Ferg's Finds

This is a short weekly email that covers a few things I’ve found interesting during the week.

Article

Mass adoption of technology has to be "sails to steam, not a better sail." BEVs never seem to provide that, as they are equal/inferior to ICE in many ways (price, range, and recharging).

Combining the best of both in PHEV provides a killer value proposition that is required for mass adoption. The Seal 06 with 2100km range (2.54L per 100km) for $13,750 USD is incredible.

Sunday China Drive | BYD Seal 06 DM-i PHEV has a 2,100 km range with quality to match

On 28 May 2024, BYD launched the new DM-i 5.0 PHEV platform and advertised its 2100 km range on the Seal 06 DM-i and Qin L DM-i. Both cars were introduced with a starting price of 99,800 yuan (13,750 USD). These cars took center stage at the BYD exhibition at the Shenzhen Auto Show, where BYD invested 138 million USD. Real-world tests concluded with 2.54L of fuel every 100 kilometers.

This also caught my attention as it’s the real long term bear case for fossil fuels in heavy industry, not the hydrogen via renewable power electrolysis pipe dream.

China produces first nuclear-generated steam for petrochemicals plant

State-run China National Nuclear Corp (CNNC) said in a Wechat post announcing the latest step in Chinese efforts to decarbonise heavy industry.

Podcast/Video

Kopernik Global Investors: Optionality: Navigating Uncertainty in Today’s Markets

Quote(s)

“Most decisions should probably be made with somewhere around 70% of the information you wish you had. If you wait for 90%, in most cases, you’re probably being slow. Plus, either way, you need to be good at quickly recognizing and correcting bad decisions. If you’re good at course correcting, being wrong may be less costly than you think, whereas being slow is going to be expensive for sure.”

– Jeff Bezos

Tweet/Notes

Fortune favours the highest energy density…

Charts

Cumulative retail volume in China's passenger vehicle market, BYD’s PHEV production alone is close to VWs total ICE production with +28.5% YoY growth vs -5.8% for VW.

Breaking this down further with top 20 ranking of passenger vehicle models models by retail delivery volume in China. You see straight BEVs MoM growth has largely turned negative while PHEV is going gang busters. The previously mentioned Seal 06 sitting at 208% MoM growth.

Something I'm Pondering

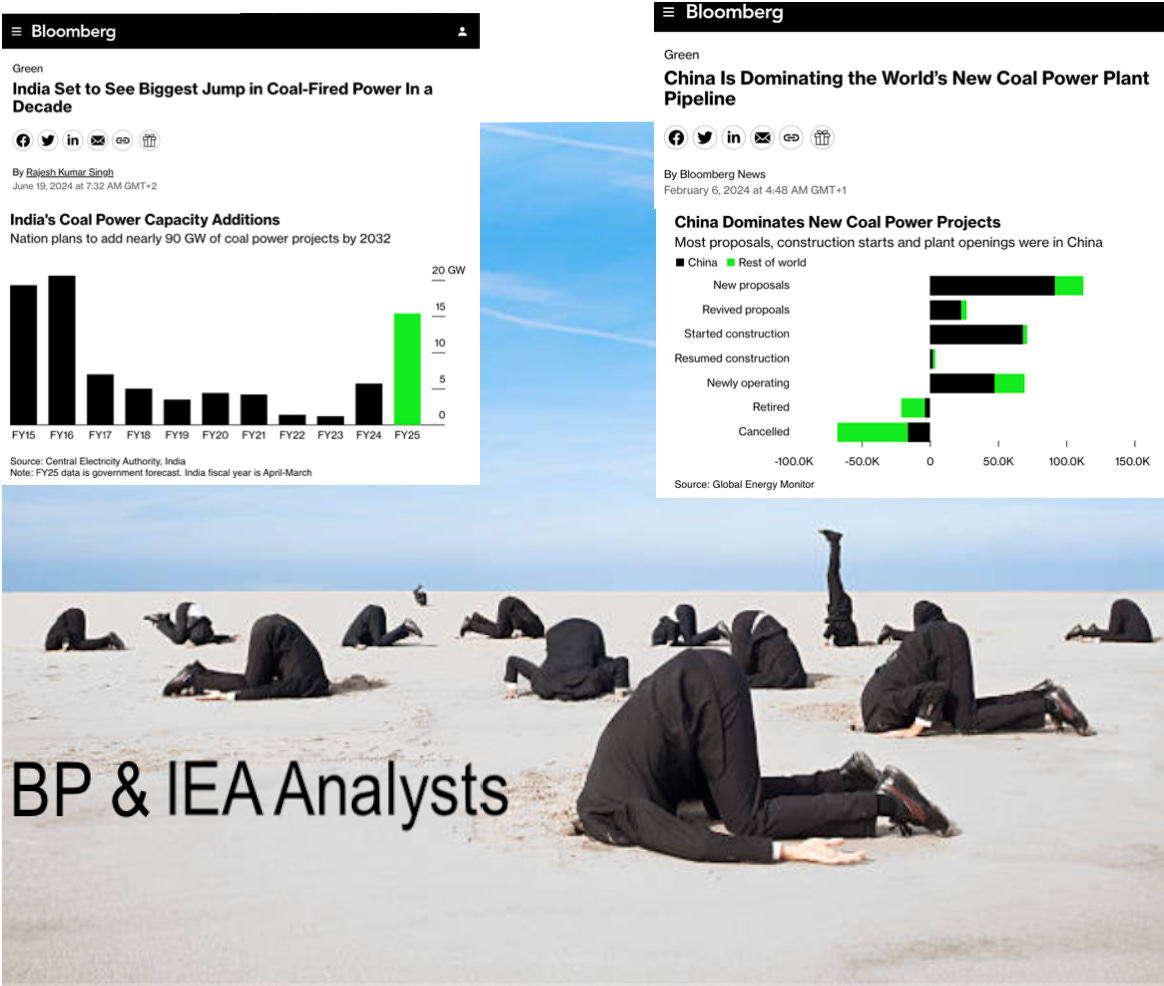

I’m pondering how political basic energy data has become.

If you have time, open both these BP Energy Outlooks and compare the coal section.

BP Energy Outlook 2024 vs BP Energy Outlook 2021

If not here is a quick summary.

The 2021 edition provides the facts in a table form, from which you can draw your conclusions. Non-OECD coal consumption has an 81.9% share and a 10-year average growth of 2.2% pa, while OECD coal consumption represents 18.1% and is declining at -2.9% pa.

Clean facts.

Compare to this years document.

It’s full of graphics pushing a narrative removed from reality.

I don't mind the Net Zero projections, as they are all a fantasy anyway, but pretending this is the current trajectory is laughable.

Anyone with 5 minutes and Google can establish that both India and China have coal capacity additions of a minimum of 25% (excluding planned but not yet permitted).

I hope you’re all having a great week.

Cheers,

Ferg

P.S we are in Zabljak (North of Montenegro) spending some time exploring the mountains and lakes.

What do you think about the recent news in YAL (no dividend, looking for acquisition). Market didn't like it.

Interesting addendum this am US pre-open:

https://www.wsj.com/business/autos/ford-cancels-plans-for-electric-suv-44817367?mod=djemalertNEWS