Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

This piece was brilliant: A Tale of Two Tariffs - Citrini Research

"The only new thing in the world is the history you don’t know."

- Harry Truman.

Podcast/Video

Luke Gromen: Trade war; equity markets; 4th Turning; gold

I think in two years, three years, and four years, it's (gold/silver ratio) going to be higher than 100 and maybe substantially higher than 100. The reason I say that is because if I'm right, this is a sovereign debt recap. That's all we're talking about here and a central bank recap. And sovereigns and central banks, they don't own silver on their balance sheets. They own gold. And so if they're going to recap, they're going to use gold, which means basically they're going to recap their debt positions using gold, which is nice because, as everyone knows, as the detractors always say, gold isn't used for anything. Well, if gold isn't used for anything, they can take gold to some really big number to recap the unproductive and the sovereign debt on their balance sheet, and it doesn't affect the real economy because it's not used for anything.

If this is the way things are heading, it's interesting to consider the path other commodities, such as silver and oil, will take relative to gold. Could it be similar to the 1970s, where gold led with other commodities getting dragged up with a lag?

Quote

It's crazy that it's been allowed to get to this.

“More than 78% of the US military’s weapons rely on Chinese materials”

-China’s rare-earth mineral squeeze will hit the Pentagon hard

Tweet/notes

A big advantage of being a retail investor is that you can take a 3-5 year view, which is where all the real asymmetry is. The majority of big money can't focus there because they need to put up quarterly performance.

This continues to be my favourite study illustrating it:

Even God would get fired as an Active Investor

Perfect foresight has great returns, but gut-wrenching drawdowns. In other words, an active investor who was clairvoyant (i.e. “God”),(1) and knew ahead of time exactly which stocks were going to be long-term winners and long-term losers, would likely get fired many times over if they were managing other people’s money.

Charts

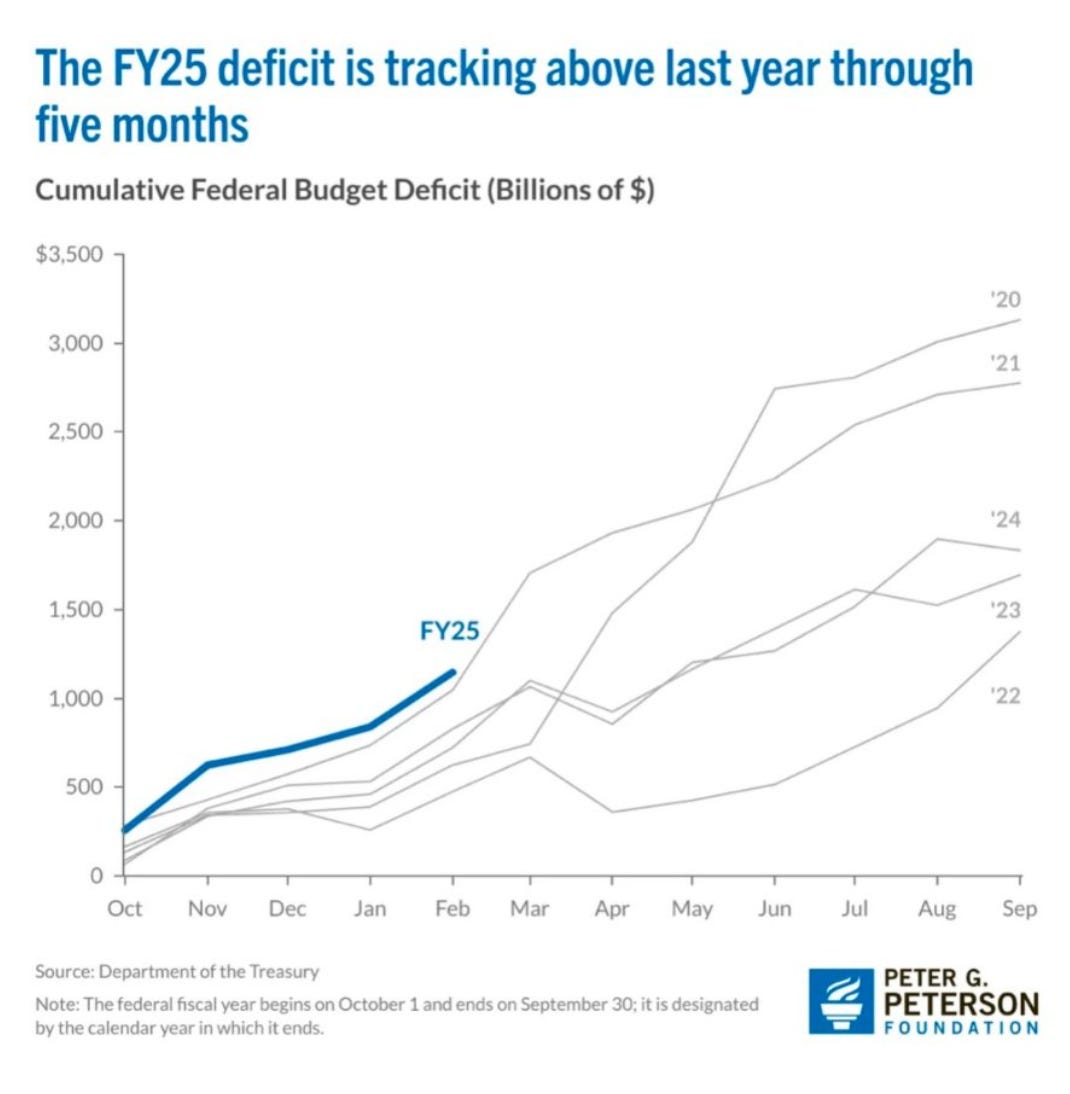

Where are the wins going to come from to narrow the deficit?

DOGE savings:

$2 trillion,$1 Trillion, $160 Billion by end FY206 ($61.5B YTD)The tariffs with China might as well be an embargo at this point.

A recession looks likely, and that isn’t good for tax receipts before considering Trump’s tax cuts (I didn’t realize the jump in tax receipts was that large post-COVID stimulus).

How things are currently tracking.

Something I'm Pondering

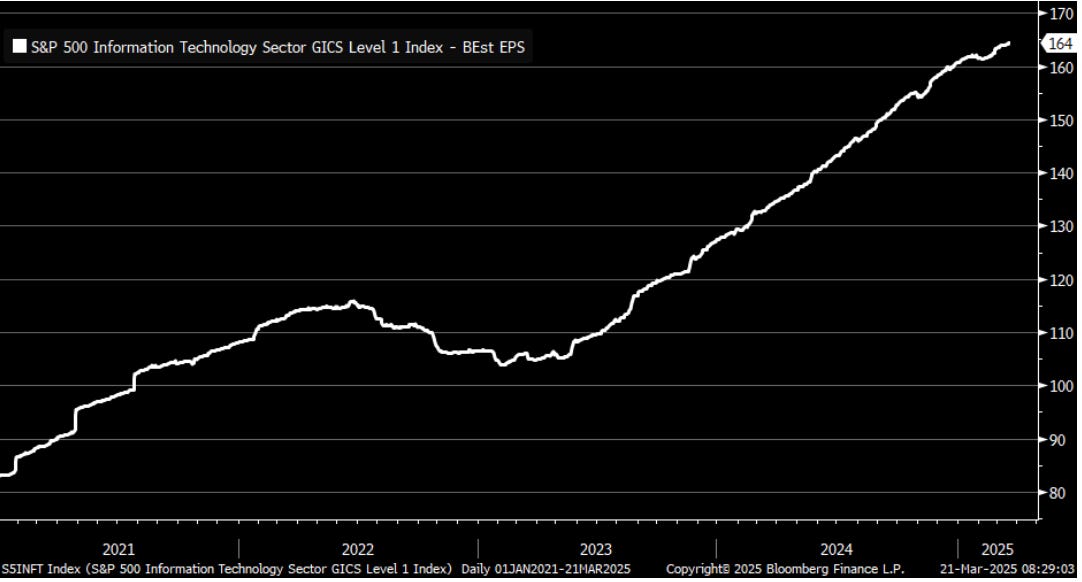

I’m pondering how humans are extrapolation machines, on both the good and bad.

EPS estimates for S&P 500 information tech.

Nvidia earnings forecast.

Annual real GDP growth expectations (from the start of the year).

I hope you’re all having a great week.

Cheers,

Ferg

P.S. Mia and Hugo took me away for my birthday to a tiny island off Lombok called Gili Asahan.

Haha, Luke’s podcast “ China shutdown during Covid for 12-18 months, they can take pain. The US shutdown and the bond market holders started crying after 4 days”.

Hey Ferg, do you or are you also considering Bitcoin?

A few people like Luke, Lyn Alden etc seem to be on board.

Well, you can say that you have a subscriber from Lombok next time you go there