Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article(s)

Gavekal's website features a book section where I highly recommend getting your hands on both 'Avoiding the Punch: Investing in Uncertain Times' and 'Clash of Empires: Currencies and Power in a Multipolar World.'

The most recent addition is The General Theory of Portfolio Construction by Charles Gave (which generously has a free download option). It's only 73 pages and packed with insight.

Podcast/Video(s)

The depth of Lyn’s analysis is on another level: Nothing Stops This Deficit Train with Lyn Alden.

Quote(s)

Charlie Munger’s response when asked, “What overall life advice do you have for young people?”

Spend each day trying to be a little wiser than you were when you woke up. Discharge your duties faithfully and well. Step-by-step you get ahead, but not necessarily in fast spurts. But you build discipline by preparing for fast spurts. Slug it out one inch at a time, day by day, and at the end of the day—if you live long enough—like most people, you will get out of life what you deserve.

Life and its various passages can be hard, brutally hard. The three things I have found helpful in coping with its challenges are:

-Have low expectations.

-Have a sense of humor.

-Surround yourself with the love of friends and family.

Above all, live with change and adapt to it. If the world didn’t change, I’d still have a 12 handicap.

Tweet/notes

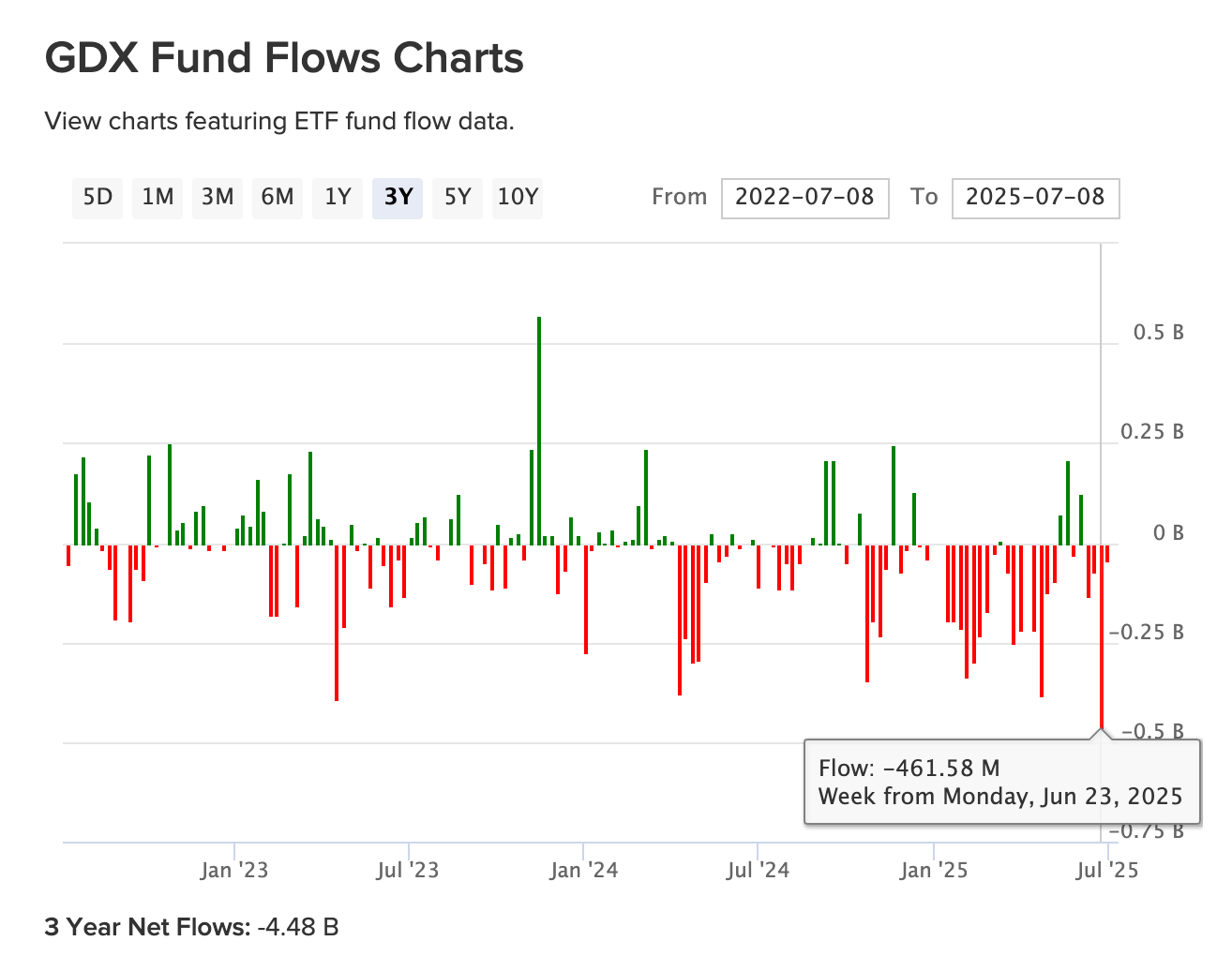

It's wild to me, given the recent surge in gold and the abandonment of efforts to get the deficit under control (from DOGE to BBB), that investor interest in gold remains anemic.

When looking at GDX fund flows, you’d be forgiven for thinking the price of gold had crashed with the largest outflows since 2016/2017, when gold dropped ~20% and GDX ~40%.

GDXJ is this trend amplified, with it managing only one week of inflows ($27m) last year, when outflows totalled $1.8 billion, and the week starting April 21, totalling $211m alone.

Charts

A bit of trivia: the US and China generated a similar amount of electricity in 2010. Fast forward to 2024, and China's total electricity generation is up 240%, while the US has managed 6.5% over the 14 years…

China routinely adds more electricity generation in a year than US has managed in over a decade…

Something I'm Pondering

Continuing from the above charts, I'm pondering, wondering WTF is Trump thinking with this announcement, as the US is reliant on imports for ~45% of its copper (source: USGS).

Trump Says 50% Tariff on Copper Imports to Take Effect August 1

“This 50% TARIFF will reverse the Biden Administration’s thoughtless behavior, and stupidity,” Trump said. “America will, once again, build a dominant Copper Industry.”

The planned copper tariff opens up yet another front in Trump’s push to remake global trade and rebuild US industries.

For all the talk of rebuilding US industry and competing in AI, this is the current state of the US grid.

US President Donald Trump’s plans to impose 50% import tariffs on copper imports are set to include the kinds of materials used for power grids, the military and data centers.

Slapping 50% tariffs on copper imports will cripple the US’s ability to get transmission growth higher when aluminum, of which US imports 47%, is also at a 50% tariff rate.

“The US does not have nearly enough mine/smelter/refinery capacity to be self-sufficient in copper,” Jefferies LLC analysts including Christopher LaFemina wrote in a note. “As a result, import tariffs are likely to lead to continued significant price premiums in the US relative to other regions.”

I hope you’ve all been having a great week.

Cheers,

Ferg

P.S. I' writing a piece currently exploring the idea we are at the start of an Asian Boom and what the investment implications could be from 60% of the world's population increasing consumption on the back of a weak dollar, cheap energy, Chinese stimulus, and no longer having growth constrained by sourcing commodities/energy in US dollars.

The energy implications are immense, as Asia is driving global energy consumption growth.

One last thing…

A bit of housekeeping: I've paused paid subscriptions on my Substack while I restructure a few things in the background. It should only be back up next week, but for now, no one new can subscribe to paid tiers. For paying subscribers, your current subscription will be extended by the period I've paused payments for (3weeks).

On another note, Buffett owns one of the largest electricity utilities in the U.S. During Berkshire Hathaway’s latest annual meeting, he pointed out that the company’s utility business has significantly diminished—primarily due to regulatory challenges related to wildfires. He is unwilling to invest any further in the utitlity business.

He emphasized the severe underinvestment in the U.S. power grid, noting that there’s been little to no meaningful investment over the past 30 years. While Berkshire has both the willingness and capacity to invest hundreds of billions of dollars to modernize the grid, the current regulatory environment makes such large-scale investments highly unlikely.

So, here you have one of the biggest owners in utilities; saying: " No más "

Aren't most transmission lines aluminum?