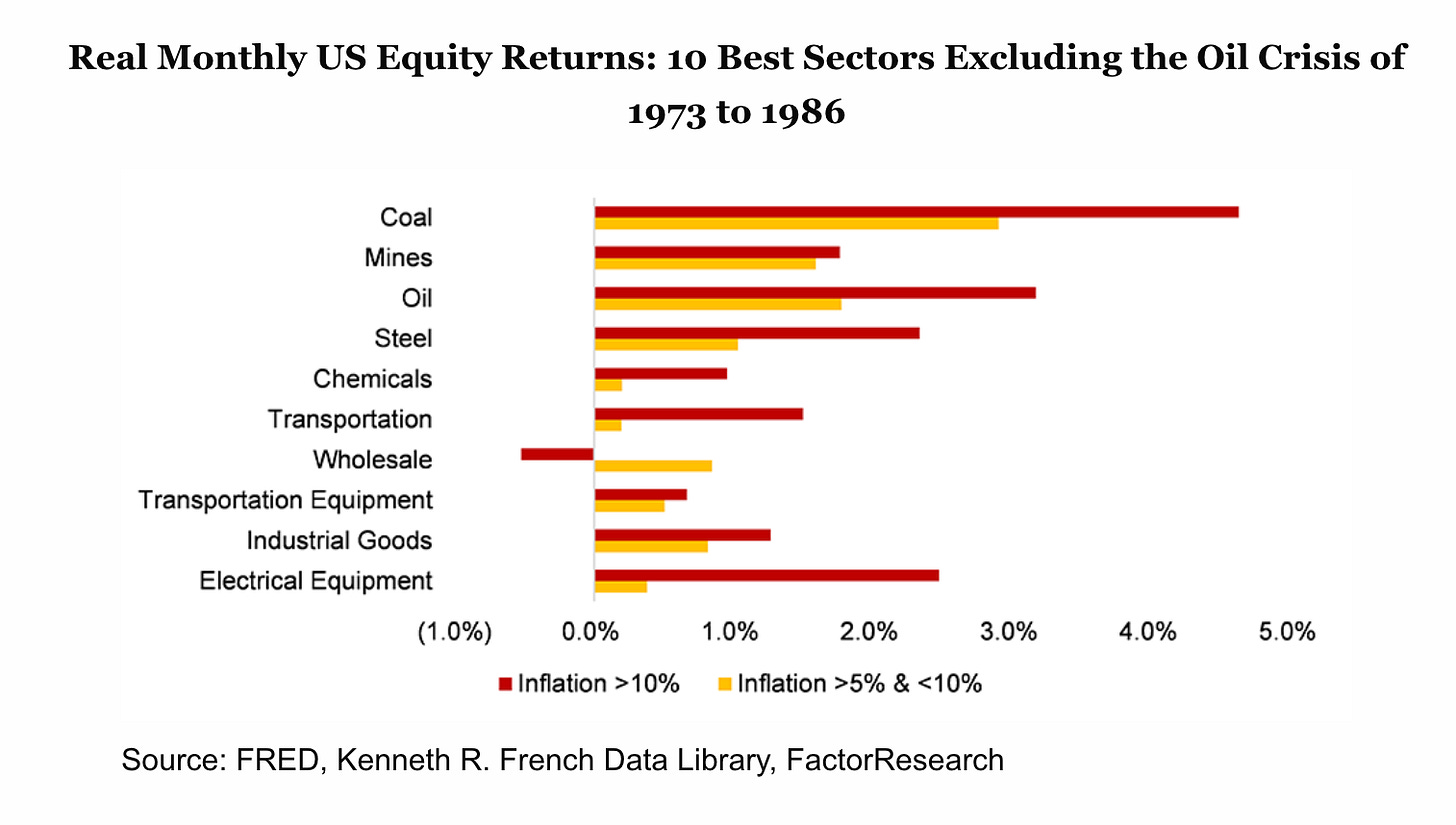

There were some great charts in this piece: Myth-Busting: Equities Are an Inflation Hedge.

Something I'm Pondering

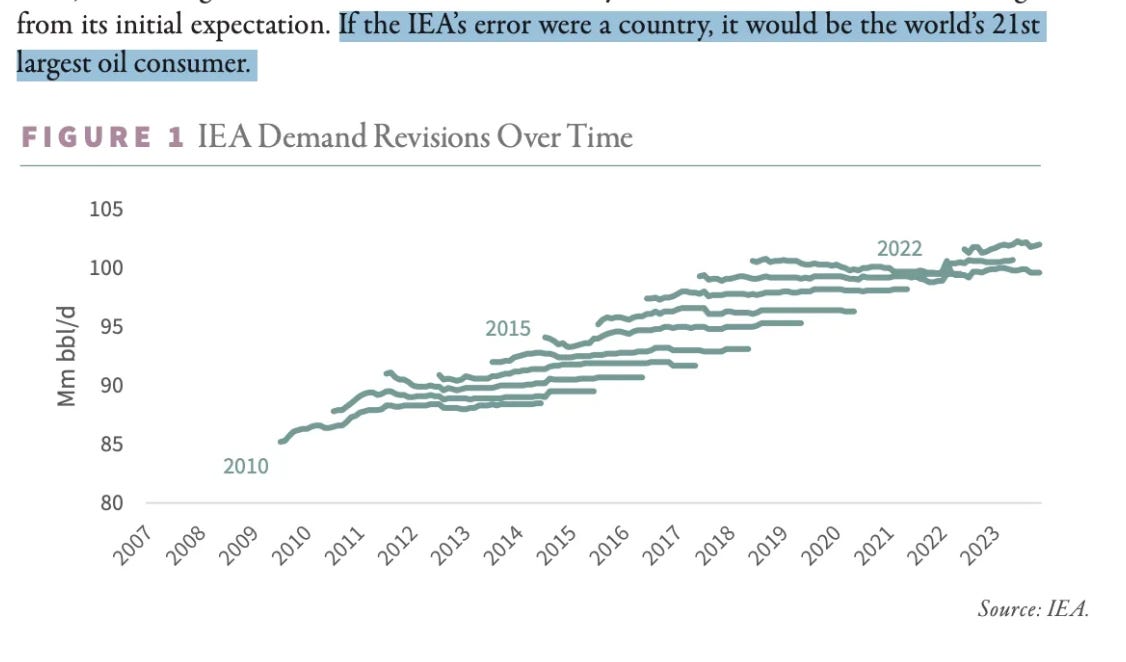

I’m pondering how IEA always misses developing market growth in energy demand aka “missing barrels,” and how, with the current setup of a weak USD, cheap energy and China and Europe stimulating, they are likely to get run over in a big way over the next 1-2 years.

Here is a reminder from Goehring & Rozencwajg on the IEA’s track record on oil demand.

The IEA’s coal demand forecasts share similar accuracy to oil.

I hope you’ve all been having a great week.

Cheers,

Ferg

P.S. I’m grateful for Ben at Kontrarian Korner having me on his show recently; definitely check out his Substack, as he’s been knocking out some great interviews and work on Sable Offshore.

Great work, Ferg.

I talking with POD:ASX MD near on couple years ago ..he had just got back from a SA PGM conference ..I recall him explaining how COVID+EV push had seen a major growth in PGM stockpiles along with Russian selling down stockpiles to fund war machine ...he stated all the PGM experts where talking of around late 2025 and certainly into 2026 as being time that PGM prices should see some growth and excess stockpiles would be well exhausted ... well looking like it was the correct call back in 2023