Assessing Oil's Risk Reward (Part 2)

Going over Argentina and the rest of my oil portfolio.

We’ve just finished January, and it already feels like a long year.

I received a handful of emails after my recent oil piece asking about Argentina's role, which I really should have touched on:

So this is me rectifying that:

The commonly referred target is 1 million barrels per day by 2030, with OPEC forecasting that.

Which Vaca Muerta is on track to achieve: Vaca Muerta smashes crude output record in 3Q; on track to meet 1 million bpd in 2030

Argentina’s Vaca Muerta shale play reached a new oil production record of 400,000 barrels per day (bpd) in the third quarter and is on track to hit 1 million bpd by 2030, according to Rystad Energy’s latest analysis.

The issue is not resource quality.

Which begs the question, could it overshoot 1m bpd?

Since the Vaca Muerta is the world's second-largest shale gas reserve and fourth-largest shale oil reserve, it can provide multiples of the projected output.

"Vaca Muerta can provide 2 million barrels per day without any problem," Sureda added. Argentina's shale oil production currently is around 400,000 barrels per day.

"But for that to happen, other things are needed: more infrastructure to bring the oil to the ports, and many more people in the workforce and more equipment."

Or, if you want to run the with the outlier example:

If the Vaca Muerta was in the US and we could put 200 rigs on it would be 5-6 million bpd day its quite capable of that. - Bill Von Gonten

Granted, when asked at the end of the interview (which I highly recommend watching) where Bill sees production, he believes 1-2 million per day in 10 years is realistic.

Why can’t Vaca Muerta pull a Shale 2.0?

Trust

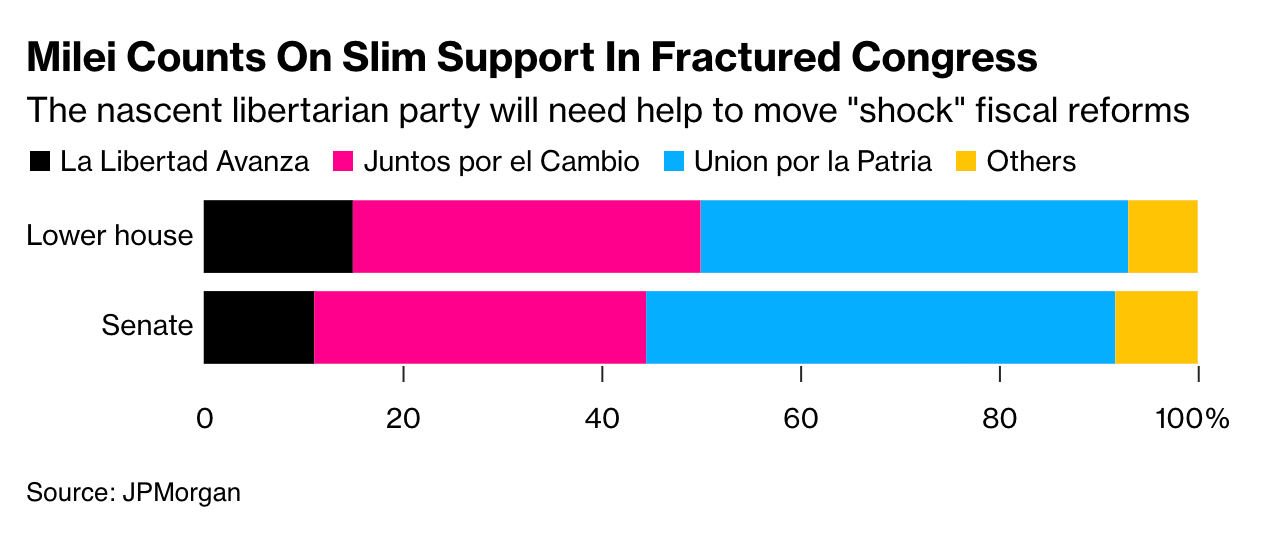

Trust is fairly straightforward in oil companies going to ramp investment gradually in a country with a history of defaulting on bonds, renationalization, energy price controls, and uncertainty over what Milei can actually achieve with a fractured congress.

As president, Milei will have to wrangle with triple-digit inflation, a stagnant economy and emptied central bank reserves—all with small minorities in both chambers of Congress and a low pain threshold among the 45% of Argentines who fall below the poverty line.

Capital controls

As with most socialist regimes, the way you keep inflation under wraps is by caping domestic energy prices and preventing oil companies from repatriating dollars.

This obviously disincentives them from investing and bringing rigs and equipment into the country when they can't get the money out.

Milei knows this and is trying to free the oil market, which is tough when inflation is ripping.

Javier Milei seeks free oil markets by law in shale-rich Argentina (29-12-2023)

Milei’s bill will likely face stiff opposition in congress, where his party is a minority, since it rips at the fabric of status-quo Argentine policymaking.

Shale oil in Argentina traded at $58 a barrel in the third quarter (2023), when Brent traded at $86, according to YPF.

This is no small undertaking as it unleashs more inflation on cizitens who are already hurting, which have caused Milei to slow and even back pedal on some conditions.

Overall, it's still moving in the right direction.

(13/06/24) Vista Reaps More From Crude Sales as Argentina Frees Oil Markets

The libertarian leader has vowed to end the meddling in crude prices of previous governments, a tactic that kept gasoline cheap but turned off international investors eyeing the heralded Vaca Muerta shale patch. Since Milei took power seven months ago, drillers and refiners have been negotiating a pathway to so-called export parity for crude, which means that oil producers like Vista can charge the same prices locally as overseas.

You can see this showing up in Argentina's first energy surplus in a decade.

Capital availability

For drill baby drill 2.0 to occur the majors with deep pockets need to be pouring money into the Vaca Mureta. This is not what we are seeing currently: Exxon Agrees to Sell Argentina Shale Oil Assets to Pluspetrol.

Chevron Corp., Shell Plc and TotalEnergies SE remain active in the shale deposit. But, by their own standards, they’re spending only modest sums there. Exxon has shifted its focus in Latin America to Guyana, which is likely to produce far more oil in the years to come.

This insight alone is interesting as it concerns the direct shale vs. deep and ultra-deep waters (Guyana) math, and Exxon has made its decision.

The ingredients for a Shale Boom 2.0 are missing

During the shale boom reinvestment was way in excess of cashflow (wish I could find a version of this chart going back further).

Estimates peg the shale boom dumpster fire at roughly $500 billion vaporised ($152billion in shale bankruptcies alone).

And unlike previous oil booms in Latin America, this expansion is increasingly a homegrown affair.

With zero/negative interest rates behind us (and PTSD from those who lit capital on fire in the first Shale Boom), it will be difficult to repeat.

YPF and Vista make up 71% of production and are mainly doing it out of cash flow.

The main factors to keep an eye on

Can Milei successfully remove capital controls this year as promised, or will high inflation and Congress tie his hands?

(11/12/24) Argentina’s President Javier Milei plans to remove all capital controls by 2025, marking a radical shift from decades of state intervention. The move aims to attract foreign investors who have avoided Argentina despite its potential.

As for production, the easiest way to monitor progress is rig count.

“If we want to grow to 1 million barrels, we have to add five rigs every year, and making Argentina even more investable is required to do that,” Galuccio said in an interview at Bloomberg’s headquarters in New York.

You can track it here, which as you can see rig count is down the last quarter.

Lastly, even if investments get the green light today, it all takes time:

Seven oil companies join forces to build a 600 km pipeline in the Vaca Muerta field

Argentina staged this Monday the agreement to build an oil pipeline that will transport more than half a million barrels per day from Vaca Muerta starting in 2027.

Conclusion

It's very promising in the long term, but unless we see a step change in investment, I see policy uncertainty and infrastructure limiting its growth prospects in the near term (5 years).

The reality is oil majors aren’t spraying CAPEX around when views like this are still consensus: IEA sees major oil capacity glut by 2030 as demand peaks

It is the polar opposite with AI with ever larger CAPEX projects being announced: Announcing The Stargate Project or take this interview:

We humans love to over-extrapolate what is working while being overly pessimistic about the thing that hasn't worked, ignoring the fact it's usually cyclical.

Narrator: Semiconductors are in fact highly cyclical

Oil is cyclical (There is a price to pay for that period of underinvestment).

It's easy to point this out; the hard part is having the stomach and patience to invest based on this.