Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

David (Deepseek) vs. Goliath (ChatGPT) & Models, Margins, and Moats.

Yes, both of these are paid $10 monthly and $15 monthly, respectively, so I’ll do my best to give you a quick and dirty summary.

AI is expensive to develop; OpenAI, for instance, has projected a $5 billion expense for 2025. ChatGPT is costing over $255 million annually, while profitability remains elusive with the current $20 or $200 month business model.

This is where the 100% open source DeepSeek is absurd, with it costing just $6 million to develop. DeepSeek doesn't rely on data centres and Nvidia chips; it works by stacking standard computing power together (private laptops, desktops, etc.)

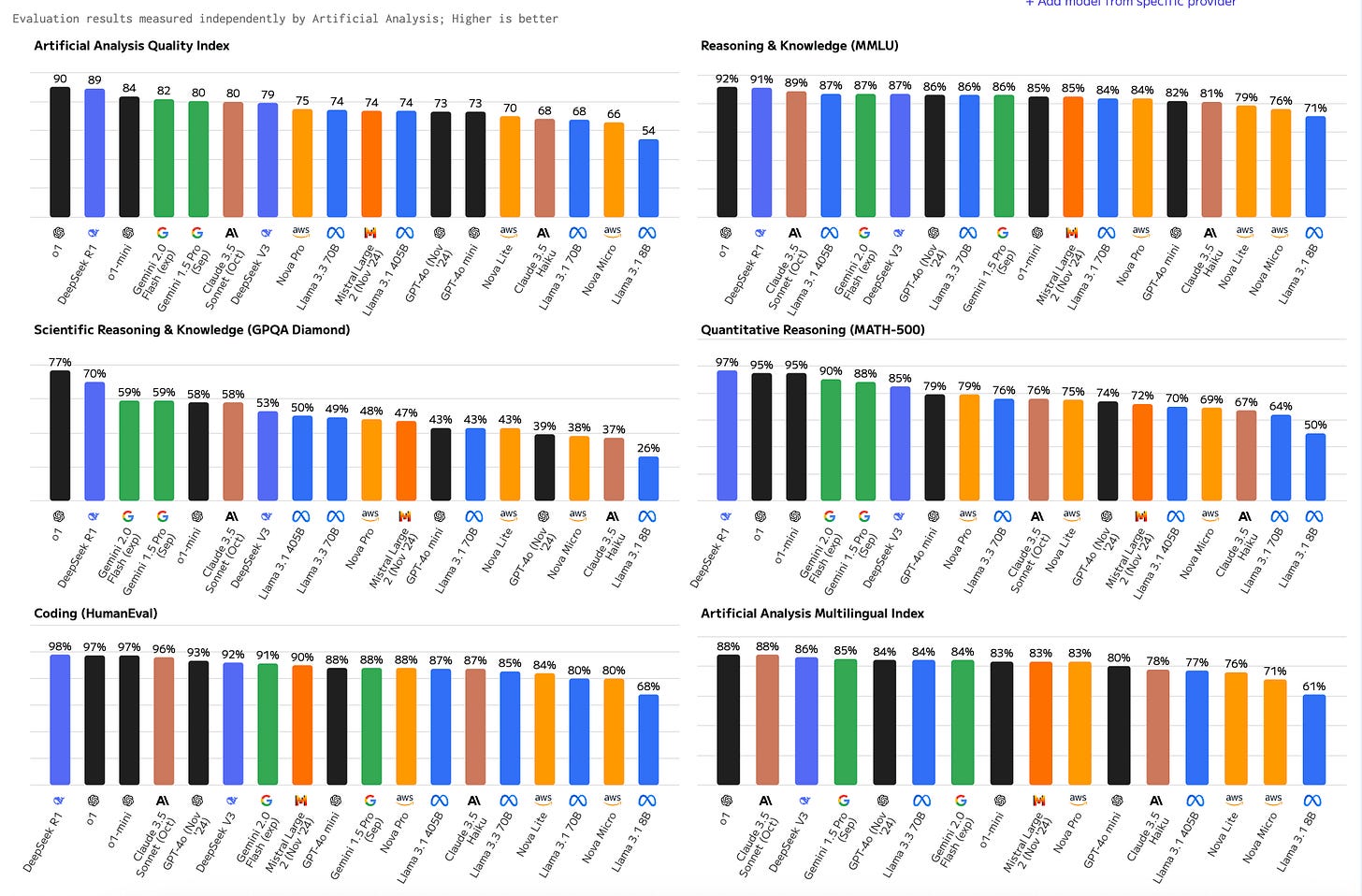

Cost is one thing, but the real kicker: DeepSeek matches, if not outperform ChatGPT 4 and the rest… Have a play on this website: Independent analysis of AI models

DeepSeek R1 is a fraction (~13%) of ChatGPTs input cost while matching, if not outperforming, it.

See the rankings here.

All this lends to the simple question of why pay when you can get the same quality service for free?

Quickly followed by what value is AI being assigned in company valuations?

Podcast/Video

Rather than opining on whether we’re in a bubble, Howard lists the signs he sees today and suggests how you might think about them . . . just as he did 25 years ago.

Quote

Wokeism is dying as quickly as it proliferated because for most people it was never a sincerely held belief, only a fashion accessory.

Tweet

It’s refreshing to see hard realities explained in politics.

To be clear, there isn’t even a race; China has grown it’s grid capacity 134% as of the end of 2023 (they grew 7% in 2024).

Check out this chart book from John Kemp, in particular page 2, where electrical generation (not capacity) jumped 9.4% YOY from 2020 to 2021 and 8.2% YOY from 2017 to 2028.

To contrast this, the US has grown its grid capacity by 11.6% in the last decade. To make matters worse, its transmission line growth has been slowing.

Charts

I've seen these articles pop up, so I wanted to add some numbers rather than say it's silly.

Trump’s Return Gives China a Second Chance at Climate Leadership

China’s Installed Renewables Achieved Yet Another Record in 2024

I could use primary energy or electricity generation to make the difference starker, but even using electricity production, as shown in capacity additions, China has added more coal over almost any period you wish to select.

Referring to John Kemps chartbook again in 2024, solar power generation stands at 4.4% while wind is 10% and coal stands at 67% (it also pays to look at page 4, which illustrates how coal generation balances renewable seasonality).

Something I'm Pondering

I'm pondering what savings the Department of Government Efficiency can actually achieve. Since all the outlays that would make any difference are off limits, i.e., social security, defence, health, and Medicare.

On the receipts side, Trump has talked a big game of using tariffs to create an "External Revenue Service,” but what is realistic without nose-diving growth?

Wall Street has already "decided" 2025 is going to be a strong year, which means something else is probably going to happen, or, to quote Humprey B. Neil:

"When everybody thinks alike, everyone is likely to be wrong."

What could go wrong?

Maybe the market figures out that over $100B of AI CAPEX investments will provide little return, and those earnings and profit margin estimates need to be revised.

I hope you’re all having a great weekend.

Cheers,

Ferg

P.S. If you’re interested in my story and why I started this Substack, you can read the story here.

The AI earnings bubble burst will be the catalyst. I’ve tried DEEP SEEK and it’s awesome… oh, and it’s free

In recent days I have read that retail investors of IBKR have increased their Margin Loans +45%. From a different source I have read that 70% of retail investor funds are allocated to the MAG7.

I suspect that there will be similar allocations from HF's trying to keep up with their benchmarks (although they are, in aggregate underweight MAG7).

The various Systematic Funds (Vol Ctrl, CTA, Risk Parity) are also heavily invested in the MAG7 simply due to index weights.

If (and that is a big IF), Deepseek is the "straw" that breaks this bubble-camel's back, then there is a lot of capital that needs to exit.

As per Mike Green, due to passive investing trends, there is no one to take the other side ....

Cheers John