The worst sin in trading/investing is to surround yourself with smart people with the same view as you. Creating an echo chamber of confirmation bias has never been easier with Social Media.

My way of combating this has always been to find the smartest bear and do my best to understand their thought process.

For this reason, I’ve thoroughly enjoyed digging into Michael Kao's work on oil, as the guy is a legend in the hedge fund space and is undoubtedly a lot smarter and better connected than me. His take is not grounded like many “transition pundits” in renewable extrapolation or EVs destroying oil demand.

It's a detailed walkthrough of his thinking about the length of time before we reach the oil supply/demand singularity.

My long-term Bull Thesis for Oil has been:

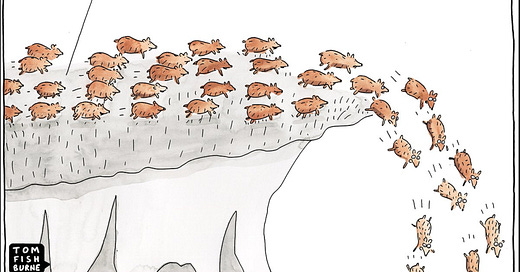

There will be a corridor in time within this decade where Demand for Oil catches up to the lack of sufficient investment in long-term Supply, coupled with the unrepeatability of the Shale Miracle.

I’ve previously referred to this as the SUPPLY/DEMAND SINGULARITY.

This has been my thesis from the start with oil; the underinvestment and resulting declines have to matter at some point against a growing demand picture on the back of developing markets.

That said, I’m very aware of what Rick Rule phrased so well:

“Be careful of confusing the inevitable with the imminent.”

This is a lesson I’ve certainly learned the hard way with the uranium thesis taking its sweet time to play out.

I’m under no illusions that I’m smart enough to time when this singularity occurs; I just want to ensure my portfolio is constructed in a way that ensures I make it to the “singularity” with maximum upside ideally.